5 Ways Outsourcing Accounting Services Can Create Profit Potential

Outsourcing accounting services is now a smart move for firms of all sizes. It helps cut costs, save time, and improve the way books are kept. More and more firms now use outsourced help to stay ahead in a tough market.

When you let experts manage your books, you get more time to work on your main goals. You also skip the need to hire, train, and pay full-time staff, which cuts your costs. With skilled teams on board, you get clear and quick reports that help you make sound choices.

When done well, accounting outsourcing does more than cut costs — it can help boost your profit. With smart tools and good use of data, it helps keep your records in shape, meet tax needs, and avoid costly slip-ups.

In this blog, we will look at five clear ways this can work for you. You’ll learn how outsourced help can drive growth, improve cash flow, and give your firm the edge it needs to grow with less stress and more ease.

What is Outsourced Bookkeeping?

Outsourced bookkeeping is a key part of outsourced accounting services, where a business hires an outside firm to handle its books. It brings full accounting help without the need to build an in-house team. These services take care of daily tasks like tracking sales and buys, paying bills, sending invoices, payroll, and making reports.

Bookkeeping firms have trained pros who work as a small team for your business. This setup gives you expert help at a much lower cost than hiring full-time staff. It also means your books stay clean, up to date, and ready when you need them.

Why is Accounting So Significant for Businesses?

Accounting is a key part of any business. It tracks money coming in and going out. It also shows how well a business is doing. The accounts team handles records, tracks patterns, manages payroll, and files taxes.

Today, many US companies are turning to accounting outsourcing by expert providers. This helps save costs and improve accuracy. This helps save costs and improve accuracy. Businesses can then focus more on their main work and improve their output.

Trendy Accounting Services Outsourced to the USA

Before choosing an outsourcing accounting service, a business must know which accounting tasks can be handled outside the company. CFOs often look to outsource finance work without losing control. The US now sees outsourcing in both large and small companies across all industries. Some common outsourced accounting services include:

- Financial Accounting Services: These services track financial activities and prepare reports like income statements and balance sheets.

- Payroll Accounting Services: Manages employee salaries, taxes, bonuses, and other payments.

- e-Accounting Services: Uses online tools to keep accounting fast, easy, and well-organized.

- Forensic Accounting Services: Helps detect and prevent fraud while offering legal support in financial matters.

- Tax Accounting Services: Prepares tax returns and plans for future tax years, keeping in mind the complex US tax laws.

- Financial Statement Preparation: Prepares reports like balance sheets and cash flow statements. These services require expert handling.

4 Key Profits of Outsourcing Accounting Services

- Financial Reserves

Outsourcing helps businesses save money by avoiding full-time salary costs. It also cuts training and hiring costs. The saved money can be used to grow the business.

- Time Investments

Using an outsourcing accounting service gives your in-house team more time to focus on important daily work. This boosts overall performance and productivity.

- Access to Field Experts

You get trained professionals who are updated with the latest rules and tech. These experts deliver better results.

- Contractual Commitment

Outsourced partners often follow strict contracts, which makes them more accountable. This is often better than managing in-house teams.

