All You Should Know About Filing Corporate Tax Returns

Running a company means more than selling products or services; it also means meeting your tax duties. One of the most important tasks is the Corporate Tax Returns. Filing them on time keeps your business legal, avoids penalties, and helps you plan your finances.

In this guide, you’ll learn what Corporate Tax Returns are, why they matter, who must file them, the documents you need, common mistakes to avoid, and tips that help you make the process stress-free.

Introduction to Corporate Tax Returns

The IRS asks every corporation to file tax forms each year, even if it makes no profit. C Corporations use Form 1120 to file, and S Corporations use Form 1120-S. This step keeps the company in legal order.

A C Corporation pays tax on profit after it claims costs. An S Corporation can pay tax as a corporation or pass the profit to owners. Owners pay tax on this income when they file their tax return.

When are these tax returns due?

The deadline for corporate tax forms is March 15 every year. C Corporations with a fiscal year may have other dates. A six-month IRS extension is possible if you request it before the deadline.

Firms with over $10 million in assets must file online. Many owners hire an accountant to send the file. This helps avoid late fees, cuts errors, and meets all rules with less stress and risk.

Why Corporate Tax Returns Matter for Your Business

Filing business tax Returns on time does more than meet legal requirements. It also helps your business operate smoothly by providing a clear view of financial performance. This transparency is valuable for decision-making and for building trust with stakeholders.

Corporate Tax Returns also help avoid unnecessary costs. Filing late or submitting inaccurate information can result in penalties and interest charges. On the other hand, accurate, timely returns can highlight potential savings and tax deductions you might otherwise miss.

Who Needs to File these Tax Returns?

All U.S.-registered corporations, including C Corporations, S Corporations, and foreign corporations operating in the country, must file business income tax returns yearly. This applies even to inactive businesses unless they are formally closed.

Filing a return, even if no tax is due, keeps your business following IRS rules and avoids legal trouble. It also ensures that your business maintains a positive standing for future operations or funding opportunities.

What information does a corporate tax return include?

The corporate tax return has detailed information about the corporation’s profit and expenses to determine the tax liability payable to the IRS. The tax returns have several schedules that report information about the

- COGS (cost of goods sold)

- Office compensation

- accounting method

- business category

- dividends, deduction

- reconciliation of income and loss

- NAICS classification number.

- Balance sheet.

- Necessary information and documents for filing tax returns

The necessary information to file a corporate tax return is the name and address, the date of incorporation, the employee ID number, and the total assets. The corporate finance officer is required to provide the following details related to the corporate income:

- Dividend.

- Interest.

- Rents.

- Royalties.

- Capital Gains.

- Gross receipts

- COGS

Deductible expenses on corporate tax returns

A corporation can reduce taxable income by certain business expenses. All the expenses required for business operations are fully deductible. Investments and real estate purchases intended to generate business income are also allowed as deductions. The following is the comprehensive list of deductible expenses:

- Salaries.

- Office compensation.

- Tax preparation fees.

- Interest payments.

- Depreciation.

- Charitable contribution.

- Sales tax

- Advertising cost.

- Fuel taxes.

- Legal service

- Bookkeeping

- Employee benefit scheme.

- Pension and profit-sharing schemes.

- Other miscellaneous deductions.

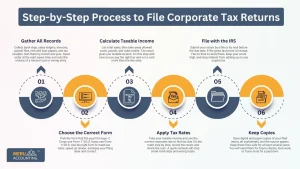

Step-by-Step Process to File Corporate Tax Returns

Follow this clear plan to file your Corporate Tax Returns with less risk and delay. Use each step to gather true data, check math, meet the due date, and keep records. Work in order and review each item before you file.

1: Gather All Records

Collect bank slips, sales ledgers, invoices, payroll files, rent and loan papers, and tax receipts. Sort them by month and year. Good order at the start saves time and cuts the chance of a missed cost or wrong entry.

2: Choose the Correct Form

Pick the form that fits your firm type. C Corps use Form 1120; S Corps use Form 1120-S. Use the right form to meet law rules, speed up review, and keep your filing clear and correct.

