How to File IRS Tax Form 1120-C

Filing taxes is very important for every business, though it can be hard, even for the co-ops. Among many forms used by businesses is the Form 1120-C. This form is made just for co-ops, or cooperatives. Co-ops are groups of people who work together as a team, and they also share profits.

If your co-op makes money from the business, the IRS wants to have the record of it. That’s why you must file Form 1120-C each year. When you file the form, it helps the IRS to see through the records the profit and the spending the co-op made. Based on this, it’s decided how much tax it needs to pay. Even if your co-op didn’t make money, you may still need to file the form.

Now, let’s learn more about Form 1120-C, how to file Form 1120, and how you can fill it out. It might sound hard, but we’ll break it down into small, easy steps.

What is Form 1120-C?

Form 1120-C is a tax form from the IRS, and it is mainly used by cooperatives. They are the ones that are businesses owned and run by members. These members help the co-op grow and also get to share the money the co-op makes.

This form is also called the U.S. Income Tax Return for Cooperative Associations. The IRS uses this form to find out how much money the co-op made and how much it should pay in taxes.

There are two parts to a co-op’s money:

- Patronage income: This is the money earned from working with co-op members.

- Non-patronage income: This is the money earned from people who are not members.

Form 1120-C helps the IRS split these two parts and tax them the right way.

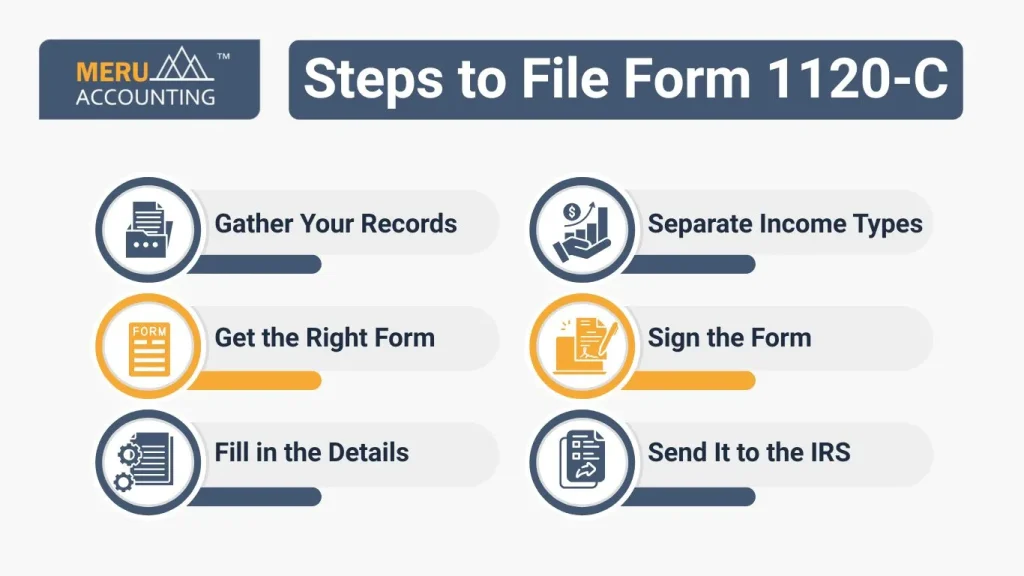

Steps to File Form 1120-C

Let’s go step-by-step so you can understand how to file Form 1120-C:

1. Gather Your Records

Before you fill out the form, you need to collect records. These include:

- Total income and costs

- Payments to members

- Bank statements

- Receipts

- Payroll records

2. Get the Right Form

You can download Form 1120-C from the IRS website or ask a tax expert. Make sure to get the newest version.

3. Fill in the Details

Here are the parts you need to fill:

- Name and Address: Write the legal name of your co-op and its full mailing address.

- EIN: This is your co-op’s Employer ID Number.

- Income Section: Show all the money your co-op made.

- Deduction Section: List all your costs, like rent, pay, supplies, etc.

- Tax and Payments Section: This tells how much tax you owe or if you get a refund.

4. Separate Income Types

Make sure you split the income into:

- Patronage

- Non-patronage

Each is taxed differently. If this feels tricky, a tax expert can help.

5. Sign the Form

An officer of the co-op (like the president or treasurer) must sign the form. This shows the form is true and complete.

6. Send It to the IRS

Once the form is filled out and signed, send it to the IRS. You can:

- Mail it to the address listed in the form instructions

- Or e-file through approved software

Keep a copy for your records.

Form 1120-C is very important for every co-op. It helps the IRS know how your co-op is doing. If you do not file Form 1120, you could get in trouble.

