Types of Bookkeeping Systems Used in Modern Businesses

Every business needs to keep track of its money. That means writing down what money comes in and what money goes out. Just like students keep notebooks to track their homework, businesses use a bookkeeping system to track their money. An effective bookkeeping system helps a business stay on the right path. It shows how much money is earned, spent, and saved.

There are many bookkeeping types used in different ways. Some systems are easy and good for small shops. Others are big and used by large companies. In this guide, we will talk about the main types of bookkeeping systems and how they help a business grow strong and smart.

What Is a Bookkeeping System?

A bookkeeping system is a method used to record all money-related actions in a business. This includes sales, payments, bills, and more. It helps you know where your money is going and where it is coming from.

Think of it like a money diary. You write down every detail, so you don’t forget later. This system helps business owners check if they are earning money or losing it. It also helps when they have to pay taxes or show reports to banks or partners.

There are two main bookkeeping types used today. Each one works in a different way.

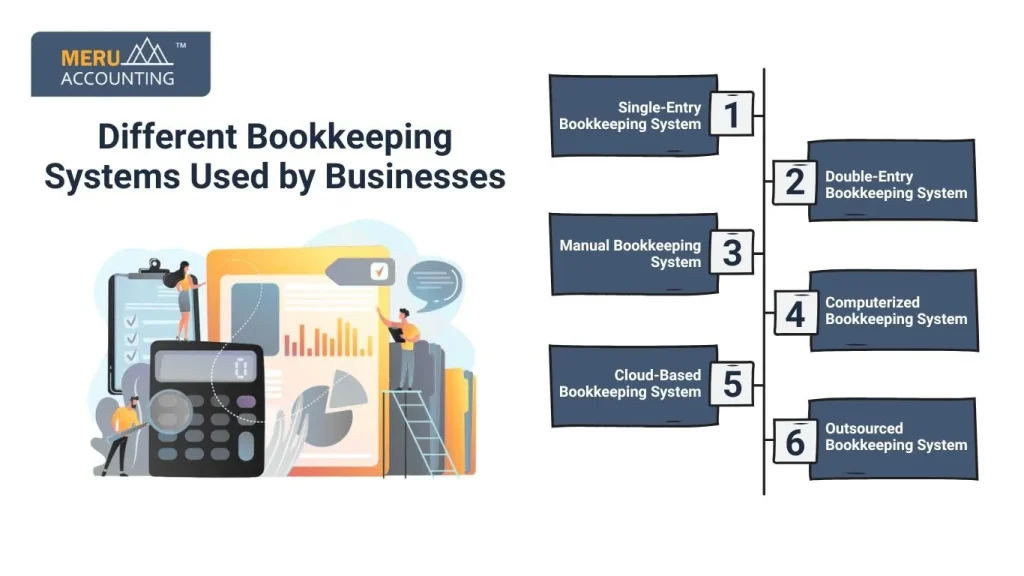

Different Bookkeeping Systems Used by Businesses

1. Single-Entry Bookkeeping System

The single-entry bookkeeping system is the easiest and most basic of all bookkeeping types. It works well for small shops, new businesses, or people who do not have many sales or bills. In this bookkeeping system, each money activity is written down only once.

How it works:

- You write down when money comes in (like from a sale).

- You write when money goes out (like when you buy items).

- You do not match each money move with another one.

- It is like using a daily money notebook or a checkbook.

Example:

- If you sell a cake for $20, you write: + $20 (cake sale)

- If you buy sugar for $5, you write: – $5 (sugar)

This shows how simple and clear this bookkeeping system can be.

Pros:

- Very easy to use

- Great for tiny or home-run businesses

- Takes less time to manage

Cons:

- Can miss some small money actions

- Hard to check for mistakes

- Not fit for big or growing businesses

2. Double-Entry Bookkeeping System

The double-entry bookkeeping system is one of the most used types of bookkeeping systems in the world. It is more advanced than the single-entry type. Medium and big businesses use this bookkeeping system because it gives better control over money records.

How it works:

- Each money action is written in two accounts: one as a debit, one as a credit.

- One account gives money; the other gets it.

- The totals on both sides must match, which helps you catch mistakes fast.

Example:

You sell a cake for $20:

- Debit: Cash Account + $20

- Credit: Sales Account + $20

You buy sugar for $5:

- Debit: Supplies Account + $5

- Credit: Cash Account – $5

Pros:

- Tracks money in and out clearly

- Helps find and fix mistakes

- Works well for all sizes of business

Cons:

- Takes more time to learn

- Needs some training

- May be hard for beginners

3. Manual Bookkeeping System

The manual bookkeeping system is an old-style way of keeping money records. It is still used in some small shops and homes. In this bookkeeping system, everything is written on paper using pens, ledgers, and books.

Features:

- Uses paper records like cash books and receipt books

- You write everything by hand

- No need for a computer or internet

Pros:

- Very low cost to start

- Great for people who like working with paper

- Good in places where there’s no computer or power

Cons:

- Takes a lot of time

- Easy to lose or damage papers

- Not easy to make changes once written

This bookkeeping type is best for very small businesses that don’t have a lot of daily sales or purchases.

4. Computerized Bookkeeping System

The computerized bookkeeping system is one of the modern types of bookkeeping systems. It uses software on a computer, tablet, or smartphone to handle all money work. Businesses that use this bookkeeping system enjoy faster and safer ways to record and check money data.

