Home » 05 effective ways QuickBooks help small business.

05 Effective QuickBooks Tips for Small Business

Every business owner is always looking for simple, smart ways to grow. For small business owners, this goal is often even stronger. You work long hours, manage many tasks, and need tools that make your work easier, not harder. That’s where QuickBooks helps. It is a smart, easy tool built for small business needs. In this blog, we will explore effective QuickBooks tips for small business owners to improve their accounting and streamline their workflow. QuickBooks helps with key jobs like sending bills, getting paid, tracking inventory, and making reports. It also helps you watch cash flow, track costs, and get ready for tax time with less stress.

One of the best things about QuickBooks is that it has many tools, but it’s still easy to use. The layout is clear, and the steps are simple to follow. You don’t need to be an expert to begin. For small business owners who want to save time, skip errors, and cut stress, QuickBooks is a great pick. It keeps your books right, helps you stay on track, and gives you more time to grow your business.

The following are some QuickBooks tips for beginners and ways it helps small businesses

Easier Inventory and Money Management

- The first of many QuickBooks tips for small business owners is to connect all bank accounts, allowing you to see all financial records in one place. QuickBooks automates your most important accounting tasks. Furthermore, it allows you to track inventory and monitor cash flows in real-time. This allows you to consolidate all of your financial data on a single platform and maintain a proper record of all tax deductions.

Invoicing

- Invoicing is a time-consuming and error-prone process. Rather than embracing it as the norm and obtaining your funds weeks later, you can use an automatic feature of QuickBooks to send invoices directly to your clients. Among the QuickBooks tips for small businesses, setting up auto-invoices is key to getting paid faster and with less effort. Invoices will even include payment buttons, allowing your customers to pay you through a protected portal that links directly to QuickBooks.

Payments Management

- One of the QuickBooks tips for beginners is to use its payment management feature. Using QuickBooks for small businesses provides flexible payment solutions for both online and physical stores. It supports debit and credit card payments, contactless payments, and e-checks. This eliminates the need to account for the money later.

Capability to Support Multiple Users

- Another smart QuickBooks tip for small business owners is to use the multi-user feature to reduce bottlenecks. QuickBooks lets many team members use the system at the same time. You can set different access levels for each person. This means you don’t have to check or approve every task yourself. QuickBooks handles it based on the rules you set for each user.

User-Friendly Design

- QuickBooks is easy-to-use accounting software. It has simple words, a clean layout, and many how-to videos. The software avoids hard terms, so even small business owners with little or no accounting background can use it well. This makes it great for both beginners and experts.

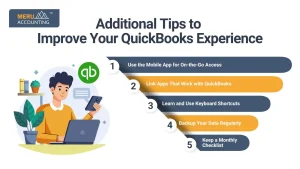

Additional Tips to Improve Your QuickBooks Experience

These bonus QuickBooks tips for small business users will further enhance your financial processes.

Backup Your Data Regularly

QuickBooks Online stores your data in the cloud, but it’s smart to export backups monthly.

Link Apps That Work with QuickBooks

Integrate with platforms like Shopify, PayPal, Square, and Gusto to sync your business operations.

Use the Mobile App for On-the-Go Access

Track sales, upload receipts, or send invoices from your phone.

Learn and Use Keyboard Shortcuts

Familiarize yourself with time-saving shortcuts, especially if you use the Desktop version.

Keep a Monthly Checklist

Use a recurring checklist to ensure you complete tasks like categorizing expenses, running reports, and backing up data.

Benefits of Using QuickBooks for Small Businesses

QuickBooks simplifies accounting tasks for small business owners. Key benefits include:

- Easy invoice generation and tracking

- Quick access to business financials

- Streamlined tax preparation

- Real-time syncing with bank accounts

- Accurate reporting for better decision-making

Implementing the above QuickBooks tips for small businesses helps you take full advantage of these benefits.

Smart Integrations to Boost QuickBooks

QuickBooks gets even more useful when linked with tools you already use. These links, called integrations, help you save time and avoid mistakes.

Helpful Integrations

- Shopify / WooCommerce: Syncs sales from your site right into QuickBooks

- PayPal / Stripe / Square: Tracks and records online payments

- Gusto / TSheets: Handles payroll and time tracking

- Expensify / Dext: Makes it easy to record and sort receipts

- HubSpot / Salesforce: Connects sales and customer data to your books

QuickBooks for Budgeting and Forecasting

QuickBooks is more than a record-keeping tool—it also helps you plan for the future.

Key Budgeting Tools

- Budget Tool: Create monthly or yearly plans

- Actual vs Budget: Spot gaps between goals and results

- Cash Flow Planner: See where your cash is going in the future

Use QuickBooks for Easy Tax Prep

One of the top QuickBooks tips for small businesses is to prep for taxes all year, not just at filing time.

Tax-Friendly Tools

- Expense Categories: Tracks what can be deducted

- Tax Reports: Run reports like Profit & Loss or Expense Summary

- Data Export: Move data to your tax software with ease

- Accountant Access: Share your books with your tax pro

- Sales Tax Tools: Auto-track tax owed and collected

Manage Inventory in QuickBooks

If you sell goods, keeping track of what’s in stock is key. QuickBooks helps with this too.

Inventory Features

- Real-Time Stock Updates: Tracks items as they sell or ship

- Low Stock Alerts: Warns you when to restock

- Inventory Valuation Reports: Shows what your stock is worth

- FIFO Tracking (Online Plus): Uses “First In, First Out” for cost tracking

Track Job Costs and Projects

For service-based work, it’s key to track each job’s costs. QuickBooks offers tools to help.

Job & Project Tools

- Create Projects: Track time, income, and costs in one place

- Assign Expenses: Link bills or costs to the right job

- Project Reports: See how much you made (or lost) on each job

- Billable Hours: Track work time and link it to invoices

QuickBooks is a powerful tool, but like any tool, it works best when used properly. These effective QuickBooks tips for small businesses, along with bonus tips and common error alerts, can help you manage finances more efficiently and avoid costly mistakes.

Don’t just install QuickBooks and forget it. Use it actively. Automate what you can. Reconcile often. Learn to read reports. And most of all, keep your data clean and up to date.

QuickBooks is among the most powerful and user-friendly automated accounting software programs. However, making the most of this software depends on how well you can understand the tips and tricks of using QuickBooks correctly. Meru Accounting is here to provide you with more effective QuickBooks tips and tricks.

FAQs

- How does QuickBooks help manage inventory?

QuickBooks tracks inventory in real time. It shows stock levels and links with cash flow data. - Can QuickBooks send invoices on its own?

Yes. QuickBooks lets you set up invoices that send automatically with payment links. - What payment options does QuickBooks support?

QuickBooks accepts cards, mobile apps, and e-checks. This removes extra work after sales. - Can more than one person use QuickBooks at once?

Yes. QuickBooks allows many users with set roles. Each user can work without delays. - Is QuickBooks simple for people new to accounting?

Yes. It uses clear words, a clean design, and short guides to help anyone get started. - Why should you link your bank account to QuickBooks?

It helps you view all your money in one place. It also tracks cash flow and tax data. - How does QuickBooks speed up billing?

It sends invoices with one click and allows clients to pay right away through secure links. - Why do small businesses choose QuickBooks?

It handles tasks like billing, stock, and payments. It stays simple while saving time.