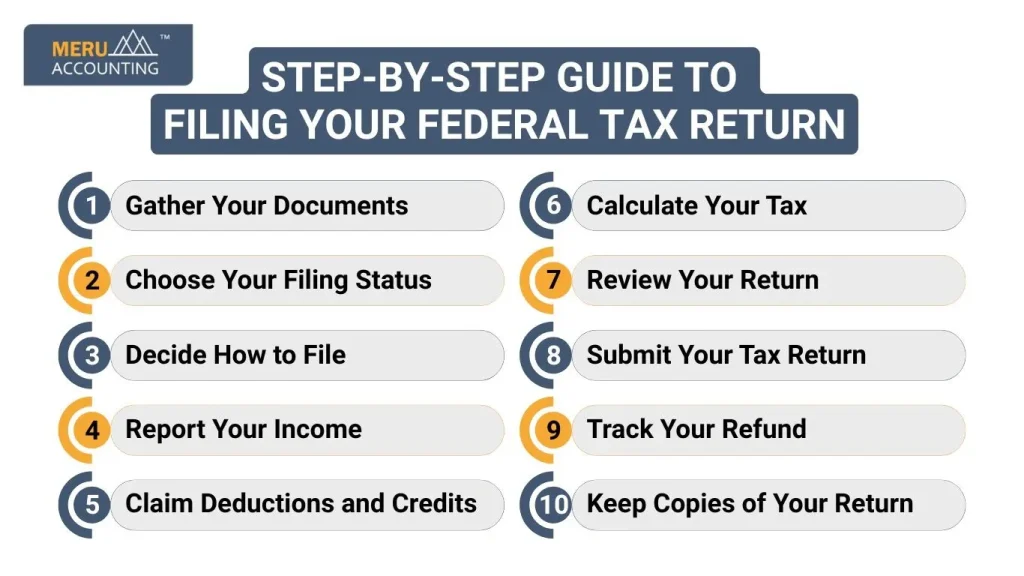

Step-by-Step Guide to Filing Your Federal Tax Return

Filing a US Federal tax return can feel hard, but it does not have to be. With the right help, you can file your return right and on time. This guide will show each step, so you avoid mistakes and get the best refund.

Knowing the tax process is key to following the rules and handling your money well. Filing right means you pay only what you owe. It also helps you claim all deductions and credits. This can raise your refund and keep you from extra fines or fees. Even if you filed taxes before, rules and forms change. Stay ready and keep your papers in order. With a plan and the right papers, filing your Federal Tax Return is easy.

What is a Federal Tax Return?

A Federal Tax Return is a form you send to the IRS each year. It reports your income, expenses, and other tax details. Filing this return shows how much tax you owe or if you will get a refund.

All US residents and citizens who earn income must follow US Federal tax rules. Filing on time helps you avoid penalties and extra interest.

Filing a Federal Tax Return in 2025

Filing your Federal Tax Return in 2025 is easy with help from skilled CPAs and tax experts. Our services aim to give you a smooth and secure process while helping you get the largest federal tax refund. You can file from home or get in-person guidance.

Our team makes tax filing easy. Each return is checked to ensure it is correct. We find deductions, credits, or changes that may raise your refund and cut errors.

E-Filing Your Federal Tax Return

E-filing is a fast and safe way to send your Federal Tax Return. Collect your W-2s, 1099s, and other records. File before April 15, 2025, to stay on time.

Ways to E-File Your US Federal Tax Return

- IRS Free File or Fillable Forms

If your AGI is $73,000 or less, you can use IRS Free File. Fillable Forms let you file your return on your own. - Free Tax Help Programs

The IRS runs VITA and TCE programs. They help eligible people file returns at no cost. - Commercial Tax Software

Tax software helps you prepare and file your return. It sends your return safely to the IRS. - Authorized E-File Providers

IRS-approved tax pros can file your return for you. They make sure it is correct and meets IRS rules.

E-Filing Through H&R Block

H&R Block offers tailored services for individual taxpayers. You can file safely from a computer or smartphone. Their 2025 service plans include:

- $0 Free Online: For simple returns with W-2 forms, dependents, and education costs.

- $49.99 Deluxe Online: To maximize credits, deductions, and Health Savings Account (HSA) contributions.

- $69.99 Premium Online: Designed for freelancers, contractors, and investors.

- $104.99 Self-Employed Online: For self-employed individuals, small businesses, and contractors.

Why Filing Your Federal Tax Return is Important

- Avoid Penalties: Filing late can cause fines. File on time to stay safe and keep your record clean.

- Claim Refunds: Paid too much tax? Filing lets you get all your money back.

- Legal Requirement: Filing is required if your income meets IRS rules. Following this rule keeps you in good standing with the law.

- Track Finance: A tax return shows your yearly income and deductions. It helps you see your finances clearly and plan your spending.

- Loan or Visa Applications: Tax returns are often needed as proof of income. Banks, lenders, and immigration offices use them to check your finances.

Step 1: Gather Your Documents

Collect all papers before you start. This makes filing easier and faster. Always keep documents in one place.

- W-2 Forms: Show your salary and taxes withheld. Needed to report income correctly. Keep them safe. Check totals carefully.

- 1099 Forms: Show freelance, interest, or other income. Include all forms to avoid missing income. Make copies for your records.

- Receipts: For deductions like medical, education, or charity. Keep them neat to claim all allowed deductions. Organize by category.

- Previous Tax Return: Helps check changes from last year. Useful for reference and accuracy. Compare numbers to avoid errors.

- Social Security Numbers: Yours, your spouse’s, and your dependents’. Use exact numbers to avoid IRS mistakes. Keep info private and secure.

Step 2: Choose Your Filing Status

Pick a status that fits you. It affects taxes and deductions. This choice can change your refund.

