Why outsource bookkeeping Key to your business growth?

As your business grows, so do your tasks. Handling daily work and admin duties can be a lot. Bookkeeping takes time and pulls you away from key work. It can drain your focus and slow down your growth. By choosing to outsource bookkeeping, you save hours and avoid stress.

Reasons for Outsourcing Bookkeeping

Boosts Productivity

When business owners or key staff handle bookkeeping, it takes time and focus away from tasks that grow the business. This shift affects their ability to plan, lead, and innovate. By using outsourced bookkeeping solutions, owners and key staff can focus more on core goals. Delegating this work to experts raises output and keeps staff where they add the most value.

Financials Ready for Audit and Tax

Outsource bookkeepers prepare your records with skill and accuracy. This gives banks, investors, and tax bodies full trust in your data. Clean and clear records mean smooth audits, timely tax filing, and strong trust with partners. With expert support, your books stay up to date and in line with rules.

Built-In Flexibility

A new business may only need basic bookkeeping, but this need can grow fast. A good outsource bookkeeping team offers flexible plans that grow with your business, from simple entries to full controller services. This saves the cost and effort of hiring and training new staff every time your business expands.

Keeps Your Data Safe

Business records often include private or sensitive data. Hiring in-house staff for this job can be risky. Trusted outsource bookkeepers using secure tools offer a safer and smarter choice. Most use secure cloud tech and strong encryption, giving you full access while guarding your data. You stay in control, with peace of mind that your records are safe and private.

How Outsourcing Helps You?

Outsource bookkeeping to expert professionals helps reduce errors that may arise from unskilled or new staff. These professionals have the tools and training to keep your records clean and correct.

When experts take over your admin work, you get more time to focus on what you do best. And in business, time saved is money earned.

Outsourced bookkeeping solutions are also a cost-effective move. It removes the need to hire, train, and manage an in-house team. You pay only for the service, not the overhead.

It also lowers stress. Month-end checks and account reviews can be a burden. Let trained bookkeepers take care of it while you focus on your business.

They also handle key jobs like invoicing, payroll, and bill payments, on time and with care. They keep you in the loop by asking for approval when needed.

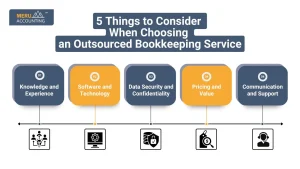

5 Things to Consider When Choosing an Outsourced Bookkeeping Service

Outsourced bookkeeping offers a smart way to manage financial records while saving time and reducing internal costs. But to gain full value, selecting the right service provider is crucial. Below are five key factors to guide your decision:

1. Knowledge and Experience

Why It Matters:

Bookkeeping involves more than data entry. A skilled provider understands business rules, tax laws, and the specific needs of your industry.

What to Look For:

- Proven track record

- Industry experience

- Certified professionals

Benefit:

Accurate records and fewer errors lead to better decisions and smoother audits.

2. Software and Technology

Why It Matters:

The right tools ensure faster processing, fewer mistakes, and real-time access to your records.

What to Look For:

- Use of trusted accounting platforms

- Cloud-based systems for easy access

- Compatibility with your existing tools

Benefit:

Improved data flow, clear reports, and secure access from anywhere.

3. Data Security and Confidentiality

Why It Matters:

Financial data must be handled with care. Breaches can harm your business and reputation.

What to Look For:

- Strong data encryption

- Compliance with data laws (e.g., GDPR)

- Clear privacy and security policies

Benefit:

Your sensitive records stay safe and private at all times.

4. Pricing and Value

Why It Matters:

It’s not just about low cost. True value lies in the balance between price, quality, and support.

What to Look For:

- Clear and fair pricing

- Service packages tailored to your needs

- Extra features like financial insights

Benefit:

More control over costs without sacrificing service quality.

5. Communication and Support

Why It Matters:

Good support ensures quick answers, smooth updates, and fewer delays.

What to Look For:

- Assigned point of contact

- Regular updates on work progress

- Support via email, phone, or chat

Benefit:

Quick issue handling and better service transparency.

Which Top Industries Outsource Bookkeeping Most in the USA?

Several industries in the USA rely on outsourced bookkeeping to save time, cut costs, and improve accuracy. Here are the top ones:

Retail

- Retailers deal with high-volume sales, returns, and inventory. Many small shops and chains outsource to keep records clear and avoid hiring in-house staff.

Hospitality

- Hotels and restaurants need to manage daily cash flow, payroll, and costs. Outsourcing helps them track all entries without extra overhead.

Real Estate

- Property firms must track rents, expenses, and deals. Outsourced bookkeepers help with clean records and cash flow management.

Healthcare

- Clinics and practices deal with billing, claims, and payments. Outsourcing reduces errors and improves record accuracy.

Manufacturing

- Producers face complex costs, inventory, and supply chain issues. Bookkeeping support keeps things organized and compliant.

