Outsource CPA Bookkeeping Services by Bookkeeping Experts

Outsource CPA Bookkeeping Services refers to the process where CPA firms hand over their day-to-day accounting tasks to trained professionals outside their office. These experts manage financial data, handle reconciliations, process payroll, and prepare reports.

By choosing outsourced bookkeeping for accountants, firms no longer need to maintain large in-house teams. Instead, they get skilled bookkeepers who work with speed and accuracy. The aim is to cut costs, improve output, and support firm growth.

Why Outsource Bookkeeping for CPAs?

Many CPA firms struggle to find trained staff for daily bookkeeping tasks. Hiring full-time help can cost more than expected, while freelance staff may lack training or tools. That’s where outsourced bookkeeping comes in.

You get access to a team of skilled bookkeepers without the need to recruit or train them. They manage tasks that slow you down, so you can focus on tax strategy and client work.

Do you know you can hire hourly remote bookkeepers with no recruiting fees? With CPA outsourcing, you get access to cost-effective staff who use smart tools and safe tech.

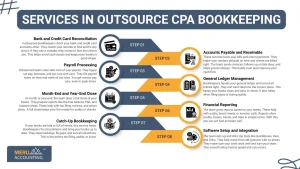

Services Offered in Outsource CPA Bookkeeping

When you choose outsourced bookkeeping for accountants, you get access to a wide range of services. These help make your work easy, save time, and keep your records clear and correct. The services are made to fit the needs of CPAs and accounting firms. You can focus more on key tasks while trained bookkeepers handle the day-to-day work.

Bank and Credit Card Reconciliations

This service matches your books with your bank and credit card statements. The team checks each item to find errors, repeats, or missed entries. It helps keep records clean and spots fraud fast.

Accounts Payable and Receivable

It’s key to track what you owe and what you are owed. The outsourced team sends bills, tracks payments, and keeps records up to date. This helps pay vendors on time and get paid by clients without delay.

General Ledger Maintenance

Your general ledger holds all the key records. The outsourced team checks and updates it often. They make sure each entry is placed correctly. This keeps your reports clear and audit-ready.

Payroll Processing

Paying staff takes time and must be done right. The team makes sure the pay goes out on time. They also handle tax cuts and track benefits. This helps meet rules and keeps your team happy.

Sales Tax Filing

Sales tax rules can change based on where you work. The team files tax returns on time and makes sure they are right. They also check for tax rule changes and help you stay in line with the law.

Monthly Financial Reporting

You get reports each month that are easy to read. These include your profit and loss, balance sheet, and cash flow. These reports help you make sound choices based on real data.

Budgeting and Forecasting

The team helps plan your budget and forecast income and costs. They study old data, set smart goals, and help you see what to expect in the months ahead.

Year-End Closing Support

At year-end, the books must be closed and set for filing. The team checks your books, gets reports ready, and helps with tax prep or audits. This makes the year-end smooth and stress-free.

Outsourcing these tasks helps CPA firms cut costs, save time, and boost the value they give to their clients. It brings both peace of mind and expert help.

Why CPA Firms Choose to Outsource Bookkeeping

Outsourcing for CPA firms is now more common than ever. Here’s why:

- Save Time: Firms focus on tax and advisory, while others handle the books.

- Cut Costs: No need to pay for office space, tools, or staff perks.

- Get Experts: Bookkeepers understand GAAP, IRS rules, and audit prep.

- Work Faster: They use cloud tools to update data in real time.

- Easy to Scale: Add more clients without hiring more people.

- Use Better Tools: Tech like QuickBooks and Xero speeds up tasks.

Services in Outsource CPA Bookkeeping

When you choose Outsource CPA Bookkeeping Services, you get more than just data entry. CPA firms offer a full range of services that help your business stay strong. These services save time, cut errors, and help you make smart choices.

