File Form 1120S with 1120 Tax Software

If you run a small business as an S corporation, you must file Form 1120S. The best way to do this is by using 1120 tax software. This tool helps small businesses file their S corporation tax return correctly and on time. This guide will help you learn how to use the right tax software to file IRS Form 1120S. We will break this process into small, easy steps.

When it’s time to file your small business taxes, the form you use depends on how your business is set up. A sole proprietor uses a different form than someone who runs an LLC or a corporation.

Each type of business files taxes in a unique way. But in most cases, you still figure out your taxable income by adding up your income and subtracting costs.

What is IRS Form 1120S?

Form 1120-S is the U.S. Income Tax Return for an S Corporation. It’s the form an S-corp uses to report income, losses, and dividends. You also must fill out a Schedule K-1 for each owner. It shows the share of the business each person owns. The IRS uses this form to track taxes owed or refunds due. It’s also used to provide K-1 statements to shareholders. The IRS Form 1120S is filed every year.

Features of 1120 Tax Software

Good 1120 tax software offers tools that help make tax work easy. Here are the top features that small firms need:

1. Simple User Dashboard

The dashboard is clean and easy to use. You can see all tasks in one place.

2. Step-by-Step Filing Guide

The software shows each step you need to take. This helps you file with less guesswork.

3. Import Data from Past Years

You can pull in data from past returns. This saves time and keeps things correct.

4. Generates Schedule K-1 Forms

The tool builds K-1 forms for each owner. It uses the info you give to fill them out right.

5. E-Filing with Direct IRS Link

You can send your tax forms to the IRS online. The tool links to the IRS for fast filing.

6. Stores Past Tax Returns

It keeps your past forms in one spot. You can check or print them when you need.

7. Great for Small Businesses

The tool is made for small firms. It is low-cost, easy to use, and saves time.

What is Form 1120S Tax Software?

With TaxAct, you can track both past and new returns from the dashboard. Just click to start a return and follow the step-by-step guide. You pay only when you’re ready to file.

You can import your income and costs using a CSV file. The help center explains how to set up your file. There’s also a tool to check your tax amount and a planner for future returns.

Why Use 1120 Tax Software?

Filing IRS Form 1120S can be hard for small businesses. That’s why many choose to use 1120 tax software. It makes the job easy, cuts down on errors, and helps you meet IRS rules. Below are key reasons why this business tax software is a smart pick:

1. Manual Filing is Slow and Tough

Filing by hand takes time. You must read long guides and check your work. It can be hard and cause stress, more so if you don’t know much about tax forms.

2. Reduces Costly Errors

The software checks your work as you go. It shows errors or missing information. This cuts the chance of wrong tax files and IRS fines.

3. Does the Math for You

The tool adds up totals and figures out the tax due. It helps you get the right numbers. You do not need to use a calculator or guess.

4. Prepares K-1 Forms with Ease

If your firm has owners, you must give each one a K-1 form. The software makes these forms from the data you give. It saves time and gives the right info.

5. Allows Fast and Safe E-Filing

With tax software, you can send your forms to the IRS online. It is fast and safe. You get a note from the IRS when they get it.

6. Saves Time and Lowers Stress

The tool walks you through each step. It helps you work fast and with less stress. This makes tax time less of a worry for small firms.

Why Choose 1120S Income Tax?

The IRS uses Form 1120-S to divide profit and loss among shareholders. The share each person owns will decide how much income or loss they must report.

If no shares change hands, the split is easy. If shares are bought or sold, the income must be split based on how long each owner held the shares.

Who Should Use Business Tax Software?

Not all tools fit all users. But business tax software works great for many people.

1. S Corporation Owners

If you run an S corp, this software helps you file your return fast and right.

2. Tax Preparers for S Corps

It saves time and helps pros work on many clients at once.

3. CPAs Serving Small Companies

CPAs can use it to handle tax jobs for small firms with ease.

4. Firms with More Than One Owner

S corporations with many owners need K-1 forms. The tool makes this easy.

