What are the Duties of an Accounts Receivable Specialist?

An Accounts Receivable Specialist plays a key role in managing a company’s cash flow. They help make sure the business gets paid on time. This blog explains what are the duties of an accounts receivable specialist. Whether you want to hire one or become one, this guide will help you know the main tasks.

They send invoices, track payments, and talk to customers about dues. Their work helps cut down late payments and keeps records clear. A good accounts receivable specialist helps the business run well by keeping money coming in.

What is Accounts Receivable?

Accounts Receivable (AR) is the money a business should get from its customers after selling goods or services. It is listed as a current asset on the balance sheet because this money is due soon. An Accounts Receivable Specialist handles this job. They send out invoices, track payments, and keep records clear and current. Their work helps the cash flow stay steady and keeps the business running well.

Why is Accounts Receivable Important?

Accounts Receivable (AR) tracks the money owed to your business for goods or services already provided. When clients pay late, it may be hard to cover bills, pay staff, or grow. A strong AR process keeps cash moving and business stable.

Improve Cash Flow

A solid AR system ensures you send and collect invoices on time. This steady flow of cash helps you pay costs without using loans. It also gives you room to plan new tasks or seize fresh chances.

Reduce Bad Debts

By tracking unpaid bills and sending prompt notes, you cut the risk of not getting paid. Regular follow-up brings in funds before debts go bad. This keeps your profits safe.

Build Customer Trust

Clear and honest bills build trust. When clients can read and grasp what they owe, they’re more likely to pay. A polite but firm tone in follow-ups builds strong links over time.

Support Financial Planning

Clean AR data helps you know when cash will come and how much to expect. This helps with plans, budgets, and smart choices. It also makes audits and tax work easier.

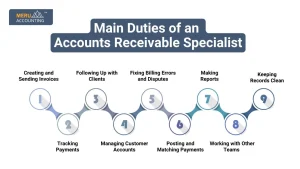

Main Duties of an Accounts Receivable Specialist

An AR specialist handles tasks that help keep the company’s books in order. Their main duties include:

Creating and Sending Invoices

One of the key accounts receivable specialist duties is to prepare and send bills for items sold or services provided. Each invoice shows:

- Customer name

- Invoice number

- Details of items or services

- Due date

- Payment terms (like net 15 or net 30)

Tracking Payments

They track who owes money and how much. They use tools or sheets to follow up on late invoices and send reminders.

Following Up with Clients

Among the routine accounts receivable specialist duties is reaching out to clients by email or phone for payments. They may also offer payment plans or adjust due dates if needed.

Managing Customer Accounts

They update records with new bills, payments, and credits. They also track credit limits and flag overdue accounts.

Fixing Billing Errors and Disputes

If a client finds a mistake, the AR expert fixes it fast. This helps keep good ties with the client.

Posting and Matching Payments

When money is received, they record it and match it with the right invoice. This helps keep books clean.

Making Reports

They prepare reports each week or month. These may include:

- Total unpaid invoices

- Days Sales Outstanding (DSO)

- Aging reports (showing how long invoices are overdue)

Working with Other Teams

They team up with sales and support staff to ensure bills are right and issues are solved fast.

Keeping Records Clean

Accuracy matters. AR experts make sure all data is right. This helps with audits, taxes, and reports.

Essential Skills of an Accounts Receivable Specialist

To do their job well, an AR specialist must have key skills. These skills help with billing, quick payments, and fewer mistakes.

Attention to Detail

Even small errors in bills can lead to big trouble. AR staff must check amounts, dates, and names with care.

Good Communication Skills

They must talk to clients in a clear and polite way. This helps build trust and solve payment issues fast.

Time Management

They must send bills and reminders on time. Staying on track stops payment delays.

Basic Accounting Knowledge

They should know ledgers, debits, and credits. This helps keep records right.

Familiarity with Tools

They must know how to use Excel and tools like QuickBooks. These tools help speed up tasks.

Problem-Solving Skills

When payments are late or in doubt, smart thinking and calm talk help solve issues.

What Makes a Great AR Specialist?

