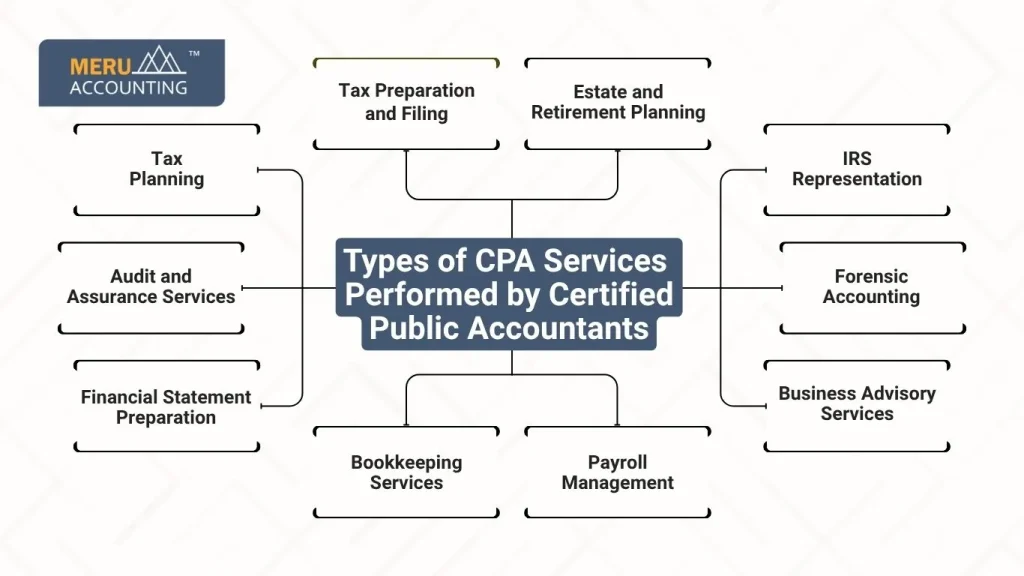

Types of CPA Services Performed by Certified Public Accountants

CPAs offer much more than tax help. They give support to both people and firms in many ways. From filing tax returns to long-term money plans, the types of CPA services can help you stay legal, grow wealth, and avoid costly errors.

CPAs are trained to do more than just work with numbers. They help with audits, budgets, risk checks, and give smart advice for key money choices. If you own a firm, invest, or run a household, a CPA can guide you to meet your goals and stay on track.

They also make sure you follow the rules from tax boards, banks, and other groups. With their help, you can cut tax bills, steer clear of fines, and plan ahead with care. A skilled CPA saves time, brings peace of mind, and helps you grow.

No matter your field—healthcare, real estate, tech, or retail—a CPA can give the right kind of help for your needs. Choosing the right CPA service can lead to smart wins now and strong results in the future.

Let’s look at the CPA services you might need and how they can help.

1. Tax Preparation and Filing

- CPAs prepare and file tax returns for individuals and businesses.

- They ensure every tax law is followed correctly.

- They help reduce tax errors and maximize refunds.

2. Tax Planning

- Tax planning helps you plan ahead to save money.

- CPAs suggest the best time to make purchases or investments.

- It helps reduce future tax liability.

3. Audit and Assurance Services

- Audits review your financial records for accuracy.

- These CPA services are important for banks, investors, or the government.

- They improve your company’s credibility.

4. Financial Statement Preparation

- CPAs prepare reports like balance sheets and income statements.

- These help business owners understand their financial health.

- Reports are also useful for securing loans or attracting investors.

5. Bookkeeping Services

- Bookkeeping is about keeping daily financial records.

- CPAs ensure everything is organized and up to date.

- Clean records help during audits and tax seasons.

6. Payroll Management

- CPA services include handling employee payments.

- They calculate wages, bonuses, and deductions.

- They also file payroll taxes on time.

7. Business Advisory Services

- CPAs help plan and manage business growth.

- They give advice during mergers, expansions, or major changes.

- Their guidance supports smart business decisions.

8. Forensic Accounting

- These services help detect fraud or theft.

- CPAs analyze data for court cases or financial disputes.

- This is one of the specialized types of CPA services.

9. IRS Representation

- If you’re audited, a CPA can deal with the IRS for you.

- They provide all the needed records and paperwork.

- They also help settle tax debts or disputes.

10. Estate and Retirement Planning

- CPA services include planning for your future.

- They help reduce estate taxes and manage asset transfers.

- They also guide on saving for retirement in a tax-friendly way.

More About CPA Services and Why They are Important

The above ten are some of the most useful types of CPA services, but CPA professionals do even more. Their work goes beyond reports and numbers. They act as financial partners and advisors for individuals, startups, small businesses, and large companies.

Here’s why their services are important:

Why Choose CPA Services?

