Outsourcing vs In-House Accounting Services for Property Management

Property owners need clear records to track income and costs. Good accounting keeps finances correct and easy to follow. Choosing the right accounting services for property management helps owners manage their properties well. It avoids mistakes and improves business planning.

Property managers must decide whether to hire internal staff or outsource work. Each choice has benefits and limits. The right choice depends on size, cost, and business goals. This guide explains both options to help owners make smart choices.

Understanding Accounting Services for Property Management

Key Services Provided

- Track rent and payments for all properties correctly.

- Record vendor bills and pay them on time.

- Make cash flow and income reports clearly.

- Handle taxes and follow all financial rules.

- Manage property budgets to control spending well.

- Create reports for owners and investors regularly.

These services keep financial records correct and clear. Owners can check the numbers anytime they need.

Why Proper Accounting Matters

Accurate Financial Tracking

- Record all rent and income correctly each month.

- Avoid errors that may cause money loss later.

Expense Monitoring

- Track costs for repairs, utilities, and other items.

- Helps owners find unnecessary expenses to reduce waste.

Tax Compliance

- Follow rules to file taxes on time each year.

- Avoid fines or legal problems due to mistakes.

Investor Confidence

- Correct books increase trust with investors and lenders.

- Transparency helps in getting support for business growth.

Growth Planning

- Data helps plan property upgrades and new investments.

- Decisions are easier when finances are clear and simple.

Proper accounting services for property management help owners stay safe. Mistakes are less likely, and reports are simple to read.

What Is In-House Accounting?

Definition

- In-house accounting means hiring staff to do all the work.

- The team works inside the company on all tasks.

How It Works

- Accountants manage books, taxes, and reports every day.

- Owners watch their work and review all numbers.

Tools Used

- Use software like QuickBooks, Xero, or Buildium daily.

- Tools help track money and make reports correctly.

In-house accounting gives owners control and quick access. Staff can follow company rules and work efficiently.

What Is Outsourced Accounting?

Definition

- Outsourced accounting sends property tasks to experts outside.

- The firm manages bookkeeping, reports, and taxes well.

How It Works

- Share data securely with the external accounting firm.

- Receive clear reports and updates every month.

Advantages

- Owners save time and focus on property tasks.

- Professionals handle work without hiring full-time staff.

Outsourcing accounting services for property management is flexible. It reduces workload and improves accuracy for owners.

Benefits of In-House Accounting Services

1. Full Control

- Owners watch all tasks done each day closely.

- Immediate decisions can be made when problems arise.

2. Quick Communication

- Staff discuss issues face-to-face without delays often.

- Questions and problems are solved fast on-site.

3. Tailored Processes

- Systems can match the company’s property business needs.

- Reports can show exactly what owners want to see.

4. Data Security

- Financial data stays in the company securely.

- Only authorized staff can see sensitive information.

5. Better Understanding of Business

- Staff know the details of each property and lease.

- They give insights that help owners plan better.

In-house teams provide personal attention to accounting work. Owners can directly guide staff and check details anytime.

Challenges of In-House Accounting

1. High Costs

- Salaries, software, and training increase expenses each month.

- Buying or upgrading software adds more money to spend.

2. Limited Expertise

- Small teams may lack knowledge of all the rules.

- Mistakes happen if staff do not know the laws well.

3. Time-Consuming

- Accounting work can take owners’ attention from other tasks.

- Owners may have less time for property operations.

4. Staff Turnover Risk

- If staff leave, work slows until replacements are trained.

- Hiring new people adds time and cost again.

In-house accounting needs careful planning to work smoothly. Mistakes or delays can affect property management.

Benefits of Outsourcing Accounting Services for Property Management

Cost Efficiency

Pay only for the services you need each month. No staff pay, benefits, or software buys are needed.

Access to Expertise

Firms hire skilled staff who know property rules well. Teams stay up to date with laws and taxes.

Time Savings

Owners can focus on tenants and property upkeep. Experts do all finance tasks fast and right.

Advanced Technology

Outsourced firms use cloud tools and simple software. Reports are kept correct and can be viewed online.

Better Compliance

All rules, taxes, and reports are followed closely. Mistakes, fines, and penalties for owners are cut.

Scalability

Services can grow or shrink as needs change. Works well for owners with many or few properties.

Outsourced accounting makes work easier and cuts stress. Owners can focus fully on growing their property work.

Challenges of Outsourcing Accounting

Less Control

Owners rely on outside staff for daily money updates. Some may feel they have less contact with money and work. Outsourced work can seem far compared to in-house teams.