5. Anyone Filing Form 1120S

If you must file Form 1120S, tax software is a smart, safe pick.

Benefits of Filing Form 1120S Online

Filing online has many good points. It is fast, safe, and less work.

1. Faster Filing

You don’t have to mail forms. You can file them in minutes online.

2. Easy to Fix Errors

If there’s a mistake, the software shows it. You can fix it on the spot.

3. IRS Confirmation in Real Time

You know fast when the IRS gets your form. You get a note to prove it.

4. Auto-Generated Calculations

The tool adds up all the numbers. You don’t need to use a calculator.

5. Live Support in Most Tools

If you need help, many tools have chat, phone, or email help.

Choosing the Right Business Tax Software

Pick software that meets your firm’s needs. Look for the tools below.

1. Supports Form 1120S

Make sure the tool lets you file IRS Form 1120S with ease.

2. Includes K-1 Form Creation

It should build and fill K-1 forms for each owner.

3. Offers Audit Support

Good tools come with help if the IRS reviews your return.

4. Easy for Small Businesses

The layout should be clean and built for non-tax pros.

5. Allows Multi-User Access

If your team or CPA helps file, they should be able to log in too.

6. Works with Bookkeeping Tools

Some tools link with QuickBooks or other apps to pull in numbers.

Common 1120S Filing Mistakes to Avoid

Avoiding these slip-ups will save time, stress, and money.

1. Missing Shareholder Info

Each owner’s data must be right and on the form.

2. Not Filling K-1 Forms Right

Wrong K-1 forms can delay the return or lead to fines.

3. Filing After the Due Date

Late forms may bring IRS fines. Always file on time.

4. Using the Wrong Form

Don’t mix up Form 1120 (for C corps) with Form 1120S.

5. Not Reporting All Income

All gains and sales must be shown on the return.

6. Forgetting to Sign and Date

An unsigned form is not valid. Don’t skip the final step.

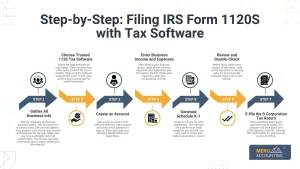

Step-by-Step: Filing IRS Form 1120S with Tax Software

Filing Form 1120S becomes much easier when you use trusted 1120 tax software. Follow these simple steps to complete your S corporation tax return without stress:

Step 1: Gather All Business Info

Start by collecting all the basic business details. You will need your business name, EIN, and full address. Also, prepare a list of your total income and expenses for the year. Make sure you have a complete list of all shareholders. You should also have information about capital shares and any payouts.

Step 2: Choose Trusted 1120 Tax Software

Select the right software for your needs. Check reviews from other users to see if the tool is reliable. Make sure the software supports IRS Form 1120S. Also, confirm that it works well for small businesses.

Step 3: Create an Account

Set up your account on the software platform. Use a secure and active email address for sign-up. Enter and verify your business details before you begin filing.

Step 4: Enter Business Income and Expenses

Start filling in your financial details. Input all your income, expenses, and deductions into the system. Double-check each figure to match your bookkeeping records.

Step 5: Generate Schedule K-1

Create K-1 forms for each shareholder. The software will auto-fill most fields based on your entries. You only need to review and make sure all data is correct.

Step 6: Review and Double-Check

Before filing, check every section of the return. Look out for any errors or missing data. Fix any issues the software flags in the review section.

Step 7: E-file the S Corporation Tax Return

Once everything looks good, submit the return online. The software will send your Form 1120S directly to the IRS. Save the IRS confirmation for your records as proof of filing.

Best Tax Software for 1120S

Choosing the right 1120 tax software is key for a smooth and correct filing process. Below are some of the best options for filing Form 1120S, especially for small businesses.

Drake Tax – Great for Professionals

Drake Tax is best for tax pros and firms. It supports many forms, including Form 1120S. The tool is fast, detailed, and built for high-volume use.

ProSeries – Easy to Use

ProSeries offers a simple layout and step-by-step help. It is great for both new users and tax experts. The software supports e-filing and built-in checks for errors.

