Home » Different Types of Bookkeeping Management Services Available.

Different Types of Bookkeeping Management Services Available

Bookkeeping is the backbone of any business. It helps in keeping financial records clean and organized. There are many types of bookkeeping that suit different business needs. Today, most businesses prefer bookkeeping management services to save time and ensure accuracy. These services help manage income, expenses, payroll, tax records, and more.

Let us understand the different types of bookkeeping and the services available. Effective bookkeeping is key to keeping records clean, tracking costs, and staying on the right side of tax laws. It builds the base for smart money moves and better plans.

Some firms handle books in-house, but more now trust expert bookkeeping service providers. These pros offer custom help to meet each business’s needs.

Types of Bookkeeping

1. Clear Financial Insights

Bookkeeping management services are more than just tracking money. These services record each transaction, match bank data, and make useful reports. This gives a full view of business health and helps in smart planning.

2. Smooth Handling of Payables and Receivables

It’s important to track what you owe and what others owe you. Bookkeeping services record bills, follow up on payments, and manage unpaid dues. This keeps vendors happy and your cash flow in check.

3. Simple and Accurate Payroll

Payroll is complex and time-based. Experts handle paychecks, tax cuts, and filings. They also give pay slips and follow labor laws. This builds trust with staff and cuts errors.

4. Reliable Tax Support

Tax prep needs care. Bookkeeping firms file income, sales, and payroll taxes. They keep up with tax law changes and find legal deductions. This helps you save money and stay compliant.

5. Smart Software Use and Help

Good bookkeeping services also set up and link top tools like QuickBooks, CRM, or ERP. They train your team so that daily tasks run smoothly, fast, and with fewer mistakes.

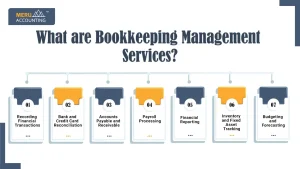

What are Bookkeeping Management Services?

Bookkeeping management services help a business keep its money records clean and up to date. These services cover a wide range of tasks that track the flow of income and spending. Bookkeeping management services give clear views of a business’s health and support better choices. These services work well for both small and large firms.

Here are the main parts of bookkeeping management services that support financial clarity:

1. Recording Financial Transactions

This means writing down each sale, buy, or cash move. It’s the base of all money tracking work.

2. Bank and Credit Card Reconciliation

This step checks if the book records match the bank and card slips. It helps find errors or skipped entries.

3. Accounts Payable and Receivable

This part tracks what the firm owes others and what others owe to it. It helps manage cash well and on time.

4. Payroll Processing

This task makes sure workers are paid on time. It also tracks hours, tax cuts, bonuses, and leaves.

5. Financial Reporting

These reports, part of most types of bookkeeping, include profit and loss, balance sheets, and cash flow. They show how the firm is doing.

6. Inventory and Fixed Asset Tracking

This keeps lists of items in stock and long-use assets like tools and machines. It helps track wear and worth.

7. Budgeting and Forecasting

This helps plan for income and costs. It guides smart steps for growth and keeps spending in line.

Top Bookkeeping Management Services Available

Below are the top bookkeeping management services that help businesses stay on track, meet their money goals, and follow the rules:

1. Transaction Recording

This service tracks all daily income and spending. It keeps financial records current and correct. Good records help with tax filing and audits.

2. Bank Reconciliation

Bank records are matched with your book entries. This helps find missing data or errors fast. It keeps cash flow clear and correct.

3. Accounts Payable Management

This service tracks what your business needs to pay. It handles due dates and pays vendors on time. Paying early avoids late fees and builds trust.

4. Accounts Receivable Management

It tracks what customers owe your business. It sends bills on time and follows up for payments. This helps keep your cash flow steady.

5. Payroll Processing

This service figures out staff pay and tax cuts. It also tracks bonuses, leaves, and overtime. Payroll taxes are filed on time to avoid fees.

6. Financial Reporting

Financial reports core to all types of bookkeeping include income, balance sheets, and cash flow. They help you make smart and clear business plans. They also inform partners and investors.

7. Tax Preparation Support

This service gets records ready for tax time. It helps with timely and accurate filing. It also cuts the risk of tax fines.

8. Budgeting and Forecasting

This service helps set and track money goals. It checks progress and plans for what’s next. Forecasts help in smart business choices.

9. Inventory Management

This tracks stock levels and product worth. It helps avoid too much or too little stock. It saves money and boosts profit.

10. Fixed Asset Management

It keeps records of tools, machines, and vehicles. It tracks wear, value loss, and asset worth. This helps with taxes and insurance.

