When is the S-Corp federal tax due for 2025?

Running an S-Corp comes with tax benefits, but it also brings important responsibilities. One of the most important tasks for every S corporation is filing its federal tax return on time. Missing the deadline can lead to penalties, extra costs, and stress for both the business and its shareholders.

For the 2025 tax year, knowing the exact due date helps business owners prepare early and avoid last-minute issues. This blog explains when the S-Corp federal tax is due in 2025, what forms need to be filed, how extensions work, and key tips to stay compliant with IRS rules.

What Is an S-Corp?

An S-Corp (short for S corporation) is a special way to set up a business. It is different from a sole owner or a big company. In an S corporation, the business itself does not pay income tax. Instead, the people who own the business (called shareholders) report the income on their tax forms.

Here are some key things about S-Corps:

- It protects the owner’s money (so your home and car are safe if the business has trouble).

- It avoids double tax, which means the business and the owners don’t both get taxed on the same money.

- The owners share profits and losses.

Many small businesses like this setup because it helps save money on federal taxes.

But there are rules. You must file special forms, follow strict deadlines, and make sure you pay taxes on time. One of the most important things for every S-Corp is knowing when its federal tax is due.

S-Corp Federal Tax Due Date for 2025

The federal tax is very important to know when you have an S-Corp. If you miss the date, you might have to pay extra fees. Here is a simple guide to help you learn the due date and why it matters.

- Usual Tax Due Date for S-Corps

Each year, S-Corps must file their taxes by March 15. They use a form called Form 1120-S. This form shows what the business earned and spent during the year. - March 15, 2025, Is a Saturday

In 2025, March 15 is on a Saturday. The IRS does not take tax forms on weekends or holidays. So, the tax due date must change. - New Due Date: March 17, 2025

Since March 15 is a weekend, the next workday is Monday, March 17, 2025. That is now the real due date. If S-Corps file late, they may need to pay extra fees. - Use Form 1120-S to File Taxes

S-Corp owners must use Form 1120-S to report money made and money spent. This form tells the IRS if the business had a gain or a loss. The form must be filled out correctly and sent by the due date. - Schedule K-1 for Each Owner

With Form 1120-S, every S-Corp must also send out a paper called Schedule K-1. This is something that every owner has. This paper tells them how much money, loss, or tax items they must put on their tax form.

This is how the S-Corp gives the income to the owners. The S-Corp does not pay the tax — the owners do.

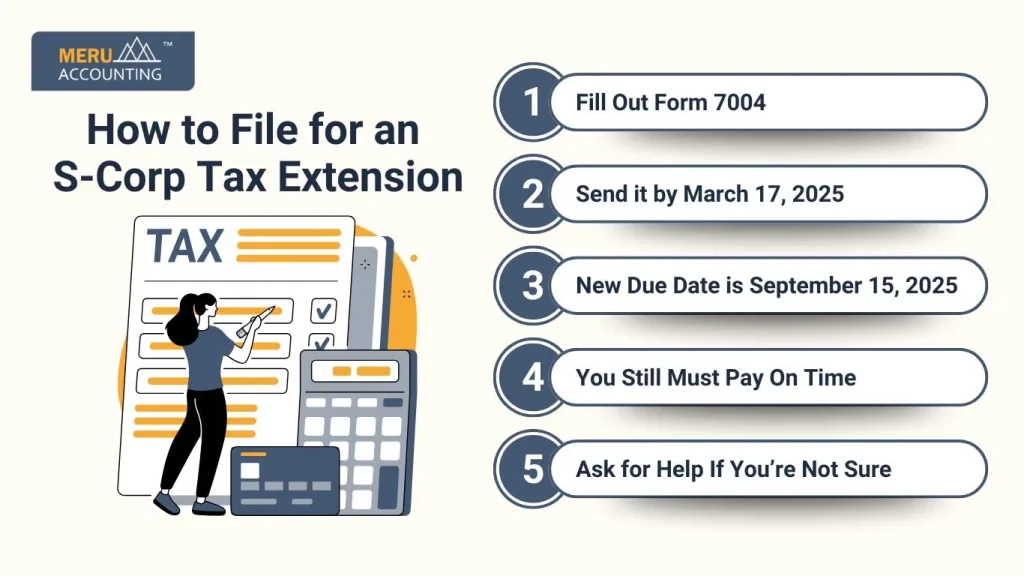

How to File for an S-Corp Tax Extension

Sometimes, your S-Corp may not be ready to file taxes on time. You may still be collecting business records or waiting for other tax papers. The good news is that the IRS lets your S corporation ask for more time. This is called a tax extension.

Here is how your S-Corp can get that extra time:

1. Fill Out Form 7004

If your S-Corp needs more time to finish the tax return, you can ask for it. Use Form 7004. This form tells the IRS that you want extra time. You do not have to say why. You just need to send it before the due date.

2. Send it by March 17, 2025

Even if you ask for more time, you must send Form 7004 by March 17, 2025. That is the normal due date to file S-Corp federal tax. If you send it late, you won’t get more time, and your S-Corp might get a fee.

