Home » What is tax and bookkeeping services?

What are tax and bookkeeping services?

If you are a business owner, then one of the important tasks before you is to keep the finances of your business better. Tax and Bookkeeping Services are key parts of any business’s financial setup. They help to bring efficiency in the planning and growth of the business.

Many self-employed, sole proprietors, and other small businesses in the USA cannot find a qualified tax and bookkeeping person. So, getting outsourced tax and bookkeeping services can work better for these businesses. They can meet the frustrating and challenging aspects of the department better. However, you need quality bookkeeping and tax services, which can be beneficial for you. This guide will be helpful in choosing the proper experts for your tax and bookkeeping requirements.

What Are Bookkeeping Services?

Bookkeeping is the process of recording the daily money tasks of a business. It involves tracking all the money that comes in and goes out. These records form the base for all other accounting work and help you stay in control of your firm’s finances.

Key Tasks Included in Bookkeeping Services:

- Recording Sales and Purchases

Bookkeepers keep track of every sale your business makes and each item or service you buy. This helps in knowing your profit and spending clearly. - Keeping Receipts and Bills

Every receipt, bill, and invoice must be saved and logged. Bookkeeping makes sure these records are stored in the right place for easy use later. - Bank Account Reconciliation

Bookkeepers match your books with your bank and card statements. This step finds and fixes any gaps between the two records. - Managing Payroll

For firms with staff, bookkeeping includes tracking hours, making pay slips, and handling tax and pay laws. This ensures your team is paid on time and with the right amount. - Creating Basic Financial Reports

Bookkeeping also includes making simple reports like cash flow, income, and balance sheets. These give you a clear view of your business health.

Bookkeeping is key to a smooth and well-run business. It keeps your accounts clean and helps avoid tax issues. When your books are in order, tax filing becomes easy, and audits are stress-free. It also helps you track how your business grows over time.

By using skilled bookkeeping services, you get more time to focus on your work while knowing your books are safe, sorted, and up to date.

What factors should to consider when choosing tax and bookkeeping services?

If you want accurate tax and bookkeeping for your business in the USA, then you need to check a few factors. Here are a few factors to consider while choosing bookkeeping and tax services providers:

1. Proper knowledge of taxes

If you want to save taxes and ensure proper tax payments, then a professional must have proper knowledge of it. They must have the relevant qualifications with a proper understanding of tax obligations in the US states. They must maintain taxation standards which can comply with the regulations.

2. Making accurate entries

The bookkeepers must have accuracy in the bookkeeping activities, which can make the further accounting process simpler. Bookkeeping activities are prone to many unintentional errors. So, bookkeepers need to make the proper entries in the proper places in the accounting books.

3. Using the latest software

There are many software programs that can handle the bookkeeping and tax-related aspects. The service providers must have the knowledge of using the related software that can automate most of the tasks. This can ensure faster accounting activities along with better accuracy.

4. Availability

When outsourcing tax and bookkeeping services, checking the accessibility is of utmost importance. If you get stuck during any of the important financial activities, it can impact further accounting tasks. Also, businesses need to do certain accounting activities before the pre-decided dates. So, the availability of the services is very important.

5. Reporting

Financial reports give an overview of the financial aspects of the businesses. Bookkeeping and tax services providers must make easy-to-understand reports that can help business owners know the financial status of their business.

6. Bandwidth of the activities

The service providers must not limit their activities when the workload increases. The services must be able to scale up the amount of bookkeeping and tax-related activities when the workload increases.

7. Affordable costing

The cost of the tax and bookkeeping services providers must be cost-effective. This cost incurred must ensure that businesses benefit from a long-term perspective.

These are key points to check when picking a Tax and Bookkeeping Services provider. Businesses in the USA can tremendously benefit by getting quality bookkeeping and taxation-related services.

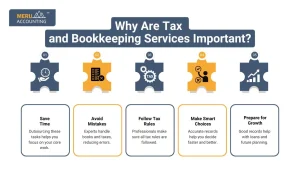

Why Are Tax and Bookkeeping Services Important?

1. Save Time

Outsourcing these tasks helps you focus on your core work.

2. Avoid Mistakes

Experts handle books and taxes, reducing errors.

3. Follow Tax Rules

Professionals make sure all tax rules are followed.

4. Make Smart Choices

Accurate records help you decide faster and better.

5. Prepare for Growth

Good records help with loans and future planning.

Benefits of Bookkeeping and Tax Services

1. Clear Financial Image

You know your profits, losses, and cash flow.

2. Easy Tax Filing

Well-managed Tax and Bookkeeping Services make filing taxes quick and smooth.

