Essential Tips for Outsourcing Tax Services for Your Business

Running a business takes time, focus, and smart moves. That’s why many firms now use offshore tax preparation services to save time and lower costs. As a business owner, you want to grow, not get stuck in numbers, forms, and tax rules. That’s where outsourcing tax services can help. Still, taxes are part of the job. If not done right, they can lead to fines, stress, and lost hours.

Outsourcing tax services lifts that weight off your shoulders. With trained pros on the job, you gain time and cut down on risks. This works well for both small shops and growing firms. Picking experts for tax return prep in the U.S. leads to smoother work and peace of mind.

Good tax help means fewer errors, on-time filing, and books that meet the law. Many firms see real gains from outsourcing, lower cost, less stress, and more time to grow.

What Businesses Need to Know About Outsourcing Tax Services

You didn’t start your business to spend late nights on spreadsheets and tax rules. Your goal was to build something great, help others, and do what you enjoy. But managing money and filing tax returns can be hard, stressful, and time-consuming. That’s where outsourcing tax services comes in.

For many small business owners, hiring experts for tax return preparation in U.S. helps save time, money, and stress. If you’re still unsure about it, here’s what you need to know before you make a choice.

Is Outsourcing Tax Services Worth It?

The short answer? Yes. Here’s why:

- More time for business tasks: Tax prep takes time—lots of it. Outsourcing gives you that time back.

- Save money: Tax experts know the rules. They find legal ways to cut tax bills.

- Stay up to date: Tax laws often change. A pro tax team will stay current.

- Avoid stress: No more long nights before deadlines or fixing tax return errors.

Hiring an impressive tax return service in the U.S. means your taxes are handled while you focus on what matters most—your business.

How to Choose the Right Tax Partner

Outsourcing doesn’t mean giving up control. It means choosing the right partner. Here’s how to start:

- Do Your Homework: Search for trusted tax return preparation companies in U.S. Check reviews and client feedback.

- Ask for Quotes: Always compare prices. Look for fair rates, not the cheapest.

- Check Experience: Look for teams with experience in your industry.

- Understand Their Process: Ask how they handle documents, deadlines, and updates.

- Ensure Data Safety: Make sure they use secure systems for data sharing.

With a bit of research, you can find a team that offers impressive tax return service U.S. while fitting your budget.

Why Choose Outsourcing Tax Services?

1. Save Time and Effort

You can focus on your main work while experts handle your taxes.

2. Reduce Errors

Professional tax teams know what they’re doing and avoid costly mistakes.

3. Meet Deadlines

You won’t miss any tax dates or face late penalties.

4. Stay Updated with Tax Laws

Tax laws change often. Experts stay updated and keep your returns accurate.

5. Access Better Tools

Outsourced firms use modern software tools for fast and clean filing.

6. Lower Your Costs

Offshore tax preparation services usually cost less than hiring a full-time staff.

Key Benefits of Outsourcing Tax Services

Whether you run a small shop or a large firm, outsourcing tax work has big perks:

1. Save Time and Effort

You don’t need to lose sleep during tax season. Outsourcing helps you meet tax deadlines while saving hours of work.

2. Reduce Costs

Offshore and onshore teams can help you cut costs. Many companies save up to 60% by outsourcing.

3. Improve Productivity

Free your in-house team from routine tax tasks. They can focus on higher-value work.

4. Avoid Overtime

No more weekend work or long hours. You can keep staff fresh and focused.

5. Turn Variable Costs into Fixed Costs

Know what you’ll spend ahead of time. Outsourcing gives you clear pricing and better cost control.

6. Faster Turnaround

Thanks to time zone differences, tax work can get done while you sleep. That means faster refunds and reports.

7. Streamline Document Management

No more messy files. Good tax services offer clear, simple systems for sharing and storing documents.

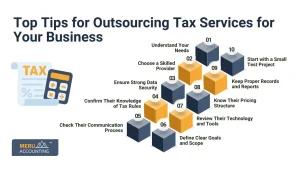

Top Tips for Outsourcing Tax Services for Your Business

1. Understand Your Needs

Decide if you need full tax support or just filing help.

Check if you also need payroll, bookkeeping, or planning.

Many offshore tax preparation services offer complete packages.

2. Choose a Skilled Provider

Find someone with experience in your industry.

Ask what software and tools they use.

Read reviews and request case studies or references.

3. Ensure Strong Data Security

Ask about data privacy policies.

Make sure they use secure systems and encrypted tools.

Trust only those offshore tax preparation services that follow strict safety rules.

4. Confirm Their Knowledge of Tax Rules

The team must know both local and international tax laws.

They should be able to handle audits and changes in tax codes.

Smart outsourcing tax services always keep you compliant.

5. Check Their Communication Process

Find a team that replies quickly and clearly.

Ask if you’ll get a dedicated contact person.

Clear communication avoids missed deadlines and confusion.

6. Define Clear Goals and Scope

List out what tasks you want them to do.

Set timelines and expected results.

Offshore tax preparation services work best with simple, clear guidelines.

7. Review Their Technology and Tools

Check if they use tools like QuickBooks, Xero, or Drake.

Make sure you can view files, reports, and updates when needed.

8. Know Their Pricing Structure

Ask for a full fee breakdown before starting.

Understand if charges are hourly, monthly, or task-based.

Compare several outsourcing tax services to find value for money.

9. Start with a Small Test Project

Start small to test quality and speed.

This helps build trust and lowers risks.

Only increase work when you’re happy with results.

10. Keep Proper Records and Reports

Always ask for reports after tasks are done.

Store digital copies of all tax files.

Reliable firms keep well-organized records for easy access.

Why Businesses Choose Offshore Tax Preparation Services

1. Lower Labor Costs

Labor is cheaper overseas, which saves your business money.

