Home » How do you prepare Fantastic monthly financial statements?

How Do You Prepare Fantastic Monthly Financial Statements?

Fantastic monthly financial statements give you the power to manage, plan, and lead your business with ease. These reports give a full picture of how your business is doing. You can see what you earn, what you spend, and how much you have left. Good financial reporting helps you make smart choices. With clear reports each month, you can spot trends fast and fix issues before they grow. They also help build trust with banks, partners, and investors.

Introduction to Monthly Financial Statements

Monthly financial statements are tools that help you track the health of your business. They show whether your business makes or loses money each month. They also help you stay on track.

Why Monthly Reports Matter

They help you fix problems fast. You don’t wait for year-end reports. You catch issues early and act fast.

A Clear View of Finances

You see all your numbers each month. It shows your income, costs, and profit clearly.

Easier Decision Making

When you know your numbers, you make better plans. You feel confident in your business choices.

Key Components of Monthly Financial Statements

Each report has parts that show different sides of your business. These help you understand the full picture.

Income Statement

This report lists your income and your costs. It tells you if your business made a profit or suffered a loss. You can track how your sales and expenses change each month.

Balance Sheet

Your balance sheet shows what you own and what you owe. It tracks your assets, debts, and equity. It’s a clear snapshot of your business position at the end of each month.

Cash Flow Statement

This report tracks your cash inflows and outflows. You can track where your cash comes in and where it goes out. It helps manage liquidity and avoid cash shortages.

Accounts Receivable Report

This shows who still owes you money. You can see which invoices are late and follow up quickly. It helps you keep cash flowing by reducing unpaid amounts.

Accounts Payable Report

This report lists what you owe to vendors. It helps you schedule payments wisely. You avoid late fees and build better supplier relationships with timely payments.

Budget vs Actual Report

This compares your planned budget with what happened. It helps you control spending and understand performance gaps. You can adjust goals or actions based on real results.

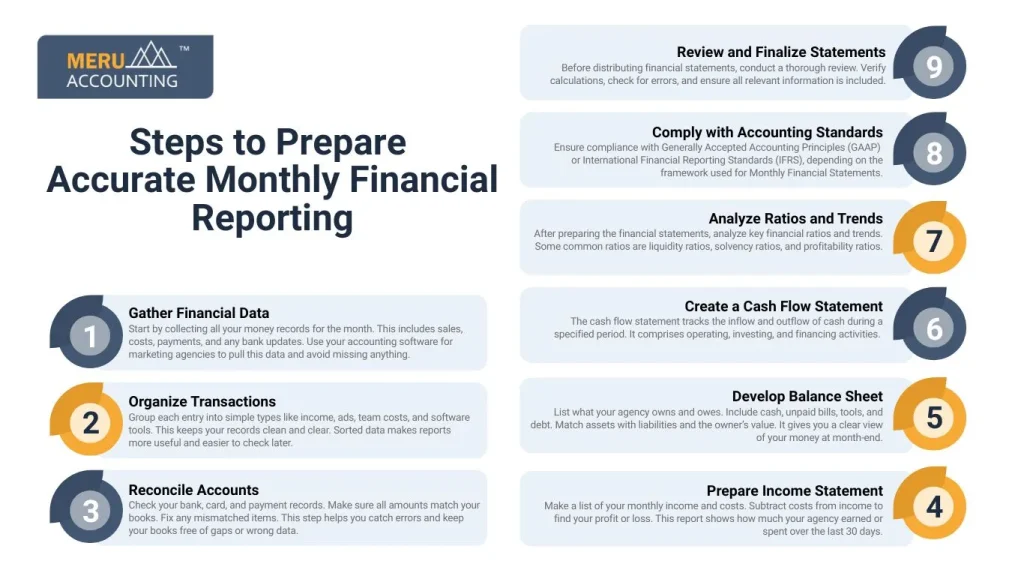

Steps to Prepare Accurate Monthly Financial Reporting

You must follow clear steps each month to keep your reports clean, simple, and correct. These steps help you track business health and spot problems early. Use easy tools and clear records at every step.

Gather Financial Data

Start by collecting all your money records for the month. This includes sales, costs, payments, and any bank updates. Use your accounting software for marketing agencies to pull this data and avoid missing anything.

Organize Transactions

Group each entry into simple types like income, ads, team costs, and software tools. This keeps your records clean and clear. Sorted data makes reports more useful and easier to check later.

Reconcile Accounts

Check your bank, card, and payment records. Make sure all amounts match your books. Fix any mismatched items. This step helps you catch errors and keep your books free of gaps or wrong data.

Prepare Income Statement

Make a list of your monthly income and costs. Subtract costs from income to find your profit or loss. This report shows how much your agency earned or spent over the last 30 days.

Develop Balance Sheet

List what your agency owns and owes. Include cash, unpaid bills, tools, and debt. Match assets with liabilities and the owner’s value. It gives you a clear view of your money at month-end.

