Home » What is included in accounting and bookkeeping services?

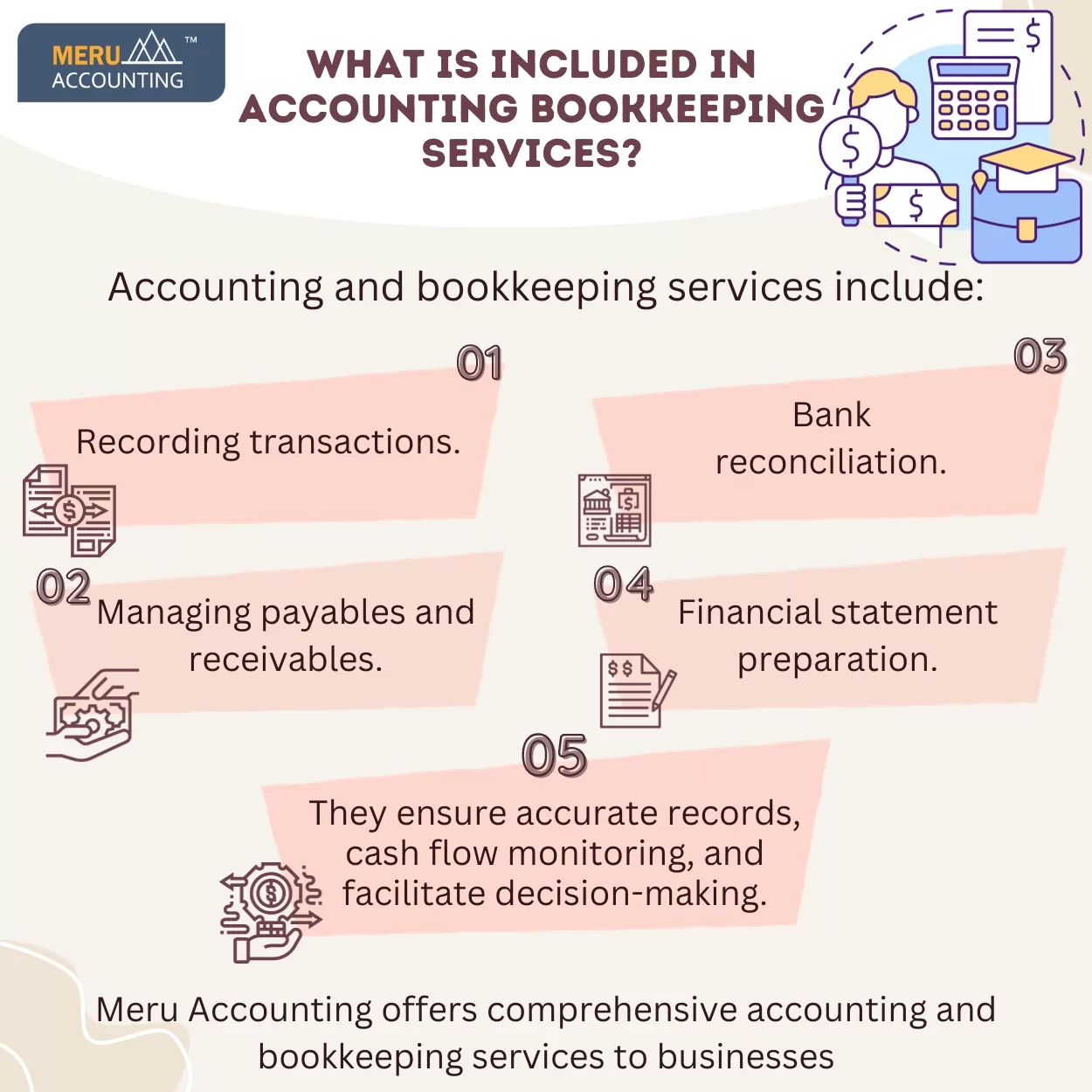

What is included in accounting bookkeeping services?

An Accounting bookkeeping service is essential for businesses to effectively manage their financial transactions and maintain accurate records.

These services encompass a wide range of tasks that contribute to the financial health and decision-making processes of a business. Here’s an overview of what is typically included in accounting and bookkeeping services:

1. Recording Financial Transactions

The core function of bookkeeping is to record and classify financial transactions. This involves accurately capturing and organizing information such as sales, purchases, expenses, and receipts.

Bookkeepers use accounting bookkeeping services providing software or manual ledgers to ensure all transactions are properly documented.

2. Accounts Payable Management

Bookkeeping and accounting services often include managing accounts payable, which involves tracking and processing payments to vendors, suppliers, and creditors.

Bookkeepers maintain records of outstanding bills, verify invoice accuracy, and ensure timely payments.

3. Accounts Receivable Management

This aspect focuses on managing the inflow of funds from customers or clients. Bookkeepers generate invoices, track payments, follow up on outstanding balances, and manage collections. They ensure accurate recording of sales revenue and monitor cash flow.

4. Bank Reconciliation

Regular bank reconciliation is crucial to ensure the accuracy of financial records. Bookkeepers compare bank statements with recorded transactions to identify discrepancies and ensure all transactions are accounted for. Reconciliation helps detect errors, fraud, or any missing transactions.

5. Financial Statement Preparation

Bookkeeping and accounting services involve the preparation of financial statements. These statements, including the income statement (profit and loss statement), balance sheet, and cash flow statement, provide an overview of a business’s financial performance, assets, liabilities, and cash flow.

6. General Ledger Maintenance

The general ledger is the central repository that contains all accounts and transactions. Bookkeepers maintain the general ledger by recording journal entries, categorizing transactions into appropriate accounts, and ensuring accuracy and completeness.

7. Financial Reporting

Bookkeepers generate various financial reports to provide insights into the business’s financial health. These reports include balance sheets, income statements, cash flow statements, and customized reports as per the business’s requirements.

8. Tax Preparation and Compliance

Bookkeepers play a vital role in assisting with tax preparation and compliance. They organize and maintain records required for tax filing, collaborate with accountants to ensure accuracy, and provide necessary financial documentation during tax audits.

9. Financial Analysis

Bookkeeping services may also involve basic financial analysis. Bookkeepers help businesses understand their financial performance, identify trends, analyze profitability, and make informed decisions based on the available financial data.

Meru Accounting offers comprehensive accounting and bookkeeping services to businesses. With their expertise, they can handle all aspects of financial record-keeping, ensuring accuracy, compliance, and timely reporting.

Their services cover transaction recording, accounts payable and receivable management, bank reconciliation, financial statement preparation, tax preparation, and financial analysis.

By leveraging Meru Accounting’s services, businesses can focus on their core operations while entrusting their financial management to qualified professionals.

Whether it’s maintaining accurate records, preparing financial statements, or meeting tax obligations, Meru Accounting provides the expertise to support businesses in their financial endeavors.

Contact Meru Accounting today to streamline your accounting and bookkeeping processes, gain valuable financial insights, and ensure compliance with accounting standards and regulations.