Accounts Payable Outsourcing: A Complete Guide for Business Owners

One job that many owners forget about is paying bills on time. You may have to pay for supplies, rent, tools, or other services. If you miss a payment, you can get in trouble. It may hurt your business. That’s why many smart companies now use Accounts Payable Outsourcing. This means they let experts handle all their bills and payments.

These experts keep track of what you owe, make sure you pay on time, and help you stay organized. It’s a simple way to make sure you don’t miss anything. Big or small, every business needs to stay on top of what it owes.

If you feel like paying bills is stressful or takes too much time, you are not alone. Many business owners feel the same. That’s where Accounts Payable Outsourcing helps.

What Is Accounts Payable Outsourcing?

Accounts Payable means the money you owe to other bills. It includes payments to vendors, service teams, or anyone who gave you products or services. Outsourcing means letting another company or team do this work for you.

So, Accounts Payable Outsourcing means you hire someone outside your company to take care of your bills and payments.

These experts handle everything from:

- Getting the bill

- Checking if it’s right

- Entering it into your system

- Getting it approved

- Paying it on time

- Recording the payment

They do all the steps for you. This is also called end-to-end accounts payable service. You don’t have to do anything.

This helps you focus on your work while they take care of the bills. You won’t miss payments, you’ll avoid late fees, and you’ll have clean records.

Why Do Businesses Use Accounts Payable Outsourcing?

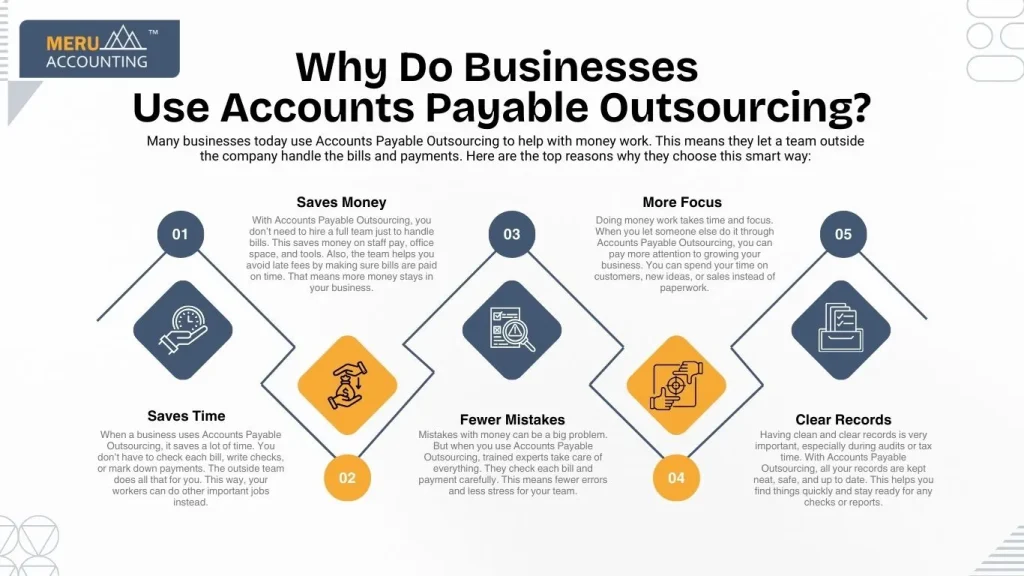

Many businesses today use Accounts Payable Outsourcing to help with money work. This means they let a team outside the company handle the bills and payments. Here are the top reasons why they choose this smart way:

1. Saves Time

When a business uses Accounts Payable Outsourcing, it saves a lot of time. You don’t have to check each bill, write checks, or mark down payments. The outside team does all that for you. This way, your workers can do other important jobs instead.

2. Saves Money

With Accounts Payable Outsourcing, you don’t need to hire a full team just to handle bills. This saves money on staff pay, office space, and tools. Also, the team helps you avoid late fees by making sure bills are paid on time. That means more money stays in your business.

3. Fewer Mistakes

Mistakes with money can be a big problem. But when you use Accounts Payable Outsourcing, trained experts take care of everything. They check each bill and payment carefully. This means fewer errors and less stress for your team.

