Home » What We Do » Tax Returns » Form 1120

Monthly Bookkeeping, Payroll, Financial Statements & Tax returns Starting From $ 10 Per Hour for Business owners

Quality Driven Approach

QuickBooks And Xero Certified Experts

50% Reduction

In Costs

Part Time / Full Time Resources For

- CPA Firms

- Enrolled Agents

- Bookkeeping Firms

- Tax Practitioners

- Business Owners

Hire Remote Team

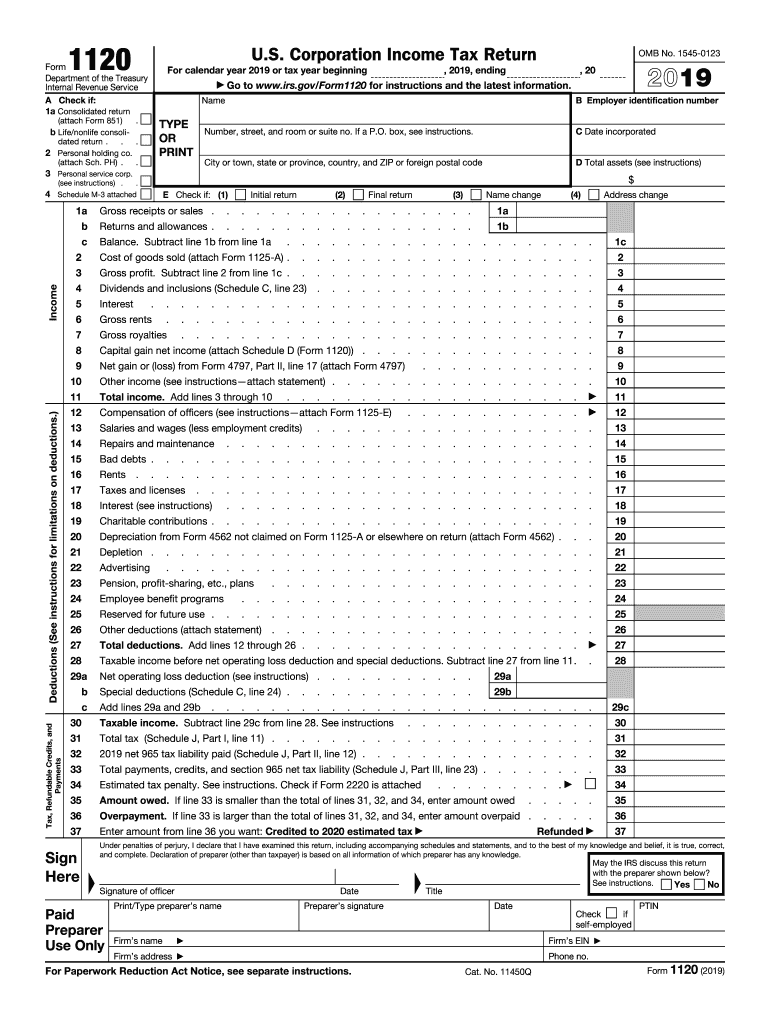

Form 1120

U.S. Income Tax Return

for an S Corporation

Tax return preparation service for

Business Owners starting at $400 including efiling.

Get Expert Advice

Form 1120 – U.S. Income Tax Return For Estates And Trusts

Form 1120S is used to file the U.S. Income Tax Return for an S Corporation. If your company is an S-corporation or if your company is taxed as an S corporation, you need to fill up Form 1120S to file your business’s federal income tax return. From this form, you are letting the IRS know how much your company has earned in that financial year. This includes income, credit, and deductions. If you are looking for an affordable outsourcing agency to do this somehow lengthy and complicated filing process for you, Meru Accounting is the perfect place for you.

Structure Of Form 1120

Information Required From The Client

In order to fill out Form 1120S on your behalf, we need these following information and documents-

- The date when your company has become an S-corp

- The date when your company was incorporated

- The business activity code of your company

- The employer I.D. number

- The details of your company shareholders

- The details of your company shareholders

- Information about your company profits, losses, assets and deductions

- Profit-loss statement for that financial year

- Balance sheet

- Detailed information about the fixed assets of the company

- Transaction listing of the Shareholders

- Previous Income tax payment copies

- Information on the accounting method if it’s accrual or cash

- Details of stock your company owns

Some of the documents or information can be difficult to obtain. In such cases, you can always coordinate with our tax expert to ensure the information is accurate.

Due Date Of Filing

The U.S. Income Tax Return for S-corp tax seems to have more tricky deadlines than the personal tax return dates since there’s no fixed date. However, the due date for submitting Form 1120S is technically by the 15th of the third month after the end of the financial year.

Our Process

Meru Accounting provides you the most error-free and hassle-free Form 1120S filing procedure.

Why Meru Accounting?

Meru Accounting is a well-known name in the USA for providing top-notch remote accounting services. It has a loyal client base in the USA and also all over the world. We are not only best in providing error-free and on-time services, but we also offer the most affordable price in the field.

The U.S. Income Tax Return for S-corp seems to be a bit complicated than the other tax returns. Hence you can rely on our experienced team of experts to get it done on time while you invest your own precious time into your business.

- The qualified team- All our accountants are highly qualified and well-trained and work under the supervision of CPA.

- Reasonable Charge- We charge the only US $15 per hour tax return service.

- Technology-driven- We have experience in various add on in Cloud Environment and along with accounting software.

- Standardised process- We have a decent Project management system that helps to communicate with our clients effectively.

- Real and Error-Free Work- We follow standard Procedures and checklist to provide error-free work.

- Quick Response- We assure timely response and generally reply to every email in a day or within 24 hours.

Experience in Use of Accounting Software:

- Thomas Reuters

- Gosystem Tax Solution

- ProSeries Tax S Lacerte

- Ultra tax solution and many more.

- We have expertise in preparing a Tax return for Federal and State Governments. We bring on table Customized solution for our Clients.

FAQs

An S Corporation is a company that meets the IRS benchmark to be taxed under Internal Revenue Code Chap-1, Sub Chap- S.

Gross receipts, interest, rents, cost of the goods sold, dividends, royalties, and capital earnings.

S corporation shareholders should be individuals, specific trusts, or tax-exempt organizations.