Form 5472 for Information Return of a 25% Foreign-Owned US Corporation

If you own or want to start a U.S. business with foreign ties, you need to know about Form 5472. The IRS needs some U.S. firms and LLCs with foreign owners to file this information return. It shows deals between the U.S. business and its foreign owners. This helps the IRS track foreign links and tax rules.

Form 5472 is not a tax form. It is a report for firms that are at least 25% foreign-owned. If your U.S. firm has deals with a foreign owner or group, this form must be filed. It is sent with Form 1120, the U.S. company tax return. If you don’t file, the fine starts at $25,000. This guide will show who must file IRS Form 5472, how it works for LLCs, and how to avoid fines.

Who Must File IRS Form 5472?

1. U.S. Corporations with Foreign Ownership

Any U.S. corporation that is 25% or more owned by a foreign person must file Form 5472.

2. Foreign-Owned Disregarded LLCs

Single-member LLCs treated as disregarded entities must file if the owner is foreign.

3. Foreign Corporations Doing Business in the U.S.

Foreign entities involved in U.S. trade or business are also required to file.

4. U.S. LLCs with 25% or More Foreign Ownership

If a U.S. LLC has a foreign individual or company owning 25% or more, it must file.

Why Is IRS Form 5472 Important?

1. Required for U.S. Tax Compliance

It ensures your business complies with U.S. tax laws for foreign-owned entities.

2. Avoid Heavy IRS Penalties

Missing this form can lead to a minimum $25,000 fine.

3. Reports Foreign Interests

It informs the IRS of foreign ownership and transactions.

4. Part of an Information Return

This form is not a tax return, but an information return disclosing reportable transactions.

When to File Form 5472

1. Due with Form 1120

Form 5472 must be filed along with Form 1120, even if no tax is owed.

2. Calendar-Year Deadline

Due by April 15 for businesses using the calendar year.

3. Fiscal-Year Deadline

For fiscal-year taxpayers, it’s due by the 15th day of the fourth month after year-end.

4. Extension Option

You may request more time by filing Form 7004.

Which Businesses Must File Form 5472?

1. C Corporations with Foreign Ownership

A C Corp with 25% or more foreign ownership must file.

2. Foreign-Owned Single-Member LLCs

LLCs with one foreign member must also file.

3. U.S. LLCs with Foreign Persons

Any LLC with a foreign owner or shareholder is included.

4. Businesses with Foreign Transactions

If the business has deals with a foreign party, it must file.

What Is a Reportable Transaction?

1. Sale or Purchase of Goods

Buying or selling products from or to a foreign person.

2. Loans or Transfers of Money

Includes loans, repayments, and money transfers.

3. Rent or Lease Agreements

Leasing space or property to or from a foreign person.

4. Use of Property

Includes using intellectual or physical property.

5. Paid Services

Services provided or received from foreign entities must be reported.

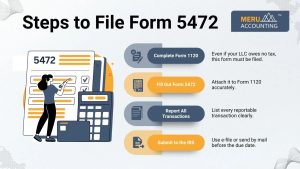

Steps to File Form 5472

1. Complete Form 1120

Even if your LLC owes no tax, this form must be filed.

2. Fill Out Form 5472

Attach it to Form 1120 accurately.

3. Report All Transactions

List every reportable transaction clearly.

4. Submit to the IRS

Use e-file or send by mail before the due date.

Form 5472 for Disregarded LLCs

1. Required for Foreign-Owned LLCs

If a foreign person owns a U.S. LLC, they must file Form 5472 as an information return.

2. File Even with No Income

This is an information return, not based on income earned.

3. Obtain an EIN

The LLC must have an Employer Identification Number.

4. Submit Blank Form 1120

You must file a blank Form 1120 with Form 5472 attached.

Details Required on IRS Form 5472

- Business name and EIN

- Name and address of the foreign owner

- Type of transactions

- The total amount of each transaction

- Relationship to the foreign person

Common Mistakes to Avoid

1. Not Filing Form 1120

Form 5472 must be attached to Form 1120 — never file it alone.

2. No EIN for the LLC

Disregarded LLCs need an EIN before filing.

3. Missing Transaction Details

Incomplete or vague reports may trigger IRS issues.

4. Filing Late

Delays bring automatic penalties.

5. Assuming It’s Not Needed Without Income

Even if the LLC had no revenue, filing is still required.

Penalties for Not Filing

1. $25,000 for Non-Filing

Each failure to file can cost $25,000 or more.

2. Additional Penalties After Notice

An extra $25,000 added for each 30-day delay after the IRS notice.

3. Criminal Charges Possible

Long-term non-compliance could lead to legal action.

4. Applies to No-Income LLCs

Penalties apply even if the LLC had no activity or income.

Form 5472 and Form 1120: Key Relationship

1. Cannot File Form 5472 Alone

It must always be part of a Form 1120 filing.