Lacerte – Detailed and Accurate

Lacerte is a good choice for complex tax work. It helps with deep tax analysis and large firm needs. The software is known for high-level accuracy.

TaxAct – Budget-Friendly for Small Businesses

TaxAct is a top choice for small firms. It supports both personal (Form 1040) and business returns (Forms 1120, 1120S, and 1065). The online version allows only one return per user. The desktop version lets you file more than one return. The average cost to file both personal and business taxes using TaxAct is about $285.

ProConnect – From Intuit, Cloud-Based

ProConnect is a cloud-based tool by Intuit. It links well with QuickBooks and other Intuit apps. It supports Form 1120S and offers smart tax planning tools.

Tips to Make Tax Time Easier Next Year

Good habits all year can help make tax season less stressful.

Follow these simple tips to stay ready and save time:

Keep Digital Records of All Income and Costs

Store all your sales, bills, and expenses in one place. Use software or cloud tools to keep them safe and easy to find.

Use the Same Business Tax Software Yearly

Stick to one tool each year if it works well for you. This keeps data in one system and makes filing much faster.

Track Shareholder Changes During the Year

Keep notes on any new owners or changes in shares. This will help you prepare the right K-1 forms.

Back Up Your Data

Save copies of your tax files on a drive or cloud. This protects your info in case of a system crash.

Using Tax Software for Multi-State Filings

Some S corporations do business in more than one state. In such cases, it is smart to choose software with added support.

Some S Corps Do Business in Many States

Multi-state work means you must file in more than one place. Each state may have its own rules and forms.

Choose a Tax Software That Handles Multi-State Forms

Pick a tool that includes forms for all states you work in. This saves time and keeps your tax return correct.

Makes Filing State Returns Much Easier

You won’t need to file by hand or use many tools. One platform can do it all and help avoid mistakes.

Customer Support for 1120 Tax Software

Help should be easy to reach when you need it.

Good tax software gives strong support during tax time.

Live Chat and Phone Options Available

Many tools offer live chat or phone support. This lets you get quick help when you’re stuck.

Some Offer CPA Help

Some platforms let you talk to a tax expert or CPA. They help you fix issues or answer hard questions.

Look for 24/7 Help During Tax Season

During busy times, round-the-clock help is key. Choose a tool that stays ready to support you anytime.

TaxAct Software Pricing (as of now)

Form | Cost |

1040 (Federal, Personal) | $74.95 |

State (Personal) | $49.95 per state |

1120, 1120S, or 1065 (Business) | $109.95 each |

State (Business) | $49.95 per state |

Due Dates for Filing

- Form 1120 (C-Corp): Due by the 15th day of the 4th month after the end of the tax year (usually April 15).

- Form 1120S (S-Corp): Due by the 15th day of the 3rd month after the end of the tax year (usually March 15).

You must file these forms separately from your personal tax return.

Filing Form 1120S does not have to be hard. With the right 1120 tax software, small businesses can file their S corporation tax return with ease. Choose the right business tax software, follow the steps, and file on time. Use the support options available if you need help. This simple process saves time and keeps you IRS-compliant.

For expert support, reach out to Meru Accounting. We handle your taxes with care. At Meru Accounting, we help small businesses file their S corporation tax return. We use top business tax software like 1120 tax software to file IRS Form 1120S quickly and correctly. Our expert team ensures smooth and stress-free filing.

FAQs

Q1. What is IRS Form 1120S?

It’s a tax return filed by S corporations each year with the IRS.

Q2. Can I file Form 1120S using tax software?

Yes, most business tax software supports this form.

Q3. What’s the deadline to file IRS Form 1120S?

It’s usually due by March 15 each year.

Q4. Do I need to file K-1 forms with Form 1120S?

Yes, each shareholder gets a K-1, and copies go to the IRS.

Q5. Is 1120 tax software safe to use?

Yes, if you choose trusted and secure software.

Q6. Can small businesses file Form 1120S on their own?

Yes, with the right tax software, it’s quite easy.

Q7. What happens if I file late?

You may face IRS penalties and interest charges.