A Brief on Outsourcing Bookkeeping Services for Small Businesses

Outsourcing Bookkeeping is just as important to your business as the business itself. It helps maintain cash flow and gives vital invoice details like customer name, amount, issue date, and due date.

By reviewing revenue often, you can track cash flows with ease. Clients and suppliers can make smooth payments through Outsourcing Bookkeeping Service for Small Business from expert providers.

Small firms, often led by one person, face mixed personal and business assets. This makes tracking money tough. That’s why Outsourcing Bookkeeping services for Small businesses and expert accounting support are crucial for small businesses. They help manage accounts well and keep records clear.

What Is Outsourced Bookkeeping?

Outsourced bookkeeping means hiring an outside team to handle your financial records. This includes entering data, managing accounts, and preparing reports. It saves costs, gives access to expert help, and lets you focus on core tasks. With skilled people and smart tools, you get accurate and timely records that may not be possible in-house.

In today’s fast business world, accurate financial records are vital. Doing it in-house can drain time and money. Many firms now choose to outsource because it is both practical and cost-effective.

Benefits of Outsourced Accounting and Bookkeeping Services

Business Evaluation

Clean records help track cash flow, profit, and loss. Outsourced bookkeepers let you measure how your business is doing and help you see strengths and gaps.

Better Decision-Making

When you have access to real and complete data, you can make smart business decisions. You will know when to expand or change direction based on facts.

Focus on Growth

To help your business grow, you need to think ahead. Outsourcing Bookkeeping services for Small businesses gives you data to plan your goals and track progress over time.

Clear Business Picture

Reports like balance sheets, income statements, and bank summaries give a full view of your business. These come through outsourced accounting services and help you evaluate your performance with ease.

Why Small Businesses Should Hire Indian Bookkeeping Services

Working with Indian providers gives several benefits. Here are the top three:

Lower Costs

Hiring full-time staff means fixed pay, health benefits, and travel perks. You can avoid all of that with outsourced bookkeepers, who work for a fraction of the cost.

Simplified Internal Processes

Outsourcing helps organize your financial tasks. The service provider handles all finance-related work and updates you as needed. This gives you more time to focus on key growth areas.

Use of Modern Tools

You may not have access to the latest software or skills in-house. Outsourced accounting services provide these tools and trained staff, so you don’t need to invest in expensive tech.

Why Businesses Choose Outsourced Bookkeeping

Cost Savings

One major reason is reduced cost. Hiring an in-house team adds up. With outsourced bookkeeping, you only pay for what you need. It is ideal for small and medium businesses that do not require full-time support.

Expertise and Accuracy

Outsourced accounting professionals follow current laws and standards. Their work is accurate and helps reduce errors while keeping you compliant.

Time Efficiency

Doing your own books takes time away from your main work. Outsourcing saves time and lets you focus on service, sales, and growth. It boosts productivity and improves results.

Access to Smart Technology

Most outsourced bookkeeping firms use the best tools. These tools improve speed and accuracy and keep your data safe. You get live reports and real-time insights without extra costs for software or hardware.

Scalability and Flexibility

Your needs may grow or change over time. Outsourced bookkeeping services adjust to those changes. Whether you need more help during busy seasons or fewer services at other times, outsourcing gives you full control.

Outsourcing Bookkeeping vs In-House Bookkeeping

Feature | Outsourcing Bookkeeping | In-House Bookkeeping |

Cost | Low | High |

Flexibility | High | Low |

Expertise | High | Depends on hire |

Tools | Latest software | May be outdated |

Scalability | Easy | Hard |

Accuracy | High | Varies |

How to Choose the Right Outsourcing Bookkeeping Partner?

1. Check Experience

- To benefit from Outsourcing Bookkeeping Service for Small Business, choose a partner who matches your needs.

2. Ask About Tools Used

- Make sure they use trusted software like QuickBooks or Xero.

3. Look for Certifications

- Certified bookkeepers offer more reliability.

4. Ensure Good Communication

- They must update you regularly.

5. Security is a Must

- Your data should be safe and private.

6. Clear Pricing Structure

- Understand their fees before signing up.

