Home » A Complete Guide on federal tax form 8995.

A Complete Guide on Federal Tax Form 8995

When the tax return filing date is around the corner, business owners always experience complications. Figuring out the deductions, calculating the taxes, reclaiming, etc., are some of the tedious tasks for US-based individuals and businesses. However, navigating and filling out the complicated forms is a difficult task for business owners, tax consultants, and accountants. If you are operating a business in the USA, then Form 8995 becomes very important. This form is to figure out the deductions for the Qualified Business Income (QBI). This federal tax form 8995 has a very complicated structure that needs to be filled out carefully. Here, we try to give complete guidance on this federal tax form.

What is Federal Tax Form 8995?

- Federal Tax Form 8995 is used to calculate the Qualified Business Income (QBI) deduction.

- It helps eligible taxpayers claim up to a 20% deduction on their QBI.

- It’s a simplified form and is used by many small business owners, freelancers, and sole proprietors.

- Introduced with the Tax Cuts and Jobs Act (TCJA) in 2018.

- It’s mainly for individuals with simpler tax situations and without phase-out limits.

What is the purpose of Form 8995?

The qualified business income deductions allow businesses to deduct up to 20% of their qualified business income share. This income may come from business, trade, pass-through firms (not C corps), REITs, and income from listed public partnerships. The calculation is done by QBI deductions minus net capital gain.

Who Can Use Form 8995?

You can use Form 8995 if:

- You have income from a qualified trade or business.

- Your taxable income is below the IRS threshold:

- For 2024: $182,100 (Single) or $364,200 (Married filing jointly).

- You are not in a Specified Service Trade or Business (SSTB) over the income limit.

- You do not have to use Form 8995-A, which is more detailed.

What are the eligibility criteria to claim the deductions?

The federal tax form 8995 can be filled out by entities to claim deductions that fulfill the below-mentioned eligibility criteria:

- Get qualified business income

- Be a pass-through business entity

- Fulfill the taxable income limits

How do I fill out Form 8995 in a simplified way?

Taxpayers who have QBI, qualified REIT dividends, or qualified PTP income must use this form to calculate their deductions. There are two versions of the form: Form 8995, Qualified Business Income Deduction – Simple Math, and Form 8995-A, Qualified Business Income Deduction – Full Version.

Taxpayers can choose between the simplified and regular computation methods for calculating their qualified business income deduction. The simplified computation method is generally used by taxpayers with taxable income. The regular computation method may be required for taxpayers with more complex situations. There are limitations and phaseouts based on taxable income, type of business, and other factors that may affect the amount of the deduction that a taxpayer can claim.

What is Qualified Business Income (QBI)?

QBI is the net amount of income, gains, deductions, and losses from a qualified business.

Examples include:

- Self-employed business income

- Rental income (in some cases)

- Income from LLCs, partnerships, or S corporations

QBI does not include:

- W-2 wages

- Capital gains/losses

- Interest income

- Dividends

How do I determine the QBI?

QBI would include deductions, gains, losses, etc., from the business that conducts the trade or business. You must consider the attributes while filling out the federal tax form 8995. Some aspects are not included in the QBI.

Some of the aspects that are not included under QBI are mentioned below:

- When S Corporation receives a reasonable compensation amount,

- Internal Revenue Code (Code) provisions provide for capital losses or gains.

- Improperly allocated income interest for the business.

- Losses, income, or deductions that we get from principal contracts.

- Real estate investors trust dividends.

- Publicly traded partnership income.

Example to Understand Form 8995

- You are a sole proprietor.

- Your QBI from business is $80,000.

- Your taxable income is $100,000.

- You qualify to use Federal Tax Form 8995.

Calculation:

- 20% of $80,000 = $16,000.

- You can deduct $16,000 from your taxable income using Form 8995.

Difference Between Form 8995 and 8995-A

Feature | Form 8995 | Form 8995-A |

Simplicity | Simple | Detailed |

Income under the threshold | Yes | No |

SSTB allowed | Yes (if under limit) | Yes (with limits) |

Who should file | Small business, freelancers | High-income business owners |

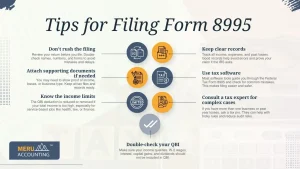

Tips for Filing Form 8995

- Keep clear records

Track all income, expenses, and past losses. Good records help avoid errors and prove your claim if the IRS asks. - Use tax software

Most software tools guide you through the Federal Tax Form 8995 and check for common mistakes. This makes filing easier and safer. - Consult a tax expert for complex cases

If you have more than one business or past year losses, ask a tax pro. They can help with tricky rules and reduce audit risks. - Double-check your QBI

Make sure your income qualifies. W-2 wages, interest, capital gains, and dividends should not be included in QBI. - Know the income limits

The QBI deduction is reduced or removed if your total income is too high, especially for service-based jobs like health, law, or finance. - Attach supporting documents if needed

You may need to show proof of income, losses, or business type. Keep all tax files and records ready. - Don’t rush the filing

Review your return before you file. Double-check names, numbers, and forms to avoid mistakes and delays.

Common Mistakes to Avoid

- Using the wrong form

If your income goes over the IRS limit for the Qualified Business Income (QBI) deduction, use Federal Tax Form 8995-A instead of Tax Form 8995. Many people file the short form (Form 8995) by mistake. This may cause delays or IRS fines. - Including W-2 wages as QBI

W-2 wages do not count as Qualified Business Income. Only income from businesses like sole proprietors, S corporations, and partnerships is allowed. Adding W-2 wages by mistake can cause big tax errors. - Not subtracting past year losses

If your business had losses in the past, you must subtract them from your QBI this year. Skipping this step may lead to claiming a bigger deduction than allowed and could trigger an audit. - Misclassifying business income

Make sure the income you list meets QBI rules. Rental income, interest, dividends, and capital gains usually do not count. Listing these as QBI may lead to issues with the IRS. - Ignoring SSTB limits

Some trades, like law, health, or finance, face QBI limits if income is too high. These are called Specified Service Trades or Businesses (SSTBs). Not checking this rule may lead to claiming more than you can. - Poor recordkeeping

You must keep clear records of income, expenses, and past year losses. Without these, you can’t support your QBI claim if the IRS asks for proof.

These are some of the basic guidelines about Form 8995 that must be considered by the respective entities in the USA. It might be very complicated for business owners and accountants to fill out this form properly.

It is advisable to get consulting from proper experts while filling out Form 8995. Meru Accounting provides filling out the federal tax form 8995 for the applicable businesses in the USA. Our team has all the knowledge about filling out this form as per IRS guidelines. Meru Accounting is one of the most proficient tax consulting service providers in the USA.

FAQs

- What is the use of Form 8995?

It helps claim a tax deduction on qualified business income from certain business types. - Who can file Form 8995?

Sole proprietors, partnerships, LLCs, and S corporations can file if they meet the rules. - What is counted as qualified business income?

It includes income, losses, and deductions from a business that is not a C corporation. - What is not counted in QBI?

Wages, capital gains, REIT dividends, and income from publicly traded partnerships are not included. - What is the difference between Form 8995 and Form 8995-A?

Form 8995 is simpler. Form 8995-A is for taxpayers with complex tax details. - When should someone use Form 8995-A?

Use it when income is above IRS limits or when special rules apply to the business. - What are the rules to claim the QBI deduction?

You need QBI, must be a pass-through business, and meet the IRS income limits. - Do I need expert help for Form 8995?

The form is hard to fill out. Many people take help to avoid errors.