Home » Top 10 Bookkeeping Tips Every Seller Needs to Know!

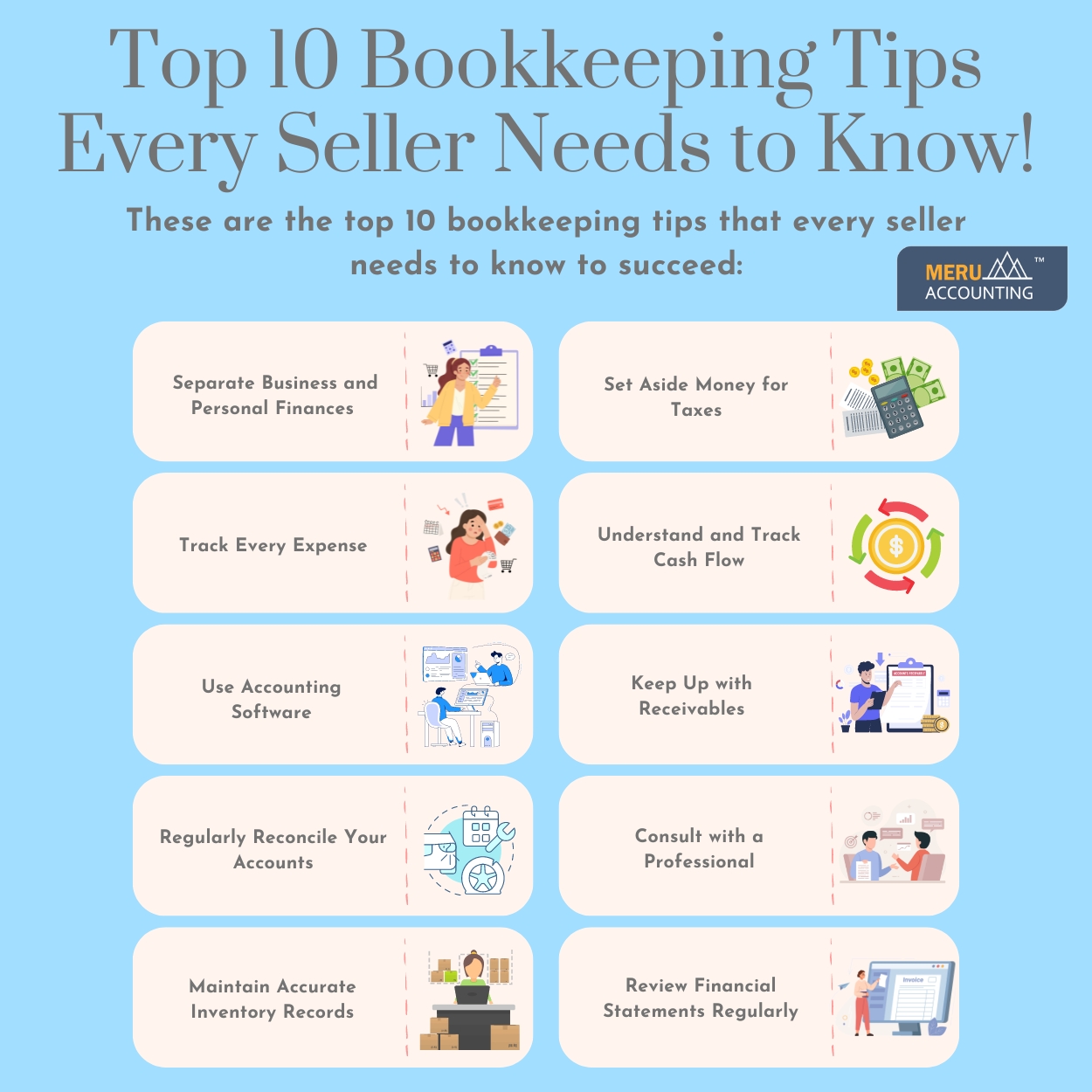

Top 10 Bookkeeping Tips Every Seller Needs to Know!

Whether you’re a seasoned entrepreneur or a newcomer to the world of selling, managing your finances efficiently is crucial for the success of your business. Bookkeeping may not be the most attractive part of running a business, but it’s essential for keeping your financial health in check. Here are the top 10 bookkeeping tips every seller needs to know to keep their financial records in order and their business thriving.

Separate Business and Personal Finances

- Ensuring that your personal and corporate earnings are kept separate is a crucial step in Amazon bookkeeping. Create a specific business bank account and utilize it only for company-related activities.

- This division makes bookkeeping easier and guarantees that personal and commercial costs don’t mix, which facilitates easier tax preparation.