3: Calculate Taxable Income

List total sales, then take away allowed costs, payroll, and valid credits. The result gives you taxable income. Do this step with care so you pay the right tax and not a cent more than the law asks.

4: Apply Tax Rates

Take your taxable income and use the current corporate rate to find tax due. Do the math step by step, record the result, and check the sum. A quick recheck will stop small math slips and wrong totals.

5: File with the IRS

Submit your return by e-file or by mail before the due date. E-file gives fast proof of receipt. File on time to avoid fines, keep your score high, and stop interest from adding up on any unpaid tax.

6: Keep Copies

Save digital and paper copies of your filed return, all worksheets, and the source papers. Keep these files safe for at least several years. You will need them for future checks, loan work, or if you must fix a past item.

Common Mistakes to Avoid When Filing Business Income Tax Returns

Watch for these common errors. Fix them early so you cut fines, speed up review, and keep your firm in good standing with the tax office.

1. Missing the Deadline

Do not file late. Even one missed day can cost you in fines and interest. Set alerts, mark the date, and start work early so you file ahead of time and avoid the rush and extra fees.

2. Incorrect Figures

Check each number on the return. Wrong totals or math slips draw audits and can cost time and money. Use a calculator, run totals twice, and match forms to your source records to keep figures true.

3. Missing Deductions

Review all costs that the law lets you take. Missed deductions mean you pay more tax than you should. Go through payroll, rent, travel, and write-offs with care or ask a pro to find all valid items.

4. Poor Record-Keeping

Keep neat, dated files for income, costs, and payroll. Messy or late records make it hard to prove claims and slow down your file work. Good record care all year makes tax work fast and keeps your risk low.

Tips to Make Filing Tax Returns Easier

Use these habits to cut stress and save time. Small moves now make tax work smoothly when the due date nears.

1. Keep Records Updated

Post income and cost entries each month, not just at year-end. Fresh, dated records make your tax work fast, cut errors, and let you spot odd facts early so you can fix them in time.

2. Use Accounting Software

Use a simple, proven app to log sales, bills, payroll, and receipts. The app can run totals, give reports, and store files. Good software cuts math slips and gives you the data you need to file fast.

3. Work with a Professional

Hire a tax pro when rules seem complex or your file has more parts. A good pro finds valid write-offs, checks your math, and files right on time. Their help can save tax and lower your risk.

4. Review Your Return Before Filing

Before you send the form, read each line, match totals to your bank and ledger, and check names and ID numbers. A final review stops small faults that can lead to long delays or extra costs.

At Meru Accounting, our team files your Tax Returns with care and speed. We sort your records, check all sums, and spot legal write-offs. We meet each due date and keep a clean file, so you avoid fines and stay free to run your firm.

We give clear fee plans, talk in plain words, and keep you in the loop at each step. If you want help to cut work, Meru Accounting can assist. We help you save on taxes. We also make sure you stay in good standing. From start to finish, we file your tax return. We keep your books accurate and up to date.

FAQ

- What are Corporate Tax Returns?

A Corporate Tax Return is a yearly form your firm sends to report sales, costs, payroll, and tax due. The return shows how much tax you owe and proves you met the law’s rules for that year.

- Who must file these Tax Returns?

Most formed firms must file, such as C Corporations and S Corporations. Even if the firm had low or no profit, you often must file to stay in good standing and keep your tax records clear.

- When do I file my Returns?

C Corporations that use the calendar year file by April 15. S Corporations file by March 15. If you use another tax year, file by the 15th day of the fourth month after your year-end.

- What if I file my Tax Returns late?

If you file late, the tax office can charge fines and interest. The cost can grow the longer you wait. File on time or ask for an approved extension to avoid most fees.

- Can I file these Tax Returns myself?

Yes, you can file on your own if you keep neat records and know the rules. Many firms hire a pro to save time, spot all write-offs, and cut the risk of wrong math or missed items.

- What docs do I need for these Tax Returns?

You need profit and loss records, bank and sales statements, payroll files, bills and receipts for costs, and any loan or lease papers. Keep these docs neat and dated to speed the work and back up your claims.