Understanding IRS Tax Returns and Filing Requirements in the USA

Filing taxes is a key task for people and businesses in the USA. Taxes pay for roads, schools, and other public needs. IRS tax returns show your income to the government. Filing on time stops fines and keeps you legal. Many think IRS tax filing is hard, but it can be simple with the right help.

Knowing IRS rules is not just about the law. It also helps you save and plan money well. Filing right lets you claim refunds, credits, and deductions. This guide will explain what IRS tax returns are, who must file, and how to file step by step.

What Are IRS Tax Returns?

Forms to Report Income

IRS Tax Returns are forms that show your yearly income to the federal government. They help the IRS calculate the taxes you owe or refund.

Shows Tax You Owe

Tax returns detail how much tax you need to pay based on your income. They prevent underpayment and reduce the risk of penalties.

Helps Claim Refunds

You can get money back if you paid more tax than required. Filing ensures the IRS refunds any overpaid tax quickly.

Legal Requirement

Filing IRS tax returns is mandatory for those above the income limits. Non-filing may lead to fines, interest, or legal issues.

Tracks Income and Expenses

Tax returns help you track yearly income and deductible expenses. This record is useful for financial planning and loans.

Who Must File IRS Tax Returns?

People With High Income

Individuals earning more than IRS limits must file each year. It ensures the government gets the correct tax.

Self-Employed or Freelancers

All freelance or business income must be reported. They also pay self-employment tax for Social Security and Medicare.

People With Other Income

Interest, dividends, rent, or capital gains require IRS Tax Returns as part of the IRS tax filing rules. This includes passive income from investments or savings.

Low-Income Earners

Even if your income is low, filing may help you claim credits. Some refundable credits can result in a tax refund.

Residents and Non-Residents

US residents and some non-residents must file if they earn US income. This includes income from work, investments, or property.

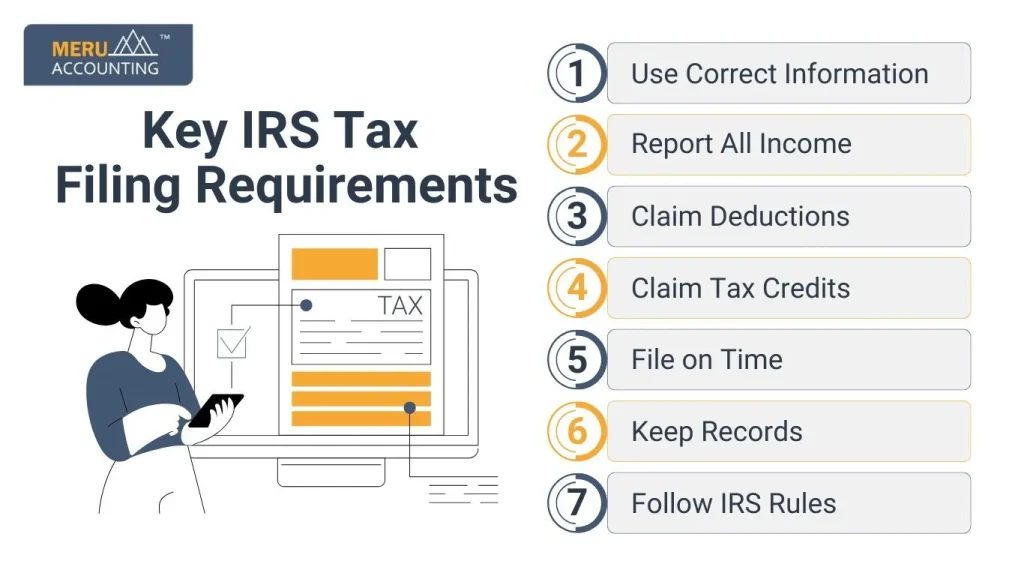

Key IRS Tax Filing Requirements

Use Correct Information

All your personal and money details must be right to avoid delays in IRS tax filing. Wrong info can slow your refund or bring IRS notices.

