Home » What is bookkeeping and accounting services?

What is bookkeeping and accounting services?

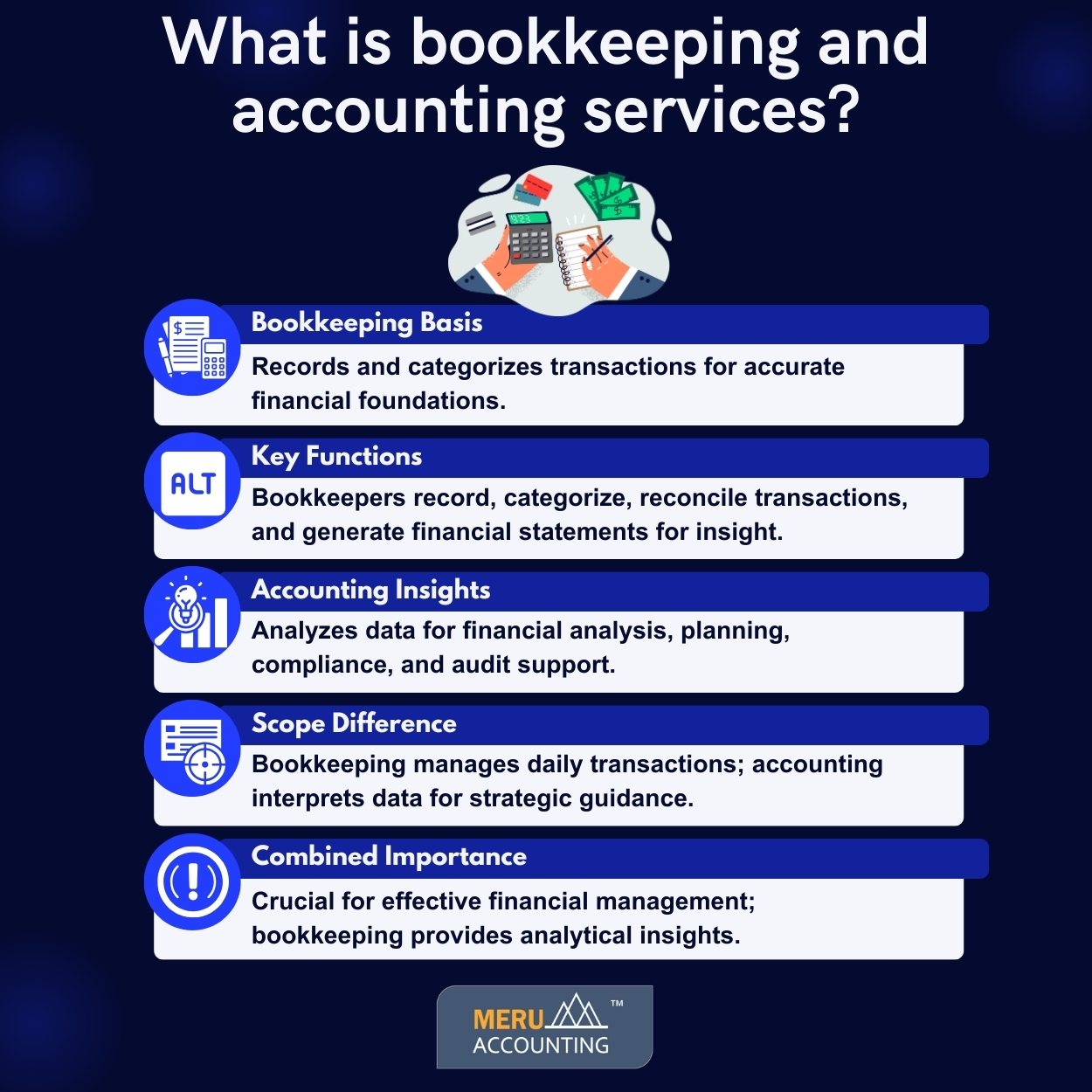

In the world of finance and business, accounting and bookkeeping services are two crucial functions that play a fundamental role in ensuring the financial well-being of any organization. These terms, often used interchangeably, are essential for tracking, organizing, and managing a company’s financial information. In this article, we will look into the differences between accounting and bookkeeping services and why these services are essential for any business.

