Home » How to maintain accounting for clubs?

How to Maintain Accounting for Clubs?

Strong accounting for clubs helps them run better, whether they are sports, social, or hobby groups. When you track income and spending clearly, your club avoids poor planning, missed bills, and lost trust. Clean club bookkeeping records help clubs grow with confidence.

Clubs often deal with fees, events, and funds from many sources, so a clear system is key. With the right setup, your club can plan well, meet its goals, and build trust with all who take part. In this blog, we will share why accounting matters for clubs, the best ways to track funds, and the tools that make the job easy.

Why Proper Accounting for Clubs Matters

Track All Club Income and Expenses

Clubs earn money from fees, donations, or events. Record each amount as it comes in or goes out. When you track everything, you stay in control and plan activities with ease.

Plan Club Activities Better

Good books help you build clear budgets for trips, meets, or events. With the right data, you avoid last-minute cuts and keep the club running smoothly.

Build Trust With Members

When members see where the money goes, they trust the process. Clear reports remove doubts. It also becomes easier to ask for fees or raise new funds.

Meet Tax and Legal Rules

Depending on size and income, clubs may need to file taxes or submit compliance reports. Proper accounting for clubs ensures all rules are followed and there are no legal risks.

Protects Against Fraud or Errors

If a club doesn’t keep records, mistakes go unnoticed. Club bookkeeping helps reduce fraud, control spending, and keep a clean record for the future.

Set Clear Goals for the Future

Past data shows how your club spends and earns. With real numbers, you plan better for the next year, set clear goals, and manage rising costs.

Encourages Better Leadership

Leaders with access to accurate data can make better choices. A clear record shows that leaders are doing their jobs and helps new members understand past actions.

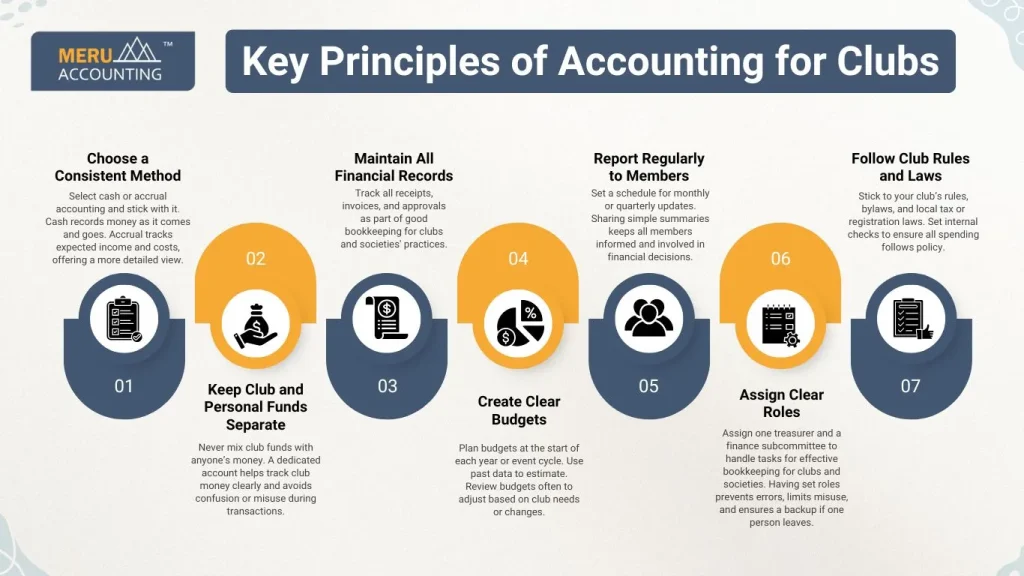

Key Principles of Accounting for Clubs

Choose a Consistent Method

Select cash or accrual accounting and stick with it. Cash records money as it comes and goes. Accrual tracks expected income and costs, offering a more detailed view.

Keep Club and Personal Funds Separate

Never mix club funds with anyone’s money. A dedicated account helps track club money clearly and avoids confusion or misuse during transactions.

Maintain All Financial Records

Track all receipts, invoices, and approvals as part of good bookkeeping for clubs and societies’ practices. Keep soft copies as backups. This makes audits or checks smooth and ensures accurate records year-round.

Create Clear Budgets

Plan budgets at the start of each year or event cycle. Use past data to estimate. Review budgets often to adjust based on club needs or changes.

Report Regularly to Members

Set a schedule for monthly or quarterly updates. Sharing simple summaries keeps all members informed and involved in financial decisions.

Assign Clear Roles

Assign one treasurer and a finance subcommittee to handle tasks for effective bookkeeping for clubs and societies. Having set roles prevents errors, limits misuse, and ensures a backup if one person leaves.

Follow Club Rules and Laws

Stick to your club’s rules, bylaws, and local tax or registration laws. Set internal checks to ensure all spending follows policy.

Differences Between Club Bookkeeping and Business Accounting

Purpose of Funds

Clubs serve social or hobby needs. Their income goes back into club use. Business income, on the other hand, is used to earn profit or reward owners.

Use of Donations and Grants

Clubs may depend on grants or donations. These must be recorded separately and used for set goals, unlike regular income from business clients.

Reporting Style

Clubs focus on income vs. expense and balance sheets. Businesses may also include profit-loss, inventory, and shareholder reports, which clubs usually do not need.

No Shareholder Needs

Clubs don’t have investors. So, they do not prepare investor-focused reports. Members care more about transparency and fair spending.

