How a tax return calculator can help you

A tax return calculator is a simple tool that helps you estimate your taxes. It shows how much refund you may get or how much you owe. You can use it before filing to get a better picture of your tax situation.

It can also save you from last-minute surprises. Whether you are a salaried person or self-employed, a tax refund calculator can guide you. It is easy to use and free on many websites.

What is a Tax Return Calculator?

An Online Tool to Estimate Tax

A tax return calculator is a free online tool. It helps you estimate how much income tax you may owe or get back.

Shows Your Likely Refund or Tax Due

This tool tells you if you are due a tax refund or need to pay more. It gives you a clear picture before you file.

You Enter Income, Deductions, and Payments

To use it, you must enter your total income, tax deductions, and tax already paid or withheld.

Based on the Latest Tax Rules

The results are based on current tax rules. This means the tool gives you a fair and updated view.

Useful for Both Individuals and Small Businesses

Whether you’re a salaried worker or a small business owner, this tool can help you plan better for tax time.

Why Should You Use a Tax Return Calculator?

Know Your Refund Early

You can get an early idea of your tax refund. This helps you plan your cash flow and spending.

Avoid Surprises

The tool helps you know in advance if you owe tax. This keeps you ready for any payment due.

Better Tax Planning

It helps you plan savings, investments, and tax breaks in a smart way. You can make better choices with early data.

Easy to Use

Most tax calculators are free and simple to use. You do not need expert skills to check your tax status.

Saves Time

You get instant results. The tool saves you from hard math or long forms.

Helps You File Correctly

With clear results, you can fill out your tax form with more ease. You know what numbers to use when you file.

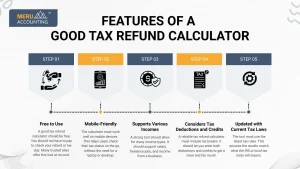

Features of a Good Tax Refund Calculator

Free to Use

A good tax refund calculator should be free. You should not have to pay to check your refund or tax due. Many trusted sites offer this tool at no cost.

Mobile-Friendly

The calculator must work well on mobile devices. This helps users check their tax status on the go, without the need for a laptop or desktop.

Supports Various Incomes

A strong tool should allow for many income types. It should support salary, freelance jobs, and income from a business.

Considers Tax Deductions and Credits

A reliable tax refund calculator must include tax breaks. It should let you enter both deductions and credits to get a clear and fair result.

Updated with Current Tax Laws

The tool must use the latest tax rules. This ensures the results match what the IRS or local tax body will expect.

How to Use a Tax Return Calculator

Go to a Trusted Website

Start by visiting a reliable tax site. Choose one that is secure and known for accurate tax help.

Choose the Tax Year

Select the year for which you are filing. Each year has its own tax rates and rules.

Enter Your Total Income

Add up all your earnings for the year. This may include your salary, freelance work, or business income.

Add Deductions (Standard or Itemized)

Enter your tax deductions. You can choose the standard deduction or list your own if you itemize.

Enter Tax Paid or Withheld

Type in the amount of tax already paid or withheld from your pay. This helps the calculator know if you’ve paid too much or too little.

Click Calculate

After filling in all details, press the “Calculate” button. The tool will do the math for you.

View Refund or Tax Due

Once the result shows, you can see if you’ll get a refund or owe more tax. This helps you plan your next steps with ease.

How Helpful Is a Tax Return Calculator?

Tax Return Estimation

A tax refund has always served as financial relief that can be used for retirement savings, paying off credit card debt, or personal spending. If you want to estimate your tax refund for this year, you can calculate it with our free tax calculator.

A financial expert can help you understand how taxes affect your overall financial goals. To get in touch with one, you can request an appointment from us.

Calculation of Tax Refund

Whenever you file a tax return, three outcomes are possible:

- You are eligible for a tax refund from the IRS.

- You owe money to the IRS.

- You have paid the correct amount of tax throughout the year.

The tax return calculator helps determine whether you’ll receive a refund, owe additional taxes, or break even.

Wondering how the IRS could owe you a refund? Yes, it’s possible in several situations. For example:

- You may have overpaid your estimated taxes.

- Too much might have been withheld from your paycheck.

- You may qualify for tax deductions and credits that reduce or eliminate your tax liability.

The tax return calculator considers all these factors to estimate how much money you can expect.

Applicable Tax Deduction and Tax Credit

Always keep in mind that a tax deduction reduces your taxable income. This means you pay tax on a lower amount.

A tax credit, in contrast, cuts your tax bill directly. For example, if you owe $500 and have a $250 tax credit, your final tax drops to $250.

But what if your credit is more than your tax bill? You may get a refund, but only if the credit is refundable. A refundable tax credit adds the extra amount to your refund total.

Our tax return calculator checks these details and helps you see how much refund you may get.

Understanding Your Tax Refund

A tax calculator is a smart tool to check your tax before you file. It shows if you will owe tax or get a refund.

It takes into account your income, deductions, tax paid, and credits. This gives a full view of your tax case.