Communication Delays

Time zones can slow replies or report delivery speed. Quick decisions may wait for checks from outside staff. Delays can slow action on urgent money matters quickly.

Data Privacy Concerns

Important financial data is shared with outside firms. Strong security steps must always be in place and used. Owners must trust firms to keep all information safe.

Even with these issues, outsourcing still cuts costs well. A trusted partner reduces risk and keeps work smooth.

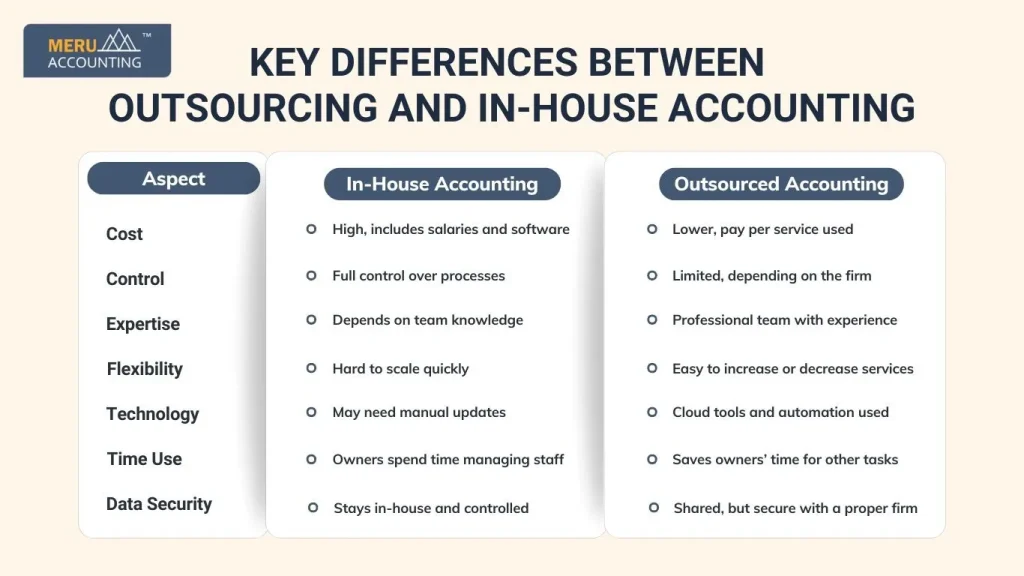

Key Differences Between Outsourcing and In-House Accounting

Aspect | In-House Accounting | Outsourced Accounting |

Cost | High, includes salaries and software | Lower, pay per service used |

Control | Full control over processes | Limited, depending on the firm |

Expertise | Depends on team knowledge | Professional team with experience |

Flexibility | Hard to scale quickly | Easy to increase or decrease services |

Technology | May need manual updates | Cloud tools and automation used |

Time Use | Owners spend time managing staff | Saves owners’ time for other tasks |

Data Security | Stays in-house and controlled | Shared, but secure with a proper firm |

This table helps owners pick the right accounting services. The best choice depends on cost, size, and needs.

When to Choose In-House Accounting

Large and Stable Business

Companies with many properties need control and stable work.

Salaries and software costs are easy to handle internally.

In-house teams keep tasks steady for larger firms daily.

Need for Control

Owners want full oversight over all money and work daily.

Immediate access lets owners make fast decisions on funds.

In-house teams give full control of all company money.

Sensitive Data Management

Important data stays safe inside the company at all times.

This cuts the risk of leaks or outside access.

Secure handling keeps the company’s financial information private and safe.

Experienced Staff Availability

Skilled staff handle tricky property tasks in-house each day.

Teams give advice to help owners make smart choices.

In-house accounting works best for large and steady firms.

In-house accounting fits firms that need full control now. Owners get safety, speed, and a full view of money. With the right team, property money stays safe and right.

When to Choose Outsourced Accounting

Small or Mid-Sized Firms

Outsourcing cuts costs and lowers your regular overhead fees. Experts make reports right without full-time staff or help. Firms get skilled work while saving time and money.

Flexibility and Growth

Services can grow fast as your properties increase in size. Workload drops a lot in busy months of the year. You can add or cut support as needs change.

Expert Support

Specialists handle taxes, rules, and accounts correctly each time. Owners avoid mistakes that could lead to fines or loss. Reports are made to meet all law rules and needs.

Frequent Accounting Changes

Providers change fast to new rules or software updates. Reports stay clear, correct, and easy for owners to read. Updates and rules are handled fast by trained experts.

Focus on Core Operations

Outsourcing lets owners focus on property growth and work. Managers spend more time with tenants and on daily tasks. Daily finance work is done right by expert staff.