4. More Focus

Doing money work takes time and focus. When you let someone else do it through Accounts Payable Outsourcing, you can pay more attention to growing your business. You can spend your time on customers, new ideas, or sales instead of paperwork.

5. Clear Records

Having clean and clear records is very important, especially during audits or tax time. With Accounts Payable Outsourcing, all your records are kept neat, safe, and up to date. This helps you find things quickly and stay ready for any checks or reports.

What Does End-to-End Accounts Payable Mean?

End-to-End Accounts Payable means the whole bill-paying process is handled for you from start to finish. When you use this kind of service, an expert team takes care of every single step. You don’t have to worry about missing a bill or paying the wrong amount. Let’s look at how it works, step by step:

1. Invoice Receipt

This is the first step. The team gets the bills (called invoices) from your vendors or suppliers. These are the people you buy things or services from. You don’t have to collect them yourself.

2. Invoice Review

Next, the team checks each bill to make sure there are no mistakes. They look at the amount, the due date, and what the bill is for. If something is wrong, they will let you know.

3. Approval Workflow

After the bill is checked, it needs approval. That means someone from your team must say “yes, this is correct.” The outsourcing team makes sure the right person sees the bill and approves it quickly.

4. Payment Processing

Once the bill is approved, the team pays the vendor. They make sure it’s done at the right time so you don’t get any late fees. You also don’t need to write checks or log in to your bank account.

5. Record Keeping

The last step is saving the info. The team enters each payment into your books. They also make reports so you can see what was paid, when, and to whom. This helps you stay ready for taxes or audits.

6. Vendor Support

If your vendor has a question about a payment, the team answers it. They make sure your vendor is happy and knows what’s going on.

7. Regular Reports

The team sends you clear, simple reports each week or month. These reports help you understand your spending and plan better for the future.

What Happens If You Don’t Outsource?

If you don’t outsource your accounts payable work and try to do it all by yourself, you may run into problems. Paying bills is a big job. It takes time, care, and a good system. Without help, things can go wrong. Here are some of the problems you might face:

1. You Might Pay a Bill Twice

If you don’t keep clear records, you may forget that a bill was already paid. Then, you pay it again by mistake. This means you lose money that could have been used for other things.

2. You Might Miss a Bill

When you’re busy, it’s easy to miss a bill. If a payment is late, you may get charged extra fees. The vendor might also stop trusting you or delay service next time.

3. You May Not Know Who You Owe

Without outsourcing, keeping track of bills can get messy. You might not know which bills are paid and which are still waiting. This can lead to stress and confusion.

4. Your Team Could Get Confused

When different people handle the bills and there is no clear plan, mistakes happen. Someone might pay the wrong amount or forget to log a payment. This slows things down and can upset your team.

5. You Lose Time to Grow Your Business

Paying bills takes time, checking them, writing checks, and logging payments. If you do this yourself, you have less time to focus on growing your business, helping customers, or selling more.

Accounts Payable Outsourcing is a smart way to take care of your business bills. It helps you save time, stay organized, and keep your records clean. You won’t have to worry about late fees or lost bills.

End-to-end Accounts Payable means the outsourcing team handles all the steps from getting the invoice to paying the vendor and logging the payment. It makes life easy.

Meru Accounting offers top-notch Accounts Payable Outsourcing. Our team makes sure your payments are on time, your books are in order, and your stress is gone.That’s why many smart business owners choose to outsource. It helps avoid these problems. A skilled team handles the bills for you, so you can relax and focus on the big picture.

If you want to run your business better, Accounts Payable Outsourcing with Meru Accounting is the right move.

FAQs

1. Can I use Accounts Payable Outsourcing if I’m a small business?

Yes! Many small businesses use outsourcing because they don’t have time or staff. It helps them grow faster and work smarter.

2. Will I lose control of my money?

No. You still approve payments. The team just helps you do the work faster and better. Meru Accounting makes sure you’re always in control.

3. Is it safe to share bills and data?

Yes. Teams like Meru Accounting use safe tools and systems to protect your data. Your info stays private and secure.

4. How much does Accounts Payable Outsourcing cost?

It depends on how many bills you have each month. Meru Accounting offers clear prices and plans to fit every type of business.

5. Can the team help with other accounting tasks too?

Yes. Meru Accounting also helps with bookkeeping, payroll, and taxes. We can be your full finance team.