1. Bank and Credit Card Reconciliation

Outsourced bookkeepers check your bank and credit card accounts often. They match your records to find and fix any errors. If they see a mistake, they correct it fast and inform you. This helps avoid cash issues and keeps your books in good shape.

2. Accounts Payable and Receivable

These services track your bills and client payments. They make sure vendors get paid on time and clients are billed right. The team sends invoices, follows up on late dues, and helps prevent delays. This builds trust and improves your cash flow.

3. Payroll Processing

Outsourced teams also take care of your payroll. They figure out pay, bonuses, and tax cuts with care. They file payroll taxes on time and meet all tax rules. You get correct pay runs, even in peak times.

4. General Ledger Management

Bookkeepers handle your general ledger and record all entries right. They sort each deal into the correct place. This keeps your books clean and easy to check. It also helps when filing taxes or during audits.

5. Month-End and Year-End Close

At month or year-end, the team does a full close of your books. They prepare reports like the trial balance, P&L, and balance sheet. These help with tax filing, reviews, and smart plans. A full close keeps your firm ready for audits or checks.

6. Financial Reporting

The team gives reports based on your needs. These help with audits, board meets, or investor calls. Reports show profits, losses, trends, and risks in simple terms. With this, you can act fast and plan well.

7. Catch-Up Bookkeeping

If your books are late or full of errors, this service helps. Bookkeepers fix old problems and bring your books up to date. They clear backlogs, fill gaps, and sort all old entries. This is key before tax filing, audits, or loans.

8. Software Setup and Integration

The team sets up and links top tools like QuickBooks, Xero, and Zoho. They help move from old systems with no stress. They make sure your tools work well and train your team. This smooth setup boosts speed and cuts errors.

Pay a Professional Bookkeeper to Handle Your CPA Reports

Management of Bills Payable

Our experts help you track and pay bills on time. They handle tasks like cost approval, fund use, payment setup, and invoice storage.

Administration of Money Due

We manage your accounts receivable. Our team sends invoices, follows up with clients, and keeps track of who owes what. They also help with order flow and client follow-ups.

Financial Institution and Credit Card Account Reconciliations

We match every check and record. This includes cleared, bounced, and open items. We do full bank reconciliations, ledger checks, and review every step.

Handling of Credit Card Accounts

Every card transaction is tracked. We help you see cost trends and remove waste. Our CPA firm outsourcing team also helps in monthly statement reviews and checks.

Benefits of Outsourcing for CPA Firms

Firms that choose outsourced for CPA firms see clear value:

1. Focus on Core Work

CPAs can spend more time on tax planning and client advice.

2. Better Accuracy

Experts follow strict rules to avoid costly errors.

3. Low Overhead

No cost for hiring, training, or office tools.

4. Strong Data Safety

Work gets done on secure, cloud-based tools.

5. Faster Output

Dedicated teams complete tasks on time.

6. Growth-Friendly

Outsourcing firms can handle more clients as they grow.

7. Top Software Access

Use modern apps with built-in audit trails.

How the Process Works

Getting started with outsourced bookkeeping for accountants is quick and simple. Here’s a step-by-step view of how the process works:

1. Initial Talk

The first step is a short talk to learn about your needs.

You share the tools you use and what goals you want to reach.

This helps the team build a plan that fits your firm.

2. Access Setup

Once the plan is clear, you give access to your books and tools.

This includes logins, past reports, and key records.

The setup is done with care to keep your data safe.

3. Daily Work Begins

The bookkeeping team starts to work on your books each day.

They record deals, sort files, and keep your books clean.

All tasks are done with speed and care.

4. Regular Reports

You get reports each week or month, based on your needs.

These include profit and loss, balance sheet, and cash flow.

The reports help you stay on top of your numbers.

5. Review Stage

The team checks each report before they send it to you.

They fix errors and explain any key points.

You can also share these with your clients or staff.

Software Used in Outsourced CPA Bookkeeping

Firms that offer outsourced for CPA firms use top tools, such as:

- QuickBooks (Online & Desktop)

- Xero

- Zoho Books

- FreshBooks

- Wave Accounting

These allow safe logins, shared files, and real-time updates.