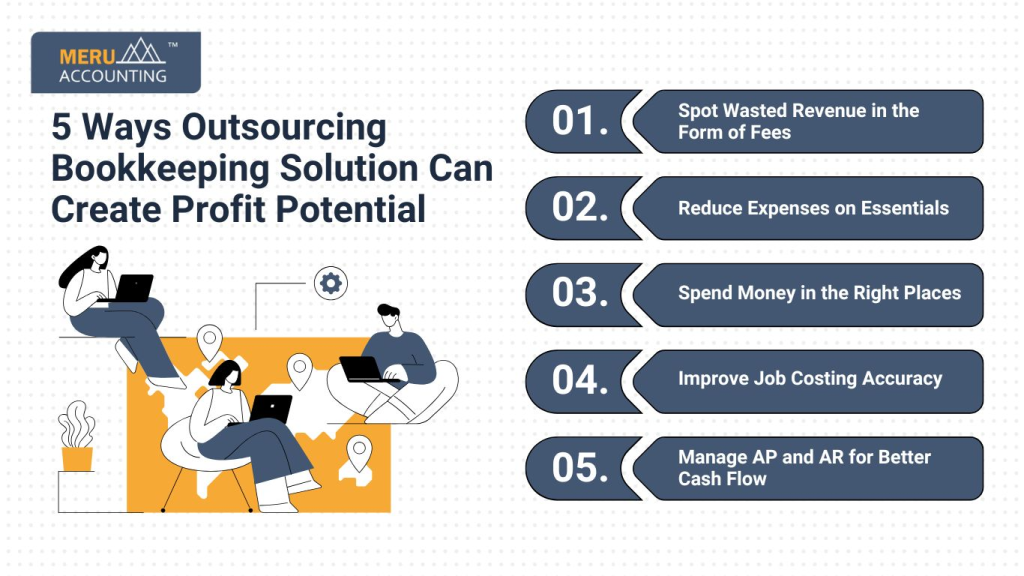

5 Ways Outsourcing Bookkeeping Solution Can Create Profit Potential

Outsourcing is not just about cutting costs. It also helps boost profits by managing money better and improving decision-making.

- Spot Wasted Revenue in the Form of Fees

A good bookkeeper can spot late fees, overdrafts, and missed payments. Fixing these issues can save your business a lot of money.

- Reduce Expenses on Essentials

Virtual bookkeepers can check where you’re overspending—on rentals, tools, or services—and suggest cost-saving ideas.

- Spend Money in the Right Places

Sometimes, spending more in the right area (like marketing or tools) can boost growth. Bookkeepers help find such smart investments.

- Improve Job Costing Accuracy

Many businesses lose money due to bad job costing. A virtual accountant can fix these problems and improve profits.

- Manage AP and AR for Better Cash Flow

By managing invoices and bills well, bookkeepers improve cash flow. This helps you meet expenses like payroll or rent on time.

What Are the Main Types of Outsourcing?

Outsourcing types are based on location. Here are the three major types:

- Local Outsourcing

Hiring someone from your own country. It’s easier to communicate, manage time zones, and track work.

- Offshore Outsourcing

Hiring from countries like India. This reduces costs but may need careful planning to manage time and culture gaps.

- Nearshore Outsourcing

Hiring from nearby countries like Eastern Europe. It’s a mix of lower costs and easier communication.

What Are the Advantages of Outsourced Accounting Services?

- Cost-Effective

Outsourcing cuts employee training, payroll, and setup costs. It saves money that can be used for business growth.

- Increased Accuracy

Outsourced teams work in a focused environment, so they make fewer mistakes. They give clear and accurate results.

- Better Business Decisions, Faster

You get timely reports and insights. This helps you make smarter choices quickly.

- Minimizing Risk

Mistakes in taxes or payroll can be costly. Outsourcing reduces this risk, as trained experts handle the work.

- Increase Profitability

Focus your in-house efforts on core tasks. This boosts your team’s productivity and helps grow the business.

What Are the Disadvantages of Outsourced Accounting Services?

- Some Extra Costs

If the scope of work grows, so can the charges. Always set clear terms in your service agreement to avoid surprises.

- Less Employer Control

You can’t just walk over and ask a question like with in-house staff. Trust and regular updates are key.

- Not Local

Some issues may take longer to resolve. While virtual teams offer support, they’re not always available instantly. Good firms solve this with solid communication plans.

How Outsourcing Bookkeeping Helps?

How Outsourcing Bookkeeping Helps

Choosing an outsourcing accounting service brings real value to firms of all sizes. Here’s how it helps:

- Cost Savings

In-house bookkeepers cost more due to wages, perks, training, and office needs. Outsourcing cuts these costs by offering pay-as-you-go options. - Access to Experts

Outsourced teams have trained pros who know the rules and tools well. They keep your books clean and up to date. - Saves Time

Bookkeeping takes time. When you outsource, you get more time to grow your business and serve your clients. - Easy to Scale

As your firm grows, so do your needs. Outsourced services grow with you — no need to hire and train new staff. - Use of Smart Tools

Firms that offer bookkeeping use top cloud tools. You get real-time access, safe data, and less manual work. - Fewer Errors & Risk

Trained experts help keep your books right and in line with tax rules. This helps avoid fines and audits. - Smooth & Steady Service

Outsourcing gives steady help, even if someone is sick or leaves the job. No breaks in your reports.

Why Outsource a Bookkeeping Service?

