5 Ways to Get a Bigger Tax Refund in 2025

Maximizing your tax refund in 2025 is more achievable with early planning and a solid understanding of key factors. Many individuals overlook straightforward strategies that could increase the amount they receive. In this blog, we share five smart ways to boost your refund, clear common myths, and show how expert help can make a big difference.

Understanding Tax Refund

Tax season may bring challenges, but your tax refund in 2025 can still work in your favor. A tax refund is the amount you get back when you’ve paid more tax than you owe. With early planning and the right steps, your refund in 2025 could be higher than before. Expert help can also make a big difference in the final amount.

Why Your Tax Refund in 2025 Might Be Lower Than Expected

Many things can cut your refund short. Here are some common reasons:

Changes in Income

When your income goes up, your refund may drop. Higher income might reduce or remove your chance to claim certain tax credits. That change could lead to a smaller refund.

Low Tax Taken from Pay

If your boss did not take out enough tax during the year, you may owe more when you file. This can cut your refund or turn it into a bill.

Missed Tax Breaks

If you skip tax breaks like work costs or school credits, you get less money back. Many people leave out things they could claim.

Wrong Filing Choice

Picking the wrong filing type can cost you more. For example, choosing “single” when you could file as “head of household” may mean you miss out on extra savings.

Income Not Reported

If you forget to list money from side jobs or gig work, the IRS may change your return. This could shrink your refund or mean you owe more tax.

Tax Planning Mistakes That Cost You a Bigger Refund

To grow your Refund, you must avoid these simple mistakes:

Filing Without Reviewing

Quickly submitting your tax return without reviewing it can lead to small errors. These mistakes may delay your refund or lower the amount you receive.

Ignoring Tax Changes

Tax laws change every year. Missing updates to tax rules or limits can cause you to miss out on new credits or deductions that may increase your refund.

Skipping Professional Help

Filing taxes without guidance can mean missing money-saving options. Tax pros can uncover hidden deductions and make sure every form is filled out correctly.

Not Tracking Expenses

If you don’t keep records of your business or personal deductions, you can’t claim them. That means you’re likely losing out on a larger refund.

Filing Late

Filing after the deadline may lead to penalties. You might also miss the window to claim a refund. Filing early keeps your refund safe and on time.

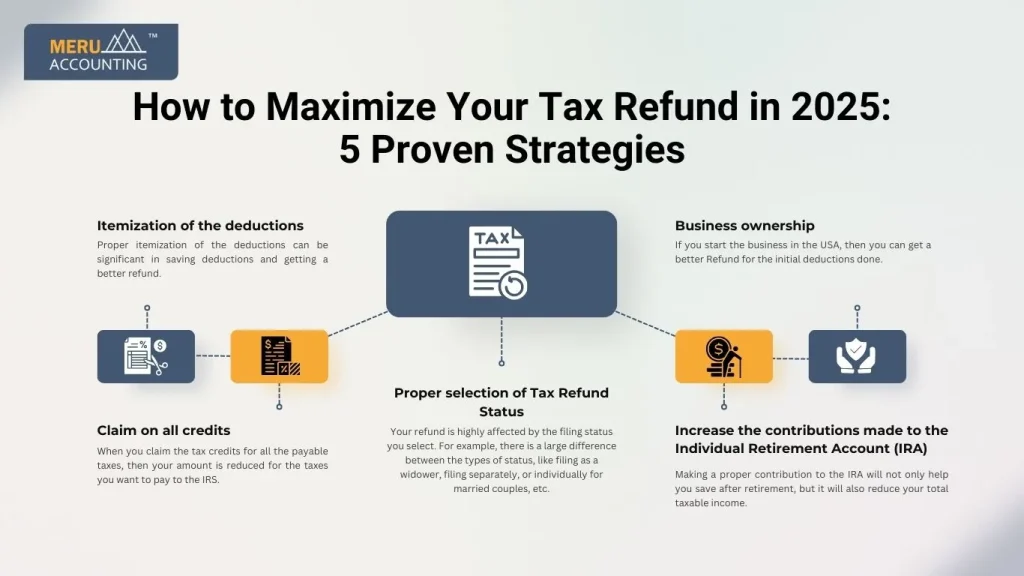

How to Maximize Your Tax Refund in 2025: 5 Proven Strategies

Maximizing your tax refund in 2025 starts with smart planning and informed decisions. Taking the right steps can help you claim more and keep more of what you earn.

1. Claim on all credits

When you claim the tax credits for all the payable taxes, then your amount is reduced for the taxes you want to pay to the IRS. There are some tax credits for a few premium insurance plans and other federal health care exchanges. It will give you a better refund. You must have an expert tax consultant who can help you understand all the tax credits you have.

2. Proper selection of Tax Refund Status

Your refund is highly affected by the filing status you select. For example, there is a large difference between the types of status, like filing as a widower, filing separately, or individually for married couples, etc. There are some smarter ways to get a better refund with proper selection of status.

