Tax Return 2025: A Simple Guide to Easy Filing

Filing your tax return for 2025 may seem hard at first, but with the right plan, it can be quick and stress-free. Each year, tax laws, cuts, and filing rules change, so it is key to stay up to date. If you start soon, you avoid slip-ups, claim all your tax cuts, and file on time with no fines.

This guide is your one-stop help for the 2025 tax season. It covers how to use the federal tax calculator 2025, avoid IRS issues, and get the most from your tax filing. You will also learn common mistakes to avoid, how to claim the right deductions,

Introduction to Your 2025 Tax Return

Tax filing is often seen as just sending forms to the IRS. In reality, your Tax Return 2025 provides a full picture of your income and tax details for the year. It lists what you earn, what you spend, tax credits, and whether you owe or get a refund.

Start early. Get your papers ready. Know the new rules. Use online tools to file fast and right. A wrong file can cost you cash, time, or lead to IRS checks.

Key Dates for Your Tax Return 2025

Know the key dates for tax year 2025 so you can plan and file on time.

- Start date: The IRS will take files in late January.

- Due date: Mid-April is the norm.

- Extension: You can ask for more time, but you still must pay on time.

Mark these dates to stay on track. On-time file means a fast refund and less stress.

Why Filing Your 2025 Tax Return Matters

- Law Rule – The IRS says you must report what you earn and pay your taxes.

- Avoid Fines – If you miss the date, you may owe late fees and high costs.

- Claim Refunds – File to get the money you paid extra. Many lose cash when they do not file.

Using the Federal Tax Calculator 2025

The federal tax calculator 2025 is a quick way to check tax due.

- Add pay, cuts, and credits.

- See tax owed or refund due.

- Change paycheck tax to plan.

This tool helps you avoid shocks and makes your Tax Return 2025 smooth and fast.

How to Prepare Before Tax Time

Start soon. Keep notes on what you earn, what you spend, and all bills. This makes it easy when you file your 2025 tax return. Early prep saves you stress and late fees.

Understanding Changes in Tax Laws for 2025

Tax rules can change each year due to economic shifts, new laws, or rising costs. Understanding these updates helps you file your Tax Return 2025 correctly and maximize savings.

Higher Standard Deduction

The IRS raised the standard deduction for 2025. This cut lowers the income you pay tax on. You do not need to list each expense to claim it.

- Single filers: A small rise from 2024.

- Married filing jointly: A bigger rise to help offset costs.

New Tax Brackets

The income levels for tax rates have moved up. This may put you in a lower or higher tax band based on what you earn. Use the federal tax calculator 2025 early to see your rate.

Tax Credit Updates

Some credits ended, while others changed:

- Child Tax Credit: Adjusted for cost-of-living rise.

- Green home credit: Bigger savings for eco upgrades.

- School credits: Still there, but with new income caps.

Higher Retirement Limits

You can now put more into a 401(k) or IRA in 2025. This lets you save more and pay less tax.

Staying on top of these changes helps you avoid mistakes on your Tax Return 2025

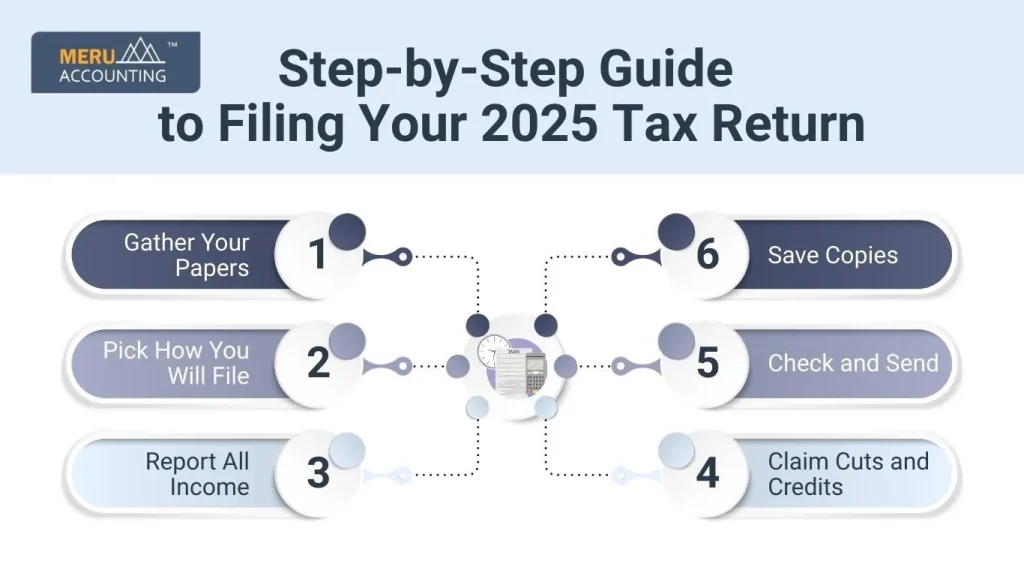

Step-by-Step Guide to Filing Your 2025 Tax Return

Filing your Tax Return for 2025 can be smooth if you stay organized. Most errors come from rushing or skipping steps.