Benefits of Bookkeeping Management Services

Bookkeeping services help keep your records clean, on time, and ready for smart money decisions. Here are some key benefits:

- Saves time

You can focus on your core work while experts handle your books. - Gives accurate data

Your records stay fresh and up to date for easy use and checks. - Cuts down on errors

With trained staff and systems, fewer mistakes are made. - Helps with rules

Experts know tax laws and help you stay on the right side of them. - Offers expert help

You get useful tips and views that guide your growth. - Saves money

Good books stop fines and late fees. This saves you more in the long run.

When to Choose Professional Bookkeeping Services?

You should go for pro bookkeeping services if:

- You’re short on time

If your work stops you from managing your books, consider hiring bookkeeping management services for support. - Your firm is growing

More sales mean more records. Let experts take care of them. - You make many errors

Bad data can harm your plans. Trained help can fix that. - You need help with pay and tax

Payroll and tax are tough. A bookkeeper makes sure it’s done right. - You want better insight

Beyond records, they give ideas to help plan your next steps.

How to Choose the Right Bookkeeping Service?

To choose the right bookkeeping service:

- Know your needs

Decide if you need full help or just for tasks like tax or payroll. - Check their record

Look for firms with good reviews and strong past work. - Ask about their tools

Make sure they use safe and well-known software. - Compare the price

Pick a firm that gives the best value, not just the lowest rate. - Check their methods

They should follow the right laws and use standard methods.

Software Used in Bookkeeping Services

Bookkeepers use tools to save, track, and report data. Common ones include:

- QuickBooks: Best for small to mid-size firms.

- Xero: Cloud-based and great for live use.

- Zoho Books: A good choice for firms that grow fast.

- FreshBooks: Simple and great for service-based firms.

- Sage: Strong tool for both small and large firms.

- Wave: Free and fit for small firms or solo owners.

These tools help manage money with ease, speed, and safety.

Why Many Businesses Use Outsourced Bookkeeping?

Many firms now choose to outsource their books. Here’s why:

- Lower costs

No need to hire or train full staff. Saves on space and tools too. - Get skilled help

You work with trained staff who know the work well. - Get live reports

Most use cloud tools, so you see your data in real time. - Easy to grow

As you grow, the service can grow with you. No extra hires needed. - No new staff needed

Skip the pain of hiring and training in-house teams.

Bookkeeping for Different Business Types

Each type of business has its own set of needs when it comes to managing books, and different types of bookkeeping address those needs. Here’s how bookkeeping helps across various setups:

Small Businesses

- Small firms often need help with simple tasks.

- They deal with fewer entries and accounts.

- They need help to stay on top of tax rules.

- Simple tools work well for them.

- Reports are basic and quick to prepare.

Startups

- Startups work on tight funds and need scalable bookkeeping management services that adapt as they grow.

- They look for low-cost and easy tools.

- Cloud-based software works best for them.

- Reports must show cash flow and growth.

- They need help to plan ahead and stay lean.

Medium Enterprises

- Mid-sized firms need full bookkeeping help.

- They handle more data and need clean books.

- Help with budgets and reports is key.

- More checks and balances are required.

- Teams may need weekly or monthly updates.

E-commerce

- Online stores have extra steps in their books.

- They must track stock and shipping costs.

- Sales across platforms need to sync.

- Bookkeeping tools should link to sites.

- Reports must show profit per item or area.

Freelancers and Professionals

- Freelancers often prefer simpler types of bookkeeping that help them track funds without stress.

- They often work alone or with small teams.

- Tools for income and costs are key.

- They need to send bills and track time.

- Online or mobile tools are best for them.

Meru Accounting offers top-tier bookkeeping management services with clear records, smooth payroll, and full tax help. We cut your workload so you can focus on growth. We go beyond basics with deep insights that help you make strong business choices. We also help link software tools to make work faster and clearer. Partner with Meru Accounting for stress-free books, better money control, and real growth.

FAQs

1. What are the main types of bookkeeping?

Single-entry and double-entry are the main types. Each suits a different business type.

2. Are bookkeeping services only for large businesses?

No, even small businesses and freelancers can use them.

3. Can I switch from in-house to outsourced bookkeeping?

Yes, most providers help with smooth transitions.

4. How much do bookkeeping services cost?

Costs depend on your business size and needs.

5. Do bookkeeping services help with tax filing?

Yes, they prepare records for easy tax filing.

6. What is the difference between bookkeeping and accounting?

Bookkeeping records data; accounting analyzes and reports it.

7. Can bookkeeping services be done online?

Yes, many firms offer virtual and cloud-based services.