Home » 05 Ways To Track Payroll Liabilities.

05 ways to track Payroll tax liabilities

Payroll tax liabilities are the taxes a business must pay based on the wages it pays to workers. These taxes include money for Social Security, Medicare, and unemployment. It is important to track payroll tax liabilities so the business does not forget to pay or make mistakes. If these taxes are not paid on time, the business may face big fines. Keeping good records and using the right tools makes it easier. Payroll tax liabilities management is the right way to help the business stay safe and follow the rules. This is something all smart business owners should do.

To run a safe and smart business, it’s very important to track these taxes the right way. There are simple steps that help you stay on top of your tax duties. A little effort now can save you a lot later. Let’s learn what payroll tax liabilities are and how to manage them well.

What Are Payroll Tax Liabilities?

Payroll tax liabilities are the taxes a business must pay when it gives workers their paychecks. These taxes include amounts taken from workers’ pay and money the boss must pay too. Common payroll taxes are:

- Income tax (taken from the worker’s pay)

- Social Security and Medicare

- State taxes

- Unemployment tax

Each time you pay your workers, you also owe taxes. These are called “liabilities” because you must pay them to the government. These taxes are not just your workers’ job. It’s your job too, as a boss, to track and send them on time. If you miss a payment, you may pay fines or face problems with the tax office. That’s why payroll tax liabilities management becomes very important.

Simple Ways to Track Payroll Tax Liabilities

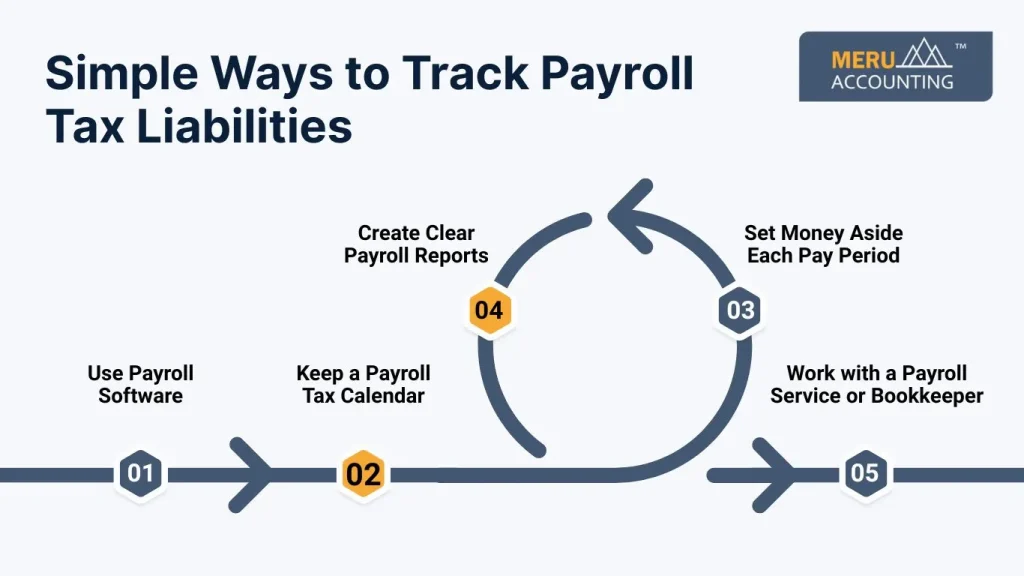

Here are five simple but smart ways to track and manage payroll tax liabilities:

1. Use Payroll Software

One of the best ways to track payroll tax liabilities is by using payroll software. These tools help you:

- Record all paychecks

- Track all tax amounts

- See what you owe

- Send reports

Popular payroll software like QuickBooks, Gusto, or Xero can do most of the work for you. You just enter the data, and it tracks your taxes. It even sends reminders when a tax payment is due. This keeps everything clear and correct.

2. Keep a Payroll Tax Calendar

It’s easy to forget tax due dates. But with a calendar, you can plan better. A payroll tax calendar helps you:

- Mark dates when taxes are due

- Plan time to prepare payments

- Avoid late fees or missed deadlines

You can use a wall calendar, phone reminder, or computer app. Just make sure you check it often. Write down monthly, quarterly, and yearly tax due dates.

3. Create Clear Payroll Reports

You should make reports each time you pay your workers. These reports show:

- How much each worker got

- How much tax was taken

- What the business owes for taxes

These reports are like your proof. If the tax office checks your records, these will help you. A good payroll tax liabilities management plan means always having reports ready.