2. Required Even Without Tax Due

Even tax-free LLCs must file a pro forma Form 1120.

3. IRS Uses Form 1120 for Recordkeeping

The IRS uses Form 1120 to track U.S. operations of foreign-owned entities.

Does My LLC Need to File Form 5472?

If your LLC is:

- A single-member LLC

- 25% or more owned by a foreign person

- Has any reportable transactions

Then yes, you must file Form 5472 with a pro forma Form 1120.

How to Get an EIN for an LLC

If your LLC has a foreign owner, you must get an EIN (Employer Identification Number) before you can file Form 5472 and Form 1120. Here’s how to get it done:

1. Apply Online or Using Form SS-4

- If you are in the U.S., you can apply online through the IRS website.

- The online tool gives you the EIN right away after you finish the form.

- Foreign owners cannot use the online method unless they have a U.S. address and a Social Security Number (SSN).

- If you are outside the U.S., use Form SS-4. You must send it by fax or mail to the IRS.

- You do not need an SSN or ITIN to get an EIN, but you must follow the rules on Form SS-4.

2. Required Before Filing

- Your LLC must get an EIN before filing Form 5472 or Form 1120.

- Without an EIN, the IRS will reject your filing.

- Even if your business made no money, this step is still required.

- The EIN lets the IRS track your firm’s U.S. tax records.

- You only need to get it once—it stays the same each year.

3. What You Need to Apply

- Business name and U.S. mailing address

- Name of the person in charge (owner or rep)

- Reason for applying (like starting a new U.S. business)

- Business type (LLC, Corporation, etc.)

- Phone number and your signature (handwritten or digital)

4. How Long Does It Take?

- Online: You get your EIN right away.

- Fax: It takes 1–2 weeks.

- Mail: It can take 4–6 weeks or more.

- To avoid delays, apply early—don’t wait till tax time.

5. Tips for Foreign Owners

- If you do not have an SSN, write “Foreign” in that field on Form SS-4.

- Try to use a U.S. address if you have one. If not, the IRS also accepts foreign ones.

- If the form seems hard, ask a tax pro or CPA to help.

- Keep a safe copy of your EIN letter. You’ll need it for every IRS form each year.

Recordkeeping Tips for Form 5472

- Save all contracts and invoices

- Track all transactions with foreign persons

- Keep proof of wire transfers and loans

- Back up transaction amounts with documents

- Use accounting software for accuracy

Examples of When to File

- Example 1: A U.S. LLC pays $5,000 to its foreign parent – must file

- Example 2: A U.S. corporation rents office space from a foreign owner – must file

- Example 3: A U.S. LLC loans money to its foreign investor – must file

Filing Options

1. E-File with IRS

Use the IRS e-file system or authorized software.

2. File by Mail

Send forms to the IRS mailing address listed for Form 1120.

3. Use a CPA or Tax Software

Professional help reduces the risk of mistakes.

4. Keep Proof of Filing

Save confirmation or tracking as proof for IRS audits.

Filing Form 5472 is not just a task—it is the law for foreign-owned U.S. firms. If your LLC has any foreign owners, this form must be filed. Even if your business made no money, you still need to file Form 5472 with a simple Form 1120. If you skip it, you may face large fines and IRS issues.

You must report all deals with foreign owners or groups. These can include payments, loans, or gifts. File this information return on time, and check each part of the form carefully. Wrong or missed details can cause trouble and extra costs.

Keep clear and full records. Track all money deals. Save copies of contracts, bills, and emails. These help when you file, and if the IRS asks for proof. If you are unsure what to add, ask a tax expert.

The IRS rules for Form 5472, Form 1120, and foreign-owned LLCs can be tough. But you don’t have to do it alone. Meru Accounting helps many foreign-owned firms stay on track. We check each step and make sure your forms are right and sent on time.

We help with getting your EIN, preparing filings, and giving full tax support. If you just set up your LLC or have run it for years, we are here to help. Let Meru Accounting make the process simple and stress-free for you and your business.

FAQs

1. What is IRS Form 5472 used for?

It is an information return that tells the IRS about deals between a U.S. business and its foreign owners.

2. Who must file Form 5472?

Any U.S. LLC or company that is 25% or more foreign-owned.

3. Do LLCs with no income still need to file?

Yes. If they are foreign-owned and have any deals, they must file.

4. What is the penalty for not filing Form 5472?

The fine starts at $25,000 and may grow if you delay more.

5. Is Form 1120 required with Form 5472?

Yes. You must file Form 1120, even if it has no income.

6. Can I file Form 5472 electronically?

Yes. You can e-file both Form 5472 and Form 1120.

7. Do I need an EIN to file Form 5472?

Yes. Every foreign-owned LLC must get an EIN to file.