Home » Industry Expertise » Real-Estate

Experience Hassle-Free

Real-Estate

With over 9+ years of experience, we are a trusted partner for accounting and bookkeeping services in the US. Whether you’re a startup, a small business, or an established enterprise, our services can meet the unique needs of your industry. Our deep understanding of US regulations and best practices can empower your financial journey and drive you toward long-lasting success!

Industry Specific Software Expertise

Yardi turbotenant bill.com buildium appfolio property manager hubdoc

Bookkeeping For Real Estate Business In The US.

- Real estate is a booming industry in the United States, with numerous opportunities for growth and success. However, managing finances can be daunting for business owners who are busy tackling day-to-day operations. This is where property management bookkeeping comes into play – an essential practice that helps real estate businesses keep their financial records accurate and up-to-date. In this article, we’ll explore different types of real estate businesses and how property management bookkeeping can benefit them. We’ll also discuss some tips on keeping accurate records and alternative options to property management bookkeeping to help you make informed decisions about your business finances.

Bookkeeping For Real Estate Business In The US.

- Real estate is a booming industry in the United States, with numerous opportunities for growth and success. However, managing finances can be daunting for business owners who are busy tackling day-to-day operations. This is where property management bookkeeping comes into play – an essential practice that helps real estate businesses keep their financial records accurate and up-to-date. In this article, we’ll explore different types of real estate businesses and how property management bookkeeping can benefit them. We’ll also discuss some tips on keeping accurate records and alternative options to property management bookkeeping to help you make informed decisions about your business finances.

Accounting For Real Estate Industry

- The real estate industry envelops the many aspects of a property, including advancement, evaluation, advertising, offering, renting, and administration of commercial, industrial, residential, and agricultural properties. This industry can change contingent upon national and local economies, even though it remains reliable as individuals dependably require homes, and organizations require office space.

- Accounting for the real estate industry can be complex. Leveraging the expertise of a real estate accountant can make a significant difference, especially when working with large sums of money. Whether you run a real estate agency or manage properties for clients, accountants for real estate can be invaluable.

- A lot of times, one house or office piece stays in similar hands for a considerable length of time or even decades, so sometimes it becomes difficult to make sense of the worth of the estate in today’s time. That is the reason most real estate evaluations depend on estimates. Until the point that a transaction happens, the real value is unknown. Therefore, accurate asset evaluation and generating financial and income statements are essential for accounting. Taxes and other charges are often based on weight.

- Accountants for real estate often use various tools such as spreadsheets or accounting software like QuickBooks to record transactions, reconcile bank statements, generate reports, and more. Some real estate businesses outsource their bookkeeping tasks to specialized accountants for real estate, while others do it in-house. Accountants for real estate play a crucial role in ensuring the success and stability of any real estate business by providing clear insights into its financial health.

The Different Types Of Real Estate Businesses

- Real estate is a diverse industry that encompasses various types of businesses. Residential real estate includes properties like single-family homes, condos, and townhouses. Commercial real estate involves leasing or selling office spaces, retail stores, warehouses, and other commercial buildings.

- There are also specialized niches within the industry, such as industrial real estate, which deals with manufacturing plants and distribution centers. Real estate investment trusts (REITs) invest in different kinds of properties to generate income from rent or property value appreciation.

- There’s the area of property management, where companies manage rental properties on behalf of landlords. These companies handle everything from tenant screening to maintenance requests. Many real estate businesses rely on real estate bookkeeping services to maintain accurate financial records.

- Whatever type of real estate business you run, it’s crucial to have accurate financial records for tax purposes, budgeting decisions, and overall growth strategy. Real estate bookkeeping services can help track expenses and income streams and ensure your finances stay organized so you can focus on growing your business instead of worrying about financial management.