3. New Due Date is September 15, 2025

If you send the form on time, your S-Corp gets 6 more months. That means you have until September 15, 2025. You now have more time to get your tax return ready.

But: You must still pay any tax you owe by the first due date. The form gives more time to file, not more time to pay.

4. You Still Must Pay On Time

Even if you get more time to file the tax form, you do not get more time to pay your federal tax. If your S-Corp owes any tax, you must pay it by March 17, 2025.

If you pay late, the IRS may charge you a fee and add interest. So it’s best to guess how much tax you owe and pay it when you file Form 7004.

5. Ask for Help If You’re Not Sure

Filing tax forms and asking for extensions can be hard for some S-Corp owners.

What Do You Need to File S-Corp Taxes?

Having the right papers makes it easier to fill out the tax form and stay out of trouble.

Here is what every S corporation should gather before filing:

1. Income and Sales Records

You must know how much money your S-Corp made during the year. This includes all sales, client payments, and any other money earned.

2. Expense and Spending Records

Keep track of what your S corporation spent. This includes rent, supplies, internet, ads, or car use for work. These records help you lower your federal tax.

3. Payroll Information

If your S-Corp has workers or pays the owner a wage, you need to report it. Have payroll records ready, including pay stubs and tax forms like W-2.

4. Last Year’s Tax Return

Look at last year’s S-Corp federal tax return. It helps you remember what forms you used, what income you reported, and what costs you listed.

5. Details for Each Shareholder

Each S corporation must report who owns it. You need the names, addresses, and share details for each owner. You also need to give each person a Schedule K-1.

6. Form 1120-S

Once you have all these records, you can fill out Form 1120-S. This is the form every S-Corp must send to the IRS to report income, spending, and profit or loss.

You can file it online or mail it on paper.

7. Get Help if Needed

If you’re not sure how to fill out the form or what records to use, you can ask a tax expert. Services like Meru Accounting help S-Corp owners file their federal tax returns the right way.

Benefits of Filing Federal Tax on Time

1. Avoids Penalties and Fees

Filing your federal tax on time keeps you safe from late fees, charges, and fines. This helps your S corporation save money and keep cash flow stable.

2. Keeps the S Corporation Compliant with IRS Rules

Meeting the due date shows that your S-Corp follows IRS rules. It helps you stay safe from issues that come with late or missed filing.

3. Builds Credibility with Banks and Investors

Timely filing shows that your firm is well run. Banks and investors trust firms that are clear, honest, and on time with tax tasks.

4. Helps in Smooth Audits in the Future

When you file on time and keep clean records, audits run smooth. The IRS can check your books with ease if they ever review you.

5. Gives Peace of Mind to Owners and Shareholders

Filing on time removes stress. Owners and shareholders feel safe that the firm is in good shape and meets all tax needs.

6. Supports Loan Applications and Credit Approvals

Banks often ask for tax returns. A timely file can help your S-Corp get loans or credit fast when funds are needed.

Tips for Meeting the Federal Tax Deadline for an S-Corp

1. Mark the Deadline on Your Business Calendar

Write down the tax due date in your work plan. This helps you and your team stay ready and avoid a last-minute rush.

2. Collect All Documents Early

Start to gather receipts, payroll files, and expense notes early. This saves stress when the due date comes close.

3. Work with an Accountant for Accuracy

A skilled accountant makes sure your return is right. They help you claim write-offs, stay compliant, and save time.

4. Use Tax Software for Simple Filing

For small firms, good tax tools can help file fast and with ease. They guide you step by step for simple returns.

5. Apply for an Extension if Needed

If you can’t file on time, ask for an extension. This gives more time to prepare, but you must pay what you owe by the due date.

6. Schedule Regular Check-ins with Your Tax Professional

Meet your accountant each quarter. This keeps your tax plan on track and avoids a big rush at year-end.

If you run an S corporation, don’t forget the key date, March 17, 2025. That is when your S-Corp federal tax return is due. Filing on time keeps you safe from IRS fines and shows you run your business well.

An S-Corp is a smart way for many small businesses to save money and avoid double taxation. But with this setup comes the need to follow rules and meet deadlines. Keeping track of money, sending in forms, and staying updated can be a lot to do alone.

That’s why many businesses trust Meru Accounting. We help with S-Corp, federal tax, and all your tax form needs so you can focus on growing your business.

FAQs

1. Can I pay my S-Corp tax online?

Yes. You can pay your federal tax online using the IRS website. You can also send a check or use tax software.

2. What is Form 1120-S used for?

Form 1120-S is the main tax form for an S-Corp. It shows how much your business made, spent, and the profit or loss to share with the owners.

3. Can I turn my business into an S-Corp anytime?

You must choose S corporation status with the IRS by filing Form 2553. To start in 2025, it must be sent in early, usually within 2 months and 15 days after the year begins.

4. How many owners can an S-Corp have?

An S-Corp can have up to 100 owners (called shareholders). They must be U.S. citizens or residents.

5. Do S-Corps pay self-employment tax?

Not on profits shared with owners. But if owners also work for the S-Corp, they must get a fair wage and pay tax on that amount.