How to Calculate Payroll Tax in Xero: A Complete Guide

Managing payroll is a key job for any business. Mistakes in Payroll Tax in Xero can lead to fines, upset staff, and messy records if not set up correctly. These problems often come from manual work or a lack of good tools. Using smart payroll software makes the task quick, easy, and free of errors. In this guide, we show how to set up, calculate, and manage payroll tax in Xero, plus tips to avoid mistakes in reports.

Introduction to Payroll Tax

Payroll tax is the money a business must pay based on staff wages. It includes tax on income, social security, and other staff payments. Doing this by hand takes time and can lead to mistakes. Payroll Tax in Xero helps you work fast and reduce the risk of mistakes. It makes sure staff pay is right and tax rules are met with ease.

What is Payroll Tax in Xero?

Payroll Tax in Xero is a tool that calculates and tracks all taxes on staff wages. It helps businesses follow tax laws and avoid fines. This feature also makes sure every staff payment is right and on time.

Key Features of Payroll Tax in Xero

1. Automatic Calculations

Xero works out tax amounts for each staff member based on pay, benefits, and tax codes. This reduces manual work and lowers the risk of mistakes.

2. Integrated Reporting

You can create real-time payroll tax reports. These help you track tax due, prepare filings fast, and stay up to date with your tax data.

3. Real-Time Updates

Xero updates its tax tables often. This makes sure your tax math follows the latest laws and rules at all times.

4. Accurate Deductions

The tool takes the right tax from staff pay each time. This avoids both overpaying and underpaying taxes.

5. Secure Data Handling

Your payroll and tax data stay safe with Xero’s built-in security. This keeps private information protected.

6. Easy Integration

Xero works well with other HR and accounting tools. This makes payroll tax tasks simple and connected across your business.

By using these features, you make payroll tasks fast, easy, and free of costly errors.

Setting Up Payroll Tax in Xero

A correct setup is key for smooth payroll runs and the right tax amounts. A wrong setup can cause mistakes, missed tax rules, and extra costs for your business.

Step 1: Add Your Business Details

Enter your company name, tax number, and address. These must match tax office records to avoid filing issues and fines.

Step 2: Configure Payroll Settings

Set pay dates, pay items, and tax codes for each staff member. The right setup makes sure tax is calculated well in every pay run.

Step 3: Add Employee Information

Fill in tax status, allowances, and deductions for each worker. Wrong info here can lead to payroll tax errors that affect both you and your staff.

Step 4: Connect to Tax Authority

Link Xero to the tax office (if allowed). This makes it easy to report and pay taxes on time, with less manual work.

How to Calculate Payroll Tax in Xero

Xero makes tax work easy by doing most steps for you. This saves time and cuts the risk of mistakes.

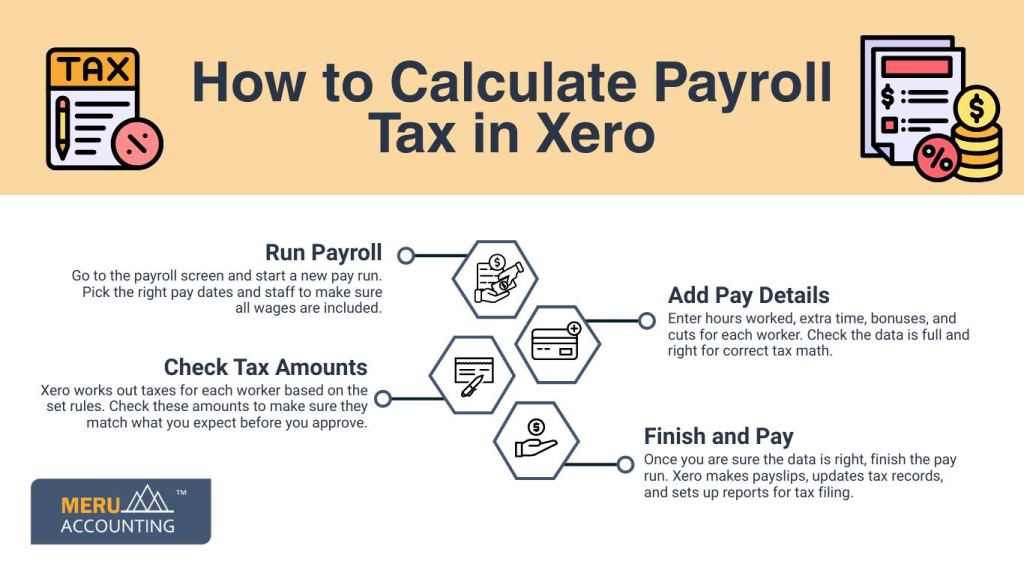

Step 1: Run Payroll

Go to the payroll screen and start a new pay run. Pick the right pay dates and staff to make sure all wages are included.

Step 2: Add Pay Details

Enter hours worked, extra time, bonuses, and cuts for each worker. Check the data is full and right for correct tax math.

