What are the Benefits of Offshore Accounting and Bookkeeping?

You sell your products or services and talk to your customers, trying to grow. But one thing that takes a lot of time is managing your money. Now, many companies use smart ideas to make this easier, as they use offshore accounting. You need to write down every sale, track what you spend, pay your workers, and get your taxes right called bookkeeping and accounting.

This means they ask trained people in another country to do this work. These people work online and send all the reports back to the company. It saves time, saves money, and helps the business grow.

In this guide, we’ll explain what is offshore accounting, how it works, and why many businesses go with offshore bookkeeping.

What is Offshore Accounting?

- Accounting means keeping track of a business’s money, what comes in, what goes out, and what’s left.

- Offshore means in another country, usually where the cost of work is lower.

So, offshore accounting is when a company hires accountants from another country to do its accounting work. This includes:

- Offshore bookkeeping – writing down daily sales and spending

- Making reports

- Helping with taxes

- Watching money in the bank

- Giving advice about money plans

The team working offshore does not need to be in the office. They work online and share updates through emails, calls, or apps. This helps the business get expert help without spending too much.

How Does Offshore Accounting Work?

Offshore accounting is easy to start and helps your business stay on track. You don’t have to do it all alone. Here’s how the whole process works step by step:

You Pick a Service

First, you choose a trusted offshore accounting firm. Look for a team that has good reviews and works with your type of business. They should understand offshore bookkeeping and the tax rules in your country.

You Send Your Data

Next, you send your business information. This may include your bills, bank records, sales receipts, tax forms, and staff payment details. You can send this safely using cloud tools or email. This helps the offshore accounting team get a full picture of your money work.

They Work on It

Now the real work begins. The offshore bookkeeping team writes down every sale and every cost. They match numbers, make reports, and find any mistakes. They also watch your bank records to keep your books correct.

You Get Results

After checking everything, the team sends you reports that are easy to read. These can come every week or every month. The reports tell you what you earned, what you spent, and what you saved. With offshore accounting, you always know where your money goes.

They Help with Taxes

Many offshore accounting teams also help with taxes. They get your forms ready and remind you of due dates. They make sure your numbers follow the tax rules in your country. This saves you time and helps you avoid fines.

They Do Payroll Too

If you have workers, your offshore bookkeeping team can also handle payroll. They make sure each person gets paid the right amount on time. They also keep track of payroll taxes and give you reports about staff pay.

You Stay in Control

Even though the team works from another country, you stay in charge. You can see your reports, check your data, and ask for changes. Offshore accounting is a partnership that helps your business grow while saving time.

Everything is done safely. The data is protected and stored online using secure tools.

Benefits of Offshore Accounting and Bookkeeping

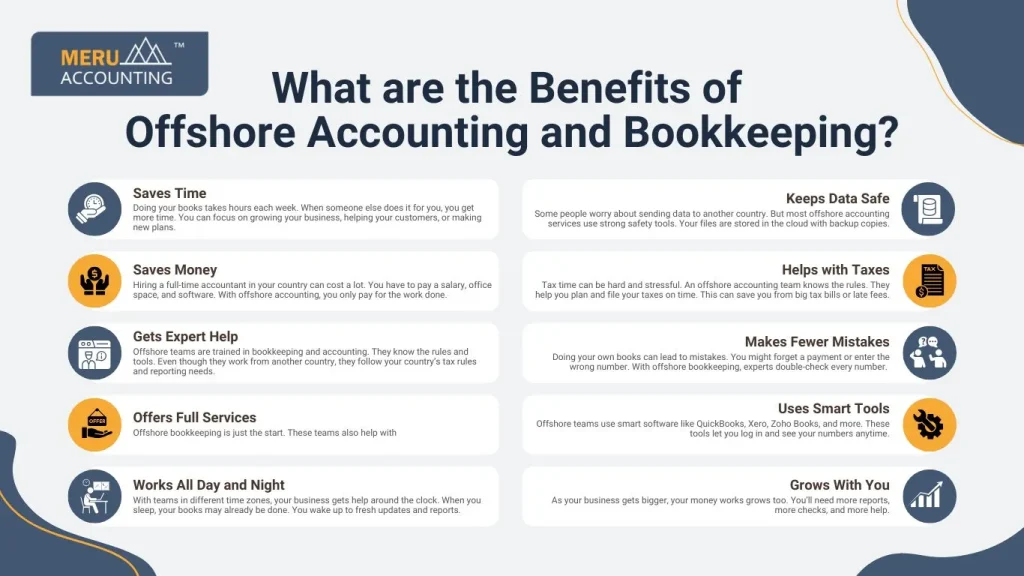

Now, let’s look at why so many companies in 2025 are using offshore accounting and offshore bookkeeping.

