Home » How Receivables Management Systems Can Improve Your Cash Flow?

How Receivables Management Systems Can Improve Your Cash Flow?

In the dynamic world of modern business, maintaining a steady cash flow is paramount for long-term success. Cash flow provides the fuel for day-to-day operations, growth initiatives, and meeting financial obligations. As enterprises extend credit to customers, the implementation of efficient receivables management systems becomes indispensable. Effective receivables management plays a vital role in ensuring timely payments and financial stability, exerting a positive influence on cash flow optimization.

Understanding Receivables Management Systems:

Receivables management systems represent sophisticated tools meticulously crafted to streamline the process of overseeing outstanding customer payments. Automation takes center stage, allowing for seamless tracking and follow-up on unpaid invoices, thus reducing the time lag between sales and actual receipt of funds.

The Transformative Power of Efficient Receivables Management:

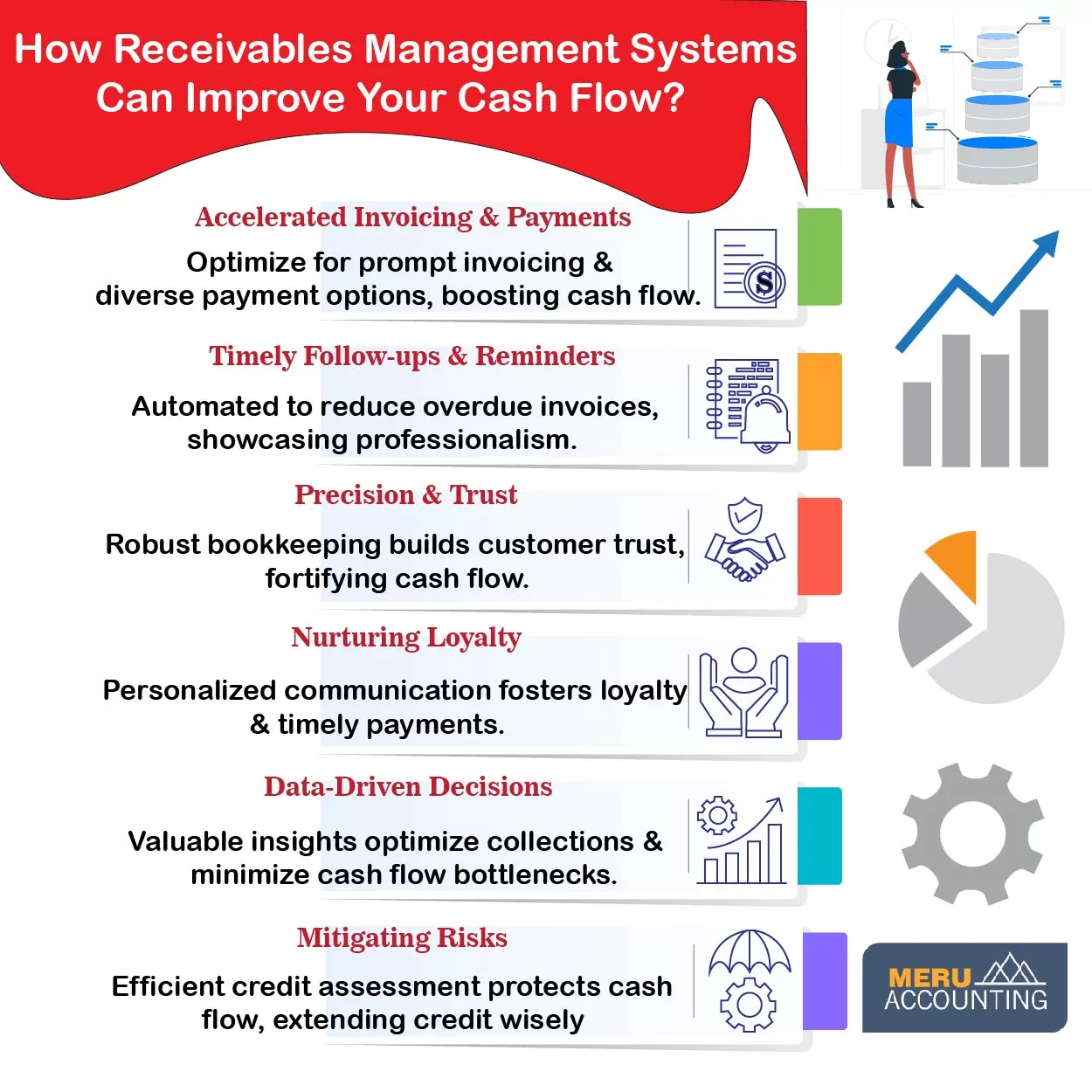

1. Accelerated Invoicing and Payment Processing:

Embracing well-optimized receivables management systems works wonders in invoicing and payment processing. Promptly generated and dispatched invoices ensure timely receipt by customers. Offering diverse payment options further facilitates swift transactions, minimizing delays, fosters positive customer sentiments and encourages timely payments, thus positively impacting cash flow.

2. Timely Follow-ups and Reminders:

Receivables management systems automate follow-ups, sending gentle reminders to customers about outstanding payments. This consistent and punctual approach reduces the number of overdue invoices, expediting payment collection without uncomfortable collection calls. By maintaining regular communication with customers through automated reminders, businesses showcase their professionalism and dedication to prompt payment collection.

3. Precision and Error Reduction:

Robust systems assure accurate bookkeeping, reducing human errors and fostering customer trust. Properly recorded and accounted payments enhance transparency, instilling confidence in customers and encouraging timely payments. This trust, in turn, fosters a more harmonious relationship between the business and its customers, promoting timely payments and further fortifying cash flow.

4. Nurturing Customer Relationships:

Automated yet personalized communications nurture positive customer relationships. Customers receive updates regarding payments, reinforcing the bond between the business and its patrons. Feeling valued and cared for, customers are more likely to reciprocate with timely payments and continued loyalty, ultimately bolstering the company’s cash flow.

5. Data-Driven Decision Making:

Modern receivables management systems provide valuable insights into receivables performance through reporting and analytics tools. Identifying trends and patterns in customer payment behavior enables businesses to optimize collection strategies, minimizing cash flow bottlenecks.

6. Mitigating Financial Risks:

Efficient systems assess customer creditworthiness based on historical data and credit scores, allowing businesses to establish appropriate credit limits for each customer. This proactive risk mitigation strategy protects cash flow by extending credit only to reliable and creditworthy customers. By reducing the risk of late or non-payments, businesses can better ensure a stable and predictable cash flow.

Final thoughts:

To succeed in the dynamic markets of tomorrow, embracing the potential of receivables management system becomes an imperative rather than a choice. Meru Accounting, as a technically advanced accounting firm, offers a comprehensive solution for receivables management. Through our streamlined invoicing and payment processing, automated follow-ups, precise bookkeeping, and data-driven insights, we at Meru Accounting empower businesses to optimize their receivable processes. With transparent reporting of outsourced work, the system ensures efficiency and accuracy in monitoring outstanding customer payments.