Know When to Expect Your Tax Refund for 2025

Many people look forward to their tax refund after filing. It is money that can help pay bills, cover plans, or go into savings. But the big question is, when will it come?

The IRS checks each return before sending refunds. The time it takes can change for many reasons. This guide shows what can affect your tax refund.

How you file, online or on paper, can make a big change. Choosing direct deposit can speed up the refund. Mistakes or missing facts may slow it down. Some tax credits may also delay the payment. You can track your refund online to plan and avoid stress.

How the IRS Processes Your Tax Return

Once you file, the tax office reviews your return step by step. They scan your details for errors or missing info. If there’s a problem, it can slow down your refund.

Steps in the IRS Review Process

1. Initial Verification

The Tax office checks your name, tax ID, and SSN first. This step makes sure your tax form is real and helps stop slips that can slow your cash back.

2. Income Match Check

Your reported income is compared with the records from employers and banks. If your reported income does not match, it could put your refund on hold until corrections are made.

3. Credit and Deduction Review

The tax office checks your tax credits and cuts with care. Wrong or high claims can bring checks or hold-ups on your cash back, so it’s key to be right.

4. Approval for Refund

Once all the checks are done, your tax return is marked for approval. The tax office then schedules your refund for processing if no issues are found.

5. Payment Processing

The tax office processes your refund through direct deposit or paper check. Direct deposit is the fastest method and can save you weeks of waiting time.

6. Possible Delays

Errors, suspected fraud, or missing documents can cause the tax office to pause your return for review. Submitting accurate forms helps prevent these delays.

This process is usually smooth if you file an accurate return.

Common Refund Delays in Processing

Sometimes, even with correct details, delays happen. Here are common causes:

- Errors in your form

- Missing W-2 or other tax slips

- Security checks for possible fraud

- Paper returns are taking longer than e-file

Knowing these reasons helps you avoid mistakes that could slow down your refund.

Average Timeframe for Receiving Your Tax Refund

Many taxpayers wonder how long they must wait after filing. While there is no fixed date, the tax office shares some average timelines.

Standard Processing Periods

- E-File with Direct Deposit: Usually 1–3 weeks

- E-File with Paper Check: Around 3–4 weeks.

- Paper Return: 6–8 weeks or more

Electronic filing with direct deposit is always faster.

Factors That Change the Timing

- Filing early or late in the season

- Errors or incomplete forms

- Claims for special credits, like the Earned Income Credit, need extra review.

- Bank processing times for direct deposits

By filing early and checking your forms, you can often get your tax refund sooner.

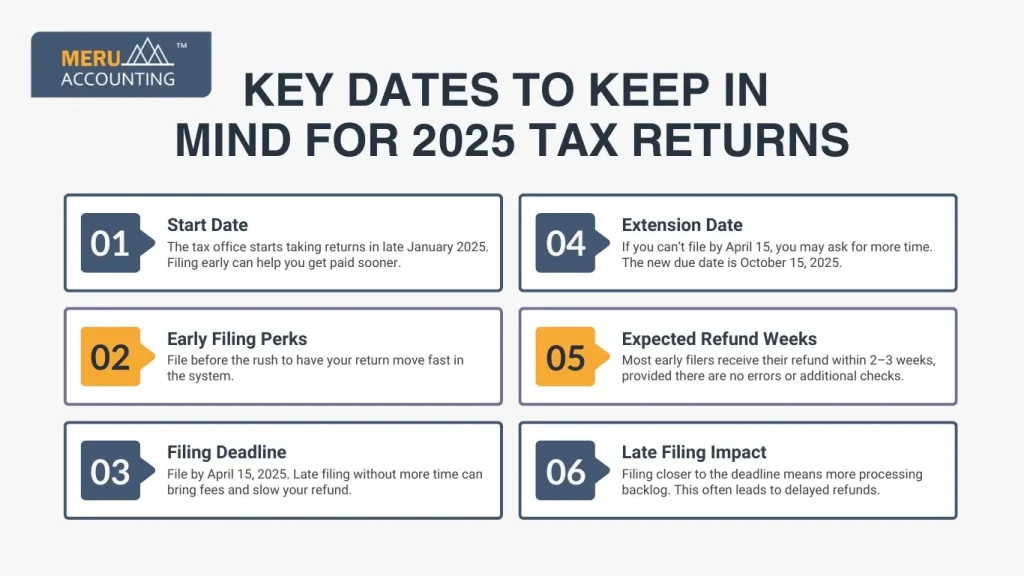

Key Dates to Keep in Mind for 2025 Tax Returns

File early to get your refund fast.

1. Start Date

The tax office starts taking returns in late January 2025. Filing early can help you get paid sooner.

2. Early Filing Perks

File before the rush to have your return move fast in the system.

3. Filing Deadline

File by April 15, 2025. Late filing without more time can bring fees and slow your refund.

4. Extension Date

If you can’t file by April 15, you may ask for more time. The new due date is October 15, 2025.