4. Set Money Aside Each Pay Period

Each time you pay your workers, set the tax money aside. You can:

- Put it in a different bank account

- Keep it saved until tax day

- Make sure you never spend it by mistake

This step helps make sure you always have the money ready when taxes are due. It’s like saving a little each time so you’re not shocked when tax time comes.

5. Work with a Payroll Service or Bookkeeper

If tracking all of this seems hard, ask a pro for help. A payroll expert or bookkeeping company knows how to:

- Track all taxes

- Send the correct forms

- Help with tax filing

- Avoid common mistakes

Challenges in Payroll Tax Liabilities Management

Here are some common challenges when handling payroll tax liabilities. Each point explains the problem in simple words so it’s easy to understand:

Missing Deadlines

One big problem in payroll tax liabilities management is forgetting to pay taxes on time. There are due dates for different payroll taxes. If a business misses these, it may need to pay fines or extra charges. Tracking dates carefully is very important.

Wrong Tax Calculations

Sometimes, the tax amounts are not calculated correctly. This can happen if someone types the wrong numbers or uses an old tax rate. When payroll tax liabilities are wrong, it may confuse the records and lead to mistakes.

Not Keeping Good Records

Every business must keep track of how much it paid in wages and taxes. If records are lost or not clear, it becomes hard to know how much tax is due. Bad record-keeping makes payroll tax liability management harder.

Changing Tax Rules

Tax laws change from time to time. A business must follow the new rules. But if the business doesn’t know about the changes, it may pay too much or too little. This can cause problems in managing payroll tax liabilities.

Handling Many Employees

If a business has many workers, it becomes harder to track payroll taxes for each one. There are different forms and numbers for each worker. Keeping it all correct is a big challenge in payroll tax liabilities management.

Multi-State Rules

If a business has workers in more than one state, the tax rules may be different in each state. This makes payroll tax liabilities management harder because each state has its own way of doing things.

How to Choose the Right Help for Payroll Tax Liabilities

Choosing the right help for payroll tax liabilities is very important for any business. Here are simple steps to help you find the best support:

1. Check Their Experience

Before picking someone, ask how long they’ve worked with payroll tax liabilities. More years mean they know more and can handle tricky problems.

2. See If They Know the Rules

The person or company should know all the rules about payroll tax liabilities. Tax rules can change, so they must stay updated and follow the latest laws.

3. Ask About Tools They Use

Good payroll help uses smart tools or software to track payroll tax liabilities. This keeps work fast and errors low. Ask what tools they use and if they are easy to use.

4. Look for Good Support

Pick a team or company that gives quick and friendly help when you need it. If you have a problem with payroll tax liabilities, they should be ready to solve it fast.

5. Check What Others Say

See what other people or businesses say about their work. If they have happy clients, they might be good at managing payroll tax liabilities. You can look at reviews or ask for feedback.

6. Make Sure They Keep Records Safe

Handling payroll tax liabilities means using private workers and tax information. Choose someone who keeps all this safe and follows strong data safety rules.

7. Compare Their Cost

Different companies charge different prices. Choose one that gives good service at a fair price. Don’t just pick the cheapest; make sure they do a good job with payroll tax liabilities too.

8. Ask About Services

Some experts do more than just taxes. They may also help with paychecks, reports, or other work. Ask what full services they offer for payroll tax liabilities.

Paying your workers is not just about giving them their paycheck. You must also take care of your payroll tax liabilities. If you ignore them, it can cost you big. But with simple steps like using payroll software, marking a calendar, keeping reports, saving money ahead, and getting help when needed, you can stay safe and stress-free.

Good payroll tax liabilities management helps your business grow strong. It helps you stay out of trouble and earn trust. If you want help from experts, Meru Accounting is a great choice. We know the rules and tools to help you stay on track. With our support, you can relax and focus on your work, knowing your payroll taxes are handled the right way.

FAQs

- What happens if I forget to pay my payroll tax liabilities?

If you forget to pay, you may have to pay extra fees or fines. The tax office may also ask for more checks or audits. It’s better to track and pay on time. - Can I do payroll tax tracking by hand without software?

Yes, but it can be hard and easy to make mistakes. Software makes it easier and faster to track taxes and pay on time. - How often do I need to pay payroll taxes?

It depends on your business. Some pay every month, some every three months. Your payroll calendar can help you know the due dates. - Do I need to file forms too, or just pay the taxes?

You must do both. You pay the tax and also file reports or forms that show how much you paid and who you paid it to. - Is hiring a bookkeeping or payroll service expensive?

It depends on the service, but many are affordable. Plus, they help you save money by avoiding late fees or errors. Services like Meru Accounting offer helpful, budget-friendly payroll support.