3. Itemization of the deductions

Proper itemization of the deductions can be significant in saving deductions and getting a better refund. Some medical expenses, as well as charitable contributions, are some of the ways you get better refunds. However, you need to get better advice from the experts while doing this.

4. Increase the contributions made to the Individual Retirement Account (IRA)

Making a proper contribution to the IRA will not only help you save after retirement, but it will also reduce your total taxable income. This is one of the important refund tips where the IRS has reduced the taxable amount when you are contributing to the IRA.

5. Business ownership

If you start the business in the USA, then you can get a better Refund for the initial deductions done. The latest tax reforms done by the IRS offer better refunds for small businesses’ tax deductions.

These are some important 5 Tips For Refund which can be beneficial for you. However, you need to do it smartly with the help of expert guidance.

Tax Filing Tips to Boost Your Refund

Organize Documents Early

Start by gathering your tax records, like W-2s, 1099s, and receipts. Staying organized helps you file faster and claim all deductions you deserve.

Double-Check Your Return

Check all details on your tax return. A simple typo in your name, number, or figures could delay your refund or cause an IRS review.

Choose the Right Filing Status

Your filing status affects your refund. Choose the one that fits your situation best, such as head of household or married filing jointly.

Use E-Filing

E-filing is quicker than mailing and reduces mistakes. It also confirms receipt of your return and sends your refund faster through direct deposit.

Opt for Direct Deposit

Direct deposit gets your refund to your bank faster. It’s safe, fast, and avoids delays that come with mailed checks.

Common Myths About Getting a Bigger Tax Refund

Let’s clear some false ideas about the Tax Refund:

A Bigger Refund Means You Saved

A large refund just means you overpaid taxes during the year. It is not a sign of savings or smart tax planning.

Filing Early Always Gets Bigger Refunds

Early filing helps get your refund faster, but it doesn’t increase the amount. Only your tax situation and credits decide that.

Claiming Fewer Dependents Increases Refund

Claiming fewer dependents may lead to more withheld tax, but not a higher refund. You might be losing valuable tax credits.

Getting a Refund Is Always Good

Getting a refund feels nice, but it means you loaned the government money for free. Smart planning means a smaller refund and more year-round cash.

You Need to Owe to Get Credits

Refundable credits like earned income and child tax credit can lead to refunds even if you owe nothing. You just need to qualify.

Extra Tips to Maximize Your Tax Refund in 2025

Use Tax Software or a Professional

- Tax software can check for missed deductions.

- A tax expert knows all the latest rules.

- Both can help boost your tax refund.

Keep Track of Education Expenses

- If you or your kids are in school, save receipts.

- Education credits and deductions can increase your tax refund in 2025.

Save for Health Care

- Contribute to a Health Savings Account (HSA).

- HSA contributions are tax-deductible.

- They reduce taxable income and may increase your refund.

Watch Out for Common Mistakes

- Wrong Social Security number.

- Forgetting to sign the return.

- Missing income records.

- Errors delay your tax refund.

Plan Every Year

- Don’t wait until tax season.

- Keep track of expenses all year.

- Planning makes it easier to get the biggest tax refund in 2025.

Common Myths About Tax Refunds

Many people still trust myths about a tax refund. Knowing the facts helps you plan better.

Myth 1: A Bigger Refund Means I Saved More

A refund is not a reward.

It shows you paid too much tax during the year.

In short, you gave the IRS an interest-free loan.

Myth 2: Only High Earners Get Refunds

This is false.

Low and mid-income workers can also get large refunds.

Tax credits like EITC or the child credit make this possible.

Myth 3: Filing Late Boosts My Refund

Filing late does not give you more cash.

It only slows down your refund.

The best way is to file on time and get your money fast.

Myth 4: Refunds Are Always Good News

Not true.

A refund means you overpaid.

It is better to adjust your tax so you keep more money each month.

Myth 5: My Refund Is Always Correct

Many think the IRS never makes mistakes.

But errors can happen.

That’s why you should check your return and track your refund.

At Meru Accounting, we work to help you get the highest possible tax refund. Our tax experts check your income, deductions, and credits to make sure you don’t miss anything. We also guide you through the year so you can plan and get the best results.

FAQs

When Will I Get My Tax Refund in 2025?

Most refunds arrive within 21 days after the IRS accepts your return. Using e-filing with direct deposit helps speed things up.

What If My Refund Is Delayed?

Use the IRS online tool “Where’s My Refund?” to track your return status. Delays may happen due to errors or extra review.

Can I Get a Refund If I Have No Income?

Yes. You can qualify for certain refundable credits even with no income. Be sure to file a return to claim them.

Do I Need to File to Get a Refund?

Absolutely. Filing a return is required to claim any refund, even if your total tax bill is zero or negative.

Will My Refund Be Taxed Later?

In most cases, your refund is not taxed. However, interest on late refunds or specific credits might be taxable.