Home » Why rental property bookkeeping is different from others?

Why is rental property bookkeeping different from others?

Rental property bookkeeping is not the same as normal bookkeeping. It covers rent, repair costs, tax write-offs, and tenant deposits. Owners must track more items than in most other types of work. It takes clear records and smart steps to stay on top of it. Rental property bookkeeping is not like other forms of bookkeeping. It has its own rules, tasks, and demands. While all businesses need clear books, rentals come with mixed income, many types of costs, and rules for tax. For landlords and property firms, good books are a must. They help with smart choices, cash flow, and tax checks.

What Is Bookkeeping for Rental Property?

Bookkeeping for rental property means keeping track of all income and expenses related to owning and managing a rental unit. This includes recording rent payments, repair costs, insurance, mortgage interest, and any utility bills. Rental property bookkeeping helps landlords stay organized, understand profits, and remain compliant with tax laws.

Why Is Rental Property Bookkeeping Unique?

Bookkeeping for rental property is not like regular bookkeeping for retail or service-based businesses. In rental property bookkeeping, you deal with both physical assets and tenants. Rental income may not be consistent every month. Also, costs for repairs, upgrades, and legal services often vary. Rental property bookkeeping must adjust for unique tax rules and management steps for each unit.

What Sets Rental Property Bookkeeping Apart?

1. Many Income Types: Track Each One Right

- In rentals, money comes from rent, late fees, upkeep charges, and deposits. You must track each type and post it correctly. If not, you risk tax issues and wrong reports. Income should be split by type, rent, late fee, pet fee, or deposit.

2. Depreciation: Big for Tax and Reports

- Homes lose value over time. Depreciation lets you spread the cost of the home across many years. This cuts taxes and helps track the real value. If done wrong, you may miss tax breaks.

3. Upkeep, Repairs, and Improvements: Know the Gap

- Not all costs are the same. A quick fix is a “repair” and is tax-ready now. But a big upgrade is an “improvement” and must be spread out. You need to log them in the right group, or you may break tax rules.

4. Each Unit Needs Its Own Books

- With rental property bookkeeping, each home or flat needs its own clean set of records. Rent, cost, fix, and tax must be tied to the right place. Mix-ups cause lost funds or tax errors.

5. Lots of Properties, Lots More Work

- If you run many homes, the task grows. Each one adds more records. This means more work and more risk of errors. A clear, neat way to track each one is key.

6. Deposit Rules: Not Your Money Yet

- Security deposits aren’t income unless the renter loses them. Till then, you must keep them safe, not mix them with rent. These rules change by state too.

7. Records Matter: For Tax, Loans, and Law

- Each deal, fee, and cost must have proof. Good records help with audits, cut stress, and show lenders or buyers that your firm is solid.

Components of Bookkeeping for Rental Property

1. Income Tracking

- Rent collected from tenants

- Late payment charges

- Extra income from laundry, parking, or storage fees

2. Expense Tracking

- Maintenance and repair costs

- Utility payments (if paid by the landlord)

- Property taxes and insurance

- Legal or accounting service charges

3. Lease Records

- Start and end dates of lease agreements

- Monthly rent amounts

- Terms for renewals or rent increases

4. Security Deposit Records

- Amount of deposit held

- Reason for holding the deposit (e.g., damage, non-payment)

- Details about refunds or usage of the deposit

5. Asset Depreciation

- Depreciation of buildings over time

- Depreciation for items like furniture or equipment

Challenges in Rental Property Bookkeeping

1. Managing Multiple Properties

With more properties, tracking rent and expenses gets harder. Manual tracking becomes inefficient and error-prone.

2. Irregular Rent Dates

Not all tenants pay on the same day. Some pay on the 1st, others on different dates. This can cause confusion and errors.

3. Tax Law Changes

Tax laws for rental income can change yearly. Landlords must stay updated and adjust their records accordingly.

4. Capital vs. Repair Costs

Repairs can be deducted right away, but upgrades or capital improvements must be spread over many years. Mislabeling these can cause tax trouble.

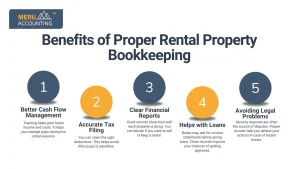

Benefits of Proper Rental Property Bookkeeping

1. Better Cash Flow Management

Tracking helps plan future income and costs. It helps you manage gaps during low rental seasons.

2. Accurate Tax Filing

You can claim the right deductions. This helps avoid IRS issues or penalties.

3. Clear Financial Reports

Good records show how well each property is doing. You can decide if you want to sell or keep a rental.

4. Helps with Loans

Banks may ask for income statements before giving loans. Clean records improve your chances of getting approved.

