Home » Unlocking the Secrets of Financial Management for US Startups

Managing Cash Flow: Smart Tips for US Startups and Small Businesses

Managing cash flow is a major challenge for many US startups trying to grow and survive. Without full control of money in and out, your business may face cash gaps. Smart small business cash flow management helps prevent these problems by tracking income, reducing waste, and keeping your plans on track. With the right tools and habits, you can build a strong base and grow your startup with ease.

What Is Cash Flow Management for Small Businesses?

Cash flow management for a small business involves tracking all the money moving in and out, which is vital for any startup to stay stable and prepare for slow periods. When you focus on Managing Cash Flow, you avoid risk and stay ready for growth.

Track Every Dollar You Spend or Earn

Write down every payment you get or make. Even small costs add up fast. Clean records show you where your money goes and help you make smart moves.

Learn the Three Types of Cash Flow

Cash flow comes in three types: operating, investing, and financing. Startups focus most on operating cash, which covers daily costs. Know the role each type plays in your business.

Build a Simple Cash Flow Statement

Use a monthly cash report to list money in and out. It shows how well your business is doing. You can use simple tools like Excel or cloud-based apps to get started. This statement is the foundation of small business cash flow management.

Why Managing Cash Flow Is Crucial for Startups

For any small business, poor cash flow management is a leading cause of failure; even profitable startups can struggle due to late payments or high expenses. Strong planning and Managing Cash Flow help you stay on track and grow.

Always Pay Bills on Time

Late payments can lead to fees. Always pay rent, suppliers, and staff on time. It keeps your business in good shape and builds trust with others.

Plan Growth with Confidence

If you know when money comes and goes, you can plan better. Growth costs money. With strong cash flow management for a small business, you know when you can afford to grow.

Attract Investors and Lenders

Strong cash flow reports build trust. Investors want proof that your business can manage money. Lenders also check these records before giving loans.

Common Cash Flow Challenges Faced by US Startups

Startups in the U.S. face many hurdles that make managing cash flow hard. But knowing these challenges early helps you stay ready and act fast.

Late Payments from Customers

Late invoices are a common problem. This slows cash inflow and can stop your work. Use clear payment terms and send reminders to get paid faster.

High Startup Costs

Launching a business takes money. Gear, software, and ads all cost more than expected. Watch your spending to avoid going over budget.

Slow Sales in Early Days

Many startups take time to gain buyers. A slow start can limit cash.

Sudden Expenses

Repairs or supply issues can cost a lot. Keep a small emergency fund ready. It helps you stay stable.

Inventory That Doesn’t Sell

Buying too much stock can tie up cash. Check what sells and order in smaller batches. Keep your inventory lean.

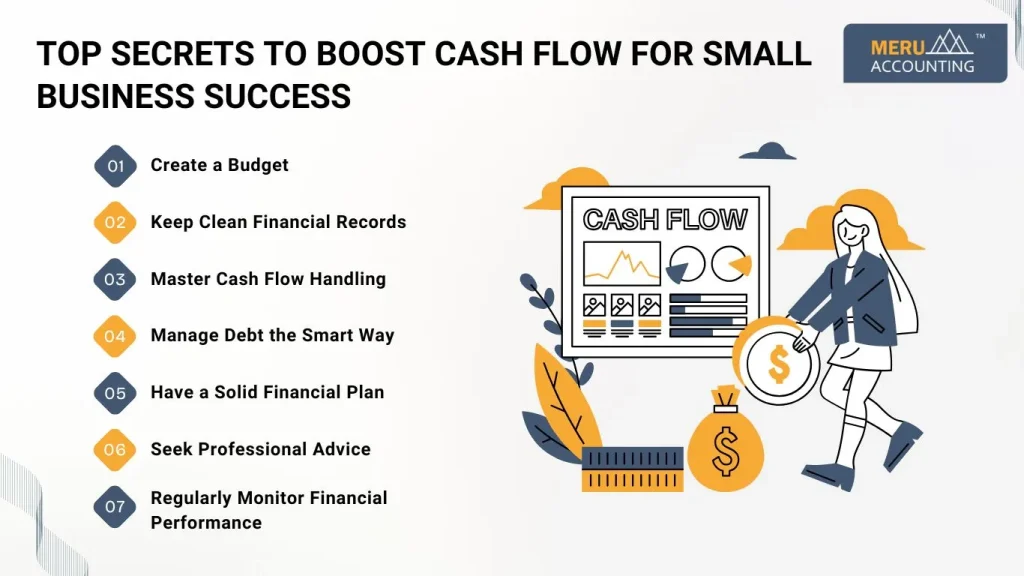

Top Secrets to Boost Cash Flow for Small Business Success

Use these proven tips to gain better control of your cash. Each supports small business cash flow management in simple, smart ways.