Cost Predictability

Outsourced services give fixed monthly fees for planning budgets. This avoids surprise costs that could hurt company funds. Owners can plan money more ease and control.

Outsourced accounting fits firms that want to grow fast. Experts handle money while owners run the day-to-day business. With the right partner, property accounts stay simple and correct.

Tips to Choose the Right Accounting Partner

Check Experience

Pick a firm that works with property clients. Ask for sample reports and client names.

Review Technology

Ensure they use cloud tools and safe systems. Owners can view data anytime online.

Verify Security

Look for strong data protection and encryption. Only trusted firms should handle sensitive info.

Compare Costs

Check prices to avoid hidden fees. Choose plans that fit your business needs.

Ask About Communication

Select partners who report clearly and on time. Clear updates keep operations smooth and correct.

The right partner boosts efficiency and cuts risk. Good choices mean accurate and stress-free work.

Future of Accounting in Property Management

Future of Accounting in Property Management

Cloud-Based Systems

Firms now use cloud software to track all data. Owners can check numbers anytime, from anywhere.

Automation

Reports are made on their own to cut errors. This saves time for both owners and staff.

Real-Time Dashboards

Dashboards show key numbers at a glance. Clear data helps owners act fast.

Outsourcing Growth

More firms will outsource for skill and ease. It cuts work and keeps reports right.

Outsourced property accounting will grow fast. Tech and skilled teams make work simple and quick.

Choosing in-house or outsourced accounting depends on business needs. Cost, control, expertise, and scalability are the main factors. Both models work, but the right choice improves efficiency and clarity.

Meru Accounting gives expert accounting for property management. We provide clear reports, tax support, and safe financial handling. With certified experts on our team, Meru Accounting offers reliable support everytime. Partner with us to simplify property accounting and grow your business.

FAQs

- What are accounting services for property management?

They track rent, costs, and make clear reports. These services keep property money correct and simple. - Why is outsourcing accounting useful?

It saves time and money and gives expert help. Experts do work right without hiring full-time staff. - Is in-house accounting safer?

Yes, data stays inside the company all the time. Owners have full control of all money files. - Can small landlords outsource accounting?

Yes, it saves money and gives correct reports. Even small property owners can get expert help. - How often should reports be checked?

Monthly checks keep money records right and up-to-date. Regular review stops mistakes and helps plan well. - Which tools help with property accounting?

QuickBooks, Xero, and Buildium are used a lot. They make bookkeeping, reports, and money tracking easy. - Which is better for growing firms?

Outsourced accounting works best for growing property firms. It gives expert help without hiring extra staff. - What is the difference between in-house and outsourced accounting?

In-house is done inside; outsourced uses outside experts. Each choice has pros for cost, control, and skill. - Can outsourced accounting handle taxes?

Yes, they file taxes and follow rules carefully. It lowers mistakes and fines for owners. - How much does outsourcing cost?

Cost depends on services and the number of properties. It is often cheaper than a full-time team. - Can in-house teams handle multiple properties?

Yes, if the team is big and skilled enough. Small teams may find many properties hard to track. - How secure is cloud accounting?

Cloud systems use strong locks to keep data safe. Passwords and access limits control who can see data. - What reports do property managers receive?

Income, cost, and cash flow reports are shared. They help owners make smart property choices. - Can outsourcing improve efficiency?

Yes, experts use tools to save much time. Owners focus on running properties, not books. - Is training needed for in-house staff?

Yes, staff must learn the software and rules well. Ongoing learning keeps tasks done fast and right. - How quickly can outsourced firms start work?

Many firms start in a few days after joining. They bring ready systems and reports fast. - Can owners access financial data remotely?

Yes, cloud systems give safe access from anywhere. Real-time data helps make quick, smart choices. - Does outsourcing reduce errors?

Yes, experts follow steps to keep work correct. Automation also cuts mistakes in reports and sums. - How does accounting support growth?

Clear data helps plan budgets and new projects. Good tracking helps owners make better choices. - What is the best choice for small portfolios?

Outsourcing works best for cost and expert help. Small owners get fast, right, and skilled support. - Can outsourced firms handle urgent issues?

Yes, most reply fast to urgent questions. Good communication solves problems quickly and right. - Do outsourced firms provide customized reports?

Yes, reports can fit owner needs exactly. Data shows in forms that are easy to read. - Is it possible to combine both methods?

Yes, hybrid models use staff and outside experts. It balances cost, control, and skill well. - How do firms ensure compliance with laws?

They stay updated on rules and tax laws. Checks and audits stop fines and penalties. - Can outsourcing help during busy seasons?

Yes, firms adjust service to match workload. It cuts stress and ensures tasks finish on time.