5. Expected Refund Weeks

Most early filers receive their refund within 2–3 weeks, provided there are no errors or additional checks.

6. Late Filing Impact

Filing closer to the deadline means more processing backlog. This often leads to delayed refunds.

Tax Refund Tracking Tools You Can Use

It provides several tools that let you monitor your tax refund status step-by-step.

1. Where’s My Refund? Tool

This online tool gives updates on whether your return is received, processed, approved, or sent for payment, keeping you informed at every stage.

2. IRS2Go Mobile App

With this app, you can track your refund on your smartphone. It offers secure, real-time updates on the status of your refund.

3. IRS Online Account

An online account lets you access your filing history, notices, and refund details in one place for easy tracking.

4. Tax Preparer Updates

If you used a tax preparer, they can provide updates directly from the IRS system, saving you time and effort.

5. Refund Hotline

You can call the toll-free hotline to hear recorded updates about your refund, especially if you cannot access online tools.

6. Daily Status Refresh

The tax office updates refund statuses once every 24 hours. Checking more often will not show new results, but can help you plan better.

Common Reasons Your Refund May Be Delayed

Many things can slow down your tax refund. Knowing these causes helps you avoid mistakes and get your money sooner.

1. Filing Errors

Simple errors like a wrong name, Social Security number, or math slip can make the tax office review your return by hand. This often leads to delays.

2. Missing Papers

If forms like W-2 or 1099 are not sent in, the tax office can’t confirm your income. This stops your refund until the missing info is fixed.

3. Fraud or ID Checks

If the system spots signs of fraud or stolen ID, it will pause and check your return more closely. This can take extra time.

4. Credit Claim Reviews

Large tax credit claims, especially without proof, may trigger an audit or extra checks. This pushes your refund date further out.

5. Late Filing

Returns filed close to the tax deadline face longer wait times because of high tax office traffic. Filing early avoids this issue.

6. Bank Info Errors

Wrong bank details or a closed account can block your direct deposit refund. The tax office holds it until you fix the problem.

Tips to Get Your Tax Refund Faster

Taking the right steps helps you receive your refund without delays.

1. File Early

Early filing means fewer returns in the system, ensuring quicker processing and faster refunds.

2. Use Direct Deposit

Electronic transfers reach your bank faster than mailed checks, reducing waiting time significantly.

3. Check for Accuracy

Review every detail, including names, numbers, and attachments, to avoid holds or rejections of your return.

4. Use Tax Software

Reliable tax software checks errors automatically, reducing mistakes and speeding up approval.

5. Keep Records Handy

Having past tax documents ready makes filing smoother, preventing last-minute errors that cause delays.

6. Avoid High Credit Errors

Only claim credits you qualify for. Unsupported or wrong claims may lead to audits, delaying your refund.

When to Contact the IRS About a Late Refund

If your refund is delayed, knowing when to contact the tax office helps you take quick action.

1. Wait 21 Days After E-Filing

Guidelines suggest waiting at least 21 days before making inquiries about electronic returns.

2. Wait 6 Weeks for Paper Filing

Paper filings are slower, and the tax office may take up to six weeks before providing updates on refunds.

3. Check Online First

Always use online tools like ‘Where’s My Refund?’ before calling the IRS. This saves time and avoids long hold times.

4. Prepare Your Details

Have your return copy, SSN, and filing status ready to help support staff find your case faster.

5. Contact IRS Hotline

If delays persist, call the IRS hotline to speak with a representative and request further review.

6. Follow Up if No Update

If more than 60 days pass without updates, request a case review to resolve your delayed refund.

At Meru Accounting, we review every detail of your tax return before sending it to the IRS. This helps avoid errors and gets your refund approved faster. Our team uses proven, simple methods to cut delays and help you receive your money sooner. With Meru Accounting, you can file with confidence, skip penalties, and get your 2025 refund on time.

FAQs

- How long does the IRS take to send a tax refund in 2025?

If you e-file and pick direct deposit, you get most refunds in 14–21 days. Paper returns may take 4–6 weeks or more, based on IRS load. - Why is my refund late this year?

Mistakes, missed forms, fraud checks, or a big rush of returns can slow your refund. Check your facts and track your file online. - Can I make my refund come fast?

Yes. File soon, e-file, not mail, use direct deposit, and keep all facts right to speed the process. - What should I do if I don’t get my refund after 21 days?

First, check the ‘Where’s My Refund?’ tool. If no update shows, call the tax office line and keep your facts ready. - How can I track my tax refund in 2025?

Go to the site, use the IRS2Go app, or call the line to see quick news on your refund. - Does my tax return change the size of my tax refund?

Yes. The facts on your tax return set how much refund you get. Cuts, credits, and pay all play a part in what the IRS sends back. - Can the IRS take my tax refund to pay debts?

Yes, the IRS can use your tax refund to pay fed or state debts, child aid, or old tax bills. You will get a note if this takes place.