Understanding the Landscape Bookkeeping Services:

Bookkeeping is the foundation upon which the entire accounting process stands. It is the systematic recording, organizing, and categorizing of an organization’s financial transactions. These transactions encompass every monetary interaction, from sales and purchases to expenses and revenues. The primary goal of bookkeeping is to create an accurate, organized record of these financial activities.

Key Functions of Bookkeeping Services:

Recording Transactions:

Bookkeepers enter all financial transactions into the accounting system, ensuring that nothing is overlooked. This precise record-keeping is the basis for financial decision-making.

Categorizing expenses and income:

Bookkeepers categorize these transactions, classifying them into relevant accounts to provide a clear overview of where money is coming from and where it is going.

Reconciliation:

Regular reconciliation of bank statements, invoices, and accounts is part of bookkeeping, allowing for the identification and rectification of discrepancies.

Financial Statements:

Bookkeepers generate essential financial statements such as the balance sheet and income statement, providing insights into an organization’s financial health.

Understanding Accounting Services:

While bookkeeping deals with day-to-day financial transactions, accounting services take these records a step further. Accounting involves interpreting, analyzing, and summarizing financial data to generate meaningful insights for decision-making.

Key Functions of Accounting Services

Financial Analysis:

Accountants assess an organization’s financial data to provide a comprehensive understanding of its financial position. They spot patterns, potential threats, and opportunities.

Financial Planning:

Accountants develop financial strategies, budgeting, and forecasting to guide an organization’s future financial decisions.

Compliance:

Accountants ensure that an organization complies with tax regulations and takes advantage of available tax incentives.

Audit Support:

Accountants prepare an entity for financial audits, working closely with auditors to ensure a smooth process.

Key Differences:

| Aspect | Bookkeeping | Accounting |

| Responsibilities Scope. | Focus on the detailed recording of financial transactions. | Analyze the data for strategic guidance and financial planning. |

| Focus. | Emphasize accuracy and organization in financial records. | Concentrate on analyzing data for strategic decision-making. |

| Tasks. | Handle data entry, reconciliations, and record-keeping. | Interpret financial data, prepare statements, and provide financial analysis. |

Why are both important?

Accounting and bookkeeping services are both crucial for the effective management of an organization’s financial affairs. Bookkeeping sets the foundation, providing accurate, up-to-date financial records, while accounting offers the analytical insights that drive informed decision-making.

Accounting and bookkeeping services are the pillars of financial stability and growth. While bookkeeping focuses on accurate transaction recording, accounting services interpret and analyze the data, offering valuable insights and guidance. Meru Accounting excels in both, making it the ideal partner for businesses seeking precision, expertise, and personalized financial solutions. Meru Accounting is a leading provider of bookkeeping and accounting services, and it stands out for several reasons. Our team of experts combines the precision of bookkeepers with the analytical prowess of accountants, providing comprehensive financial support for businesses of all sizes.

FAQs

- What are bookkeeping and accounting services?

These services include tracking money, sorting income and costs, checking records, creating reports, planning budgets, and meeting tax rules. - How is bookkeeping different from accounting?

Bookkeeping records each transaction in order. Accounting studies those records and explains what they show about the business. - Why does a business need both services?

Bookkeeping keeps data clear and updated. Accounting uses that data to plan ahead, follow rules, and support decisions. - What does a bookkeeper do?

A bookkeeper writes down every payment, groups it correctly, checks records with bank data, and prepares clear reports. - What does an accountant handle?

An accountant reads the records, finds patterns, plans budgets, checks tax steps, and helps with audits. - What do financial statements show?

They show income, spending, assets, and debts. These reports help owners know where they stand. - Why is reconciliation needed in bookkeeping?

It checks if the records match real data. This helps fix mistakes and keeps the books correct. - Can one firm manage both bookkeeping and accounting?

Yes. One firm can record all money data and also explain what the numbers mean for the business.