- Accurate Financial Records:

CPAs make sure your books are clean and correct. - Compliance With Laws:

CPAs follow local, state, and federal laws for taxes and business operations. - Help With Big Financial Choices:

Buying property? Investing in a business? A CPA helps weigh pros and cons. - Confidence During Tax Time:

With CPA help, you don’t fear IRS letters or deadlines.

Industries That Use CPA Services

Different types of CPA services are useful in many lines of work, depending on each industry’s needs. From small shops to large firms, skilled CPAs help manage money, meet rules, and plan for the future. Here are some key fields that often use CPA help:

- Healthcare

Doctors, clinics, and health centers deal with complex billing and strict rules. CPAs help with medical billing, claim checks, tax filings, and staying in line with health laws. They also help with payroll and cost control. - Retail

Retail shops handle cash, stock, staff pay, and vendor bills. CPAs help track inventory, file sales tax, set up point-of-sale systems, and manage profits. They help stores grow while staying within budget. - Construction

Builders must track many costs—materials, pay, and tools. CPAs set up job cost systems, track work hours, and build cash flow plans. They help firms bid smart, stay on track, and stay within their budget. - Entertainment

Artists, streamers, and actors deal with royalties, gigs, and tax laws. CPAs in this field help handle pay for shows, file tax on global income, and track work deals. They help keep creative minds focused on their art. - Real Estate

Property firms need to manage rent, loans, and tax breaks. CPAs help with deals, cash flow, asset value, and rules on gains and losses. They also guide on write-offs, tax plans, and cost tracking for upkeep. - More Industries

CPAs also help in tech, farming, travel, law, and education. Each field has its own needs. A CPA who knows your trade brings better tools, clear advice, and fewer risks.

Each industry has specific needs. CPAs who know your field can offer better results.

How to Choose the Right CPA

Not all CPAs offer the same help. When picking the right one, keep these points in mind:

- Experience in Your Industry

Pick a CPA who knows your field. They will better grasp your money needs and the rules you must follow. - Good Client Reviews

Check what others say. Good reviews show that the CPA is skilled, trusted, and helpful. - Clear Pricing Plans

Go with a CPA who lists all fees up front. Clear costs help you know what you will pay with no bad surprises. - Active CPA License

Make sure the CPA has a valid license in your state. This proves they meet key rules and skills. - Willingness to Offer Ongoing Support

Pick a CPA who helps you all year—not just at tax time. Year-round support gives peace of mind.

CPA Services vs. General Accountants

Some people confuse CPAs with regular accountants. Here’s a quick comparison:

Feature | CPA Services | General Accountants |

License Required | Yes | No |

Can Represent at IRS | Yes | No |

Services Offered | Broader (tax, audit, etc.) | Basic bookkeeping |

Government Trust | Higher | Limited |

CPAs are more qualified and offer a wider range of financial services.

Common Tools Used in CPA Services

Modern types of CPA services rely on digital tools to offer fast and accurate solutions. These include:

- QuickBooks

- Xero

- Microsoft Excel

- IRS e-File tools

- Tax software like Drake, Lacerte, and ProConnect

Knowing how to use these tools is part of offering quality CPA services.

Benefits of Using CPA Services

- Save Money in the Long Run

At first, hiring a CPA may seem like an extra cost. But in time, it often pays off. With smart tax plans, fewer errors, and better ways to cut costs, you may save more than you spend. A CPA helps you hold on to more of your income. - Peace of Mind

Tax work can be tricky, and errors can lead to stress or fines. A CPA knows the rules and handles the work for you. You won’t need to worry about missing forms or dates. This brings peace and saves time. - Better Decisions

A CPA knows how to read your money records and spot trends. They can help you understand the data and use it to make wise choices. Their advice gives you a clear path to reach your goals. - Growth Support

As your work or firm grows, so do your money needs. A CPA helps you plan for growth. They help you build budgets, check cash flow, and set goals. Their support helps you grow in a safe and smart way.

How CPA Services Help in Business Growth

CPA services are valuable tools for expanding any business.

- Boosting Profits

CPAs study your income and costs to improve your profit margin. - Controlling Expenses

They help find areas where you can reduce wasteful spending. - Strategic Planning

CPAs create clear financial plans for growth and expansion. - Helping with Loans

They prepare documents and reports needed for loans or funding.

Role of CPAs in Startups

Startups need strong financial support, and the right types of CPA services can provide that from the start.

- Choosing the Right Business Structure

CPAs advise on setting up LLCs, corporations, or sole proprietorships. - Setting Up Accounting Systems

They help install tools like QuickBooks or Xero for recordkeeping. - Claiming Startup Expenses

CPAs know what startup costs are tax-deductible and how to claim them. - Managing Early Cash Flow

They help track income and expenses to avoid early-stage cash problems.