The Benefits Of Bookkeeping

Having a real estate accountant is essential for the bookkeeping of a real estate business in the US. It involves keeping accurate financial records, including income and expenses, to ensure your business remains profitable and compliant with tax regulations. Here are some benefits of bookkeeping:

Allows To Track Cash Flow

- By monitoring your income and expenses regularly, your real estate accountant can identify potential problems early on and take steps to address them before they become more significant issues.

Helps To Stay Organized

- Keeping detailed records with the assistance of your real estate accountant makes it easier to manage your finances efficiently and reduces the risk of errors or omissions when reporting taxes or other financial matters.

Saves Time And Money In The Long Run

- Having all relevant financial information readily available lets you quickly respond to audit requests from government agencies or lenders without wasting valuable time trying to gather documents retroactively. A real estate accountant can provide you with all the financial information of your business

- Investing in Meru Accounting, ensures that your real estate business operates smoothly while minimizing legal risks associated with non-compliance with tax laws.

QuickBooks For Real Estate

- QuickBooks is an essential tool that can help you track expenses and income. It can help you get an idea of where you can save money by cutting expenses of your real estate business. Using QuickBooks for real estate bookkeeping can help you evaluate your business performance and track finances efficiently.

- QuickBooks is a flexible and scalable tool. It is one of the most preferred software for real estate bookkeeping. Its customizability and integration options make it even more reliable. At Meru Accounting, we offer specialized services using QuickBooks for real estate businesses. Get in touch with us now and harness the capabilities of this powerful tool.

Meru Accounting: Your Reliable Partner For Real Estate Bookkeeping And Accounting Solutions

- Real estate business owners can find managing bookkeeping and accounting tasks overwhelming, taking valuable time and resources away from their core operations. To meet the unique needs of your business, Meru Accounting offers tailored solutions based on our extensive experience in accounting and bookkeeping for real estate.

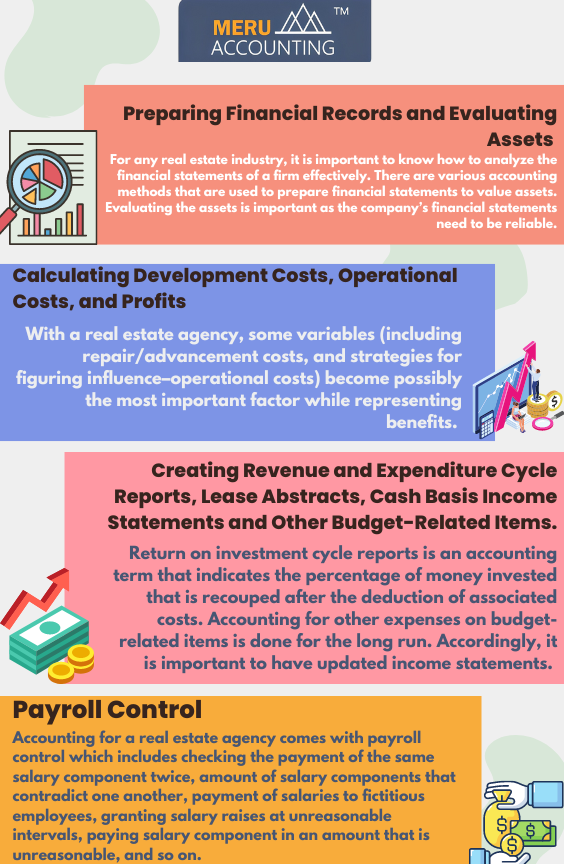

- Accurate financial records are vital in the real estate industry, and our team of experienced professionals understands the complexities involved. As part of our bookkeeping services, we can record transactions, reconcile accounts, and generate financial reports. Our process is streamlined using industry-leading software and tools, ensuring efficiency and accuracy throughout.

- Real estate agents are also a part of the real estate industry. At Meru Accounting, we also offer bookkeeping for real estate agents. We can help you evaluate assets, prepare financial statements, and calculate development and operational costs. To gain valuable insights into your business’s financial performance, we provide comprehensive reports like revenue and expenditure cycle reports, lease abstracts, and cash-basis income statements.

