How to fill out a Schedule C?

Running a small business means dealing with income, costs, and taxes. A key step in this work is learning how to file Schedule C. This tax form helps small business owners report income and claim write-offs. Filling it the right way can save money and help avoid tax issues.

Many owners are not sure how to file Schedule C. At first, it may look tough, but step by step, it gets easy. In this guide, we explain how to fill out the form, what it means, and why it matters for your small business. We will also go through each part of the form so you know what to do. By the end, you will feel ready to file it with ease.

Schedule C is more than a record of what you earn. It lets you claim costs such as rent, supplies, and trips. This way, you pay tax only on your real profit, not your full sales. Learning how to use the form well can cut your tax bill each year. With a clear plan, you can stay safe with the IRS and keep more cash in your business.

What Is Schedule C?

Schedule C is a tax form that sole proprietors use to report the money their small business earns and spends. It is part of your personal tax return (Form 1040).

- It shows the IRS your income and expenses.

- It helps you calculate your net profit or loss.

- The profit is added to your personal income and taxed.

- The loss can sometimes reduce your other income.

In short, this tax form for small businesses tells the IRS how your business performed during the year.

Who Needs to File Schedule C?

1. Self-Employed Individuals

If you work for yourself and not as an employee, you need to file Schedule C. This includes small side jobs, online sales, or service work.

2. Sole Proprietors

A small business owned by one person must use this form. Income and costs are reported on your own tax return.

3. Freelancers, Contractors, and Gig Workers

If you earn money as a freelancer, contractor, or gig worker, you must use this tax form for a small business. Work done through apps like Uber, Lyft, or Upwork counts too.

4. Non-Corporate Business Owners

If your business is not a corporation or partnership, you still need to file Schedule C. It shows the IRS your profit or loss.

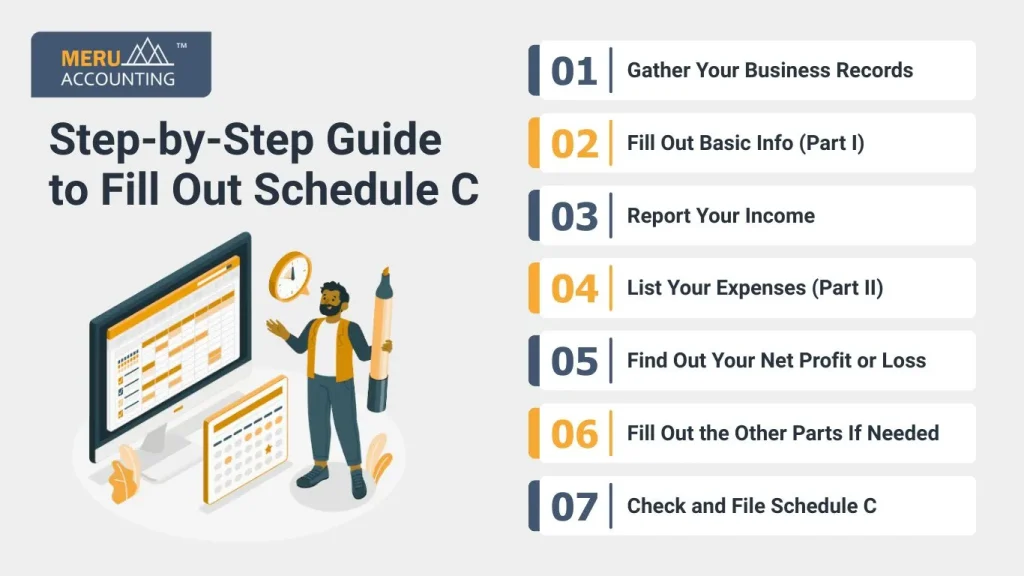

Step-by-Step Guide to Fill Out Schedule C

Step 1: Gather Your Business Records

Before you start, get all your papers ready. You will need:

- Your income records (sales, payments)

- Receipts for business costs

- Bank statements

- Mileage logs (if you used your car for work)

- Any 1099-NEC forms if clients paid you that way

Good records make it easy to fill in the form right.

Step 2: Fill Out Basic Info (Part I)

The first part of Schedule C asks for simple info:

- Your name

- Social Security Number (SSN)

- Your business name (if you have one)

- Business address

- What your business does (like pet grooming, tutoring, baking, etc.)

- Business code (found in the IRS instructions)

- How do you keep records (cash or other methods)

Just be clear and honest.

Step 3: Report Your Income

Still in Part I, now enter the money you earned.

- Line 1: Gross receipts or sales – This is all the money you earned.

- Line 2: Returns and refunds – If someone returned something, subtract it here.

- Line 7: Gross income – This is your total income after subtracting returns.

This shows how much your small business made.

