Home » Industry Expertise » Bookkeeping For Rental Business

Experience Hassle-Free

Bookkeeping for Rental Business

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Bookkeeping and accounting for Rental business in the US

- As a rental property owner in the US, managing the bookkeeping and accounting aspects of your business can be overwhelming. However, it’s crucial to keep track of your finances to maximise revenue and ensure tax compliance. Here we will provide a comprehensive guide on rental property bookkeeping and accounting in the US, helping you navigate this complex task with confidence.

- Bookkeeping involves recording and monitoring all financial transactions associated with your rental property. This includes tracking tenant rent payments, maintenance and repairs expenses, and other monetary activities. On the other hand, accounting goes beyond bookkeeping by analysing and interpreting these records to gain insights into the overall financial health of your rental property. Accounting provides a comprehensive view of your revenue streams and profit margins and empowers you to make data-driven decisions.

- Double-entry bookkeeping, the foundation of financial record-keeping, ensures accuracy by recording every transaction as a debit and credit entry in separate accounts. This system enables the generation of reliable financial statements like income statements and balance sheets, which are essential for tax filings and loan applications.

Key Points To Consider For Effective Rental Business Bookkeeping And Accounting In The US.

Section 1: Bookkeeping Considerations

- Importance of Bookkeeping: Understand the significance of accurate and systematic recording of financial transactions as the foundation for practical accounting.

- Chart of Accounts: Establish a categorised list of accounts to classify financial transactions, including assets, liabilities, equity, revenue, and expenses.

- Double-Entry System: Implement a double-entry bookkeeping system to maintain the balance between debit and credit accounts by recording each transaction with at least two entries.

- General Ledger: Maintain a general ledger summarising all financial transactions and account balances.

- Bank Reconciliation: Regularly reconcile bank statements with the company's records to identify discrepancies and ensure accurate cash balances.

Section 2: Accounting Considerations

- Software Solutions: Consider utilising accounting software like QuickBooks, Xero, or Wave to streamline bookkeeping processes and enhance efficiency.

- Financial Statements: Understand the critical financial statements that provide an overview of your business's financial position and performance:

- Income Statement (Profit and Loss Statement): Summarizes revenue, expenses, and net income or loss over a specific period.

- Balance Sheet: Presents assets, liabilities, and equity at a specific time, offering insights into the business's financial position.

- Cash Flow Statement: Tracks cash inflows and outflows, highlighting operating, investing, and financing activities.

- Statement of Changes in Equity (for corporations): Shows shareholder equity changes, including share issuances, dividends, and retained earnings.

Section 3: Tax Compliance Considerationss

- Federal Taxes: Understand and comply with federal tax obligations, including income taxes, payroll taxes, and self-employment taxes. Familiarise yourself with relevant tax forms, deadlines, and available deductions or credits.

- State and Local Taxes: Research and adhere to state-specific tax requirements, such as sales tax, property tax, and state income tax. Check for any local taxes imposed by your city or county.

- Employer Identification Number (EIN): Obtain an EIN from the IRS if you have employees or operate as a corporation or partnership.

- Sales Tax: Determine if your business needs to register for a sales tax permit and collect sales tax from customers, especially if you sell taxable products or services.

Section 4: Professional Assistance

- Bookkeeper: Consider hiring a bookkeeper, such as Meru Accounting, to handle day-to-day financial transactions, maintain records, and prepare financial reports.

- Accountant: Consult an accountant at Meru Accounting for complex accounting issues, financial analysis, tax planning, and ensuring compliance with accounting standards and tax regulations.

- Certified Public Accountant (CPA): Engage the services of a CPA, like those at Meru Accounting, for higher-level assurance, expertise, and additional financial benefits like audits and financial statement reviews.

- General Ledger: Maintain a general ledger summarising all financial transactions and account balances.

- Bank Reconciliation: Regularly reconcile bank statements with the company's records to identify discrepancies and ensure accurate cash balances.

- Effective bookkeeping and accounting practices, with the assistance of professionals like Meru Accounting, are essential for managing your rental business’s finances, ensuring accurate records, and meeting tax compliance requirements. By following these considerations, you can enhance financial management and make informed decisions for long-term success.

How To Keep Track Of Rental Income And Expenses In The Rental Business?

- Tracking rental income and expenses is crucial for the success of your rental business. Without accurate records, you could avoid deducting certain expenses from your taxes or even face legal issues.

Tracking of income per property

- You should track income on the property based on class tracking for real estate. You should maintain a separate bank account per property to allocate the expenses to that property efficiently.

Tracking of expenses via a property

- One should track expenses via property for each property. General costs that cannot be explicitly allocated to a property should be assigned on either the proportion of income, the area occupied or any other scientific basis.