Report All Income

Include pay from jobs, tips, freelance work, interest, and dividends when filing your IRS Tax Returns. Leaving out any income may lead to fines or audits.

Claim Deductions

Deductions lower your taxable income. Common ones are medical costs, mortgage interest, and charity gifts.

Claim Tax Credits

Credits cut the tax you owe. These include the child tax credit, earned income credit, and school credits.

File on Time

Most tax returns are due by April 15. Filing early avoids stress and penalties.

Keep Records

Hold W-2s, 1099s, and receipts for at least three years. These help if the IRS checks your return.

Follow IRS Rules

IRS rules change each year. Check them to keep your filing correct and complete.

Common IRS Tax Return Forms

Form 1040

Used by most individuals for standard tax filing. It reports income, deductions, and credits.

Form 1040-SR

Designed for seniors with a simple format. It is easier to read and complete for people over 65.

Form 1065

Used by partnerships to report business income. Each partner receives a K-1 form for individual reporting.

Form 1120

Used by corporations to report income and taxes. It calculates corporate tax liability separately from owners.

Form 1099

Reports freelance, interest, or dividend income. It is sent to both the taxpayer and the IRS.

Form W-2

Shows wages earned and taxes withheld by employers. It is essential for calculating your tax liability.

Steps to File IRS Tax Returns

Step 1: Collect Your Documents

- W-2 from your employer.

- 1099 for freelance or investment income.

- Receipts for deductions like charity, education, or medical.

- Last year’s tax return to compare entries.

- Any other income statements, such as rental or royalty income.

Step 2: Choose Filing Method

- Step 2: Choose Filing Method

- E-file: Fast and safe. Refunds come quickly.

- Paper Filing: Mail forms to the IRS. Must reach by the deadline.

- Tax Pros: An accountant or tax preparer can help.

- Software: Simple tools can do the math and forms.

Step 3: Report Your Income

- List all wages, salary, and tips from work. This shows the IRS what you earned.

- Add any freelance or business income. Include every job or small project you did.

- Include income from interest, dividends, rent, or royalties. These can change your tax owed.

- Check that all income sources are recorded. Errors can slow your refund or cause fines.

Step 4: Claim Deductions and Credits

- Standard Deduction: This lowers your tax. Most people can claim it. No other forms are needed.

- Itemized Deductions: List costs like medicine, mortgage, charity, or school. Keep receipts. They cut your tax.

- Tax Credits: Use credits like the child credit or the earned income credit. They lower your tax. Some give a refund.

- Check Your Work: Make sure all claims are right. Mistakes can raise tax or delay a refund. Check numbers and receipts.

Step 5: Calculate Your Tax

- Subtract Deductions: Take deductions off your income. This shows the amount you pay tax on.

- Apply Credits: Use credits to cut your tax. Some credits can give you money back.

- Use IRS Tables: Check IRS tables or use tax software. Both help you find the right tax.

- Check Numbers: Go over each number again. Mistakes can raise taxes or slow a refund.

Step 6: Submit IRS Tax Returns

- Check Details: Make sure all info is right.

- File Your Return: Send forms by e-file or mail.

- Save Copies: Keep all papers for your records.

- Get Refund Fast: E-filing usually speeds up refunds.

Step 7: Pay Tax or Get a Refund

- Pay on Time: Pay your taxes before the due date to avoid fines. Late payment can cost extra.

- Get a Refund: You get a refund if you paid too much tax. Check your return to be sure.

- Fast Refund: Use direct deposit for the quickest refund. It reaches your account in days.

- Keep Proof: Save your payment receipt for your records. You may need it later for proof.

Step 8: Review After Filing

- Confirm the IRS received your return.

- Check the refund status online if expecting money.

- Correct any errors as soon as possible.

- This helps avoid issues later with audits or notices.

Important Tips for IRS Tax Filing

- File Early: File soon. It avoids stress and mistakes. You also get refunds faster.

- Use Software: Tax software is simple. It shows each step and cuts errors.

- Save Records: Keep W-2s, 1099s, and receipts for 3–7 years. They help if the IRS checks.

