What is Schedule K1?

Everything about the Schedule K-1 Tax Form

Schedule K-1 is an IRS tax form issued annually by the business partnership or S corporation’s shareholders to report their share of profit, losses, dividends, deduction or credits. The Schedule K-1 document is prepared for the individual partner or shareholders and is including in their tax return.

The S corporation shareholder reports activity on Form the 1120S and the partnership business members to report their total net income on Form 1065.

The S corporation and partnership are considered as pass-through entities, as the income of the business flow directly to the owners without paying the corporate tax.

The LLC members are also required to report their income in Schedule K-1. The K-1 Form is used to show the distribution of income to its members who are taxed the same as under the partnership business.

Who is required to file the K-1 file?

- General Partnership

- Limited Partnership

- Limited Liability Partnership

- LLC elected to tax as a partnership.

- Beneficiaries of trusts or estate in Form 1041.

Calculations in the Schedule K-1?

The Basis generally refers to a partner’s investment in the partnership business. The Schedule K-1 requires to track every individual partner basis in the partnership. For example, a partner contributes $60,000 and 20,000 in equipment to a partnership. The partner’s share of income $20,000 for the year.

The total Basis is $100,000 less if there are any withdrawals. The basis calculation is essential as when the basic balance of a partner becomes zero, an additional payment to the partners is taxed as ordinary income. The basis calculation is reported on the partner’s capital account analysis on K-1 Schedule.

When is the due date of K-1?

The Schedule of the K-1 due date deadline is the same as the due date of the personal income tax return, usually from 15 April to 15 July presently. However, the due date of form 1065 is 15 march unless you file a ^ month extension in the form 7004. 15 March is also the due date for the partnership to issue the individual Schedule K-1 to each partner.

When does the partner don’t report their income share in the individual K-1’s?

Even there is a lot of cash brought in a partnership; the partners agree to re-invest the money back into the business. In this case, they don’t report any income on individual K-1’s.

When is the due date of K-1?

The Schedule of K-1 due date deadline is the same as the due date of the personal income tax return usually from 15 April to 15 July presently. However, the due date of form 1065 is 15 march unless you file a ^ month extension in the form 7004. 15 March is also the due date for the partnership to issue the individual Schedule K-1 to each partner.

Is K1 required for the Schedule S Corporation?

Yes, the S corporation members are required to report their income as a shareholder of the S corporation in the Form 1120S.

What are the things included in the Schedule K-1?

The reporting the Schedule K-1 form will slightly differ depending on whether it is for trust, partnership or S Corporation. However, all K-1 include the detail information about the type of income, tax deduction or loss so there can be accurate reporting of the tax returns.

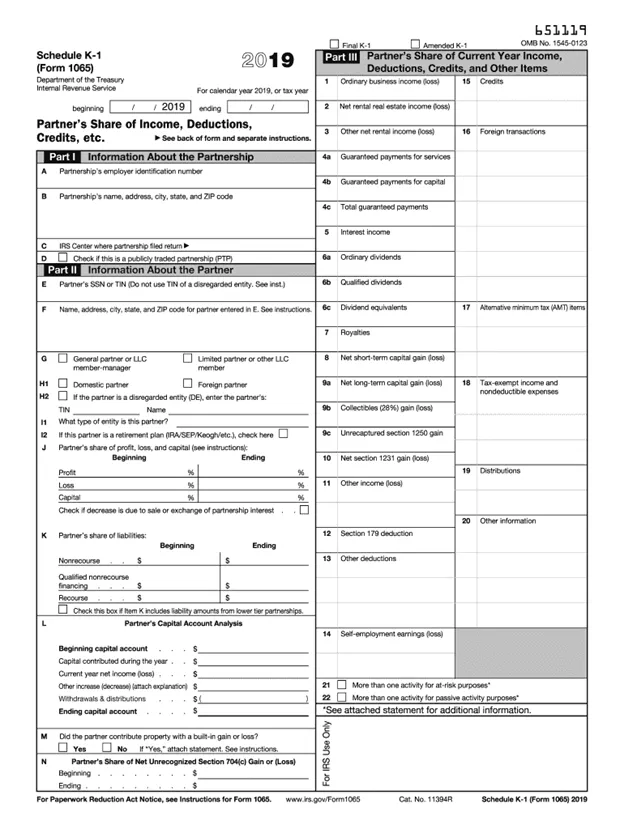

Below is the Schedule K-1 in Form 1065:

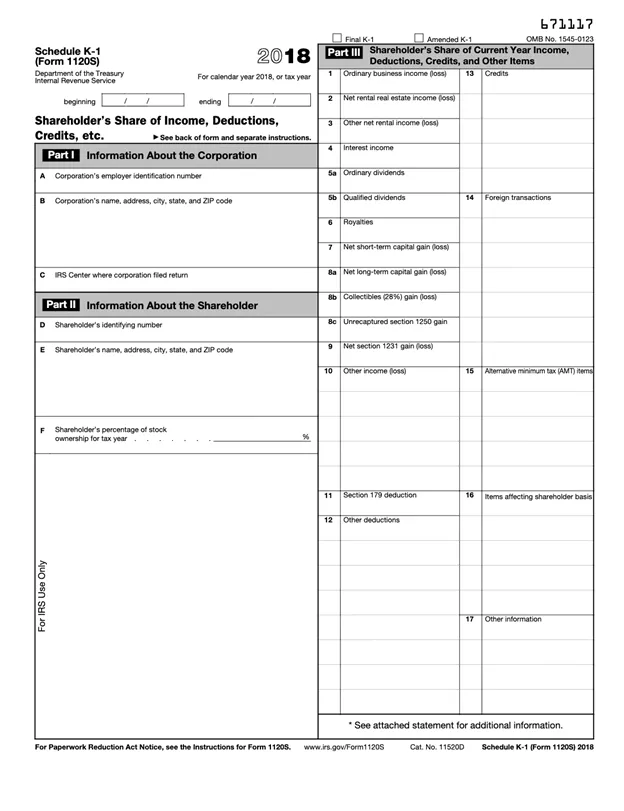

Below is the K-1 in the Form 1120s:

As there are two versions of the K-1 Schedule, the major difference between the Form 1120S and 1065 version is how the income or loss and kind of deduction includes.

How the Schedule K-1 has relevance on the personal Tax return?

The information in the Schedule K-1 contains information about the partner’s or shareholders personal tax return on a different schedule depending on the type of income. Most types of income through the partnership are entered in Schedule 1 (2018 and beyond) of the form 1040.

Is there any difference between Schedule K and Schedule K-1?

There is no difference between Schedule K and Schedule K-1. The Schedule K-1 is anonymously referred to as Schedule K.

The preparation and calculation of Schedule K-1 of each partner can be very complex and time-consuming. An experienced tax professional like us “Meru Accounting” could be a great help. We highly recommend that our expert will help you to file to make sure you get it on time. We just charge a US $15 per hour of service. We have experience in various kind of taxation software. We have a team of qualified accountants along with CPA to deliver seamless service on time.