CPA Services for Freelancers and Creators

Freelancers and creators can benefit from the many types of CPA services designed to track income, taxes, and expenses.

- Tracking Project Income

CPAs organize income from clients, platforms, or contracts. - Handling Estimated Tax Payments

They make sure taxes are paid on time throughout the year. - Claiming Proper Deductions

CPAs help claim things like home office, equipment, and software. - Planning for the Future

They guide on setting money aside for savings and retirement.

Difference Between CPA and Tax Preparer

Knowing the difference helps you choose better financial support.

- CPA Licensing

CPAs must pass exams and hold active state licenses. - Range of Services

CPAs handle more than just tax returns, including audits and planning. - IRS Representation

Only CPAs can fully represent you before the IRS during an audit. - Trusted Professional Advice

CPAs are held to higher standards and ethics than general tax preparers.

Ethical and Legal Standards in CPA Services

CPAs follow strict rules to protect clients and maintain quality.

- Code of Conduct

They follow the AICPA Code of Professional Ethics. - Continuing Education

CPAs must complete learning hours every year to stay updated. - Legal Responsibility

They are legally accountable for their reports and filings. - Client Confidentiality

CPAs are trained to keep all financial data safe and private.

CPA Services in Remote and Virtual Models

Many CPAs now work online, offering flexibility to clients.

Virtual Consultations

Meetings can be done through Zoom, Google Meet, or similar tools.

Online Portals

Clients can upload and receive files using secure systems.

E-signatures and Approvals

Approvals and forms can be signed digitally without delays.

Real-time Support

CPAs can answer questions or fix issues without in-person meetings.

How CPA Services Reduce Business Risks

CPAs help protect your business from legal and financial issues.

Early Detection of Errors

They catch small mistakes before they become big problems.

Compliance with Laws

CPAs make sure your business follows tax and financial rules.

Fraud Prevention

They check for signs of internal fraud or mismanagement.

Safe Financial Planning

Their advice helps you make safe choices with your money.

Seasonal vs Year-Round CPA Services

Choosing year-round CPA support has more benefits than seasonal help.

Regular Monitoring

Your finances stay on track with ongoing reviews and updates.

Better Tax Planning

Year-round advice helps lower your total tax bills.

Timely Adjustments

CPAs can help make mid-year changes to avoid losses or penalties.

Closer Client Relationships

More time together means better understanding of your goals and needs.

Technology in CPA Services

Modern CPA services use smart tools to work faster and safer.

Cloud Accounting

Data is saved and backed up in real-time with tools like QuickBooks Online.

AI and Automation

Some CPAs use tools that speed up data entry and error detection.

Secure Data Handling

All documents and files are shared using encryption and protected logins.

Efficient Communication

Emails, messages, and alerts keep everything running smoothly.

When Should You Hire a CPA

At certain times, call for expert help from a CPA.

Starting a New Business

CPAs guide you in setting up the right structure and systems.

Getting Audited by the IRS

A CPA can handle the full process and speak with the IRS on your behalf.

Planning for Growth

When your business expands, a CPA helps plan budgets and investments.

Saving for Retirement or Estate Planning

They help structure savings and asset transfers in a tax-friendly way.

How CPA Services Differ in the US and Other Countries

Different regions follow different financial laws and standards.

Local Standards

In the US, CPAs follow GAAP and IRS rules. Other countries may use IFRS.

International Tax Help

CPAs can help if you work, earn, or invest in more than one country.

Cross-Border Compliance

They handle foreign bank account reports, global income, and filings.

Global Business Advice

If your business grows internationally, CPA guidance helps avoid legal trouble.

There are many types of CPA services that support financial health, reduce risk, and build future growth. Whether you’re planning taxes, growing a business, or preparing for retirement, these services are valuable tools.

Choose the right CPA who understands your needs. With the right help, your finances stay clean, smart, and ready for the future. At Meru Accounting, we specialize in offering reliable and cost-effective CPA services tailored for individuals, startups, and businesses of all sizes. Our expert team ensures you stay compliant, make informed decisions, and achieve long-term financial success.

FAQs

Q1. What does a CPA do?

A CPA helps with taxes, accounting, audits, and financial advice.

Q2. Are CPA services only for businesses?

No, individuals use them for taxes, planning, and audits.

Q3. Can a CPA represent me to the IRS?

Yes, a CPA can deal directly with the IRS on your behalf.

Q4. Do CPAs only do taxes?

No, they also help with audits, payroll, planning, and more.

Q5. How often should I use CPA services?

At least once a year for taxes, or regularly for business help.

Q6. What’s the cost of CPA services?

Costs vary by service type, location, and complexity.

Q7. How do I find the right CPA for me?

Look for licensed CPAs with good reviews and experience in your field.