Outsourcing bookkeeping is not just a trend. It is a smart and cost-friendly way for businesses to manage their books. Whether you choose online, virtual, or full-service help, outsourcing gives you real value.

1. Access to Skilled Professionals

Outsourcing lets you work with trained bookkeepers. They know how to handle records, tax rules, and reports. You get the help of experts without hiring full-time staff.

2. Real-Time and Accurate Financial Data

Outsourced teams use cloud tools to update your records fast. You can check your data any time, from anywhere. This helps you plan and make the right moves for your business.

3. Lower Operational Costs

Keeping an in-house team means paying for wages, tools, and space. With outsourcing, you only pay for the service you need. This cuts down on costs and saves money.

4. Improved Data Security

Your data is stored in secure cloud systems. These systems protect your records from theft or loss. Even in a crisis, your data stays safe and backed up.

5. Better Business Continuity

If your in-house bookkeeper quits, your work may suffer. But with outsourcing, the service goes on without pause. This keeps your business running smooth and steady.

The Role of Technology in Outsourced Accounting Services

- Real-Time Access to Financial Data

Cloud tools let you view your books at any time, from any place. You don’t have to wait for monthly reports, your data is always up to date. - Automated Updates and Backups

Your records are safe with built-in backups and system updates. This lowers the risk of lost data and keeps your software tools fresh. - Faster Reports and Less Paperwork

With tech, reports are made in less time and shared in a click. There’s no need for long printouts or stacks of files. - Seamless Software Integration

Your accounting tools work well with other systems like payroll, billing, and CRM. This saves time and cuts down on manual work. - Secure Data Storage

Cloud servers use high-end safety tools to guard your data. This means your info is safe from theft, loss, or system crashes. - Mobile and App Access

Many systems now offer mobile apps, so you can send bills, track costs, or approve payments on the go. - Smart Dashboards and Insights

Tech offers clear views of cash flow, profits, and costs. These tools help you make fast, smart choices for your business. - Error Reduction and Accuracy

Built-in checks and smart features help catch errors early. This means your books stay clean and right the first time.

How Outsourcing Helps in Tax Planning and Filing

- On-Time Tax Returns

Outsourced teams make sure your tax forms are sent in before the due date. This keeps your business safe from late filing issues. - Avoid Penalties and Fees

When taxes are filed on time and with care, you avoid fines, late fees, and extra charges. - Expert Knowledge of Tax Laws

Outsourced pros stay up to date with tax rules. They adjust your returns to meet the latest legal needs. - Better Record Keeping for Taxes

Your books stay neat and sorted. This makes tax work smooth and cuts down stress during tax season. - Claim All Legal Deductions

Experts know what costs can be claimed. This helps lower your tax bill without breaking any rules. - Help with Tax Audits

If the tax office asks for a review, your records are clear and ready. This helps you stay calm and well-prepared. - Save Time and Reduce Errors

You don’t have to spend hours on forms. Outsourcing cuts down on manual work and keeps errors low. - Year-Round Support

Good outsourcing firms also help you plan ahead, not just during tax time, so you’re ready all year long.

Many US small businesses and startups struggle with managing accounts. Outsourcing is a smart way to save time and costs. It helps firms grow without extra stress.

Bookkeeping must be accurate and up to date. It’s key for smooth operations. A skilled bookkeeper makes smart decisions and helps the business grow.

At Meru Accounting, we offer expert outsourced accounting services tailored to your business needs. Our team ensures accuracy, cost savings, and complete compliance. Whether you’re a startup or a growing firm, our accounting outsourcing solutions help you stay focused on growth while we handle your numbers. Trust Meru Accounting to be your reliable financial partner.

FAQs

1. What is accounting outsourcing?

It means a business hires a firm to manage tasks like books, payroll, and taxes.

2. Is outsourcing accounting services good for small businesses?

Yes, it cuts costs and gives access to skilled help without full-time staff.

3. Will my financial data be safe with an outsourced firm?

Yes, good firms use secure tools to keep your data safe.

4. How much can I save by outsourcing accounting?

You can save 30% to 50% compared to in-house staff.

5. Can I outsource only part of my accounting work?

Yes, you can choose to outsource tasks like payroll or tax filing.

6. Will I lose control over my accounts?

No, you stay in charge and get reports from the firm.

7. How quickly can outsourced services start?

Most setups take a few days to one week.