With this, you can plan better and avoid surprises when tax season comes.

When to Use a Tax Return Calculator

Before Filing Your Tax Return

Use the calculator before you file to get a rough idea of your refund or tax due.

After Getting Your Form W-2 or 1099

Once you get your income forms, you can enter the numbers for a quick check.

After Making Big Purchases or Donations

Bought a house or gave to charity? These actions can affect your taxes. A calculator can help you plan.

When Your Income Changes

If you got a raise, bonus, or side income, check how it may change your tax amount.

When You Want to Plan Your Budget

Use the tool to see how much tax you may pay or get back, so you can plan your money better.

Who Can Use a Tax Refund Calculator?

Salaried Employees

People with fixed monthly pay can use it to check how much tax is due or what refund to expect.

Freelancers

If you earn from gigs or freelance jobs, the tool helps you track income and plan tax payments.

Small Business Owners

Business owners can use it to estimate tax after adding income and deducting valid costs.

Students with Part-Time Jobs

Even if you earn a small amount, use the calculator to check if you owe tax or can get a refund.

Retired People with Pension Income

If you get a pension or other income in retirement, the tool helps plan taxes in a simple way.

What You Need to Use a Tax Return Calculator

Total Annual Income

Add all your income—salary, freelance, rent, or gains—to get the full yearly figure.

Tax Paid Through TDS or Advance Tax

Check how much tax has been paid already to avoid paying too much or too little.

Investment and Savings Details

List all tax-saving tools like PPF, ELSS, and fixed deposits under the right sections.

Deductions Under 80C, 80D, etc.

Add health plans, school fees, or home loan parts under these popular tax sections.

Any Other Tax Credits or Exemptions

Include credits like education loan interest or HRA to get the right refund or dues.

Tax Refund Calculator vs. Tax Professional

Tax Refund Calculator | Tax Professional |

Free or low-cost | Charges apply |

Quick estimates | Detailed analysis |

Easy for simple returns | Best for complex tax situations |

No human advice | Offers personal advice |

Best for early planning | Best for final filing |

Things a Tax Return Calculator Can’t Do

Handle Complex Tax Issues

A tax return calculator is not built to deal with complex tax laws or rare tax cases.

Give Personal Advice

It gives general results and can’t look at your full financial picture like a tax pro can.

Check for Errors in Your Documents

It won’t scan your papers for mistakes. You must check your data before using the tool.

File Your Tax Return

The calculator helps you plan, but it does not file your return with the IRS.

Replace a CPA for Business Taxes

For business owners, a CPA gives expert help that no tool can match.

Common Mistakes to Avoid While Using a Tax Refund Calculator

Wrong Income Entry

Always type in the right income amount as shown on your forms.

Missing Deductions

Be sure to add all tax breaks and credits you qualify for.

Not Updating for the Right Year

Use a calculator made for the tax year you’re filing for.

Relying on Estimate Only

The tool gives an estimate. Use it as a guide, not the final figure.

Ignoring Local Taxes

Check if your state or city has its own tax rules and add those in.

Online Tax Refund Calculator Tools You Can Try

- IRS Tax Withholding Estimator

- TurboTax Tax Calculator

- H&R Block Tax Refund Estimator

- TaxAct Refund Calculator

- SmartAsset Tax Return Calculator

These tools are easy to use and are built by trusted brands.

Using the Tax Return Calculator for Freelancers and Self-Employed

Include Income from All Sources

Add all streams—clients, platforms, and side work.

Don’t Forget Business Expenses

List what you spent on tools, rent, or travel to lower your tax.

Estimate Quarterly Tax Payments

Use the tool to plan and stay ahead on your tax dues.

Check for Special Deductions

See if you can claim a home office or self-employed credit.

How to Read the Results of a Tax Refund Calculator

Refund

This is how much you might get back from the IRS.

Tax Due

This is what you may still owe for the year.

Effective Tax Rate

Shows how much of your income goes to taxes as a percent.

A tax return calculator is a helpful tool for anyone filing taxes. It gives you quick and simple tax estimates. You can use it to plan your finances better.

It saves time and helps avoid mistakes. Use it along with your tax documents for the best results. While it’s not a replacement for a tax expert, it is a great tool for early planning. At Meru Accounting, we guide you in using tax calculators effectively and offer expert review of your estimates. Our team ensures your final tax filing is accurate, compliant, and stress-free.

FAQs

1. Is a tax return calculator free to use?

Yes, many websites offer it for free.

2. Can I use a tax refund calculator on my phone?

Yes, most are mobile-friendly and easy to use.

3. Is it safe to use a tax calculator online?

Yes, if you use trusted and secure websites.

4. Can it file my tax return?

No, it only gives estimates. You need to file separately.

5. Do I need tax documents to use it?

Yes, have your income and deduction details ready.

6. Can I use it for business taxes?

It is better for simple personal taxes, not complex business returns.

7. What if my income changes during the year?

You can use it again to see how changes affect your taxes.