Different Tax Treatments

Nonprofits may enjoy tax exemptions. Still, they must follow rules, file annual returns, and provide accurate financial records like any entity.

Event and Activity Tracking

Many club expenses relate to events. Tracking each event’s cost helps clubs budget better. Businesses focus more on products or services.

Focus on Community Goals

Clubs aim to improve member experience. Financial goals exist, but support programs and activities instead of driving profits.

Essential Records for Bookkeeping for Clubs and Societies

Income Log

Maintain a register for income. Log date, amount, and source. This may include member dues, sponsorships, or donations. Review it monthly for accuracy.

Expense Tracker

Use a tracker to log all costs by category. Include dates, vendors, amounts, and receipts. It helps in audits and understanding regular spending patterns.

Bank Reconciliations

Match books with bank statements every month. This helps spot errors, missed entries, or fraud, keeping financial records complete and honest.

Member Ledger

Create a ledger showing paid and pending dues. Include join dates, payment dates, and subscription types to track member contributions efficiently.

Asset Register

Log all club assets with purchase date, price, and current use. This includes items like chairs, equipment, or gadgets owned by the club.

Event Budget Sheets

Each event should have its budget sheet. Track expenses vs income. This helps to assess which events are most effective and affordable.

Meeting Minutes with Finance Notes

Always record financial decisions in meeting notes. Include vote results and fund approvals. These help validate future decisions and show due process.

Best Practices to Maintain bookkeeping for clubs and societies Efficiently

Update Books Every Week

Weekly club bookkeeping updates prevent errors. Timely entries mean better recall of details and fewer missed items. It also reduces the end-of-month rush.

Use Templates or Tools

Digital tools or spreadsheet templates save time. They reduce human error and give quick reports. Choose free or paid tools that fit your club.

Review With the Committee Often

Monthly club bookkeeping reviews allow members to discuss spending. This builds trust and ensures records are understood by more than one person.

Store Files in the Cloud

Save files in Google Drive, Dropbox, or OneDrive. Cloud storage keeps them safe from loss and gives easy access from any location.

Secure Passwords for Access

Use tools that allow password protection or user roles. Limit access to treasurers and committee heads to reduce risks.

Keep a Petty Cash Log

Track small expenses like postage or snacks. Even petty costs add up. A simple log helps in balancing overall accounts.

Seek Advice When in Doubt

Ask experts in club bookkeeping when unsure. Many small issues can lead to big mistakes. Getting professional advice early avoids problems later.

Common Mistakes in Accounting for Clubs and How to Avoid Them

Ignoring Small Expenses

Many clubs skip logging small items. Over time, this adds up. Log everything, even if it’s under a few dollars.

No Record for Cash Payments

Always give receipts and request them. Cash payments without records can create disputes or leave gaps in the ledger.

Not Backing Up Data

Devices fail. Natural damage happens. Keep two copies of all data—one on a device, one in the cloud or USB drive.

Leaving One Person in Full Control

Split roles between at least two people. Oversight and cross-checking help avoid fraud or simple mistakes.

Poor Invoice Tracking

Use an invoice list to follow who owes money. Remind members in advance and log all follow-ups for clarity.

Delaying Data Entry

Don’t wait until year-end to update records. Log details weekly. Delays cause lost information and errors.

Not Auditing the Records

Hire someone to audit once a year. Even a small club should have its club bookkeeping reviewed to avoid blind spots or legal issues.

Useful Tools and Software for Bookkeeping for Clubs and Societies

Xero

Xero helps manage money with live bank feeds, auto-updates, and simple reports. Clubs with frequent events benefit most from their smart dashboards.

Wave

Wave is a free tool for small clubs. It tracks income, receipts, and makes invoices. Easy setup and no cost make it popular.

QuickBooks

QuickBooks handles big volumes and reports. It suits clubs with a large income or many members. Features include payroll, billing, and financial dashboards.

Google Sheets

Google Sheets is free and flexible. Create custom trackers. It’s best for small clubs but needs careful entry and protection.

ClubExpress

ClubExpress is built for clubs. It handles events, fees, members, and finances in one place. Good for clubs seeking an all-in-one tool.

MYOB

MYOB is a powerful suite, ideal for clubs with multiple cost centers. It supports tax reporting and works well for long-term growth.

Zoho Books

Zoho Books is user-friendly and works well for budget control. It gives clean reports and handles recurring bills or subscriptions with ease.

Meru Accounting provides custom solutions for accounting for clubs. We understand what clubs need and how to keep your records compliant and useful. Our experts handle everything from logs to reports. You receive complete and accurate bookkeeping for clubs and societies, ready to review anytime. We create simple yet deep monthly reports. They explain the numbers and trends in ways your team can understand easily.

FAQs

1. What is the importance of accounting for clubs?

Accounting for clubs ensures accurate records, avoids fraud, and helps clubs manage funds responsibly. It builds trust among members and keeps activities financially secure with proper planning and regular reporting.

2. How do we separate personal and club finances?

Always open a separate bank account for club use. Keep all receipts and spending under the club’s name to avoid confusion and ensure clean, compliant accounting for clubs and their members.

3. What records are essential for bookkeeping for clubs and societies?

Key records include income logs, expense sheets, event budgets, member dues, and bank reconciliations. Keeping these updated ensures reliable bookkeeping for clubs and societies throughout the year.

4. Can small clubs use free tools for bookkeeping?

Yes. Tools like Google Sheets or Wave help small clubs manage records. These platforms are cost-free, simple, and useful for basic club bookkeeping and financial tracking without heavy costs.