Great AR staff do more than basic tasks—they help the company grow.

- Keeps a Clean Aging Report

- Follows Up Often

- Builds Client Trust

- Works Well Under Pressure

- Boosts Cash Flow

How AR Specialists Help in Business Growth

AR staff who master their accounts receivable specialist duties help your business stay strong and plan ahead.

- Steady Cash Flow – They make sure payments come in on time.

- Less Overdue Money – Their reminders help cut unpaid bills.

- Real-Time Updates – They give fresh reports to help managers act fast.

- Support for Smart Choices – Good AR reports help with smart spending and saving.

- Builds Client Trust – Clear and timely billing builds strong bonds with clients.

Common Tools Used by AR Specialists

Tools help AR staff do more in less time, with fewer errors.

- Accounting Software

QuickBooks, Zoho Books, and Xero help make and track invoices with ease. - CRM Tools

Salesforce or HubSpot stores client data and past talks. - Spreadsheets

Excel or Google Sheets help review and track payment information. - Communication Tools

Outlook, Gmail, or Slack help send reminders and work with teams. - Invoicing Apps

FreshBooks and Bill.com help send and track bills quickly.

Tips for Efficient AR Management

Good AR habits help keep cash flowing and reduce stress.

- Set Clear Terms Early – List due dates and late fees on every invoice.

- Send Invoices Fast – Bill right after the job or sale. Fast billing means fast pay.

- Follow Up Quickly – Send kind reminders when bills go unpaid.

- Keep Records Organized – Save all bills, notes, and emails in one spot for easy checks.

- Make Payment Easy – Let clients pay by card, bank, or mobile apps.

- Review Aging Reports Weekly – Check reports each week to spot late bills early.

How to Become an Accounts Receivable Specialist

You need both study and work to become an AR pro. Follow these steps:

- Earn a Degree – Study accounting, business, or finance to build a strong base.

- Learn Accounting Basics – Know how to handle credits, debits, and ledgers.

- Understand Billing Work – Learn to make invoices, follow up, and fix common billing issues.

- Get Work Experience – Try internships or junior roles in finance to build hands-on skills.

- Learn Key Software – Know how to use Excel, QuickBooks, and other AR tools.

- Build Soft Skills – Work on your talk skills, time use, and teamwork. These help in every task.

Industries That Need AR Specialists

Many sectors rely on professionals skilled in accounts receivable specialist duties to manage customer payments and credit. These fields rely on them most:

- Retail – They manage many small sales and returns.

- Healthcare – They deal with claims, bills, and patient pay.

- Manufacturing – They sell on credit and must track large orders.

- IT and Software – They use billing plans that require follow-ups.

- Real Estate – They track rent, fees, and upkeep charges.

- Hospitality – They work with both vendors and guests on billing matters.

The accounts receivable specialist duties are key for any firm that sends bills. A good AR expert helps cash flow stay smooth, cuts delays, and keeps clients happy. If you want a solid finance team, hire an AR pro. If you want a job in finance, this is a great place to start.

In addition to core tasks, an accounts receivable specialist may also work with the sales team to make sure invoices go out on time. They may help create or update financial rules and steps as well. To do well in this role, a specialist should have good people skills and a strong focus. They must work well under stress and be at ease using financial tools. A sound grasp of accounting is also key.

Meru Accounting, a CPA firm, offers full-service outsourced bookkeeping and accounting for small and mid-sized firms in the USA, UK, Australia, New Zealand, Hong Kong, Canada, and Europe.

FAQs

- What are the duties of an accounts receivable specialist?

They send bills, follow up, record payments, and fix payment issues. - Does an AR specialist work with other teams?

Yes, they often work with sales, accounts, and support teams. - What skills does an AR specialist need?

They need good talk skills, care for detail, and know how to use AR tools. - Is accounting knowledge needed?

Yes, basic skills in accounting help make clean and true records. - Can AR specialists help in audits?

Yes, they share files and reports to help the audit go well. - Do they need special software?

Yes, they use tools like QuickBooks or Zoho Books to work fast and right. - Are AR tasks the same in all firms?

No, it may change by firm size and field.