2. Skilled Professionals

Offshore firms often employ CPAs and trained tax staff.

3. Work Done Overnight

Time zones work to your benefit—tasks get done while you sleep.

4. Flexible Workloads

You can scale services up or down depending on your needs.

5. Global Tax Coverage

Many offshore teams can file returns in multiple countries.

Common Tasks Outsourced by Businesses

1. Tax Return Preparation

Filing personal, business, or corporate tax returns.

2. Bookkeeping and Reconciliation

Managing accounts and matching bank records.

3. Payroll Management

Running payroll, deductions, and tax reporting.

4. Tax Planning and Advice

Creating tax-saving plans for future quarters or years.

5. IRS Audit Help

Responding to IRS queries or audit notices.

6. Financial Report Creation

Monthly, quarterly, or yearly financial summaries.

7. Budgeting and Cash Flow Support

Planning business budgets and managing cash cycles.

8. Filing for Tax Credits

Research and apply for eligible business tax credits.

Benefits of Outsourcing Tax Services

1. Higher Accuracy

Experienced professionals make fewer mistakes.

Your tax filings are clean and correct.

2. Peace of Mind

No stress about taxes or missing dates.

You can focus on your goals, not forms.

3. Fast Work Completion

Tasks are finished quickly with a trained team.

Offshore tax preparation services often work while your office is closed.

4. Access to Experts

You get a team with years of tax training and software knowledge.

5. Save on Expenses

You skip costs like office space, software, and training.

What to Look for in a Tax Outsourcing Partner

1. Proven Track Record

Choose a provider with long-term experience.

2. Industry Expertise

They should understand the rules of your business field.

3. Data Safety Compliance

Look for secure servers, NDAs, and good tech systems.

4. Simple and Flexible Packages

They should offer plans that grow with your business.

5. 24/7 Availability

Support teams must be reachable for urgent needs.

6. Certified Team Members

Check if they have CPAs, EAs, or tax law professionals.

Mistakes to Avoid While Outsourcing

1. Picking the Cheapest Option

Low cost often leads to poor work or hidden charges.

2. Ignoring Security Standards

Never share data with firms that lack proper safeguards.

3. Vague Service Agreements

Read contracts in detail before signing. Ask questions.

4. No Backup Plan

Have a copy of everything shared, filed, or approved.

5. Skipping Reviews and Feedback

Check the provider’s work and give regular feedback.

Data Safety Tips for Offshore Tax Preparation

1. Use Two-Factor Login

Use two-step logins for portals and shared tools.

2. Sign NDAs with the Provider

Make them legally responsible for keeping your data safe.

3. Use Encrypted File Sharing

Use trusted platforms like Google Drive or Dropbox with password locks.

4. Update Passwords Regularly

Change passwords every month and avoid reuse.

5. Monitor Access Logs

Know who opened which files and when.

Best Practices for a Smooth Outsourcing Experience

1. Use Project Tools

Use tools like Trello or Asana to track tasks.

2. Schedule Weekly Check-ins

Talk often to review progress and resolve issues early.

3. Backup All Communication

Save chats, emails, and shared notes for future reference.

4. Create Process Documents

Write down your steps, so the team knows what to follow.

5. Share Timelines Early

Tell them when things are due, so they can plan ahead.

6. Give Feedback Often

Don’t wait till the end—share thoughts in real time.

7. Stay Organized

Keep your records sorted by date, type, and task.

When to Start Outsourcing?

It’s never too early to think about outsourcing. If handling money tasks feels like a load, it might be time to get help. Here are some signs:

- You Dread Tax Season

If tax time causes stress or panic, it may be time to outsource. A trained team can file your taxes right and on time. This gives you peace of mind. - You Spend Too Much Time on Money Tasks

If you spend hours on books, payroll, or bills, you’re not using your time well. Outsourcing can free you up to focus on growth and key work. - You Struggle with Tax Law Changes

Tax laws change often. If it’s hard to keep track, let experts handle it. They help you stay on track and avoid fines or mistakes. - You Want to Cut Costs Without Losing Quality

Full-time staff can be costly. With outsourcing, you get expert help for less money—without a drop in work quality.

Common Myths About Tax Outsourcing

Let’s clear up a few myths:

- “It’s only for big companies.”

No. Even solo founders and small shops can benefit. - “It’s too risky.”

Trusted providers use strong security. Your data is safe. - “It costs too much.”

It may cost less than hiring a full-time employee or fixing tax mistakes.

Taxes are a big deal, but they don’t need to take over your life. With the right partner, outsourcing can give you peace of mind, better savings, and more time to grow your business.

If you want to enjoy an impressive tax return service in the U.S., start by finding a team that fits your needs. Do your research, ask questions, and make a smart move for your future. Outsourcing tax services is a smart, cost-friendly choice for small and large businesses alike. Whether you work with a local firm or choose offshore tax preparation services, your main goal is to get expert help, save time, and reduce errors.

Follow these tips and best practices to make your outsourcing journey smooth and successful. With the right support, taxes no longer need to be a worry.

FAQs

- What are offshore tax preparation services?

They are tax services done by teams in other countries to cut costs. - Is outsourcing tax services safe?

Yes, if the provider uses secure tools and signs NDAs. - How much does outsourcing tax services cost?

Costs vary, but are often lower than hiring a full-time employee. - What software do outsourced tax teams use?

They use QuickBooks, Xero, Lacerte, Drake, and others. - Can offshore teams handle IRS audits?

Yes, many are trained to support audits and respond to notices. - Is communication hard with offshore services?

No, most offer email, phone, or video support in your time zone. - How do I start outsourcing tax services?

Begin with one task, review the outcome, and expand if it works well.