Home » Income Tax vs Payroll Tax: What’s The Difference?

Payroll tax vs income tax: What’s The Difference?

When you get your paycheck, you might see deductions. The biggest ones show the payroll tax vs income tax difference. Many people think they are the same. But they are very different. If you run a business, you know tax season can be tough. You must file taxes on time, use the right codes, follow laws, and stay on top of deadlines. That’s why many clients trust us to handle their tax work with care and skill.

Business taxes can be complex. To make things simple, let’s look at the two main types of taxes businesses deal with: income tax and payroll tax. Let’s break down the difference between income and payroll tax in a clear and easy way. This blog will help you understand payroll tax vs income tax, how each one works, and why both are important.

Payroll tax vs income tax

What Is Payroll Tax?

Payroll tax is money taken from an employee’s pay to fund Social Security and Medicare. It’s paid by both the employer and the worker.

- Social Security tax: 6.2% from the employer + 6.2% from the employee

- Medicare tax: 1.45% from the employer + 1.45% from the employee

These funds help pay for health care, disability, and retirement. Besides the federal payroll tax, some states also collect payroll tax.

What Is Income Tax?

Income tax is the amount an employee pays based on their total earnings. The rate is not fixed; it changes based on income. This is one key difference between income and payroll tax.

This tax is based on details in the W-4 form. The more you earn, the higher your tax rate.

Employers must also deduct and send this tax to the IRS during payroll processing.

Payroll tax vs income tax

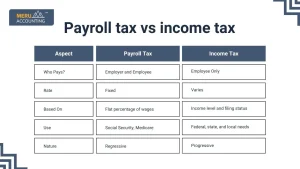

Aspect | Payroll Tax | Income Tax |

Who Pays? | Employer and Employee | Employee Only |

Rate | Fixed | Varies |

Based On | Flat percentage of wages | Income level and filing status |

Use | Social Security, Medicare | Federal, state, and local needs |

Nature | Regressive | Progressive |

- Income tax is progressive; payroll tax is not. That’s the core difference between income and payroll tax.

- Payroll taxes are regressive, meaning the tax takes a smaller percentage of income as earnings rise.

Detailed Look at Payroll Tax

1. Standard Payroll Tax Rates

Payroll tax has two main parts: Social Security and Medicare. As a worker, you pay 6.2% for Social Security and 1.45% for Medicare. That’s a total of 7.65% from your pay.

Your employer also pays 7.65%, which matches what you pay. So in total, 15.3% goes toward payroll taxes—half from you and half from your boss.

2. Extra Medicare Tax for High Incomes

If you earn more than $200,000 a year, you must pay an extra 0.9% in Medicare tax. This extra tax only applies to the amount over $200,000. Only workers pay it—employers do not match it.

For example, if your income is $250,000, you pay 1.45% on the first $200,000 and 2.35% on the last $50,000.

3. No Tax Return Needed

You do not need to file a tax return for payroll taxes. Your boss takes the right amount from each check and sends it to the IRS. This happens every time you get paid.

That means you don’t have to track or send these taxes. Your employer takes care of it.

4. No Deductions or Credits

Payroll taxes are not like income taxes. You can’t use credits, deductions, or exemptions to lower them. The rate is the same for everyone, no matter your age, income, or family size.

That makes payroll tax simple but strict. You always pay a set part of your pay, with no way to reduce it.

Self-Employed People: A Special Case

1. They Pay Both Shares of Payroll Tax

- Total payroll tax is 15.3%:

- 12.4% for Social Security

- 2.9% for Medicare

- 12.4% for Social Security

- If income is above $200,000, add 0.9% extra Medicare tax.

2. Can Deduct Half the Payroll Tax

- You can deduct 7.65% of the tax when filing your income tax return.

- This deduction lowers your taxable income.

3. Must File Income Tax Return

- Self-employed workers must still file a return each year.

- They also must pay quarterly estimated taxes to avoid penalties.

- Keeping detailed records helps reduce tax errors.

Why You Should Know the Difference Between Income and Payroll Tax

1. Smarter Money Management

- Helps with financial planning and tax savings.

- Knowing the difference between income and payroll tax helps you estimate take-home pay and avoid mistakes.

2. Better Understanding of Paycheck

- See which taxes are taken out and why.