Step 3: Check Tax Amounts

Xero works out taxes for each worker based on the set rules. Check these amounts to make sure they match what you expect before you approve.

Step 4: Finish and Pay

Once you are sure the data is right, finish the pay run. Xero makes payslips, updates tax records, and sets up reports for tax filing.

Example:

If a worker earns $2,000 gross, Xero may take $200 for income tax and $150 for social security. This leaves $1,650 net pay. Xero does this math for you, saving time and effort.

Payroll Tax Management in Xero

Payroll tax work is more than math. It also needs good records, on-time tax pay, and regular reports to stay within the law.

Key Tools for Payroll Tax in Xero

- Tax Reports: Get full tax reports to track what you owe and file taxes fast.

- Compliance Tools: Xero updates tax rules so you don’t make mistakes or face fines.

- Automation: Set repeat pay runs and tax cuts to save time and avoid manual errors.

- Easy Filing: In some areas, Xero lets you send tax files directly to tax offices online.

Using these tools keeps payroll tax fast, smooth, and safe for your business.

Common Issues in Payroll Tax Calculation and Fixes

Even with tools like Xero, mistakes can still happen. Knowing these issues helps you spot and fix them fast.

1. Wrong Employee Tax Codes

Wrong tax codes can lead to too much or too little tax being taken out.

Fix: Check and update tax codes in each staff profile often.

2. Missed Deductions or Benefits

If you skip some pay items, tax amounts will be wrong.

Fix: Use a checklist for each pay run and review all pay items before you approve.

3. Outdated Tax Rates

Old tax rates cause wrong tax numbers and may lead to fines.

Fix: Keep auto updates on in Xero to use the new tax rules.

4. Late Pay Run Approvals

If you delay payroll, tax reports, and payments can be late too.

Fix: Plan pay runs ahead and approve them on time.

5. Wrong Staff Details

Wrong names, tax IDs, or pay rates can mess up tax numbers.

Fix: Review staff info often and fix errors right away.

6. Manual Edits Without Checks

Changing tax figures by hand can cause mistakes in reports.

Fix: Limit manual edits and always double-check changes before saving.

Addressing these issues promptly ensures accurate payroll tax management and prevents financial or legal trouble for your business.

Simple Ways to Improve Payroll Tax Accuracy in Xero

Good habits make payroll tax easy and error-free. Try these steps to boost speed and accuracy:

- Set Reminders: Mark dates for pay runs and tax filings. This stops late payments and avoids fines.

- Use Templates: Make pay templates for the staff you pay each month. This keeps the pay and tax amounts right every time.

- Reconcile Often: Check payroll reports against bank records. This helps you spot and fix wrong or missed entries fast.

- Review Reports Monthly: Look at tax reports each month. You can find and correct odd deductions or missing data early.

- Train Staff: Teach payroll staff how to use Xero and follow tax rules. This cuts down on mistakes.

These steps keep your payroll tax clear, on time, and fair for your staff.

Benefits of Using Xero for Payroll Tax Management

Payroll Tax in Xero offers many advantages that go beyond automation. It simplifies payroll processes, enhances accuracy, and saves valuable time.

- Time Savings: Automating calculations eliminates repetitive manual tasks, freeing up time for other business operations.

- Error Reduction: Accurate tax rules and automatic deductions lower the risk of costly mistakes.

- Compliance: Xero updates tax tables automatically, helping your business meet regulatory requirements with ease.

- Simple Reporting: Generate detailed payroll and tax reports to streamline audits or tax return preparations.

- Employee Trust: Reliable payroll processes ensure employees are paid correctly and on time, boosting confidence in your management.

These benefits make Xero one of the most trusted tools for payroll tax management among small and medium businesses.

Even with the best tools, payroll tax can still feel complex. At Meru Accounting, we specialize in making payroll tax handling seamless and stress-free for businesses. We provide ongoing payroll tax management, including updates and compliance checks, Detailed payroll reporting, and filing services to meet deadlines without hassle.

With Meru Accounting, you can focus on running your business while we ensure payroll tax is calculated and reported accurately every time.

FAQs

1. Does Xero handle payroll tax on its own?

Yes. Once you set it up, Xero works out payroll tax for each pay run. This saves time and keeps the numbers right.

2. Can I handle more than one tax type in Xero payroll?

Yes. Xero can handle many tax types like income tax, social tax, and local levies.

3. What if I make a payroll tax mistake?

You can edit the pay run or add a fix before you send tax files. This helps you avoid fines and keep records right.

4. Is payroll tax in Xero good for small firms?

Yes. Xero is good for small and mid-size firms. It is low-cost, easy, and smart to use.

5. How often should I check payroll tax reports in Xero?

Check reports after each pay run and at least once a month. This helps you find mistakes fast.

6. Can Xero link with HR tools for payroll tax?

Yes. Xero links with HR and time-tracking tools. This helps you track hours, benefits, and taxes in one place.

7. Can I change payroll tax settings later?

Yes. You can change tax codes, rates, or staff details at any time. New rules will show in the next pay run.