- Check Updates: Tax rules change each year. Visit the IRS site for new info.

- Get Help: Tax pros save time. They guide you in tough tax cases.

Common Mistakes to Avoid

Filing Late

Late tax filing adds fines and extra interest. File early to stay safe. If needed, request an extension.

Wrong Income Reporting

Do not skip any income. Include salary, freelance work, rent, or bank interest. Missing even small amounts can cause IRS checks and penalties.

Missing Deductions or Credits

Deductions and credits reduce tax. Many miss them and pay more than needed. Review all options before filing.

Using Old Forms

IRS updates forms each year. Old forms may not be valid. Always use the latest version online.

Forgetting to Sign

Unsigned returns are rejected. Sign with a pen or e-sign before you send it.

Math or Bank Errors

Wrong math or bank details can delay refunds. Double-check numbers and account info.

Benefits of Filing IRS Tax Returns on Time

Avoid Penalties

No fines or interest on unpaid taxes. Helps maintain a good financial record.

Claim Refunds

Receive money back if you overpaid. Refunds can be direct-deposited for convenience.

Legal Compliance

Filing ensures you meet federal requirements. Reduces risk of legal issues with the IRS.

Track Finances

See income, deductions, and credits clearly. Helps in budgeting and financial planning.

Support Applications

Required for loans, visas, and mortgages. Provides proof of income for financial transactions.

IRS Tax Filing for Special Groups

Self-Employed People

Report all freelance or business income. Pay self-employment tax for Social Security and Medicare. Keep detailed records of all expenses and income.

Senior Citizens

Use Form 1040-SR for easier filing. May get extra deductions and credits. Helps manage retirement income reporting.

Students

File if earnings exceed IRS thresholds. Claim education credits to reduce tax. Keep tuition and education expense receipts.

Military Personnel

Special deductions may apply. Check IRS rules for military benefits. Can include allowances and tax-free income properly.

Non-Residents

File if earning US income. Includes investment, rental, or work income. Use correct forms to avoid fines.

IRS Tax Filing Deadlines

Standard Deadline

April 15 each year for most individuals. Filing on time avoids penalties and interest.

Extended Deadline

October 15 if an extension is approved. Useful for those who need extra time to prepare returns.

State Deadlines

Check state tax rules; dates may differ. States may have separate forms and filing rules.

Late Filing

Leads to fines and interest. Late filing can delay refunds and trigger IRS notices.

How Technology Helps with IRS Tax Returns

Tax Software

Automates calculations and forms. Reduces errors and simplifies complex returns.

E-filing Platforms

Submit returns fast and securely. Provides confirmation that the IRS received your return.

Record Keeping Tools

Organize receipts and tax documents. Helps during audits or income verification.

IRS Online Resources

Check refund status and filing guides. Stay updated with current rules and deadlines.

Mobile Apps

Track income and expenses on the go. Useful for freelancers and self-employed individuals.

Filing IRS tax returns on time is very important. It helps you avoid fines, claim refunds, and keep track of money. Using the right forms, reporting all income, and claiming valid deductions and credits makes the job easy.

Meru Accounting helps both people and businesses with IRS tax returns. Our team guides you step by step and handles tough filings. We make sure you follow all rules. We also offer tax planning, record keeping, and timely reminders. With Meru Accounting, your tax filing is safe, correct, and stress-free. You can focus on work or life while we handle your IRS returns.

FAQs

- What is an IRS Tax Return?

A form that reports income, deductions, and taxes to the IRS. - Who must file IRS tax returns?

Anyone earning above IRS limits or with special income. - Can I file IRS tax returns online?

Yes, e-filing is fast, safe, and accepted by the IRS. - What happens if I miss the filing deadline?

You may pay fines and interest on unpaid taxes. - Are deductions and credits the same?

No, deductions reduce income; credits reduce tax owed. - How long to keep tax records?

Keep them for at least 3 years. - Can I file IRS tax returns for free?

Yes, IRS Free File is available for eligible taxpayers.