What Tasks Can Be Outsourced?

1. Daily Record Keeping

- Recording all income and expenses.

2. Bank Reconciliation

- Matching business books with bank statements.

3. Invoice Management

- Creating and tracking customer invoices.

4. Payroll Processing

- Calculating salaries, taxes, and deductions.

5. Financial Reporting

- Monthly profit and loss statements, balance sheets.

6. Budgeting and Forecasting

- Helping you plan for the future.

7. Tax Preparation Support

- Getting your books ready for the tax expert.

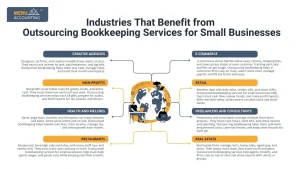

Industries That Benefit from Outsourcing Bookkeeping Services for Small Businesses

1. E-commerce

- E-commerce stores handle online sales, returns, shipping fees, and taxes across states or even countries. Tracking each sale and fee can get tough. Outsourcing bookkeeping helps e-commerce firms stay on track, watch stock costs, manage payroll, and file tax forms with ease.

2. Retail

- Retailers deal with daily sales, vendor bills, and stock shifts. Outsourced bookkeeping services for small businesses help them track cash flow, review trends, and make profit reports. With real-time views, store owners can plan stock and avoid waste.

3. Freelancers and Consultants

- Freelancers and consultants manage multiple short-term projects.. They must track hours, send bills, and check income and spending. Outsourcing bookkeeping helps them split work and personal costs, claim tax breaks, and keep clean records for each job.

4. Real Estate

- Real estate firms manage rents, home sales, agent pay, and loans. Their books must show clear asset worth and gains. Outsourced bookkeeping services help agents, brokers, and firms stay on top of rules and share reports with clients or groups.

5. Restaurants

- Restaurants have high sales each day, with many staff, tips, and vendor bills. They must track costs and pay on time. Outsourced bookkeeping services for small businesses help track daily spend, wages, and goods sold, while keeping cash flow smooth.

6. Health and Wellness

- Gyms, yoga hubs, coaches, and therapists run many sessions and plans. Some serve online and on-site. Outsourced bookkeeping helps handle auto fees, track income, manage tax, and check growth each month.

7. Non-Profits

- Nonprofits must follow rules for grants, funds, and donor cash. They must show how each cent was used. Outsourcing bookkeeping services helps track all gifts, prepare for audits, and build reports for tax, boards, and donors.

8. Creative Agencies

- Designers, ad firms, and creators handle many clients at once. They must track income by task, pay freelancers, and log bills. Outsourced bookkeeping helps them stay neat, manage costs, and build clear month-end reports.

How to Choose the Right Outsourcing Bookkeeping Partner?

1. Check Experience

- Choose someone who has worked with small businesses before.

2. Ask About Tools Used

- Make sure they use trusted software like QuickBooks or Xero.

3. Look for Certifications

- Certified bookkeepers offer more reliability.

4. Ensure Good Communication

- They must update you regularly.

5. Security is a Must

- Your data should be safe and private.

6. Clear Pricing Structure

- Understand their fees before signing up.

Signs You Need to Outsource Your Bookkeeping

If you notice any of these issues, it may be time to consider Outsourcing Bookkeeping Service for Small Business:

1. You Are Always Behind on Bookkeeping

Do you keep putting off your books? Falling behind on records can lead to missed bills, wrong reports, and more stress. An outsourced bookkeeper can keep your books current, so you stay in control.

2. You Fear Tax Season

If tax time gives you stress, it’s a red flag. Scrambling to find receipts and sort numbers is a sign of poor bookkeeping. Outsourcing bookkeeping means all records are in order before tax season begins.

3. Your Cash Flow Is Unclear

Not sure how much cash you really have? That’s risky. Good bookkeeping gives you a clear view of cash in and out. Outsourced services make it easy to monitor money flow, so you can plan and grow.

4. You Miss Payments or Send Late Invoices

Late bills or missed invoices lead to money loss. If you forget to bill clients or skip due dates, cash flow may suffer. A bookkeeper makes sure all bills and dues are paid on time.