Consulting

- Consultants often work with projects, contracts, and hourly rates. Outsourced bookkeeping helps track invoices and income streams.

Non-Profit

- Non-profits must stay transparent with funds and grants. Bookkeeping partners help them meet audit and report needs.

Education

- Schools manage grants, budgets, and donors. Outsourcing keeps records updated and ensures clean audits.

Construction

- Firms track project costs, labor, and vendors. Outsourced teams help manage records across sites.

Logistics

- Transport and logistics firms handle fuel, fleet, and route costs. Outsourcing helps with clear reports and faster entries.

Should I Outsource Bookkeeping? How to Decide?

As a business owner, it is important to understand that bookkeeping is essential for your business. It records all the financial transactions and helps in preparing financial statements. However, maintaining accurate books without outsourced bookkeeping solutions can be a challenge. Many businesses are solving this using virtual or offshore bookkeeping services.

As a business owner, it is important to understand that bookkeeping is essential for your

business. It records all the financial transactions and helps in preparing financial statements.

However, maintaining accurate books without outsourced bookkeeping solutions can be a

challenge. Many businesses are solving this using virtual or offshore outsource bookkeeping

services.

How to Decide About Offshore Bookkeeping Services?

Here are some ways that can help you decide:

- Difficulty in Achieving Accuracy

If you’re facing constant errors in bookkeeping, it affects your financial reports. This often

results from underqualified staff. Offshore accounting gives you access to experts and brings

more accuracy. - Difficulty in Achieving Better Cash Flow

In-house bookkeepers often lack the skills to improve cash flow or offer financial advice.

Outsourcing helps you gain insights on improving receivables, payables, and cost reductions. - Difficulty Focusing on Core Business Activities

When business owners get involved in bookkeeping, it distracts from growth-focused activities.

Outsourcing allows you to stay focused on your main business goals. - Inability to Use Software Efficiently

Many small businesses find it hard to use modern accounting software. Outsourcing gives you

access to professionals familiar with tools like QuickBooks or Xero, often without additional

software costs. - High In-House Costs

Recruiting and training in-house bookkeepers adds cost. Outsourced services already have

trained staff who understand tax regulations and compliance, especially in the U.S. market.

How to Outsource Bookkeeping?

Doing bookkeeping during business growth consumes valuable time. Eventually, you realize the benefits of outsourced bookkeeping solutions.

Now you have two options: hire a local bookkeeper or a virtual bookkeeper. In-house bookkeeping is possible, but only if you can bear the high maintenance cost.

Local Bookkeeper

A local bookkeeper is located near your business. It’s ideal if you:

- Want face-to-face meetings

- Prefer physical records

- Don’t use online payment systems

Local bookkeepers may be freelancers or firms. Freelancers offer limited services based on their skills. Bookkeeping firms may be certified, cost more, and provide a team, ensuring continuity in service.

Virtual Bookkeeper

Virtual bookkeepers provide paperless online solutions using cloud software. They:

- Handle your books remotely

- Use software to monitor finances

- Offer access via mobile apps

- Work flexibly over the phone or email

Outsource bookkeeping saves time and brings peace of mind. Your data is safely stored in the cloud and accessible anytime.

Why Opt for Virtual Bookkeeping?

- Cost-Effective – Virtual outsource bookkeepers are certified and experienced. They offer part-time remote services, ideal for small businesses, and reduce the cost of hiring in-house staff.

- Secure and Reliable Data Backup – They use cloud software to keep your financial data secure and accessible. Most offer services via QuickBooks, Xero, etc., ensuring accuracy.

- Flexible Services – Outsourced bookkeepers adapt to your schedule. Whether you’re available evenings or weekends, they can accommodate your needs.

Outsource bookkeeping is more than just a way to cut costs. It is a smart choice that helps your business grow. With skilled outsource bookkeepers, you get peace of mind, clear reports, and more time to focus on your work. The right outsourced bookkeeping solutions keep your business strong and on the right track.

Meru Accounting is a trusted firm to whom you can reliably outsource bookkeeping. We have over years of experience in this field. Our team gives clear, on-time, and simple solutions for many types of firms. With our help, you can keep your books in good shape and focus more on your business goals.

FAQs

Q1. What is outsourced bookkeeping?

It means hiring a firm or expert to manage your accounts.

Q2. Can small firms benefit from outsourced bookkeeping?

Yes, they can save time and reduce costs.

Q3. Are outsourced bookkeepers trustworthy?

Yes, if they have strong skills and good reviews.

Q4. What work do outsourced bookkeepers do?

They handle records, invoices, reports, taxes, and payroll.

Q5. Do I lose control over my books?

No, you stay in charge with clear and updated data.

Q6. How do I pick the right bookkeeping firm?

Check their skills, tools, security measures, and pricing.