Features:

- Uses software like QuickBooks, Zoho Books, or Xero

- Can record sales, payments, bills, and make reports

- Easy to update, share, and store data

Pros:

- Saves a lot of time

- Makes fast and correct reports

- Fewer chances of errors

Cons:

- Needs a phone or computer

- Some software may cost money

- Some tools need the internet

This bookkeeping type is good for businesses of any size that want speed and accuracy.

5. Cloud-Based Bookkeeping System

The cloud-based bookkeeping system is a special kind of computerized system. It stores all your records on the internet instead of only on your device. This bookkeeping system is safe and easy to use from anywhere.

Features:

- Stores data online in the “cloud”

- You can use it from any computer or phone

- You can share access with your bookkeeper or team

Pros:

- You can log in and work from any place

- Data is backed up and safe from being lost

- Many people can work together from different places

Cons:

- You need the internet to use it

- Some cloud services charge monthly fees

- Needs strong passwords and security steps

Out of all bookkeeping types, cloud systems are the most flexible for growing or team-based businesses.

6. Outsourced Bookkeeping System

In the outsourced bookkeeping system, you don’t do the bookkeeping yourself. Instead, you hire a professional or a company to handle your records. This is one of the types of bookkeeping systems that saves time and gives expert results.

Features:

- A team or expert outside your business manages your books

- You can send them records, and they do all the work

- Can be done in person or online

Pros:

- Saves your time and energy

- Reduces mistakes as experts do the job

- You can focus more on your business work

Cons:

- May cost more than doing it yourself

- You need to choose someone honest and skilled

If you’re unsure which bookkeeping system to use, this is a great way to get things done right without stress.

Choosing the Right Bookkeeping System

When picking a bookkeeping system, a business should check key factors:

- The size of the business matters. Small firms may use single-entry. Big firms need double-entry or cloud-based systems.

- The number of transactions is important. A large volume is best handled with digital or cloud-based bookkeeping types.

- The budget should be kept in mind. Free or low-cost tools fit small firms. Large firms can invest in advanced tools.

- Staff skills play a role. Skilled staff can use complex systems. Others may need simple tools or outsourced help.

- Legal and tax needs must be met. A good bookkeeping system ensures compliance and smooth tax filing.

- Growth plans guide the choice. Firms that plan to grow should use scalable systems like cloud or hybrid.

Benefits of Using Modern Bookkeeping Systems

Modern types of bookkeeping systems give many benefits:

- Automation saves time and reduces manual work.

- Accuracy improves since digital systems cut down errors.

- Reports are ready fast, giving a clear view of finances.

- Tax filing becomes simple with well-kept records.

- Budget planning is easier with reliable data.

- Cash flow is tracked better, avoiding shortages.

- Clear records build trust with banks and investors.

- Costs go down with less paper and fewer errors.

- Cloud-based systems support remote work.

- Systems scale with growth and last long-term.

Common Mistakes to Avoid in Bookkeeping

Even with a strong bookkeeping system, mistakes can harm a business:

- Mixing personal and business costs makes records unclear.

- Ignoring small transactions causes gaps in accounts.

- Skipping bank reconciliation leaves errors hidden.

- Not backing up records may lead to data loss.

- Delaying entries makes the balances wrong.

- Not checking reports hides trends and risks.

- Relying only on software without reviews is risky.

Tools and Software for Bookkeeping

Many tools support different bookkeeping types. Some popular ones are:

- QuickBooks – Best for small and mid-size firms with strong features.

- Xero – Cloud-based and good for teamwork.

- Zoho Books – A low-cost option for startups.

- FreshBooks – Ideal for freelancers and small firms.

- Wave Accounting – Free software for very small firms.

- Sage – A trusted tool for large businesses.

- Tally – Common in many regions for business accounts.

These tools make a bookkeeping system more effective and accurate.

Future of Bookkeeping Systems

The future of types of bookkeeping systems will bring big changes:

- AI tools will detect errors and spot trends.

- Automation will replace manual entries and reports.

- Cloud systems will be the norm for most firms.

- Virtual bookkeeping will grow with remote work.

- Blockchain may add safe and clear records.

- Real-time reports will guide daily choices.

- Links with banks will make tracking smooth.

- Mobile apps will help owners on the move.

- Data security will get stronger with new tech.

Some bookkeeping types, like the single-entry bookkeeping system, are easy and good for small shops. Bigger businesses may use the double-entry bookkeeping system because it tracks more details. Some people still write by hand with the manual bookkeeping system, but many now use computerized or cloud-based systems that are faster and safer. If you want to save time and avoid errors, you can use the outsourced bookkeeping system and let experts do the work for you.

Choosing the best bookkeeping system depends on how big your business is, how good you are with tech, and how much time you have. If you’re not sure which one to pick, Meru Accounting can help. We know all the bookkeeping types and can find the right fit for your needs. With our help, your money records will be clear, safe, and easy to manage.

FAQs

1. Which bookkeeping system is best for a small shop?

A single-entry bookkeeping system is best for small shops. It’s simple and quick. But if you grow, you may need a double-entry system or software.

2. Can I switch from manual to computerized bookkeeping?

Yes! Many people start with paper records and later move to computers. You can switch anytime to make work faster and safer.

3. What is the biggest benefit of double-entry bookkeeping?

The biggest benefit is accuracy. It helps you catch mistakes and keeps both sides of your accounts balanced.

4. Is cloud bookkeeping safe?

Yes, if you use strong passwords and trusted tools. Cloud systems back up your data and let you work from anywhere.

5. How does Meru Accounting help with bookkeeping?

Meru Accounting gives expert help for all bookkeeping needs. We set up the right system, record your data, make reports, and help with tax time. It saves you time and stress