How Can Franchisees Prepare for an Audit with Proper Franchise Bookkeeping?

As a franchisee in the USA, preparing for an audit may seem hard. But with the right systems in place, it becomes easier and less stressful. One of the most important tools in this process is bookkeeping for franchisees. Good franchise bookkeeping helps you meet legal rules, build trust with the franchisor, and prove your numbers are right. Franchise owners must follow the rules set by the franchisor. One of the most important tasks is bookkeeping for franchisees. Good records make it easy to handle money, file taxes, and face audits. A proper system can save time and stress.

In this blog, you’ll learn how to prepare for an audit with the right bookkeeping habits. We will also cover useful tips, checklists, and common mistakes to avoid.

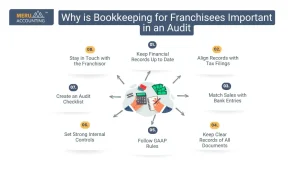

Why is Bookkeeping for Franchisees Important in an Audit

1. Keep Financial Records Up to Date

Track your sales, expenses, and payroll every day. Make sure all entries are clear and accurate. Use franchise accounting software to help you stay on track. This reduces the chance of errors and gives you a clear view of your finances.

2. Align Records with Tax Filings

Make sure that your books match your tax returns. Any mismatch between your data and tax reports may lead to audit issues. Accurate bookkeeping for franchisees can help you stay safe and avoid red flags.

3. Match Sales with Bank Entries

Your daily sales from the POS system must match your bank deposits. Compare them often. If you spot a gap, look into it right away. This shows that you are in control of your cash flow.

4. Keep Clear Records of All Documents

Save everything — from receipts to meeting notes and staff pay stubs. This helps build an audit trail that is easy to follow. It will support your numbers and help answer any audit questions.

5. Follow GAAP Rules

Use Generally Accepted Accounting Principles (GAAP) to prepare your financials. These rules help make sure your reports are fair and legal. It also helps you compare past and current results better.

6. Set Strong Internal Controls

Avoid fraud and mistakes by using checks and controls. Have a second person review books and bank statements. Good controls make your books stronger and reduce audit risks.

7. Create an Audit Checklist

Use a list to review key areas such as tax forms, staff pay, royalty payments, and cash flow. This helps you cover all bases and prepare your files for the audit.

8. Stay in Touch with the Franchisor

Share updates with your franchisor. If something goes wrong, tell them early. Open talks help fix issues fast and show that you’re running your franchise well.

Franchise Bookkeeping Best Practices to Ensure Compliance

Track Initial and Ongoing Franchise Costs

- Start-Up Costs: Keep track of all the money you spend to launch your franchise.

- Ongoing Fees: These may include royalty fees or marketing fees, both of which must be paid on time.

Report Revenue Correctly

- Record all sales as per franchisor rules.

- Use a consistent method to track sales so your reports stay clear and trusted.

Pay Royalties and Fees On Time

- Royalty fees are based on your revenue. Keep a tight watch on your income to pay these on time.

- Marketing fees go towards brand ads and campaigns. Pay them as set in the contract.

Manage Payroll Properly

- Keep your payroll records clean and current.

- Make sure you follow all labor laws, both at the state and federal levels.

Monitor Cash Flow

- Keep a close eye on how much money comes in and goes out.

- Use cash flow reports to see if you’ll have enough money for the next month.

Send Reports as Required

- Your franchisor may want reports every month. Share them on time.

- Bookkeeping for franchisees makes it easier to meet reporting rules.

Use Approved POS and Payroll Systems

- Use systems that your franchisor has approved. These help you stay aligned and avoid tech issues.

Challenges in Bookkeeping for Franchisees (And How to Solve Them)

1. Standard vs Custom Needs

- Challenge: Each franchise must follow standard rules, but some locations need custom setups.

- Fix: Use flexible systems that support both basic needs and custom tweaks.

2. Data from Many Locations

- Challenge: Getting numbers from all sites can take time and cause mistakes.

- Fix: Use cloud-based tools that update in real time and sync across all sites.

3. Different Tax Rules

- Challenge: Some states or cities have unique tax laws.