Importance of Form 1120-C

1. Tell the IRS About the Money You Made

When your co-op fills out Form 1120-C, the form is the way to show the amount that the co-op earned during the year. After that, the IRS uses a form and through it it checks whether your co-op has made any profit and whether it owes any tax. If you don’t send this form, the IRS doesn’t know how much your co-op made, and that’s a big problem. So, it’s very important to file Form 1120 on time every year.

2. Lists the Costs and Expenses

Your co-op spends money too, not just earns it. With Form 1120-C, you get to write down all your costs. These can be things like:

- Rent for the office

- Paychecks to workers

- Power bills

- Supplies and tools

When you file Form 1120, listing these costs helps lower the amount of tax your co-op has to pay. This means you save money by showing the IRS all your true costs.

3. Shares Info About Payments to Members

Most co-ops give back some money to their members at the end of the year. This is called a patronage refund. Form 1120-C helps you show how much money was shared with your members. This makes sure everything is fair and clear. It also shows the IRS that your co-op is being honest about its business with members.

4. Helps You Stay Legal

Filing Form 1120-C is not a choice; it’s the law. If your co-op earns money and does not file Form 1120, the IRS can give you a fine. The fine can be big, and it can grow the longer you wait. Filing the form keeps your co-op legal and safe. It also helps you avoid stress and problems later.

5. You Might Get a Tax Refund

Sometimes your co-op pays more tax than it needs to. That means you may get some money back from the IRS. But to get that refund, you must file Form 1120-C. If you don’t file it, you won’t get that extra money back. That’s why it’s a smart move to file the form the right way and on time.

Aspect | Form 1120 | Form 1120-C |

Who Files | Regular corporations (C-Corporations) | Cooperative associations |

Purpose | Reports the income, gains, losses, deductions, and credits of a corporation | Reports income, gains, losses, deductions, and credits of cooperatives |

Type of Income Reported | General corporate income | Separates member income and non-member income |

Special Features | Standard corporate tax form | Designed to handle patronage dividends and allocations |

IRS Use | Used to calculate tax liability for corporations | Used to calculate tax liability for cooperatives, considering member transactions |

Availability | Filed by most corporations | Filed only by co-ops such as agricultural, utility, or other cooperative businesses |

Common Mistakes to Avoid When Filing Form 1120-C

When you file Form 1120-C, it’s important to be careful. Making mistakes can lead to problems, delays, or even extra money to pay. Here are some common mistakes to avoid:

1. Missing the Deadline

You must send Form 1120-C on time. If you miss the due date, the IRS may charge you a late fee. Always check the deadline before you file Form 1120.

2. Using the Wrong Form

Some people use the wrong tax form. Only co-ops should use Form 1120-C. Make sure you use the correct one for your business type.

3. Forgetting to Sign the Form

A common mistake is not signing the form. Someone from the co-op, like a president or treasurer, must sign Form 1120-C. If it’s not signed, the IRS may send it back.

4. Wrong Math or Totals

If you add numbers the wrong way, your totals will be wrong. Check all math before you file Form 1120. You can also use a calculator or ask a tax expert to check.

5. Not Reporting All Income or Expenses

Sometimes, co-ops forget to report all the money made or spent. This can cause big problems. On 1120-C, you must list everything, no missing parts.

6. Not Keeping Backup Papers

After you file Form 1120-C, keep all records like bills, receipts, and income lists. If the IRS asks for proof, you need to show it. Don’t throw these papers away.

Form 1120-C may seem hard at first, but with the right help and steps, it becomes much easier. Every co-op that earns money needs to file Form 1120 to report its income. This keeps your co-op legal and in good shape with the IRS.

If you want to help file your taxes or don’t want to make a mistake, Meru Accounting can help. Their experts know how to handle co-op taxes, including Form 1120-C. We will make sure your form is done right and filed on time.

With the right help, filing taxes doesn’t have to be scary. Meru Accounting can be the partner your co-op needs.

FAQs

- What happens if I don’t file Form 1120-C on time?

If you don’t file Form 1120-C, you may have to pay a fine if the due date is crossed. You might have to pay $485 or more. The longer you wait, the more you may have to pay. - Can a small co-op file Form 1120-C without help?

Yes, a small co-op can file Form 1120-C by itself. This can also lead to many mistakes, so it’s better to hire an expert. - Do I have to file if my co-op made no money?

Yes, if the co-op has made no profit, then also a must to file Form 1120. The IRS wants to see your form, even if the income is zero. - Is Form 1120-C the same as Form 1120?

No. Form 1120 is for normal companies. Form 1120-C is only for co-ops. It has special rules for co-op money and taxes. - Can I e-file Form 1120-C?

Yes. You can send Form 1120-C online using IRS-approved software. It is faster and safer than mailing. Many co-ops like to e-file to save time.