3. Avoid Fines and Penalties

Timely filing and rule-following help avoid extra costs.

4. Better Budget Planning

You can set better budgets with clear data.

5. Peace of Mind

No need to stress over missed payments or errors.

Services Included in Tax and Bookkeeping Packages

Bookkeeping Services:

- Daily entry of income and expenses

- Invoice creation and tracking

- Bill payments

- Payroll setup and updates

- Monthly reconciliation

- Reporting (P&L, balance sheet)

Tax Services:

- Business and personal tax return filing

- Tax deductions planning

- Quarterly tax payment helps

- GST/VAT filing

- Handling tax notices and audits

- Tax savings tips and advice

Tools Used in Bookkeeping and Tax Services

1. QuickBooks

QuickBooks helps manage daily tasks under Tax and Bookkeeping Services.

2. Xero

Great for small businesses. Easy to use.

3. Zoho Books

Good for managing books and preparing tax data.

4. Tally

Popular with Indian small businesses.

5. FreshBooks

Simple and good for freelancers.

Who Needs Bookkeeping and Tax Services?

1. Small and Medium Businesses

They need regular help with records and tax filing.

2. Freelancers and Contractors

To keep track of income and expenses.

3. Startups

They need help with new systems and rules.

4. Large Companies

For complete support with finance and tax.

5. Nonprofits

To make sure they follow special tax rules.

In-House vs Outsourced Bookkeeping and Tax Services

In-House:

- Needs full-time staff

- Costly if you don’t have many entries

- Good for large firms

Outsourced:

- Cost-effective

- Flexible work and faster results

- Great for small to mid-size businesses

How to Choose the Right Service Provider?

1. Check Experience

Choose a firm with years of handling bookkeeping and tax services.

2. Ask About Tools

They should use good software for clean records.

3. Look for Industry Fit

Make sure they know your industry rules.

4. Ask About Cost

Get clear prices with no hidden charges.

5. Check Reviews

See what other clients say about them.

Steps Involved in Bookkeeping and Tax Process

Step 1: Data Collection

Tax and Bookkeeping Services is to collect bills, receipts, and bank statements.

Step 2: Record Transactions

Enter all income and spending data.

Step 3: Reconciliation

Match records with bank and credit statements.

Step 4: Report Preparation

Make financial reports like a balance sheet, P&L.

Step 5: Tax Planning

Plan to save tax and avoid risks.

Step 6: Filing Returns

File tax forms on time.

Common Mistakes to Avoid

1. Not Keeping Proper Records

Many businesses do not keep full records of their income and spending. This causes confusion during tax time or audits.

2. Missing Tax Deadlines

If you miss tax due dates, you may face late fees, interest, and stress.

3. Not Updating Books Monthly

If you delay updates to your books, it can lead to mistakes and unclear reports.

4. Not Saving Receipts

Receipts prove your costs. Without them, it is hard to claim tax cuts or check your records.

5. Not Tracking Petty Cash

Even small cash spends should be noted. Not doing this may harm your final reports.

6. Trying to File Taxes Without Help

Not using Tax and Bookkeeping Services may lead to costly filing mistakes. A tax expert can guide you better.

Role of Technology in Tax and Bookkeeping Services

1. Real-Time Tracking

Software gives live access to your books.

2. Automation

Auto-entry of data saves time and reduces errors.

3. Cloud Storage

Easy access from any device.

4. Reminders

Alerts for due bills and taxes.

Future Trends in Bookkeeping and Tax Services

1. AI and Automation

Faster data entry and smart tracking.

2. Cloud Accounting

Books are accessible from anywhere.

3. Paperless Process

No paper files, only digital.

4. Global Access

Remote teams are managing your books.

Tax and Bookkeeping Services help every business stay on track. From daily records to yearly taxes, these services take the load off your shoulders. By using bookkeeping and tax services, you save time, avoid risks, and focus on growth.

If you are a US-based business finding difficulty in handling bookkeeping and accounting activities, then you can outsource this to the experts. Meru Accounting provides quality tax and bookkeeping services in the USA. They have a qualified team to handle the bookkeeping and tax services for your business. Meru Accounting is a proficient bookkeeping and taxation-related service provider in the USA.

FAQs

- What are bookkeeping and tax services?

These are services to manage your books and file your taxes on time. - Why are these services needed?

They help avoid errors, save tax, and keep your business legal. - Can I do it myself?

Yes, but using a professional is safer and faster. - Are these services costly?

No, many plans fit small business budgets. - What if I miss the tax filing?

You may face penalties, but experts can help fix it. - Is my data safe?

Yes, top firms use safe, encrypted systems. - Can I change service providers later?

Yes, you can switch anytime as per your needs.