Tax Provisions & Updated Tax Rules: How to Prepare for Tax Season 2025-26

Tax season brings pressure, set dates, and the need for smart plans. Each year, the IRS updates tax rules and key tax provisions that affect how you file. Staying updated helps avoid errors and missed tax breaks. It also gives more time to collect forms and file with ease.

Whether you file as a person or a business, deadlines are key. Missing them may cause fines or hold back refunds. Good preparation is the best way to stay safe and stress-free.

This guide shares key tax provisions and what to know for the 2025–26 tax year. It includes rule changes, due dates, and smart steps to file on time.

When Is Tax Season 2025?

IRS Filing Start Date

The IRS is likely to start e-filing on January 27, 2025. This date may shift if the IRS delays start. Still, it’s smart to prep in advance.

Tax Filing Deadline

The due date to file your federal tax return is April 15, 2025. Most people must file by this date unless there’s an IRS exception.

Extension Deadline

Need more time? File Form 4868 to move the deadline to October 15, 2025. Note: this extends the filing, not the payment. You still must pay by April 15.

How Early Can You File Taxes in 2025?

Start Prep in Early January

Tax software firms and tax pros start prep in the first week of January. They can hold returns and file once the IRS starts e-filing.

When W-2s and 1099s Are Sent

Most employers and banks must send forms by January 31, 2025. Once you get these, you can begin your filing prep.

Why File Early?

Filing early brings these perks:

- Lower risk of ID theft

- Faster refund via direct deposit

- Time to fix errors

- Less stress at the last minute

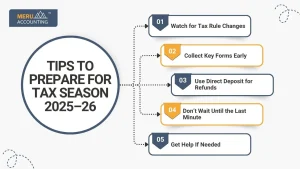

Tips to Prepare for Tax Season 2025–26

1. Watch for Tax Rule Changes

Tax laws may change each year. Check the IRS site or a tax pro to learn the latest tax provisions and changes.

2. Collect Key Forms Early

Gather these docs early:

- W-2s and 1099s

- Last year’s return

- Loan or mortgage forms

- Medical or charity bills

3. Use Direct Deposit for Refunds

E-file with direct deposit to get refunds in 21 days or less.

4. Don’t Wait Until the Last Minute

Rushed work can cause mistakes. Take time to review all forms and numbers.

5. Get Help If Needed

Self-employed or have extra income? A tax pro can help you stay safe and save more.

Key Tax Provisions for 2025–26

1. Standard Deduction Adjustment

- Single filers: likely $14,200

- Married filing jointly: likely $28,400

This reduces taxable income if you don’t itemize.

2. Earned Income Tax Credit (EITC)

- Income limits are higher

- Credit amount is also set to rise

3. Child Tax Credit (CTC)

- Expected to be $2,000 per child under 17

- Phase-outs apply for higher incomes

4. Retirement Plan Contribution Limits

- 401(k): May rise to $23,000

- IRA: May rise to $7,500

5. Education Tax Benefits

- No major changes

- AOTC and LLC still apply

New IRS Rules and Adjustments for 2025

1. Form 1099-K Reporting

Apps like PayPal, Venmo, and Etsy must send Form 1099-K if your income is over $600.

2. Clean Vehicle Credit

You may claim up to $7,500 for a new electric car, based on where it’s built and battery parts used.

3. Home Energy Credits

Credits for upgrades like:

- Heat pumps

- Solar panels

- New insulation

4. Capital Gains Tax Rates

These rates are part of the key tax provisions tied to capital gains. The cutoffs are higher due to inflation.

Steps to Prepare for Tax Season 2025–26

1. Gather Needed Forms

Collect these:

- W-2s

- 1099s

- Mortgage or student loan forms

- Charity or school bills

2. Track Deductible Costs

Track costs such as:

- Medical bills

- Childcare

- Work expenses

Use a spreadsheet or app.

3. Pick the Right Filing Status

Choose one:

- Single

- Married Filing Jointly

- Married Filing Separately

- Head of Household

4. Review Itemized Deductions

You may want to itemize if:

- You paid mortgage interest

- You paid local property tax

- Medical costs were high

5. Choose DIY or Tax Pro

- Use software if your return is simple

- Hire a pro for business, rentals, or foreign income

6. File Early

Filing early helps with new tax provisions, IRS delays, refund timing, and identity fraud.