- Fix: Hire tax pros who know local rules and update your team as things change.

4. High Expense Tracking

- Challenge: Some costs go unchecked, leading to loss.

- Fix: Use expense tracking tools and review them weekly. Catch overspending early.

5. Cash Flow Issues

- Challenge: Some units earn more than others. Cash may run dry at some sites.

- Fix: Plan cash needs in advance. Have a small reserve or line of credit.

6. Low Financial Know-How

- Challenge: Some franchisees don’t have a strong financial background.

- Fix: Offer training on basic finance and bookkeeping for franchisees.

7. Poor Communication

- Challenge: Gaps in talk between franchisor and franchisee can cause issues.

- Fix: Hold regular calls, share updates, and ask for feedback. Stay in sync.

8. Fear of Audits

- Challenge: Many see audits as scary.

- Fix: View audits as a tool to get better. Use them to fix gaps and learn best practices.

Key Financial Metrics Franchisees Must Track

Revenue Growth

Watch your sales over time. Compare each month and year. It shows how well your business is growing.

Gross Profit Margin

This shows how much money is left after you remove the cost of items sold. A low margin means it’s time to cut costs or raise prices.

Operating Costs

Track rent, staff pay, tools, and ads. Don’t let small costs build up. Use reports to keep track of where money goes.

Net Profit Margin

This shows what’s left after all costs. It tells you if your franchise is truly earning money.

Cash Flow

Track how much cash comes in and goes out. If it’s low, pay close attention. You need steady cash for bills, wages, and growth.

Break-Even Point

This tells you how much you must earn to cover costs. Once you pass this point, you start making a profit.

Receivables and Payables

- Receivables: What others owe you.

- Payables: What you owe to others.

Track both well to keep a good cash flow.

Franchise Fees

Track royalty and ad fees closely. Know how much to pay and when. These costs must be in your reports.

Franchise Accounting vs. Regular Accounting

Franchise accounting has more rules compared to a regular business:

Feature | Regular Business | Franchise Business |

Royalty Payments | Not required | Mandatory and recurring |

FDD Compliance | Not needed | Legally required |

Multi-unit Tracking | Rare | Often required |

Franchisor Audits | Not applicable | Expected periodically |

Centralized Reporting | Optional | Often mandatory |

This makes franchise bookkeeping more structured and policy-driven.

Understanding Franchise-Specific Financial Terms

Bookkeeping for Franchisees involves some terms that are not part of most other small business setups. These terms are key to franchise bookkeeping and help avoid errors, especially during audits.

Royalty Fees

These are regular payments to the franchisor, often a fixed percentage of total sales. They must be tracked each month to meet terms and keep good standing.

Advertising Fees

Franchisees often fund shared ads at the brand or regional level. These payments should be logged and labeled right in your books.

Initial Franchise Fee

A one-time cost when you sign the deal. This needs to be logged as a start-up cost and may need to be spread over time (amortized).

Gross Sales Reporting

This shows your total sales before any returns or cuts. You must report this with care, as it affects royalty fee amounts.

Franchise Disclosure Document (FDD)

This file lists the rules and costs of your franchise. Go through it in full and use it to guide how you book each fee or term.

How Franchisors Use Your Bookkeeping Data

A franchisor uses your franchise accounting data to guide the brand, not just to check your store. Here’s how your data helps:

To Calculate Royalties

Your sales reports are used to bill you the right royalty fee. If your books are off, you may pay too much or too little, which can lead to fines.

To Check Franchise Rules

Franchisors, compare your data with what is in your deal. Missed fees or late payments can flag your store for review.

To Review Store Health

Your store’s sales, costs, and profits are used to see how you rank next to others. This helps guide you to improve or fix weak spots.

To Track Marketing Payments

Ad fees are tracked too. If you fall behind or miss one, it could affect your brand rights or trust.

To Compare with Peers

Your data helps the brand suggest changes. You get to see how your store stacks up with others in the network.

Good bookkeeping for franchisees keeps things clear, helps avoid conflict, and builds trust.