- Know what part of your income funds public benefits.

3. Avoid Mistakes

- Reduces chance of tax errors and missed filings.

- Helps avoid IRS audits or penalties.

4. For Business Owners

- Helps calculate labor costs better.

- Avoid costly mistakes in tax reporting and payroll setup.

What Employers Must Know

1. Withholding Taxes

- Employers must withhold both payroll and income tax from wages.

- These funds are sent to the IRS and/or state tax office.

2. Employer Contribution

- Employers must match the 7.65% (Social Security and Medicare) of payroll tax.

- Failure to do so leads to heavy fines and legal trouble.

3. Filing Reports

- Employers must file Forms like 941, W-2, and 940.

- Payroll tax deposits are due either monthly or semi-weekly.

4. Keep Payroll Records

- Maintain clear records of wages, hours worked, and tax withheld.

- IRS may audit these records anytime.

How to Spot Taxes on Your Payslip

1. Income Tax Line

- Look for terms like “Federal Income Tax” and “State Income Tax.”

- This is a tax based on your income level and filing status.

2. Payroll Tax Lines

- Usually labeled as “Social Security Tax” and “Medicare Tax.”

- May also show additional Medicare tax for high earners.

3. Total Deductions

- This shows the sum of all taxes taken from your check.

- Helps you understand your net vs. gross pay.

4. Employer Contribution (Often Not Shown)

- While not always listed, employers pay their share too.

- Your real cost to the company is higher than your paycheck.

Real-Life Example

Case: You earn $60,000 a year

Payroll Tax:

- Social Security (6.2%) = $3,720

- Medicare (1.45%) = $870

- Total = $4,590 (your employer pays the same)

Income Tax (Estimate):

- Based on tax bracket, filing status, and deductions

- Could range from $6,000 to $9,000 or more

- May be lower with tax credits

You pay both taxes, but the payroll tax vs income tax purpose is different, one funds benefits, the other funds public programs.

Tips to Stay Tax-Smart

1. Review Your Pay Stubs Monthly

- Check your pay stubs each month to ensure taxes are withheld right. Early review helps avoid costly year-end mistakes.

2. Use Online Tax Estimators

- Use trusted tax tools to guess your income and payroll taxes. They help you plan ahead and avoid shocks.

3. File Your Tax Return on Time

- Send in your tax form before the IRS due date. Late filing can lead to fees, fines, or late refunds.

4. Make Quarterly Payments if Self-Employed

- If you work for yourself, you pay taxes each quarter. This avoids a big bill later and helps you follow the law.

5. Maintain Receipts and Expense Records

- Keep all bills, slips, and logs of your costs. Good records help with tax cuts and lower audit risk.

6. Consult a Tax Professional When Needed

- For tough tax cases, get help from a tax pro. They make sure your tax work is done right and can cut your costs.

7. Stay Informed on IRS Rules

- Tax laws change fast. Check IRS news or join updates to stay up to date.

8. Know Your Tax Role and Duties

- Whether you’re staff, freelance, or own a firm, know what taxes you owe. It helps you stay safe and stress-free.

Knowing the difference between income and payroll tax is key all year, not just at tax time. Income tax pays for public needs like roads and schools. Payroll tax helps fund Medicare and Social Security.

By understanding how payroll tax vs income tax works, you can stay compliant, cut errors, and plan better. You’ll also know what’s being taken from your pay and why.

Taxes can be tough, but you’re not alone. Meru Accounting handles tax filing and payroll with care, so you can focus on what matters most: growing your business.

FAQs

Q1. What is the main difference between income and payroll tax?

- Income tax funds public services.

- Payroll tax supports Social Security and Medicare.

Q2. Can I reduce payroll tax?

- Not directly unless self-employed, then you can deduct half.

Q3. Are both taxes deducted from my paycheck?

- Yes, they show on different lines in your pay stub.

Q4. Do employers pay income tax for employees?

- No, but they do withhold and send it to the IRS.

Q5. What if my employer doesn’t pay payroll tax?

- They may face large penalties and legal trouble.

Q6. Do high earners pay more in payroll tax?

- Yes, they pay an extra 0.9% Medicare tax on over $200,000.

- Social Security tax has a wage cap, but Medicare doesn’t.