Tax-Saving Tips for 2025–26

1. Max Out Retirement Accounts

Put the most allowed into:

- 401(k)

- IRA

- HSA

It lowers your tax bill and builds your future.

2. Track Self-Employed Costs

Keep clear records of:

- Mileage

- Travel

- Office tools

Apps like QuickBooks help.

3. Claim All Credits

Credits help cut your tax due:

- Child Tax Credit

- EITC

- AOTC

- Lifetime Learning Credit

4. Donate to IRS-Approved Groups

Give to groups that qualify. Save your proof—cash or goods both count.

5. Adjust Withholding if Needed

Use the IRS Estimator Tool. If your refund is too high or too low, change your Form W-4.

Filing Options for 2025

1. Use IRS Free File

- Available to those who meet income limits.

- Easy to use and safe.

2. Hire a Tax Preparer

- Good choice for complex returns.

- Ask about experience with 2025 tax provisions.

3. File Electronically

- E-filing is faster and reduces errors.

- Direct deposit means quicker refunds.

Tax Obligations for U.S. Citizens Abroad

U.S. citizens who live or earn money abroad must still follow U.S. tax rules. This applies even if they pay tax to another country.

They must follow U.S. tax provisions and file a return each year, no matter where they live.

If their foreign bank accounts total more than $10,000 at any time, they must file an FBAR form. This helps the IRS track overseas funds.

To avoid being taxed twice, they can use Form 2555 or Form 1116. These forms help reduce or remove double taxation.

Tax Credits & Deductions to Note in 2025

Note – Average Syllables per Word: Below 1.40

1. Standard Deduction vs Itemized

- Choose the higher of the two.

- Use itemized if you have high medical bills, mortgage interest, or gifts.

2. Education Credits

- American Opportunity Credit: Up to $2,500

- Lifetime Learning Credit: Up to $2,000

- Great for students and families paying tuition.

3. Home Office Deduction

- If you’re self-employed, claim a share of your home.

- Based on the space used for work.

4. Energy-Efficient Home Improvements

- Claim credits for upgrades like solar panels, heat pumps, or insulation.

- Keep all records and certificates.

Self-Employed and Small Business Filers

1. Understand Your Tax Provisions

- You must pay both income and self-employment tax.

- Track your business income, costs, and receipts.

2. Quarterly Estimated Payments

- Pay in April, June, September, and January.

- Avoid year-end surprises or IRS penalties.

3. Use Accounting Tools

- Use software to track sales, costs, and trips.

- Choose tools that make tax prep simple.

Important Tax Dates to Remember

Date | Event |

Jan 1, 2025 | Start collecting tax documents |

Jan 27, 2025 | IRS expected to start e-filing |

Apr 15, 2025 | Tax return due |

Oct 15, 2025 | Extended return deadline |

Tax Compliance for Gig Economy Workers

- Many people now work as freelancers or use gig platforms. If you earn this type of income, you must follow the tax rules set by the IRS.

- You must report all self-employment income. Use Schedule C to list your earnings and costs.

- You must pay both income tax and self-employment tax. This covers Social Security and Medicare.

- You can lower your tax by claiming work-related costs. These may include software, subscriptions, or travel costs like mileage. Make sure you keep good records.

At Meru Accounting, we offer full tax help for people and firms. Our team stays current with all tax provisions and helps you save more during tax season. From form prep to filing, we make tax season smooth. Choose Meru Accounting for a stress-free 2025–26.

FAQs

1. When is tax season in 2025?

Tax season starts in late January 2025, on January 27. It’s best to plan and prep your forms early.

2. How early can you file taxes in 2025?

You can file once IRS e-file opens — late Jan. The sooner you file, the sooner you may get paid.

3. What are the new tax provisions for 2025?

New tax rules bring new brackets, more cuts, and more credits. These updates can change what you owe or save.

4. Do I need to file if I had no income?

You may not need to. But filing may help you get a refund. You might still claim tax breaks or past credits.

5. Can I still file taxes after April 15?

Yes. File an extension before April 15 to avoid fines. This gives you more time to file, not to pay.

6. Are refunds faster if I e-file?

Yes. E-filed returns get refunds in about 3 weeks. Use direct deposit to speed it up even more.

7. What if I make a mistake on my tax return?

Use Form 1040-X to fix any errors you made. You have 3 years to file and make it right.