Role of Technology in Audit Preparation

Digital tools help you stay ahead of checks and audits in franchise bookkeeping:

Cloud Accounting

Tools like QuickBooks Online give real-time access and let you share files with your CPA or the brand team with ease.

POS Integration

A good POS system links to your books and cuts down on time spent on entries. This makes your audit file clean and fast.

Inventory Software

These tools track your stock. They help reduce theft or loss and give clean data during audits.

Automated Invoicing

Auto tools send bills, track unpaid ones, and help with cash flow. They also save time and reduce errors.

Mobile Access

Cloud apps let you work from your phone or tablet. Great for those who run more than one unit or travel often.

Tech in franchise accounting saves time and improves your audit trail.

Monthly Bookkeeping Checklist for Franchisees

A clean, repeatable list helps you stay on track and ready for audits:

- Bank Reconciliation – Match book records with bank and card statements.

- Match POS and Sales Records – Make sure all sales are in the books.

- Payroll Updates – Record hours, pay, and tax files on time.

- Review Cash Flow – Spot trends and issues early.

- Track Royalty Fees – Log them month by month.

- File Taxes – Keep up with IRS, state, and local needs.

- Store Bills and Receipts – Scan and save all files online.

- Back Up Files – Save a copy of all data in the cloud.

This list helps reduce stress when audit time comes.

How Poor Bookkeeping Can Hurt Your Franchise

Missed tasks or poor records in franchise bookkeeping can do more harm than you think:

Missed Royalty Payments

If you don’t track sales well, you may miss a fee. This can lead to fines or even legal trouble.

Audit Failures

Your franchisor may drop you if your books are full of errors or missing files.

Tax Fines

Bad books often mean wrong tax files. This leads to high fines or audits from the tax office.

Cash Flow Issues

If you don’t track where your money goes, you may run out of cash without notice.

Lost Trust

Bad books can make your franchisor doubt your skill or care. It may limit help or deals in the future.

Good franchise accounting builds strong ties and protects your rights.

How a Bookkeeping Partner Adds Value

A pro franchise bookkeeping team can help from day one:

Setup Done Right

They help you build a chart of accounts that meets the brand’s rules.

Tax, Pay, and Fee Help

They handle all these tasks and keep you in line with both tax and brand laws.

Stay Current

They keep up with new laws or rule changes that affect your books.

Great Reports

You’ll have clean reports to show your brand team or banks when needed.

Audit Support

They guide you on what to prep and can even talk to the auditor on your behalf.

This help gives you more time to run and grow your business.

Future Trends in Franchise Bookkeeping

Franchise accounting is moving fast. Keep up with these trends:

AI-Powered Tools

AI scans your records to spot issues fast and gives you smart tips to fix them.

Blockchain

This tech keeps a secure, clear record of your sales and deals that no one can change.

Franchisor Dashboards

These tools let brand teams see their key stats live and give fast feedback.

Mobile Bookkeeping Apps

You can check all your stores from one app. This is key if you run more than one site.

Remote Audits

No need for on-site checks. Your records can be shared online with your franchisor or tax team.

Staying up to date with tools helps make your franchise bookkeeping fast and clean.

Audits don’t have to be scary. With clear records, open talks, and smart tools, bookkeeping for franchisees can be your shield. If you feel overwhelmed, you can outsource it. Meru Accounting helps franchisees get audit-ready with clear books, accurate reports, and expert support. Let us help you build strong systems so you can focus on growth.

FAQs

- What is bookkeeping for franchisees?

It is the process of tracking all money-related tasks for a franchise. - Why is proper bookkeeping important for audits?

It helps keep all records ready and avoids last-minute issues. - What software is best for franchise bookkeeping?

QuickBooks, Xero, and Zoho Books are some good options. - How often should I back up my franchise data?

At least once a week, or daily if possible. - Can I do franchise bookkeeping myself?

Yes, but it’s better to hire an expert for better results. - What records are checked during a franchise audit?

Sales, royalties, payroll, taxes, and expense records. - How do I track royalty payments to the franchisor?

Use software that includes royalty tracking or maintain a log manually.