Gather Your Papers

Collect W-2s, 1099s, bank slips, bills, and any notes on what you spent. Having all files ready saves time and stops mistakes.

Pick How You Will File

You can send your 2025 tax return in three ways:

- Online: Fast, easy, and checks for errors.

- Paper: Slower, but some still use it.

- Tax pro: A tax expert, like Meru Accounting, can help you file right and get full refunds.

Report All Income

List all the money you made, such as:

- Pay from jobs.

- Cash from side work.

- Gains from stocks or funds.

- Rent or other business pay.

Missing even small amounts can lead to IRS alerts.

Claim Cuts and Credits

Cuts lower the money you pay tax on. Credits take cash off your tax bill. Keep notes and bills to show proof.

Check and Send

Read through your return before you send it. A wrong Social Security number or math slip can slow down your refund.

Save Copies

Keep paper and online copies for at least three years. You may need them if the IRS asks for proof later.

Why Use a Tax Calculator?

The federal tax calculator 2025 is a smart way to plan before you file.

- Plan Ahead: See early if you will owe tax or get a refund. Plan your budget better.

- Avoid Shocks: Know your tax due before you file. No big, late bills.

- Fix Pay Checks: Check if your boss takes enough tax out. Change it if needed.

Steps for a Right Result

- Pick your file status: single, married, or head of household.

- Add all income: job pay, side work, or other cash.

- Add cuts and credits you can claim.

- Check the tax guess and plan what to do next.

The federal tax tool 2025 is a smart way to plan. It helps you avoid fines, make good cash moves, and stay calm at tax time.

How to Max Out Cuts and Credits in 2025

Many pay more tax because they miss cuts or credits. Learn what you can claim to lower your bill and boost your refund on your Tax Return 2025.

Common Cuts

- Home Costs: Loan interest, tax on land, and loan fees.

- Health Bills: Costs you paid over the IRS limit.

- School Costs: Loan interest, class fees, and books.

- Gifts: Cash or goods you give to charities.

Key Credits

- Child and Care Credit: For kids or others you support.

- Earned Income Credit: Helps low or mid-income earners.

- Green Home Credit: For solar or other energy-saving tools.

Tips for More Savings

- Keep all bills and proof of costs you can cut.

- Use tax tools or ask a pro to spot missed credits.

- Check new tax rules each year to stay on track.

Claiming all cuts and credits helps you get the best deal on your 2025 tax return. A bit of prep can mean big cash back.

Common Issues and How to Avoid IRS Penalties in 2025

“Mistakes can delay your refund or lead to IRS fines. Learn the top errors to avoid so you can file your Tax Return 2025 correctly the first time.

Top Errors People Make

- Wrong or missing Social Security numbers.

- The income reported does not match IRS records.

- Forgetting to sign or confirm your e-file.

- Claiming cuts without bills or proof.

Late File and Pay Fines

If you file late or pay late, the IRS adds fees and interest. Even if you can’t pay all at once, file on time to cut extra costs.

How to Avoid These Issues

- Start early so you don’t rush or make slips.

- Use IRS tools you trust or a tax pro if your case is hard.

- Keep clear notes of pay, cuts, and credits.

These steps help you file a clean Tax Return 2025, avoid fines, and stay in good standing with the IRS.

At Meru Accounting, we offer:

- Preparing and filing federal and state returns.

- Reviewing past returns to correct errors.

- Identifying deductions and credits you may have missed.

- Providing tax planning advice for future years.

FAQs

- When is the deadline for filing my 2025 tax return?

The IRS sets it in mid-April most years. It can change for holidays or big events. File early to fix errors and avoid fees. - Can I file my 2025 tax return online?

Yes. It is fast, safe, and checks for mistakes. You often get refunds quicker than with paper. - What if I make a mistake on my return?

You can file again with IRS Form 1040-X. Do this fast to avoid extra costs and keep your records right. - Do I need a tax pro for my 2025 tax return?

No. But it helps if you have many incomes, big write-offs, or self-work pay. A pro can save time and find more refunds. - What papers should I keep after filing?

Keep W-2s, 1099s, bills, and a copy of your return for three years. They help if you face an audit and make the next year easy. - What if I miss the filing date?

You may get late fees and interest. The longer you wait, the more you owe. File soon, even if you can’t pay all, to cut costs. - Can I still get a refund if I file late?

Yes, you can file as long as it is within three years of the due date. Filing late may slow your refund or make you lose credits.