Home » What We Do » Tax Returns » Form 1040 » Form 1040-ES

Form 1040-ES

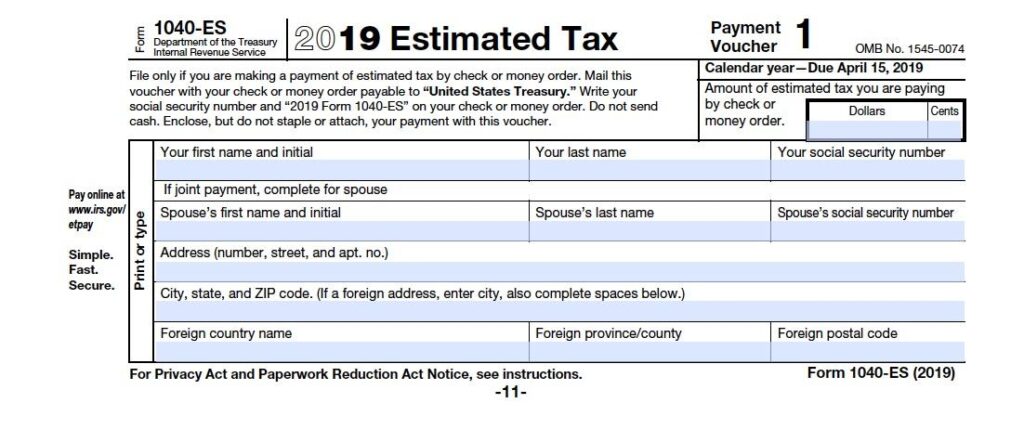

Estimated Tax, Self-employment Tax, Internal Revenue Service

Get Expert Advice

Form 1040-ES – Estimated Tax, Self-Employment Tax, Internal Revenue Service

Form 1040-ES is used to pay estimated taxes for the current year in the United States. When a person indulges in any form of work that contributes to him/her through income, he/she is liable to pay taxes to the Government. For the United States, Internal Revenue Service (IRS) is the federal authority that individuals are abided by for paying taxes.

Though filing tax is not that easy, that you simply turn on the computer and click on “Pay Tax” and it’s done. There are various Forms that are to be filed as per the eligibility, income amount, and nature of work. Form 1040 is used to file taxes for the income earned, whereas Form 1040 ES is used to file the estimated tax for the current year on an estimation of incomes to be earned.

Who has to file Form 1040-ES?

- If you are working as an independent contractor, freelancer, sole proprietor, partner, or are self-employed, you are supposed to file for estimated tax as your taxes are not deducted from your paychecks, unlike salaried employees.

- In addition to that, if you have any income from interests, dividends, rent, retirement benefits, taxable unemployment compensation, etc. you have to file Form 1040-ES as taxes on these particulars are not deducted at source.

- If you have due in estimated tax amounting $1000 or more, you have to file Form 1040-ES.

Structure Of Form 1040-ES

Information Required From The Client

To file Form 1040-ES, we would require the following information from your hand

- Personal and Professional Identification Proofs

- Income Details

- Other Income if any (Through dividend, rent, etc.)

- Bank Details

- Social Security Numbers

Due Date Of Filing

As it is a quarterly tax payment, there are four deadlines set by the Internal Revenue Service.

- April 15

- June 15

- September 15

- January 15

Though, if you file your yearly tax return of the current year by February 1 of the next year, you are not required to file quarterly tax on January 15.

Our Process

Meru Accounting has more than 10 years of experience in providing outsourcing services. We make sure that our clients have an easy and hassle-free experience.

Clients are required to provide us with the necessary documents. Do not worry as we send a standard checklist of the documents needed to our clients to make sure of a smooth process. Meru Accounting operates in the following modes:

Why Meru Accounting?

Meru accounting is a leading outsourcing and bookkeeping company, and masters in but not limited to auditing, taxation, IFRS, various regulations in a variety of industries in the US as well as around the globe.

We have a strong hold of satisfied clients around the world; our team of experts looks after even the smallest of details to ensure quality. We have expertise in outsourcing solutions for the U.S. Income Tax Return for Estates, Trusts, and Individuals.

In addition to that, the best part is that we charge a very competitive rate of $15/per hour. Thus, choosing us would only make your process easy, rapid, and pocket friendly.

- You had no tax liabilities in the previous year

- You were a US citizen or resident for that entire year

- The previous year you referred consists of 12 months

- In this case, you are not liable to pay estimated tax.

Internal Revenue System provides various easy and secure payment options that taxpayers can use as per their convenience.

I. Pay online

– Credit/Debit card

– IRS Direct Pay

– Electronic Fund Withdrawal (WFW)

– Online Payment Agreement (For monthly instalment payments)

– IRS2Go (Mobile Application)II. Pay by Phone

– Credit/Debit card

– EFTPSIII. Mobile Device

– Using IRS2Go ApplicationIV. Pay by Cash

V. Pay by Cheque or Money Order using Estimated Tax Payment Vouchers

Visa, MasterCard, American Express or Discover credit cards are acceptable cards for tax payments. In addition to that, one can use your debit card with the NYCE, Pulse or Star logos or a Signature Debit card as well.

After the payment is done, it usually takes the Internal Revenue System 5 to 7 days to reflect the completion of paying estimated tax.

If you have any other queries related to filing or paying tax through Form 1040-ES, do not hesitate to Contact us. We are just a touch away, and would be happy to assist you!