Create a Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash during a specified period. It comprises operating, investing, and financing activities. Operating activities involve the core business functions, while investing and financing activities cover asset acquisitions and financing sources. The cash flow statement ensures the company’s liquidity and financial stability.

Analyze Ratios and Trends

After preparing the financial statements, analyze key financial ratios and trends. Some common ratios are liquidity ratios, solvency ratios, and profitability ratios. Assessing these metrics provides insights into the company’s financial health and performance, aiding in strategic decision-making.

Comply with Accounting Standards

Ensure compliance with Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), depending on the framework used for Monthly Financial Statements. Adhering to these standards enhances the credibility of the monthly statements and ensures consistency.

Review and Finalize Statements

Before distributing financial statements, conduct a thorough review. Verify calculations, check for errors, and ensure all relevant information is included. Seek input from financial professionals or stakeholders to enhance the accuracy and reliability of the statements.

Common Mistakes in Monthly Financial Statements and How to Avoid Them

Many businesses make the same mistakes in their monthly financial statements. Knowing these mistakes helps you stay alert and keep your reports clear and useful.

Missing Transactions

If entries are left out, reports become unreliable. Always check that all invoices, bills, and bank items are entered. Use software to track missing items easily.

Wrong Classifications

Putting costs or income in the wrong category can mislead decisions. Always use proper labels and check groupings. Review your chart of accounts regularly.

Not Reconciling Monthly

Without reconciling, mistakes can stay hidden. Each month, compare your books to bank records. Fix differences fast before they grow or spread across reports.

Mixing Personal and Business

Using one account for both personal and business leads to confusion. Always keep business and personal transactions separate to avoid tax and audit issues.

Ignoring Small Errors

Even small errors can grow with time. Review and fix them quickly. Don’t delay corrections, or your reports may be off for months.

Skipping Reviews

If no one checks your work, mistakes go unnoticed. Always review your reports. Ask others to help review if possible.

Not Using Tools

Manual work increases the chances of error. Use tools like Xero or QuickBooks to make entries and reports accurate and fast with less stress.

Tools and Software That Simplify Monthly Financial Reporting

The right tools can transform how you manage monthly financial statements. They make reporting faster, easier, and more accurate, with fewer errors.

Xero

Xero offers smart features for tracking money. It links with banks, sorts entries, and gives monthly reports with just a few clicks. It works well for small and growing firms.

QuickBooks

QuickBooks is great for tracking sales and costs. It sends invoices, matches payments, and builds clean monthly financial reporting. It’s easy to use and offers strong customer support.

FreshBooks

FreshBooks is perfect for service-based firms. It helps manage time, expenses, and client billing. It gives monthly reports that are clear, fast, and ready to use anytime.

Zoho Books

Zoho Books gives great value with its strong features. It covers billing, tax, and full reporting. It’s good for small teams wanting clear monthly statements.

Wave

Wave is free and easy. It gives clean reports for small businesses. You can send invoices, track payments, and build basic monthly reports with zero cost.

Excel or Google Sheets

Spreadsheets offer control, but need to be taken care of. Use templates to build your monthly financial reporting. Check for formula errors and always back up your data.

Hubdoc or Dext

These tools pull data from bills and receipts. They help reduce typing and speed up reporting. They save time while reducing mistakes from manual entry.

Benefits of Consistent Monthly Financial Reporting

Doing reports each month brings many gains. It keeps your business sharp and strong.

Clear Business Health: Reports show whether you grow or shrink. You can track your health month by month.

Better Cash Control: You see cash gaps before they hurt. You plan payments better.

Smart Planning: Monthly reports help you build good budgets. You base your plans on real facts.

Easier Tax Time: No last-minute rush when taxes are due. You already have clean books.

Quick Fixes: Spot problems early and act fast. No need to wait for year-end.

Builds Trust: Lenders and investors trust you more. Clean monthly reports show control.

At Meru Accounting, we do monthly financial reporting for firms of all sizes. We handle the tough work so you can focus on growth. Our team knows how to build perfect reports. You get clean and clear numbers each month. We use top tools like Xero and QuickBooks. Your books stay safe and updated. We don’t use one-size-fits-all. You get reports that match your needs. We work fast and keep costs low.

FAQs

- What is included in monthly financial statements?

They include the income statement, balance sheet, and cash flow. Some reports also show receivables, payables, and budget vs actuals.

- How often should I review monthly financial reporting?

Review your reports every month without fail. This helps you fix problems fast and track business growth.

- Can small businesses benefit from monthly statements?

Yes, monthly reporting helps small firms spot issues early, track income, and plan better.

- What tools help prepare monthly financial reports?

Use Xero, QuickBooks, or Wave. They are easy and help build reports fast and right.

- How do monthly reports help in tax filing?

You save time at tax time. Clean monthly records mean fewer smoother returns.

- Should I hire help for monthly financial reporting?

If you want error-free reports, yes. Firms like Meru Accounting handle this well for less time and stress.