- To start tracking your rental income and expenses, create a system to organise all relevant documents, such as lease agreements, receipts, and invoices. Consider using a digital platform to upload and store these documents easily.

- Next, categorise each expense accordingly to track them accurately. Common categories include repairs/maintenance costs, property management fees, advertising fees and utilities.

- When it comes to tracking rental income, ensure that you are recording the amount received from rent payments as well as any additional sources of revenue, such as late payment fees or pet deposits.

- Keep track of important dates, such as when rent is due or an invoice needs to be paid, to make sure to meet deadlines and avoid missing unnecessary late fees.

- By implementing a consistent system for tracking rental income and expenses, you can reduce stress while ensuring financial stability for your business.

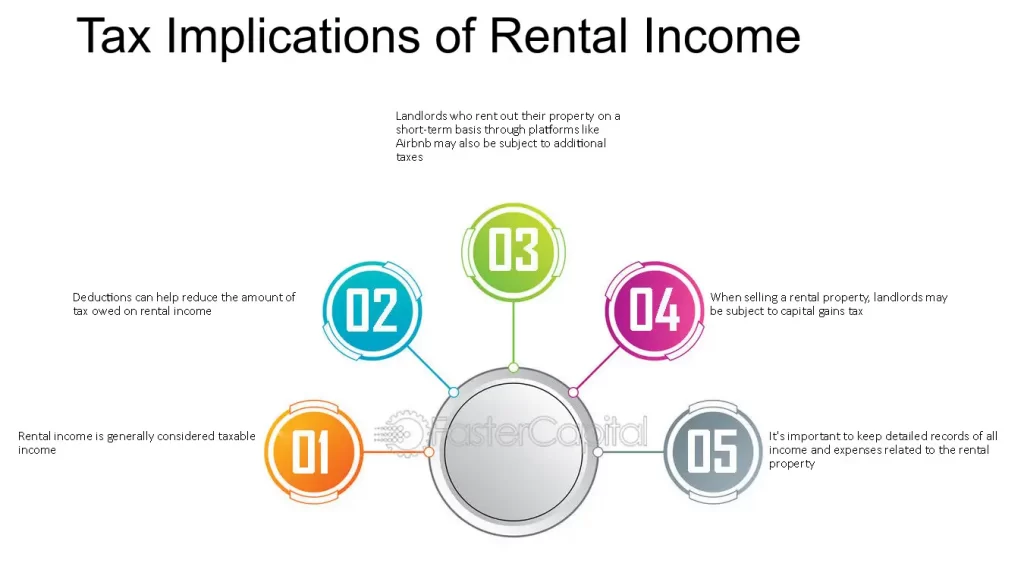

Understanding The Tax Implications Of Rental Income

How To Choose A Bookkeeping System For Your Rental Business?

- When managing the financial aspects of your rental business, having an efficient bookkeeping system is crucial. Choosing the right plan can help you stay organised and on top of your revenue, expenses, and taxes.

Accounting For Rental Properties - Meru Accounting

- India’s leading bookkeeping and consultant firm has made it easier for you. We track your rental property or business regularly and manage them on your behalf effectively.

- Profit Margins in the rental business can be pretty challenging, whether it is a machine rental business or a property rental business.

- However, a Rental business can be highly profitable if one adequately amortises the capital cost against the receipts.

- We at Meru Accounting provide reporting for a rental business to help you analyse revenue per working hour of the machine.

- We at Meru Accounting can help you plan and budget your revenue based on various inputs and tell you whether the machine can be worth investing in your rental business.

Features that you should investigate while selecting accounting software

- Ability to manage apartments, commercial properties, condominiums, cooperatives, homeowner associations, residential properties, etc.

- Ability to operate in a Cloud environment

- Collect rent online

- Automatic invoicing

- Listing management

- Alerts for software

- Expense management

- Vacancy Tracking

- Maintenance of task

Conclusion

Bookkeeping and accounting are essential for any rental business in the US. Properly tracking your income and expenses is crucial for managing your finances effectively. You can do it yourself or outsource to a professional bookkeeper or accountant.

When selecting a bookkeeping system, consider your specific needs as a rental property owner. Look for software to manage rent payments, track expenses, and generate financial reports.

Remember that understanding the tax implications of rental income is vital. Keeping accurate records to claim all possible deductions come tax time is essential.

By implementing best practices in bookkeeping and accounting, you’ll be able to streamline your operations and focus on growing your business. Feel free to seek guidance from professionals if needed; they can help ensure you make informed decisions about your finances.

With these tips in mind, you’ll be well on your way to success as a rental property owner!

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS