Pros and Cons of Progressive Tax in the Taxation System in the USA

Taxes play a key role in building the economy of the United States. They help fund services like schools, hospitals, and roads. The U.S. uses different tax structures, and one major one is the progressive tax. Understanding the pros and cons of progressive tax is important for every taxpayer. This blog explains how it works, its benefits, and its drawbacks to help you understand your role in the tax system. We will also cover the pros and cons of taxes in general to give you a clear view of how taxation impacts everyone.

Introduction to the U.S. Tax System

Taxes in the U.S. are collected from individuals and businesses. These funds help run public services and government programs. Among different tax types, progressive tax is widely used because it is seen as fairer compared to flat tax systems. Understanding the pros and cons of taxes helps citizens see how their money is used.

What is Progressive Tax?

Progressive tax is a system where the rate of tax increases as your income rises. This means people with higher earnings pay a larger percentage of their income compared to low earners.

The goal of progressive tax is fairness. Those who earn more contribute more to help reduce inequality.

How Progressive Tax Works in the U.S.

A progressive tax makes sure people pay based on what they earn. Those with higher incomes give more, while low-income earners give less.

Income Brackets

The U.S. tax system has income brackets. Rates rise as income goes up. This way, high earners pay a fair share.

Marginal Tax Rates

Tax is not one flat rate. It is charged in steps. Each part of income falls in a bracket with a set rate.

Federal vs State Tax

Aside from federal tax, some states use progressive tax rules. This can change the total tax you pay.

Taxable Income Calculation

Taxable income comes after cuts and credits. This figure decides the bracket you fall into.

Withholding and Payments

Employers take taxes from paychecks all year. This helps avoid a big bill at tax time.

IRS Role

The IRS collects taxes and makes sure rules are met across the country.

Key Features of Progressive Taxation

Progressive tax is fair. People pay based on what they earn. Rich people pay more. This helps pay for schools, roads, and hospitals. It also helps poor people live better.

Fair Contribution

People who earn more pay more tax. This cuts the gap between the rich and the poor. Taxes fund public needs. Everyone shares the cost, but those with less pay less.

Adjustable Tax Rates

The government can change tax rates. This keeps taxes fair. Rates can rise or fall to match the economy and the needs of people.

Deduction Options

Deductions lower taxes. People can deduct costs like rent, school, or health bills. This helps people with low pay save money and meet their needs.

Tax Credits Support

Credits cut tax bills. Families and poor people get direct help. This gives money back and helps them pay for daily needs.

Shared Responsibility

Taxes are shared by all. Low earners pay less. High earners pay more. This keeps the system fair and helps the community.

Incentive for Fairness

When rich people pay more, people trust the system. This builds fairness. It helps all citizens feel that taxes support schools, roads, and care for the poor.

Helps the Economy

Higher taxes on the rich can help the poor. This puts money in the hands of more people. They spend it, which helps shops, jobs, and the whole economy.

Lowers Wealth Gap

Progressive taxes shrink the gap between the rich and the poor. They let everyone get the needed help and a fair chance to live well.

Progressive tax is fair and strong. It helps all people and keeps society safe. Rich people give more, and poor people get more help.

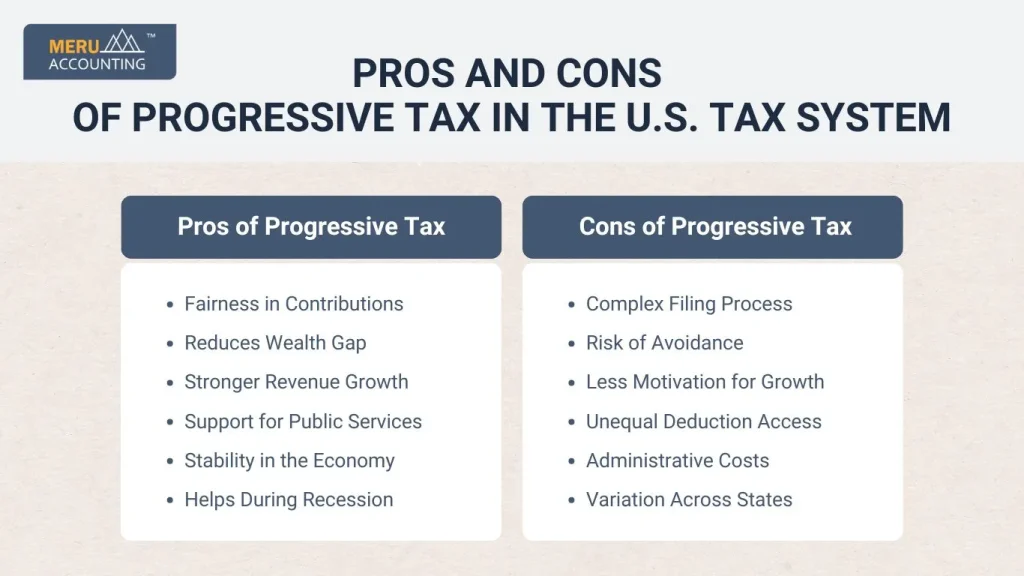

Pros and Cons of Progressive Tax in the U.S. Tax System

Progressive tax has both good and bad sides that affect people and the economy. Knowing the pros and cons of progressive tax helps you see how this system works.

Pros of Progressive Tax

Fairness in Contributions

The system makes sure rich taxpayers give a bigger share. This makes tax rules fair and even for all.

Reduces Wealth Gap

Progressive tax cuts the gap between the rich and the poor. It funds aid plans that help low and middle-income households.

Stronger Revenue Growth

As earnings go up, tax funds grow too. This gives the government more money to run the country and serve people.

Support for Public Services

Extra tax from rich earners helps build roads, fund schools, and improve health care.

Stability in the Economy

This tax rule stops big wealth gaps. It spreads money in a fair way, keeping the economy steady.

Helps During Recession

Progressive tax brings more funds for aid plans in hard times. It helps people and supports growth.

Cons of Progressive Tax and Its Challenges

Complex Filing Process

Many brackets and rules make filing hard. People often need experts to help avoid mistakes.

Risk of Avoidance

Rich taxpayers may use tricks to lower their tax bills, which hurts fairness in the system.

Less Motivation for Growth

High tax rates may stop some people from working more or investing extra money.

Unequal Deduction Access

Wealthy earners can use more deductions since they have better help and tools.

Administrative Costs

This tax rule needs more time and workers to manage, which adds costs for the government.

Variation Across States

Different state tax rules confuse people. Tax bills change based on where you live.

Comparing Progressive Tax with Other Tax Systems

Different tax systems exist globally. Comparing them shows where the pros and cons of progressive tax stand out.

Flat Tax Simplicity

Flat tax applies one rate for all incomes, making it easy but often harder on low earners.

Regressive Taxes Impact

Taxes like sales tax take a larger share from poor families, worsening inequality in society.

Global Examples

Countries mix tax systems differently. Some balance flat and progressive taxes for fairness and simplicity.

Economic Growth Effects

Some argue that flat taxes support growth, while others believe progressive taxes offer better stability.

Fairness Debate

Experts argue about which system best balances simplicity and fairness for taxpayers.

Policy Reforms

Governments often adjust rules to make tax systems fairer and simpler for citizens.

When looking at both local and global tax models, it is clear that the pros and cons of taxes shape how well the system works for growth, fairness, and long-term balance.

Overall Pros and Cons of Taxes in the U.S.

Taxes are vital, but can also create challenges for individuals and businesses. Knowing the pros and cons of taxes gives a balanced view.

Essential for Development

Taxes fund healthcare, education, security, and infrastructure, supporting national progress.

Equity in Contributions

Progressive systems distribute the tax load fairly among people with different income levels.

Financial Burden Concern

Some taxpayers feel overburdened due to high rates, which reduce their disposable income.

Complex System Issues

Tax rules can be complicated, leading to mistakes and delays in filing returns.

Enforcement Challenges

Collecting taxes fairly requires strict monitoring to prevent fraud and underpayment.

Need for Reforms

Regular updates to tax rules are essential to ensure fairness and efficiency for all citizens.

A clear view of the pros and cons of progressive tax and the wider pros and cons of taxes helps taxpayers and lawmakers plan a system that is both fair and sustainable.

At Meru Accounting, we make tax filing simple. Our experts help you plan your taxes, avoid errors, and save money legally. Whether you are an individual or a business, we guide you in understanding the U.S. tax system

FAQs

- What is a progressive tax system in simple words?

A progressive tax means people with more income pay a bigger part of their income. People with less pay a smaller part. This keeps taxes fair for all.

- How does progressive tax help the economy?

Rich people pay more tax. Those money funds go to schools, roads, and hospitals. It also helps poor people. This spreads money fairly and keeps the economy safe for all.

- What are the main pros of a progressive tax?

The main pros of progressive tax are fairness, money for schools and hospitals, less gap between rich and poor, and steady funds for the government to serve everyone.

- What are the main cons of a progressive tax?

The cons are complex rules, more work to file taxes, and rich people may find ways to pay less. Some may also work less due to high taxes.

- Is a progressive tax better than a flat tax?

Progressive tax is fairer for low earners. A flat tax is easy to file. Which is better depends on what the tax system wants: fairness or ease of use.

- How does progressive tax affect low-income earners?

Low-income earners pay less tax. They may get credits or deductions. This helps them pay for daily needs and saves money for their family.

- Can progressive tax reduce wealth inequality?

Yes. Progressive tax takes more from the rich and helps the poor. This cuts the gap between the rich and the poor and gives all people a fair chance.