1. Saves Time

Doing your books takes hours each week. When someone else does it for you, you get more time. You can focus on growing your business, helping your customers, or making new plans.

2. Saves Money

Hiring a full-time accountant in your country can cost a lot. You have to pay a salary, office space, and software. With offshore accounting, you only pay for the work done. Countries with lower labor costs offer the same quality for less money.

3. Gets Expert Help

Offshore teams are trained in bookkeeping and accounting. They know the rules and tools. Even though they work from another country, they follow your country’s tax rules and reporting needs.

4. Offers Full Services

Offshore bookkeeping is just the start. These teams also help with:

- Payroll

- Tax planning

- Budget tracking

- Bank reconciliation

- Financial reports

So, you don’t just get help with simple tasks, you get support with everything money-related.

5. Works All Day and Night

With teams in different time zones, your business gets help around the clock. When you sleep, your books may already be done. You wake up to fresh updates and reports.

6. Grows With You

As your business gets bigger, your money works grows too. You’ll need more reports, more checks, and more help. Offshore accounting makes it easy to add more services as your needs grow. You don’t have to train new people or buy new tools.

7. Uses Smart Tools

Offshore teams use smart software like QuickBooks, Xero, Zoho Books, and more. These tools let you log in and see your numbers anytime. Reports are shared online. You can track money without having to meet anyone in person.

8. Makes Fewer Mistakes

Doing your own books can lead to mistakes. You might forget a payment or enter the wrong number. With offshore bookkeeping, experts double-check every number. This keeps your records clean and ready for taxes.

9. Helps with Taxes

Tax time can be hard and stressful. An offshore accounting team knows the rules. They help you plan and file your taxes on time. This can save you from big tax bills or late fees.

10. Keeps Data Safe

Some people worry about sending data to another country. But most offshore accounting services use strong safety tools. Your files are stored in the cloud with backup copies. You can ask for passwords and limits on who sees what.

Challenges of Offshore Accounting

Even though offshore accounting has many good parts, there can be a few hard things too. Here are some common challenges you might face:

Time Zone Difference

Your offshore accounting team may live in a far place. That means they work when you sleep. This can make it hard to talk in real time or get quick replies.

Language Gaps

Sometimes, the people doing your offshore bookkeeping may speak a different first language. This might lead to confusion or small mistakes if things are not clear.

Data Safety Worries

When you send your money data far away, you may worry if it’s safe. Some people ask, “What is offshore accounting really doing with my info?” That’s why you must pick a trusted team that uses safe tools.

Hard to Meet in Person

With offshore accounting, you don’t meet the team face-to-face. You can only talk by email, chat, or video. Some people miss meeting their accountant in real life.

Internet Problems

If the internet is slow or down, your offshore bookkeeping work may get delayed. This can make it hard to send or get files on time.

Different Laws and Rules

Your offshore accounting team must know your country’s tax rules. If they don’t, they might miss something or file your taxes the wrong way. Always work with teams that know your local laws.

Now you know what is offshore accounting and why it is helpful. In 2025, many smart business owners are using offshore bookkeeping to save time, cut costs, and get expert help. Offshore teams can do everything from tracking sales to helping with taxes.

By working with a trusted service like Meru Accounting, you get great support without hiring a full-time team. It is safe, simple, and smart.

If your business is ready to grow, offshore accounting may be the best next step.

FAQs

- Is offshore accounting legal?

Yes. Offshore accounting is legal. Many companies use it to save money and time. You must still follow your local tax laws, but offshore teams can help with that. - Can offshore accountants handle my country’s tax rules?

Yes. Most offshore accounting teams are trained to follow your country’s rules. They stay up to date and use trusted software. - Is offshore bookkeeping safe?

Yes. Offshore services use cloud tools with strong safety steps, like passwords and backups. You can ask for extra safety too. - What is the difference between bookkeeping and accounting?

Bookkeeping means writing down what you earn and spend. Accounting means checking those numbers, making reports, and helping with taxes and planning. - Can I still see my reports and data?

Yes. You can log into the online tools anytime to see your money reports, bank info, and invoices. Everything is shared with you clearly.