Problems Solved by Outsourced CPA Bookkeeping Services

Here are real issues CPA firms face—and how outsource CPA bookkeeping services solve them:

- Hard to Hire: Skilled bookkeepers are tough to find.

- High Costs: Salaries, rent, and tech stack add up.

- Busy Seasons: Staff can’t handle spikes in work.

- Tight Deadlines: Too much to do, not enough time.

Outsource bookkeeping for accountants removes these roadblocks with smart staffing, fast service, and cost control.

Are Outsourced Accounting Services a Threat to Local CPAs?

Competition is everywhere, no matter the field or size of the business. The same applies to the CPA world. Tech changes and new ways of working have caused fear of missing out (FOMO) among local CPA firms. Before, only large accounting brands ruled the space, but now online firms have made the race tougher.

Instead of seeing this shift as a threat, smart CPAs should look for ways to team up with others. These steps can help them serve better and boost their profits.

Routine Bookkeeping Tasks

Daily accounting tasks include:

- Basic data entry

- Journal entries

- Adjustments

- Monthly reports

- Reconciliations

- Planning

Some of these need more skill than others. Big firms have pay levels based on task skills.

For small CPA firms, it’s not easy to hire junior staff. They often pick part-time or freelance help. But this puts client data at risk. Freelancers may not have the right skill or training.

CPAs can either take that risk or pay more for skilled help. CPA outsourcing services fix this. They let firms scale up or down with ease. No need to worry about slow seasons or layoffs.

Tax Preparations

Like bookkeeping, tax prep needs:

- Lots of number crunching

- Math skills

- A clear tax plan

The more time you spend on forms, the less time you have to plan big savings for clients. Some CPAs ask clients to do their own books. But not all clients know how to do that well.

This is where CPA outsourcing helps. It fills that gap. It gives CPAs time to focus on real value:

- Help the client’s business

- Offer higher-level service

- Win more clients in the long run

Additional Checks and Review

Even top staff make errors. Mistakes can hurt clients. That’s why reviews are a must.

When you check your own work, you may miss a rule or a small error. Another set of eyes can help catch things you overlook.

Outsourced teams can help with that. They provide a review process that checks client files more than once.

Safe and Secured Data Storage

If you still work offline, ask yourself:

- How do you collect data from clients?

- Do they visit your office?

- Do you get mail?

- Are files sent in unsafe ways, like email?

Online theft is growing. Many firms can’t afford to build secure systems. But CPA outsourcing firms use:

- Data encryption

- Secure tech

- Online tools

By teaming up with them, local CPAs gain both:

- Strong data security

- Expert knowledge

Whether you’re a solo CPA or a large firm, choosing outsourced services for CPA firms gives you a powerful edge. You reduce stress, boost accuracy, and scale with ease. Let Outsource CPA Bookkeeping Services simplify your workflow, so you can focus on what matters most. They handle the busy work so you can grow your firm, help clients, and boost profits. At Meru Accounting, we offer cost-effective outsourced bookkeeping services tailored for CPA firms in the USA and Canada. Our skilled remote bookkeepers help you cut costs, save time, and manage work with more ease.

FAQs

- What are outsourced CPA bookkeeping services?

Bookkeeping done by outside pros, not by your in-house team. - Is outsourcing bookkeeping safe?

Yes. Trusted firms use strong tools to keep your data safe. - Can small CPA firms outsource bookkeeping?

Yes. Small firms and solo CPAs can also gain from this. - Which software is used in outsourced bookkeeping?

QuickBooks, Xero, and Zoho Books are often used. - How does outsourcing help during tax season?

It gives more hands, quick work, and on-time reports. - What industries can outsourced bookkeepers handle?

They serve all fields—real estate, shops, health, and more. - Do outsourced teams work with CPA standards?

Yes. They follow all CPA rules and U.S. laws.