Track Every Expense

- It is essential to maintain a thorough log of all business spending for Amazon bookkeeping. To keep track of every transaction, including shipping charges, advertising expenses, and inventory purchases, use Amazon bookkeeping software.

- Maintaining proper expense tracking guarantees that you can claim all allowable deductions throughout tax season and helps you evaluate the financial health of your organization.

Use Accounting Software

- Purchasing dependable bookkeeping software for Amazon will help you save time and minimize mistakes. Your Amazon seller account can be integrated with software like QuickBooks or Xero to automate numerous bookkeeping activities including expense monitoring, invoicing, and financial reporting.

- You may now concentrate more on expanding your company instead of being mired down in financial administration thanks to this automation.

Regularly Reconcile Your Accounts

- Making sure your bank statements and financial records match is the procedure of reconciliation for Amazon bookkeeping.

- Frequent reconciliation assists you in identifying disparities early on and keeps minor mistakes from growing into major issues.

- Set up a time each month to update your Amazon bookkeeping software with accurate balances and reconcile your accounts.

Maintain Accurate Inventory Records

- Keeping an accurate inventory record is essential to preventing overstock and stockout scenarios. Make use of the inventory management features found in Amazon bookkeeping software.

- You may stay on top of your stock levels and know when to place new orders by using this software to track sales, buy orders, and inventory levels.

Set Aside Money for Taxes

- By putting money aside for taxes all year long, one might avoid financial hardship come tax season. Based on your income, calculate your estimated tax burden and make recurring deposits of a percentage of your income into a separate tax account.

- This procedure guarantees that you have enough money to pay your taxes without negatively affecting your cash flow.

Understand and Track Cash Flow

- The lifeblood of your company is its cash flow. By keeping a regular eye on your cash flow, you can better understand your earnings and outlays and make sure you have the funds available to fulfill your commitments.

- To stay on top of your financial condition, prepare cash flow statements using your Amazon bookkeeping software and review them once a month.

Keep Up with Receivables

- Keeping a sustainable cash flow depends on managing accounts receivable. Make sure you send out invoices to your clients on time and chase down any unpaid balances.

- Automating invoices and payment reminders with Amazon bookkeeping software can help you get paid more quickly and lower your risk of bad debts.

Consult with a Professional

- Even though bookkeeping software is capable of handling a lot of work, speaking with a qualified accountant or bookkeeper can yield insightful information.

- You can get expert assistance with financial planning, tax planning, and making sure all tax regulations are followed.

- You can prevent costly errors and make well-informed decisions with the support of regular consultations.

Review Financial Statements Regularly

- By routinely examining your financial documents, including the balance sheet and profit and loss statement, you may get a comprehensive understanding of your business’s financial health.

- Use Amazon bookkeeping software to generate these reports and review them monthly. This practice helps you identify trends, spot potential issues, and make data-driven decisions to grow your business.

Conclusion

Meru Accounting is an expert in offering complete accounting and bookkeeping services specifically designed for Amazon sellers. With innovative tools to guarantee accuracy and compliance, our team of professionals can assist you in putting successful Amazon bookkeeping ideas into practice. You may concentrate on expanding your company while we handle your financial management when you work with Meru Accounting. Contact us right now to find out how we can assist you with your bookkeeping needs and help you succeed financially.

FAQs

- Why should Amazon sellers keep business and personal finances separate?

Keeping finances separate helps Amazon sellers track income, control spending, and prepare clean records for taxes. It avoids mixing personal costs with business payments. - What expenses should Amazon sellers record for bookkeeping?

Record every business expense. Include shipping fees, ad costs, returns, tools, and supply purchases. Clear records help you claim deductions and review business costs. - Which bookkeeping software supports Amazon sellers best?

Amazon sellers often use QuickBooks or Xero. These tools connect with your Amazon seller account and help track expenses, create reports, and manage payments. - How often should Amazon sellers reconcile their accounts?

Reconcile your accounts each month. Match your bank data with your records. This helps spot errors early and keeps your bookkeeping accurate. - Why is inventory tracking useful in Amazon bookkeeping?

Inventory tracking helps sellers avoid extra stock and missed sales. It supports better restocking, price checks, and smoother order flow. - How can Amazon sellers prepare for tax season during the year?

Set aside money from each payout. Use a separate account for tax savings. This avoids cash flow problems when you file taxes. - Why must Amazon sellers track cash flow each month?

Cash flow shows money coming in and going out. Tracking it helps you meet bills, plan ahead, and check if your business earns steady profit. - Do Amazon sellers need a bookkeeper if they use software?

Yes. Software helps with tasks, but a bookkeeper gives tax advice, checks reports, and keeps your business on track with laws.