Create a Budget

The first key to smart Small Business Cash Flow Management is having a clear budget. This is your money plan. It shows how much money your startup will make and spend over time. When you set a budget, you know what your business needs to run well and what you can spend on other tasks. A good budget helps you stay on track and find areas where you can cut extra costs.

Keep Clean Financial Records

The second tip for better financial control is keeping clean and accurate records. It’s a key part of how successful startups are managing cash flow. You must record every sale, purchase, and payment. These records help you check how your business is doing. When your records are clear, you can spot issues fast and fix them before they grow.

Master Cash Flow Handling

The third tip for smart financial control is cash flow management, which every small business needs to avoid money problems and stay financially prepared. Cash flow means money coming in and going out. If you do not track this well, you may run short when it’s time to pay bills. Regular tracking is the foundation of cash flow management for a small business’s success.

Manage Debt the Smart Way

The fourth key is learning to deal with debt. Loans and credit can help your startup grow, but they can hurt if not used correctly. Know how much debt you have and how long you have to pay it off. Make a plan. Save a part of your income for loan payments. If things get hard, try to change your terms or ask for lower rates.

Have a Solid Financial Plan

A financial plan is a roadmap that outlines the financial goals of the business and the strategies to achieve them. A good financial plan includes a budget, cash flow projections, and a plan to manage debt. It also includes growth strategies such as investments in new products or services, marketing campaigns, and partnerships.

Seek Professional Advice

The sixth tip is to successful Business Cash Management is to seek professional advice. Many US startups may not have the expertise or resources to manage their finances effectively. Seeking professional advice from accountants, financial planners, or business advisors can help US startups develop a sound financial management strategy and avoid costly mistakes.

Regularly Monitor Financial Performance

The seventh tip for successful Cash Flow Management is to monitor financial performance regularly. US startups should monitor their financial performance regularly, including revenue, expenses, and profitability. They should also track key performance indicators (KPIs) to measure progress towards their financial goals.

Tools and Software for Managing Cash Flow Effectively

Use software like QuickBooks or Xero. They track money, send invoices, and show reports. Such tools play a major role in modern small business cash flow management by automating reports and improving decision-making.

Try Cloud-Based Accounting Tools

Use software like QuickBooks or Xero. They track money, send invoices, and show reports. Easy to use and update.

Pick a Cash Flow App

Apps like Float or Pulse focus on cash tracking. They offer clean dashboards and alerts. Choose one that fits your budget.

Use Bank Alerts

Set alerts for low balances or large charges. It helps you act fast. Most banks offer this for free.

How to Handle Seasonal Fluctuations in Cash Flow

Seasonal planning plays a big role in cash flow management for a small business’s growth.

Track Past Sales Seasons

Look at records to find busy and slow times. This helps you plan for cash gaps.

Save During Busy Periods

Put extra cash aside when sales are strong. Use it to cover slow months. This keeps the business stable.

Offer Seasonal Deals

Use offers to boost sales in slow months. It helps smooth out income year-round.

Seasonal planning plays a key role in cash flow management, helping a small business stay steady during times of income changes throughout the year.

Cash Flow Mistakes Startups Must Avoid

New business owners often repeat common cash errors. Avoiding these can save time and stress.

Ignoring Cash Flow Reports

Not reviewing reports leads to surprises. Always check your inflow and outflow. Make it a habit.

Growing Too Fast

Rapid growth can drain cash. Hire or expand only when your cash can handle it.

Underpricing Your Work

Setting low prices might win sales but hurt cash flow. Charge fair rates based on your costs.

Forgetting to Follow Up on Payments

Unpaid invoices harm your business. Set reminders and follow up quickly. Keep the cash coming in.

Not reviewing reports leads to surprises. Always check your inflow and outflow. Make it a habit. Strong cash flow management for a small business means knowing where money stands at all times.

Meru Accounting helps startups with smart cash flow plans. We track your earnings, cut your costs, and guide your growth. We know what startups need. Our team builds simple cash plans you can follow with ease. We use cloud tools for reports you can trust. You always know where your money stands.

FAQs

- What is cash flow for a small business?

Cash flow shows the money coming in and going out. Positive cash flow means you earn more than you spend.

- Why do US startups need to manage cash flow?

Without good cash flow, startups can’t pay bills or grow. Cash keeps the business going.

- How often should I check my cash flow?

Weekly checks work best. It helps you spot issues early.

- Which software is best for cash flow management?

QuickBooks, Xero, and Float are all strong tools. Choose what fits your business.

- What causes cash flow problems?

Late payments, high costs, and poor planning are the top reasons. Strong cash flow management for a small business helps avoid these issues.

- What is cash flow forecasting?

It is a method to predict cash in future months. It helps plan and grow.