5. You Don’t Understand Financial Reports

If balance sheets and profit reports seem like a puzzle, you’re not alone. But they’re key to smart choices. Outsourced bookkeeping services help you read and use these reports to guide your business.

6. You Spend Weekends Balancing Books

Bookkeeping eats up your nights and weekends? That’s not how it should be. Your time is best spent growing your business. Let experts handle the books so you can reclaim your free time.

These are clear signs that Outsourcing Bookkeeping services for Small businesses can bring relief and better results.

How Outsourced Bookkeeping Helps During Tax Season

Tax season doesn’t have to be a panic. Outsourced bookkeeping helps in the following ways:

1. Year-Round Clean Records

When your books are updated each month, you avoid the end-of-year scramble. Clean records mean fewer errors and less stress.

2. Reports Ready for Your CPA

Bookkeepers send the needed reports to your tax expert. No more digging through receipts or spreadsheets.

3. All Deductions Are Tracked

Outsourced bookkeepers track every expense to make sure you claim all valid tax deductions. That means more savings for you.

4. You Avoid Fines and Audits

With good records and timely filing, your chances of IRS penalties drop. And in case of an audit, you’ll be well-prepared.

5. You Save Hours of Work

No more sorting papers. No more Excel late at night. Let a pro handle it and enjoy a smoother tax season.

Outsourcing Bookkeeping for Startups

Startups have a lot to manage. Outsourcing Bookkeeping Services for Small Businesses gives new firms a head start:

1. Save Money from Day One

Hiring a full-time bookkeeper can be costly. Outsourcing gives you expert help at a lower price.

2. Avoid Early Mistakes

Startups often make errors in tax and tracking. Outsourced pros help you set things right from the start.

3. Focus on Growth

With bookkeeping off your plate, you can focus on product design, service launch, or customer growth.

4. Build a Solid System Early

Outsourced services help build clean, strong financial systems that scale as you grow.

5. Help with Funding and Reports

Startups need to show numbers to banks or investors. Your outsourced bookkeeper can help create those vital reports fast and easily.

Outsourcing bookkeeping gives startups the support they need to grow smart.

Questions to Ask Before You Outsource

Before you hire a service, ask these key questions to find the right fit:

1. Do You Work with Businesses Like Mine?

Make sure the firm has worked with your industry before. Each sector has its own needs and quirks.

2. What Software Do You Use?

You may already use QuickBooks, Xero, or Zoho Books. Make sure they support the tools you use—or can help you switch.

3. How Often Will You Send Reports?

Ask about how often you’ll get updates. Monthly? Weekly? Set clear terms so you’re never in the dark.

4. What Security Measures Do You Follow?

Your books hold private data. Ask how they keep that safe. Look for encryption, access control, and backups.

5. Is Your Pricing Monthly or Hourly?

Know how you’ll be billed. Fixed monthly fees are often best—they avoid surprises.

6. Will I Get a Dedicated Bookkeeper?

Having one go-to person helps. Ask if you’ll have a point of contact or work with a team.

7. What Happens if I Want to Cancel?

Check their terms and exit process. A good firm makes it easy to leave or switch plans if needed.

Outsourcing Bookkeeping services for Small businesses is a smart move. It helps save money, ensures accuracy, and frees your time. You gain a partner who keeps your books in shape while you focus on growth.

Meru Accounting gives full outsourced bookkeeping and accounting help to small and mid-sized firms in the US, UK, Canada, Australia, New Zealand, Hong Kong, and Europe.

Our team ensures your records are accurate, up to date, and well managed. This lets you focus on what matters most, growing your business. Partner with Meru Accounting for expert and reliable outsourced bookkeeping solutions that support your success.

FAQs

- What is outsourcing bookkeeping?

Hiring a third-party expert to handle your business books. - Is it safe to outsource my bookkeeping?

Yes, if the provider uses secure tools and protocols. - How much can I save by outsourcing?

You save 40–60% compared to hiring in-house staff. - Will I lose control over my accounts?

No, you stay informed and in control through reports. - Can I outsource just a few tasks?

Yes, many providers offer custom packages.