05 Tax Preparation Mistakes And How To Avoid Them

Doing taxes can feel hard, even for adults.It is easy to make Tax Preparation Mistakes. These mistakes can cause big trouble. You might pay more tax or get your tax refund late. Many people make small mistakes like spelling mistakes in their name, typing the wrong number, or missing tax breaks. Though at start these might be small mistakes but later on they can slow down your tax return. That’s why it is good to learn about Tax Preparation Mistakes and how to stop them. When we know what to check, we can do our taxes right and feel proud. This guide will help you learn about tax preparation mistakes and how to avoid them. We will also give you tips so you can stay safe and smart when doing your taxes. Whether you do your taxes by yourself or get help from someone else, these tips will help.What Are Tax Preparation Mistakes?

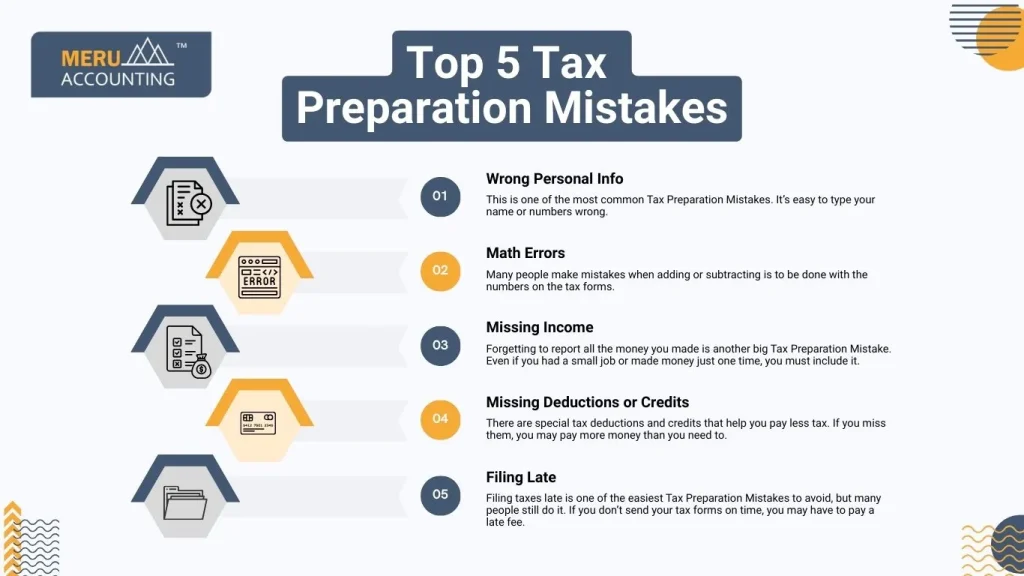

Tax preparation mistakes are the errors people make when they fill out their tax forms. These mistakes can be big or small. Sometimes, it is a math error. Other times, it could be forgetting to write something important. Some people forget to sign the form or leave out details about their income. These things may sound small, but they matter a lot to the tax office. If the tax form is not correct, you may owe more money later or even get a letter from the tax department. That’s why learning about tax preparation mistakes is so important. When you know what to look out for, you can stop the problems before they start.Top 5 Tax Preparation Mistakes

Let’s now look at the five most common Tax Preparation Mistakes that many people make. These mistakes are simple but can cause big problems. Knowing about them helps you stay safe and do your taxes the right way.- Wrong Personal Info This is one of the most common Tax Preparation Mistakes. It’s easy to type your name or numbers wrong. But if your name, Social Security number, or bank account info is not right, the tax office may send your form back. That means your tax refund could be late. Example: You write your name as “Jon” instead of “John” or enter the wrong bank number. This mistake slows everything down and may stop your refund.

- Math Errors Many people make mistakes when adding or subtracting is to be done with the numbers on the tax forms.Doing math can be tricky, but these mistakes can later on make you too much or even in some cases you may have to pay too much or not get all the money back that you should. Example: If you add $5,000 and $2,000 and write $6,000 instead of $7,000, that’s a problem. It’s a small Tax Preparation Mistake, but it changes your total amount.

- Missing Income Forgetting to report all the money you made is another big Tax Preparation Mistake. Even if you had a small job or made money just one time, you must include it. If you don’t, the tax office might think you are trying to hide money. Example: You worked a weekend job but forgot to write that money on your tax form. That can lead to a fine or even an audit.

- Missing Deductions or Credits There are special tax deductions and credits that help you pay less tax. If you miss them, you may pay more money than you need to. This is one of the costliest Tax Preparation Mistakes because you lose money you could have saved. Example: If you paid for school but didn’t claim the education credit, you miss out on big savings. Always check for deductions before you file.

- Filing Late Filing taxes late is one of the easiest Tax Preparation Mistakes to avoid, but many people still do it. If you don’t send your tax forms on time, you may have to pay a late fee. If you owe taxes and don’t pay right away, the fees and interest keep growing. Example: You miss the April deadline and don’t ask for extra time. Later, you owe more money because of late fees. Always mark your calendar and file on time.