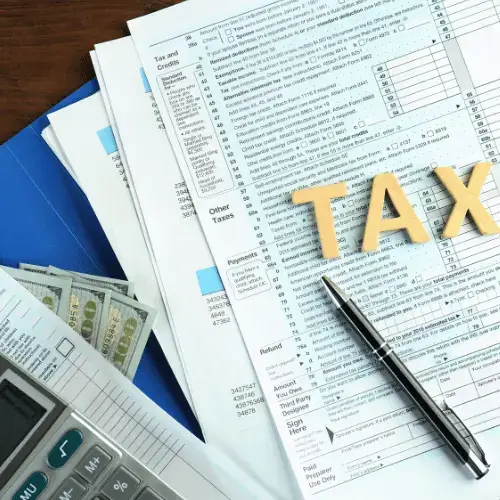

File Tax Return in USA

Get Expert Business Support!

Tax Filing in the USA

Why Choose Our Tax Filing Services?

Accurate Filing:

Ensure accuracy in all tax return submissions.

Compliance:

Stay compliant with federal and state tax regulations.

Maximized Returns:

Optimize deductions and credits to maximize your tax return.

Timely Submissions:

Guarantee timely filing of all tax returns.

Expert Guidance:

Receive expert advice and support from experienced tax professionals.

Our Tax Filing Services

1. Personal Tax Filing

- Individual Returns: Prepare and file federal and state individual tax returns.

- Deductions and Credits: Optimize deductions and credits to minimize tax liability.

- Audit Support: Provide support in case of IRS audits.

2. Business Tax Filing

- Corporate Returns: Prepare and file corporate tax returns.

- Partnerships and LLCs: File partnership and LLC tax returns.

- Estimated Taxes: Calculate and file estimated tax payments.

3. Tax Planning and Advisory

- Tax Optimization: Develop strategies to optimize your tax position.

- Regulatory Updates: Stay informed about changes in tax laws and regulations.

- Expert Consultation: Receive guidance on complex tax issues and compliance matters.

4. Audit Support

- Audit Preparation: Assist in preparing for IRS audits.

- Audit Representation: Represent your business during IRS audits.

- Post-Audit Support: Provide support and address any issues identified during the audit.

How can filing tax returns benefit your business?

Enhanced Compliance

- Regulatory Adherence: Ensure full compliance with federal and state tax regulations.

- Risk Mitigation: Reduce the risk of non-compliance and associated penalties.

Operational Efficiency

- Streamlined Processes: Simplify and automate tax filing processes.

- Time Savings: Save time on tax preparation and submission.

Maximized Returns

- Tax Optimization: Optimize deductions and credits to maximize your tax return.

- Strategic Planning: Develop long-term tax strategies to minimize future liabilities.

How We Work: Our Process

Step 1: Initial Consultation

- Needs Assessment: Conduct a thorough assessment of your tax filing requirements.

- Solution Design: Design a tailored tax filing solution to meet your needs.

Step 2: Data Collection and Preparation

- Document Gathering: Collect all necessary documents and information.

- Tax Preparation: Prepare accurate and compliant tax returns.

Step 3: Review and Filing

- Comprehensive Review: Conduct a thorough review to ensure accuracy.

- Timely Filing: File tax returns on time to avoid penalties.

Step 4: Post-Filing Support

- Ongoing Assistance: Provide continuous support for any post-filing issues.

- Future Planning: Offer guidance for future tax planning and compliance.

Why Choose Meru Accounting for filing your tax returns in the US?

- Expertise in Tax Filing: Specialists with extensive experience in US tax law and regulations.

- Certified Professionals: Work with certified tax professionals dedicated to your success.

- Client-Centric Approach: Solutions tailored to meet the specific needs of each client.

- Proven Results: A history of successful tax filings and satisfied clients.