- Choose Meru Accounting as your trusted partner in real estate bookkeeping and accounting and experience the benefits of having accurate financial records, streamlined processes, and expert guidance. Let us help you navigate the financial aspects of your real estate business, so you can focus on achieving long-term success and growth.

CPA For Real Estate Business

- When it comes to managing a successful real estate business in the United States, having a Certified Public Accountant (CPA) with expertise in real estate can be very helpful. A CPA for real estate is well-versed in the complex financial landscape of the real estate industry, making them an invaluable asset to any business owner.

- Transactions in the real estate business often involve substantial sums of money, and the tax implications can be significant. A CPA for real estate brings a deep understanding of the specific tax laws, regulations, and financial strategies that apply to the real estate sector. Whether you’re dealing with residential, commercial, industrial, or investment properties, a specialized CPA can help you develop tailored tax strategies that minimize your tax liabilities while maximizing your profits.

- A CPA for real estate also ensures that your income, expenses, and financial statements are precisely maintained. This precision not only facilitates tax compliance but also provides you with the data needed to make informed financial decisions. Contact Meru Accounting now to have a CPA and push your real estate business towards financial excellence.

Real Estate Tax Accountant

The real estate industry in the United States is not just about buying and selling properties; it involves a lot of financial complexities that demand expertise and precision. A real estate tax accountant is a vital partner for any real estate business, whether you’re a real estate agency, property manager, or investor.

Expertise In Tax Laws And Regulations

Real estate transactions are often high-value and can trigger significant tax implications. A real estate tax accountant specializes in the tax laws and regulations that are specific to the real estate sector. They can help you optimize your tax planning, minimize tax liabilities, and ensure compliance with tax laws.

Accurate Financial Records

Maintaining accurate financial records is the basis of any successful real estate business. A real estate tax accountant ensures that every financial transaction is meticulously recorded, from income and expenses to property valuation and depreciation.

Audit Preparedness

Government agencies and lenders may request audits of your financial records, especially when dealing with substantial real estate assets. A real estate tax accountant can ensure that your records are well-organized and readily available, saving you valuable time and reducing stress when facing audit requests. Their expertise in audit preparation can make the process smoother and less burdensome.

Strategic Financial Planning

A real estate tax accountant is not just focused on the past; they also play a critical role in helping you plan for the future. They can offer strategic financial guidance, helping you make informed decisions about property acquisitions, sales, and investments. By considering tax implications in your long-term financial strategy, you can maximize your profits and reduce risks.

In Conclusion

Bookkeeping is essential to running a successful real estate business in the United States. Not only does it help you keep accurate records of your financial transactions, but it also enables you to make informed decisions based on reliable data.

By outsourcing your bookkeeping needs to Meru Accounting’s experts specializing in real estate businesses, you can save time and money while ensuring compliance with tax laws and regulations. Offshore bookkeeping services offer even more cost savings without sacrificing quality or security. At Meru Accounting, we have property management bookkeeping, real estate bookkeeping services, and bookkeeping for real estate agents.

Remember that keeping up-to-date records helps identify potential issues before they become more significant problems. With accurate financial statements, your business will be better equipped to handle any challenges and set itself up for long-term success. Contact Meru Accounting now and achieve financial excellence in the real estate industry of the US.

FAQs

Outsourcing bookkeeping saves time, reduces costs, provides expertise on demand, and offers scalability for your growing firm

Absolutely. Meru Accounting employs advanced security measures to ensure the confidentiality and compliance of your client’s financial information.

Yes, Meru Accounting ensures seamless integration with your firm’s existing systems.

Yes, Meru Accounting understands that every CPA firm is unique. We offer customizable solutions to align with your practice’s goals.

Meru Accounting brings a wealth of experience, a proven track record, and a client-centric approach, ensuring your firm’s success.

