Home » What is the role of bookkeeping in bars?

What Is the Role of Bar Bookkeeping in Running a Successful Bar

Bar bookkeeping is the base of every smart and well-run bar. From tracking drink sales to monitoring daily costs, bar accounting helps keep your books clean and clear. In a fast-moving world, owners must use simple tools like accounting software for bars to stay ahead. If your bookkeeping for bars is a mess, it’s hard to grow, manage staff, or even serve your best drinks. So let’s look at how strong bar bookkeeping supports your business goals.

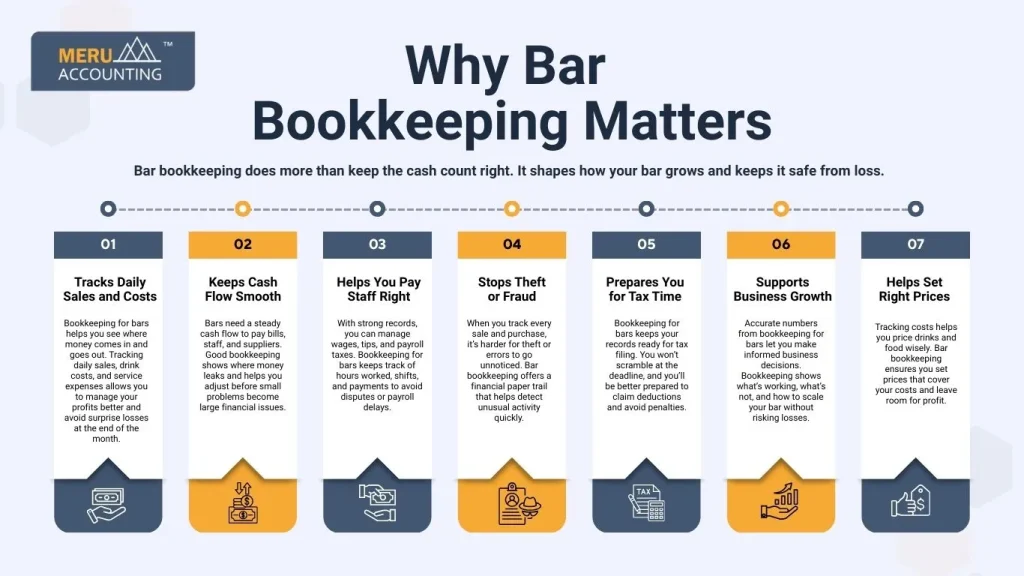

Why Bar Bookkeeping Matters

Bar bookkeeping does more than keep the cash count right. It shapes how your bar grows and keeps it safe from loss.

Tracks Daily Sales and Costs

Bookkeeping for bars helps you see where money comes in and goes out. Tracking daily sales, drink costs, and service expenses allows you to manage your profits better and avoid surprise losses at the end of the month.

Keeps Cash Flow Smooth

Bars need a steady cash flow to pay bills, staff, and suppliers. Good bookkeeping shows where money leaks and helps you adjust before small problems become large financial issues.

Helps You Pay Staff Right

With strong records, you can manage wages, tips, and payroll taxes. Bookkeeping for bars keeps track of hours worked, shifts, and payments to avoid disputes or payroll delays.

Stops Theft or Fraud

When you track every sale and purchase, it’s harder for theft or errors to go unnoticed. Bar bookkeeping offers a financial paper trail that helps detect unusual activity quickly.

Prepares You for Tax Time

Bookkeeping for bars keeps your records ready for tax filing. You won’t scramble at the deadline, and you’ll be better prepared to claim deductions and avoid penalties.

Supports Business Growth

Accurate numbers from bookkeeping for bars let you make informed business decisions. Bookkeeping shows what’s working, what’s not, and how to scale your bar without risking losses.

Helps Set Right Prices

Tracking costs helps you price drinks and food wisely. Bar bookkeeping ensures you set prices that cover your costs and leave room for profit.

What Makes Bar Accounting Different?

Unlike typical business bookkeeping, bar accounting comes with its own set of requirements.

Daily Volume and Fast Sales

Bars handle dozens or hundreds of small transactions each night. A good system logs each sale so you know what sells best and what needs adjustment.

Mix of Cash, Card, and Tips

Most bars handle multiple payment methods. Bar accounting tracks cash, card payments, and staff tips to prevent missing funds or miscounts.

Inventory That Moves Fast

Drink and food stock change daily. Without strong tracking, you might run out of key items or waste money on expired stock.

High Staff Turnover

Staff are often in bars. Accurate records of training, hours, and pay help with smooth transitions and lower hiring costs.

Late Hours and Split Shifts

Bar workers often follow rotating shifts and late nights. Your books must reflect complex work patterns to ensure fair pay and proper staffing.

Complex Tax Needs

Alcohol comes with tax rules like excise duties and local levies. Bar bookkeeping helps manage these and avoid costly errors or fines.

How Accounting Software for Bars Helps

Using the right tool makes all the difference. Accounting software saves time and cuts errors.

Tracks Sales in Real-Time

Integrated software records sales as they happen. This gives instant insights into your revenue trends, best-selling items, and daily performance summaries.

Automates Payroll

Payroll software tracks hours and calculates wages. It processes pay, taxes, and deductions, making it easier to pay your staff correctly on time.

Simplifies Tax Filing

Tax-ready reports come with built-in templates. Accounting software for bars makes tax filing smoother and reduces errors during audits or assessments.

Gives Quick Reports

You can access sales, expense, and profit reports anytime. These reports help you make informed business decisions backed by real-time financial data.