- Single: For unmarried individuals. Simple to file. Works well if you have no dependents.

- Married Filing Jointly: For couples filing together. Often gives higher refunds. Combines income and deductions.

- Married Filing Separately: Useful if one spouse has high debt or deductions. Can reduce tax in some cases.

- Head of Household: For single parents or people supporting dependents. Gives bigger deductions. Must meet IRS rules.

- Qualifying Widow(er): For those recently widowed. Can file like joint for 2 years. Helps with tax relief after a loss.

Correct status can lower taxes and increase refunds. Always review before filing.

Step 3: Decide How to File

You have three main options. Choose what is best for your situation. Filing choice affects speed and accuracy.

- Online Filing: Fast and secure. Many tools check errors automatically. You can e-file anytime.

- Paper Filing: Mail forms to the IRS. Keep copies for your records. Track mail for safety.

- Tax Professional: CPAs or experts file for you. They can find extra deductions and credits. It can help if taxes are complex.

Choose based on your comfort and the complexity of your taxes.

Step 4: Report Your Income

Include all income to avoid mistakes. Report everything accurately. Missing income can cause penalties.

- Wages and salaries. Record totals from W-2s.

- Business or freelance income. Include all sources. Keep records organized.

- Interest and dividends. Report all bank and investment income.

- Capital gains from investments. Report each sale separately.

- Retirement payouts. Include all distributions. Avoid IRS errors.

Double-check totals to be accurate.

Step 5: Claim Deductions and Credits

Deductions lower income; credits reduce tax. Claim all allowed. Keep proof of every claim.

- Standard Deduction: Fixed amount based on filing status. Most people use it. Lowers taxable income easily.

- Itemized Deductions: Medical, mortgage, donations. Keep all receipts. Include all eligible expenses.

- Education Credits: Tuition or student loans. Reduces tax if you or your child studies. File forms properly.

- Child Tax Credit: Lowers the tax for children. It can also increase the refund. Make sure children qualify.

Claim all allowed deductions and credits to save tax.

Step 6: Calculate Your Tax

Figure out what you owe or get as a refund. Accuracy is important. Check all numbers twice.

- Use IRS tables or tax software for accuracy. Helps avoid mistakes.

- Check extra taxes like self-employment tax. Include correct amounts.

- Add state or local taxes if needed. Keep totals correct.

- Review all forms and numbers to prevent mistakes. Compare with last year.

Step 7: Review Your Return

Check everything before sending. Errors can cause delays. Take your time.

- Social Security numbers. Make sure they match the documents.

- Income amounts. Verify with W-2 and 1099 forms.

- Deductions and credits. Confirm eligibility and totals.

- Signatures. Ensure everyone signs if required.

- Bank info for refunds. Double-check account and routing numbers.

Mistakes can delay refunds or trigger IRS notices.

Step 8: Submit Your Tax Return

Send your return safely. Keep proof of submission. Meet the deadline.

- E-file: Fast and safe. Instant confirmation. You get status updates online.

- Mail: Keep proof and tracking info. Use certified mail if needed.

- Pay any taxes by the deadline to avoid fines. Keep a record of payments.

Step 9: Track Your Refund

Know when money will arrive. Use IRS tools to check. Direct deposit is the fastest.

- Use the IRS “Where’s My Refund?” tool. Track progress online.

- E-file refunds take about 3 weeks; mail may take longer. Plan accordingly.

- Use direct deposit to get money faster. Avoid paper checks.

- Keep notes of expected dates for future reference.

Step 10: Keep Copies of Your Return

Save copies for future use. Helps with audits or loans. Organize safely.

- Save for at least 3 years. Store securely.

- Useful for audits, loans, or future checks. Easy access is important.

- Keep both paper and digital copies safe. Label clearly for reference.

- It can help solve errors or disputes with the IRS.

Common Mistakes to Avoid

1. Wrong Social Security Numbers

Wrong Social Security numbers can delay your refund. Check all numbers before you file.

2. Forgetting to Sign the Return

An unsigned return is not valid. Sign by hand or use an e-signature.

3. Filing Late Without an Extension

Late filing without an extension can bring fines. File Form 4868 if you need more time.

4. Wrong Bank Account Info

Wrong account numbers can delay your refund. Check your account and routing numbers.

5. Not Keeping Copies

Keep copies of your return and receipts. You may need them for audits.

6. Listing Dependents Wrong

Wrong info for dependents can cut your credits. Check names and Social Security numbers.

7. Forgetting Estimated Payments

Not reporting prior payments can change your refund. Add all payments carefully.

Tips for a Smooth Filing Experience

- Start Early: Collect documents before tax season.

- Use Software: Reduces calculation mistakes.

- Stay Organized: Keep income and deduction records.

- Ask for Help: CPAs or tax experts simplify complex returns.

- Double-Check Forms: Prevents errors and delays.

Filing your US Federal Tax Return does not need to be hard. With the right steps and documents, you can file on time and get it right. Meru Accounting helps you file your Federal Tax Return fast and safely. Our expert CPAs work to get you the best refund and avoid mistakes. We give clear guidance for your unique tax needs, whether you file from home or with our team in person.

FAQs

- What is a US Federal Tax?

It is a tax the US government takes on your income. - Who must file a Federal Tax Return?

Anyone with income above the IRS limit must file. - Can I e-file my Federal Tax Return?

Yes. Online filing is safe, fast, and easy. - What documents do I need to file?

W-2s, 1099s, receipts for deductions, Social Security numbers, and last year’s return. - How long does it take to get a refund?

E-file refunds take about 3 weeks. Paper returns take longer. - Can a tax professional help me?

Yes. Experts can handle complex returns and help you get more back. - How long should I keep my tax return?

Keep it for at least 3 years for audits or future reference.