5. Avoiding Legal Problems

Security deposits are often the source of disputes. Proper records help you defend your actions in case of tenant issues.

Tools Used in Bookkeeping for Rental Property

1. Spreadsheets

Excel or Google Sheets are basic tools. They are free and easy to set up, though they require manual work.

2. Property Management Software

Apps like Buildium, Rentec Direct, and AppFolio help track rent, deposits, and repair costs. These tools are made for landlords.

3. Accounting Software

Software like QuickBooks, Xero, and FreshBooks helps with overall accounting. They work well for both new and experienced landlords.

Tips to Improve Rental Property Bookkeeping

1. Keep Personal and Business Accounts Separate

Use a different bank account for rental income and costs. It makes tracking easier and avoids confusion.

2. Set Reminders

Use tools or apps to remind you of rent due dates and bill payments. This keeps your books up to date.

3. Go Digital

Scan your bills and receipts. Store them in folders on your computer or cloud. This makes finding records easy.

4. Hire a Bookkeeper or CPA

A trained expert can handle bookkeeping for rental property with accuracy. It saves time and reduces the chance of errors.

Common Mistakes in Rental Property Bookkeeping

1. Ignoring Small Expenses

Even small costs can add up over time. Always record them.

2. Wrong Labels for Transactions

Putting costs in the wrong category can lead to bad reports. Use clear labels for each type of income or expense.

3. Skipping Depreciation

Forgetting to include depreciation means you may miss a big tax break.

4. Not Checking Bank Records

Always match your bookkeeping for rental property with your bank statements each month. This ensures accuracy.

Why Landlords Should Take Bookkeeping Seriously

- Helps You Stay in Control

Bookkeeping for rental property shows your income, costs, and cash flow. It helps you make smart choices for your rental. - Reduces Stress During Tax Time

With records in place, tax filing is smooth. You won’t miss bills or lose receipts. - Shows Property Performance

You can tell if your rental makes money or not. This helps you plan ahead or make changes. - Supports Loans and Refinancing

Lenders ask for clean reports. Good books make the loan or refinance process simple. - Boosts Trust with Buyers or Investors

If you plan to sell or raise funds, clear books show that your rental is managed well. - Tracks Rent and Deposits Accurately

You can track rent paid, late fees, and deposits. This helps you avoid tenant issues. - Avoids Legal Trouble

If a problem comes up, clear records help prove your case and protect you.

Bookkeeping for Rental Property with a CPA or Service Provider

1. Why Hire a Professional?

CPAs and professional bookkeepers know the tax rules and how to handle bookkeeping for rental property with care. They save you time and help avoid mistakes.

2. What You Can Expect

You’ll receive monthly reports, clean ledgers, and documents ready for taxes.

3. Is It Worth the Cost?

Yes, you pay for the service, but it can save you more in taxes and prevent costly errors.

Rental Property Bookkeeping for Short-Term Rentals

1. Unique Needs

Income changes often due to many guests. Bookkeeping for rental property becomes more complex with short-term stays and frequent guest turnover.

2. More Maintenance

You may need to clean and maintain the place after every stay. These costs must be tracked carefully as part of bookkeeping for rental property.

3. More Taxes

Short-term rentals may require you to pay lodging or occupancy taxes. These need proper tracking and reporting.

Rental Bookkeeping and Tax Deductions

1. Common Deductible Expenses

You can deduct:

- Property taxes

- Mortgage interest

- Repairs and maintenance

- Utilities

- Insurance

- Depreciation on buildings and equipment

2. Stay Ready for an Audit

Always save receipts and records. Keep them safe for at least 3 to 5 years. This proves your deductions if the IRS audits you.

Meru Accounting knows that rental bookkeeping can be tough. We offer clear, simple ways to keep your records neat, sorted, and tax-safe. We track all income, rent, fees, and deposits, and place each in the right spot. We also keep an eye on costs, from small fixes to big upgrades, so nothing is lost. Your books will be ready for tax time, with rules for cost and value drop used the right way. If you own more than one home, we help you track each one without mix-ups. If there’s an audit, your records will be set. With Meru Accounting, you can skip the stress and grow your cash with ease.

FAQs

- What makes rental property bookkeeping different?

It has rent, fees, deposits, and many tax steps to follow. - Why is rental income tricky?

There are many kinds—each needs its own spot in the books. - How does depreciation help?

It spreads the cost across years, which cuts the tax. - Why keep each home in its own file?

It avoids mix-ups and shows real results per unit. - Do repairs and upgrades change taxes?

Yes. Each kind has its own tax rule. - Why are records so key?

They help during audits and prove what you spent or got. - Are many rentals hard to track?

Yes. More homes mean more books and risk of error. - Can a firm help with this?

Yes. Meru makes your books neat, right, and tax-safe.