Helps Track Inventory

Software can monitor how much stock you use daily. This helps you reduce waste, avoid running out of popular items, and reorder at the right time.

Saves Time on Data Entry

Automated tools reduce the need for manual entry. You get more time to manage your bar and spend less time crunching numbers.

Helps with Budget Planning

The software lets you compare spending vs. budget. You can track monthly goals and make changes when actual costs don’t meet your plans.

Choosing the Right Accounting Software for Bars

Not all tools work the same. Pick the one that fits your bar best.

Look for Ease of Use

Pick accounting software for bars that offers a clean layout and is easy to learn. Your staff should not need weeks of training to use it well.

Pick One Made for Bars

Choose a solution designed for bar needs. These include features like tracking tabs, tips, split bills, and hourly payroll suited to bar environments.

Check Support Options

Reliable support is key when problems arise. Make sure the provider offers chat, phone, or email support and timely help with updates or bugs.

Review Mobile Access

You might not always be at the bar. Software with mobile access allows you to monitor sales and reports on your phone anytime.

Check for POS Integration

Your software should sync with your point-of-sale system. This keeps your numbers accurate and saves hours on manual work.

Review Your Budget

Don’t overspend on features you don’t need. Compare costs and ensure the tool gives good value while meeting your core needs.

See If It Grows With You

As your bar grows, you may need more features. Pick a tool that offers upgrades and can scale with your business goals.

Bookkeeping for Bars: Best Practices

To make the most of your bookkeeping for bars, follow some key tips.

Track Daily Income and Costs

Update your books every day without delay. This keeps records fresh and helps you spot any unexpected costs or sales trends early.

Keep All Receipts

Save and label every bill, receipt, and supplier note. These help you during tax filings and also confirm spending if doubts arise.

Match Sales to Inventory

If your sales data and stock count don’t match, there may be theft or waste. Matching ensures control over your items.

Review Reports Weekly

Regular report checks help catch changes or losses. Make weekly reviews a habit to maintain a stable cash flow and catch issues early.

Use Separate Bank Accounts

Keep business funds apart from your funds. This helps track your bar’s true earnings and protects your money.

Reconcile Bank Statements

Check your bank records against your books monthly. This ensures your records reflect real account balances and prevent accounting gaps.

Save Time with Apps

Use mobile apps for tracking expenses and bills on the go. This saves time, boosts accuracy, and lets you manage the bar even when away.

Common Errors in Bar Bookkeeping

Avoid these mistakes to keep your books clear and your mind at ease.

Skipping Daily Entries

If you skip entries, your records won’t reflect true earnings or losses. This leads to wrong tax numbers and bad business planning.

Ignoring Cash Sales

Cash sales may seem small, but they can add up fast. Missing them means incomplete records and could create tax or budget issues.

Not Backing Up Data

A system crash could wipe out all your records. Regular backups, either online or offline, are key to protecting your data.

Mixing Business and Personal

Don’t use the same card for bar and personal spending. It creates confusion and makes financial tracking harder during audits.

Forgetting About Tips

Tips are part of your staff’s pay and must be tracked. Unreported tips can lead to tax issues or unhappy workers.

Missing Tax Deadlines

Filing late means fines and lost sleep. Use software or a calendar to keep tax deadlines in check.

Not Reviewing Reports

Reports are not just for storage. Use them to spot growth or risks and to guide weekly or monthly plans.

Benefits of Using Bar Accounting Services

Some bar owners hire expert help. This can save stress and time.

Get Expert Tax Help

Professional bar accountants know the tax laws that apply to alcohol, wages, and tips. Their advice helps you stay within the law and save money.

Gain Time Back

When you hand off your books, you get hours back. Use that time to improve service or focus on growing your bar.

Cut Risk of Errors

Experts are trained to spot and avoid errors. Clean records help you avoid fines, confusion, or costly mistakes later.

Receive Real Insights

Accountants can give detailed reports with useful insights. These reports can help you boost profits and plan better.

Stay Compliant

Accounting services help you meet all legal rules. This reduces the chance of audits or fines from tax bodies.

Access the Best Tools

Firms use advanced tools that offer features you may not have. They also know how to use these tools efficiently.

Plan Better Budgets

You can make smarter plans with expert help. Accurate forecasts help with long-term goals and avoid cash flow gaps.

Running a bar comes with unique challenges, from tracking daily sales and staff tips to handling payroll, taxes, and inventory. At Meru Accounting, we specialize in bar bookkeeping and provide tailored solutions that fit your needs. Our team uses the best accounting software for bars to simplify payroll, reconcile sales, and keep your books clear and accurate. With our support, you can cut errors, save time, and focus on serving your customers while we handle the numbers.

FAQs

- What is bar bookkeeping?

Bar bookkeeping tracks your sales, costs, and tips daily. It helps manage staff pay, reduce fraud, and keep taxes in check. Bar bookkeeping builds a clear view of your bar’s money flow.

- Why is accounting software for bars important?

It automates your work and reduces manual errors. Accounting software for bars tracks sales, staff pay, and stock easily. It also helps during tax season and gives fast financial reports.

- How does bar accounting differ from other businesses?

Bar accounting must track tips, split shifts, and fast sales. It also deals with stock that changes daily and complex tax rules. These unique needs make bar accounting more detailed.

- What should I look for in accounting software for bars?

Look for POS links, staff pay tools, and inventory tracking. Good accounting software must be easy to use and mobile-friendly. It should also create fast reports and support tax filing.