Step 4: List Your Expenses (Part II)

This is the longest part of the form. Here, you list all the money you spent to run your business. These are called deductible expenses. They help lower your taxes.

Some common ones include:

- Line 8: Advertising – money spent on flyers, social media ads, etc.

- Line 9: Car and truck – if you drive for business (you’ll also fill out Form 4562 or use the mileage method)

- Line 10: Commissions and fees – money paid to helpers or agents

- Line 18: Office expenses – paper, pens, etc.

- Line 20b: Rent or lease – like your office or shop space

- Line 22: Supplies – goods you buy to run your work

- Line 23: Taxes and licenses – business license, sales tax

- Line 24a: Travel – work trips

- Line 25: Utilities – phone, internet, electricity for your work area

- Line 27a: Other expenses – anything else you spent on the business

Add all the expenses to get your total expenses.

Step 5: Find Out Your Net Profit or Loss

Now subtract your total expenses (Line 28) from your gross income (Line 7). This is your net profit if the number is positive, or a net loss if you spent more than you earned.

Write this number on Line 31.

If it’s a profit, you will report it on your main Form 1040, and you may pay self-employment tax. If it’s a loss, you may be able to subtract it from other income (like wages if you also have a job).

Step 6: Fill Out the Other Parts If Needed

- Part III: Cost of Goods Sold – only if you sell products (like a shop or bakery)

- Part IV: Info on your car if you claimed car expenses

- Part V: Other expenses – list anything not covered above, like software or books

Not all businesses need to fill every part. Just the parts that match what you do.

Step 7: Check and File Schedule C

Once all the parts are done, check your math. Make sure your business income and costs are correct. Then, attach Schedule C to your Form 1040 and file your taxes.

You can file Schedule C on paper or online. Many people use tax software. Others get help from accountants.

Challenges In Filing Out Schedule C

Filling out Schedule C can be tricky for some small business owners. Here are some of the main problems people face:

1. Too Many Details

There are lots of small boxes and lines to fill. You must write down your sales, costs, and money spent. This makes Schedule C hard for people who do not like forms.

2. Hard Words on the Form

The words on the tax form for small businesses can be hard to read. Words like “gross income,” “deductions,” or “net loss” may confuse some people.

3. Missing Records

If you lose your receipts or bank slips, you cannot prove what you spent. Then it is hard to fill out Schedule C the right way.

4. Mixing Business and Personal

Some people use the same money for home and small business stuff. This makes it hard to know what belongs on Schedule C and what does not.

5. Car and Home Costs

If you use your car or house for work, it can be hard to know how much you can list on the tax form for a small business. There are special rules, and some people do it wrong.

6. Not Knowing What Counts

Some people don’t know what costs they can list. They miss out on tax savings when they file Schedule C.

7. Math Mistakes

If you add numbers wrong, your tax can be wrong. You might owe more later or get a letter from the IRS.

8. Form Changes Each Year

The Schedule C form can change. A new rule may be added, or a line may move. If you don’t check each year, you may use the form the wrong way.

9. Doing It All Alone

Many small business owners try to do their taxes by themselves. If they do not know the rules, it may lead to errors on the tax form for a small business.

10. Fear of IRS Trouble

Many people worry that if they file Schedule C wrong, they will get in trouble with the IRS. This fear can stop people from filling it out on time.

Filing taxes is part of running a small business. When you work for yourself, Schedule C is the form that tells the IRS how much money your business earned and how much it spent. It may seem hard at first, but if you follow each step, it gets easier.

By learning how to fill out a Schedule C, you can be sure you report your business income the right way and don’t pay more tax than you should. Always keep good records, check your math, and be honest.

If you want help with your taxes or tax forms for a small business, you can work with experts like Meru Accounting. We understand Schedule C and make it easier for business owners to file taxes the right way. Whether you are just starting your business or have been working for years, Meru Accounting can help you step by step.

FAQs

1. Who needs to file Schedule C?

Anyone who runs a small business by themselves (a sole owner) or works as an independent worker (like a freelancer or gig worker) usually files Schedule C. You do not file it if you are just an employee.

2. Can I file Schedule C if I make very little money?

Yes, Even if you only made a little money, you still need to report it. You might not owe tax, but you still need to file.

3. What if I made no profit this year?

You still file Schedule C. You report your income and expenses. If your expenses are more than your income, that is called a net loss. It might lower your total tax.

4. Can I do Schedule C myself, or do I need help?

You can fill it out yourself if you keep good records and understand the steps. But if it’s confusing, a tax pro or a service like Meru Accounting can help.

5. What if I forgot to add an expense on Schedule C?

If you already filed, you can fix it by filing an amended tax return. It’s called Form 1040-X. Try to keep track of all costs so you don’t miss any next time.