Meru Accounting utilizes industry-leading tools such as QuickBooks, Xero, and Sage Intacct to enhance efficiency and accuracy in bookkeeping for CPA firms.

Hiring Virtual Accountant With Meru Accounting

Meru Accounting provides world-class services that cater to all the needs of cloud accounting and bookkeeping of your business.

We work on the best accounting software like Xero and Quickbooks, as well as add-ons that will make sure all your work is up-to-date.

We also manage VAT, BAS, Sales Tax and Indirect taxes for you so you are always ready at the end of the financial year.

Help you with switching from your traditional software to Xero and Quickbooks.

- Cost-saving.

- Access to skilled and experienced professionals.

- Better management of books of accounts.

- Decreased chances of errors.

- Improve business efficiency.

- De-burdens in-office employee’s dependency.

- Better turnaround time.

We work on virtual technologies like Team Viewer, Virtual Private Network (VPN) to share and access data from your system.

You have to share your accounting software login details.

Through that, we complete all of your work and update it on the cloud, so you can have access to your data from anywhere and at any time.

Software is not a barrier for us. Due to our strong and professional accounting knowledge, we can prepare your books in almost any of the accounting software

Our experts are always all ears to listen to your queries regarding bookkeeping and accounting or our services. You can contact us anytime by visiting: Contact Us page.

We provide our bookkeeping services at the rate of US $10 per hour. So, you only need to pay for the amount of time actual work is done.

We take certain preventive measures to secure your data, like:

- Cyberoam Firewall to prevent any kind of foreign threat.

- Dual-step authentication

- Implement anti-virus

- Limit user access so that login details are with a few people.

Meru Accounting work on some of the best accounting software’s like:

- Xero

- Quickbooks

- Netsuite

- Saasu

- Wave

- Odoo

Along with that, we also work with many add-ons like Workflow Max, Receipt Bank, Slack, TradeGecko etc., to extend your software’s capacity and improved work experience.

To book for trial, call us on our numbers or Please fill out the form here.

Our Work Information

We have combined team of Professionals. Seniors are generally Certified Chartered Accountants. Junior Bookkeepers are having Qualifications like Bachelors of Commerce, Masters of Commerce, Masters in Business Administration in the subject of Accounts and Finance, Intermediate level Qualification of Chartered Accountancy, etc.

For information visit our work methodology page.

We prepare a checklist of information required for bookkeeping and send you at timely intervals so as to ensure that we can do bookkeeping faster.

We can provide to you once we move ahead in our interview.

We serve clients on MYOB and have expertise working in Essentials, Account Rights Plus, etc.

Yes, We are presently processing Payroll for Number of clients in US , UK and Australia and take care of complete payroll activities.

Goods and Service tax (GST) is levied on sales of all the goods and services in Australia. GST is generally chargeable at 10% of value of sales.

Business Activity Statement is a predefined form to be submitted to the Australian Tax office by all the business persons in order to report on their all the tax obligations during the period covered.

BAS is generally required to be filed quarterly by various businesses.

Individual Business Owners

Yes, Owner of the business can prepare sign and lodge the tax return on his own. Its not mandatory that the Tax return needs to be signed by an EA or CPA.

No , its not mandatory that it should be prepared by only CPA or EA. It can be prepared by anyone who has PTIN.

We have Enrolled Agent who has the Authority to sign the documents for our clients after completing the through professional check.

Meru Accounting has its operational centre in India and hence the prices are quite less as compared to US based CPA’s and Enrolled Agents.

Meru Accounting has a team of Tax experts. Each Tax expert prepares around 300-400 Tax returns every year for various CPA’s in United States and Individual Businesses like yours. Due to this vast Experience and Robust Quality Check processes in place we can ensure you about correct Tax planning for your firm.

Get a Free Quote

CONTACT US FOR ANY QUESTIONS