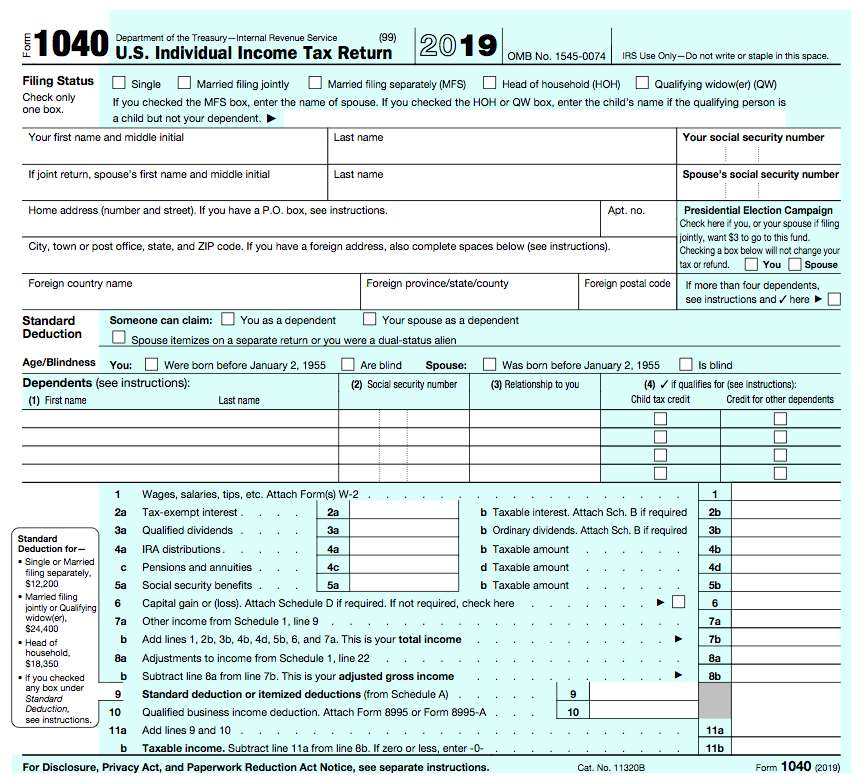

Individual Tax Return Preparation – If you are contributing to the economy of the nation through business income or else wise, you have to mandatorily pay taxes. You can use Form 1040 to file the federal tax payment for the income earned. Legally, it is the U.S. Individual Income Tax Return under the Internal Revenue Service (IRS). You will have to pay additional taxes depending on business income, along with other sources, which include rental income, investments and others.

Additionally, you will also have to pay state tax returns and multi-state tax returns along with the income tax. As per the rules, you have to submit the Form 1040 by 15th April of each year.